An Insurance Premium Is

In the world of insurance, the concept of a premium is fundamental to the entire system. An insurance premium is the cost that policyholders pay to the insurance company for the coverage and protection they seek. It is a vital component that determines the financial relationship between the insured and the insurer. Understanding how insurance premiums work is crucial for individuals and businesses alike, as it directly impacts their financial planning and risk management strategies.

The Nature of Insurance Premiums

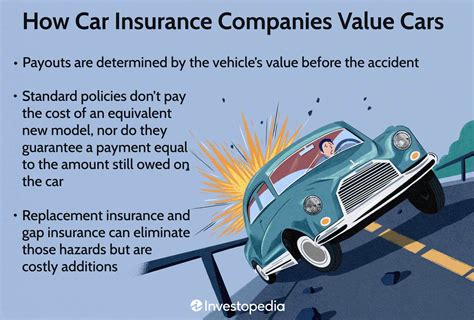

At its core, an insurance premium is a payment made by the policyholder to the insurance company in exchange for assuming the financial risk associated with a particular event or situation. This event could be anything from a car accident to a natural disaster, depending on the type of insurance coverage purchased.

Insurance premiums are typically paid at regular intervals, such as monthly, quarterly, or annually. The frequency of premium payments is often determined by the insurance policy and the preferences of the policyholder. These premiums serve as the primary revenue stream for insurance companies, allowing them to cover claims, operate their business, and generate profits.

Factors Influencing Insurance Premiums

The amount of an insurance premium is not set arbitrarily. Insurance companies employ complex mathematical and statistical models, known as actuarial science, to determine the appropriate premium for each policy. Several key factors influence the calculation of insurance premiums:

- Risk Assessment: Insurance companies carefully assess the level of risk associated with each policyholder. Factors such as age, gender, health status, driving record, and claim history are considered to determine the likelihood of a claim being made.

- Coverage Limits: The extent of coverage provided by the insurance policy plays a significant role in premium determination. Higher coverage limits generally result in higher premiums.

- Deductibles: Deductibles are the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Policies with higher deductibles often have lower premiums, as they reduce the insurer's potential financial liability.

- Location and Usage: For certain types of insurance, such as auto or home insurance, the location where the insured property or vehicle is situated can impact premiums. Additionally, usage patterns, like the number of miles driven annually for auto insurance, can also influence premium costs.

- Claims History: Insurers analyze the claim history of potential policyholders. A history of frequent or costly claims may result in higher premiums, as it indicates a higher risk profile.

- Regulatory Factors: Government regulations and industry standards can impact insurance premiums. For example, certain states may have minimum coverage requirements, affecting the cost of insurance policies.

Types of Insurance Premiums

Insurance premiums can be structured in various ways, depending on the type of insurance and the preferences of the policyholder. Here are some common types of insurance premiums:

Level Premiums

Level premiums remain constant throughout the policy term. This means that regardless of the age or health status of the policyholder, the premium remains the same. Level premiums provide predictability and stability for both the insurer and the insured.

Increasing Premiums

Increasing premiums, as the name suggests, rise over time. This type of premium structure is often used in life insurance policies, where the cost of coverage tends to increase with age. Increasing premiums account for the higher likelihood of claims as individuals get older.

Decreasing Premiums

In contrast to increasing premiums, decreasing premiums start high and gradually decrease over the policy term. This structure is commonly found in mortgage protection insurance, where the coverage amount decreases as the mortgage balance is paid off.

Variable Premiums

Variable premiums are flexible and can change based on certain factors. For instance, in some health insurance policies, premiums may adjust based on the policyholder’s health status or their utilization of healthcare services.

The Impact of Insurance Premiums

Insurance premiums have a significant impact on both individuals and businesses. For individuals, the cost of insurance premiums can be a substantial expense, especially for those with high-risk profiles or specific coverage needs. It is essential for individuals to carefully assess their insurance needs and shop around for policies that offer the best value for their money.

Businesses, on the other hand, often face more complex insurance scenarios. They may require multiple types of insurance, such as property, liability, and employee health insurance. The cost of insurance premiums can significantly affect a company's bottom line, and business owners must balance the need for adequate coverage with the financial constraints of running a business.

Additionally, insurance premiums can vary greatly depending on the industry and the specific business. High-risk industries, such as construction or manufacturing, often face higher insurance premiums due to the increased likelihood of accidents or property damage. On the other hand, low-risk industries, like software development or consulting, may enjoy more competitive insurance rates.

Strategies for Managing Insurance Premiums

There are several strategies individuals and businesses can employ to manage their insurance premiums effectively:

- Shop Around: Compare insurance policies and premiums from different providers. The insurance market is competitive, and rates can vary significantly between companies.

- Bundle Policies: Many insurance companies offer discounts when multiple policies are purchased together. For instance, bundling auto and home insurance can result in cost savings.

- Increase Deductibles: Choosing a higher deductible can lead to lower premiums, as it reduces the insurer's financial exposure. However, this strategy requires careful consideration, as it means the policyholder will bear more financial responsibility in the event of a claim.

- Improve Risk Profile: For individuals, maintaining a good driving record, staying healthy, and taking safety precautions can positively impact insurance premiums. Businesses can implement risk management strategies to reduce the likelihood of claims and potentially lower their insurance costs.

- Review Policies Regularly: Insurance needs can change over time. Regularly reviewing and updating insurance policies ensures that coverage remains adequate and premiums are not excessive.

Future Trends in Insurance Premiums

The insurance industry is continuously evolving, and advancements in technology and data analytics are shaping the future of insurance premiums. Here are some potential trends to watch:

- Usage-Based Insurance: With the rise of telematics and connected devices, usage-based insurance is becoming more prevalent, particularly in auto insurance. This approach allows premiums to be tailored to an individual's actual driving behavior, offering a more personalized and potentially cost-effective option.

- Telehealth and Remote Care: In the healthcare industry, the shift towards telehealth and remote care is expected to impact insurance premiums. As more healthcare services can be provided remotely, the need for traditional in-person visits may decrease, potentially reducing the cost of health insurance premiums.

- Data-Driven Underwriting: Insurance companies are increasingly leveraging big data and advanced analytics to refine their underwriting processes. This allows for more accurate risk assessment and could lead to more precise premium calculations, benefiting both insurers and policyholders.

- Parametric Insurance: Parametric insurance is an innovative approach that pays out based on the occurrence of a specific parameter, such as a natural disaster or a severe weather event. This type of insurance can provide faster and more predictable payouts, making it an attractive option for certain industries.

Conclusion

Insurance premiums are a crucial aspect of the insurance industry, serving as the financial foundation for the protection and security that insurance policies provide. Understanding how insurance premiums work, the factors that influence them, and the various types available empowers individuals and businesses to make informed decisions about their insurance coverage. As the insurance landscape continues to evolve, staying informed about emerging trends and technologies will be essential for navigating the complex world of insurance premiums effectively.

How often should I review my insurance policies and premiums?

+It is recommended to review your insurance policies and premiums annually or whenever there are significant changes in your personal or business circumstances. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

Can I negotiate my insurance premiums?

+While insurance premiums are typically based on standardized rates, there may be room for negotiation in certain cases. Some insurance companies may offer discounts or adjust premiums based on individual circumstances or loyalty. It is worth discussing your options with your insurance provider to see if any flexibility exists.

What happens if I can’t afford my insurance premiums?

+If you are facing financial difficulties and cannot afford your insurance premiums, it is essential to communicate with your insurance provider. They may offer payment plans, premium adjustments, or provide information on government-funded insurance programs that can help make coverage more affordable.