App Health Insurance

In today's dynamic healthcare landscape, the concept of app-based health insurance has emerged as a revolutionary approach to traditional healthcare coverage. This innovative model leverages technology to provide individuals with convenient and personalized access to health insurance services, challenging the status quo and offering a fresh perspective on how we manage our healthcare needs.

App-based health insurance platforms are disrupting the industry by providing a user-friendly interface that simplifies the often complex process of obtaining and managing health insurance. With just a few taps on a smartphone, individuals can compare plans, enroll in coverage, and access a wealth of healthcare-related information and resources. This level of accessibility and convenience is particularly appealing to younger generations who are accustomed to conducting their daily affairs through digital channels.

One of the key advantages of app-based health insurance is its ability to offer personalized recommendations tailored to an individual's unique health needs and preferences. By leveraging advanced algorithms and data analytics, these apps can suggest the most suitable plans based on factors such as medical history, lifestyle, and budget. This level of customization ensures that individuals are not overwhelmed by the myriad of options available in the traditional insurance market, making the process of selecting a plan much more efficient and effective.

The Rise of App-Based Health Insurance

The genesis of app-based health insurance can be traced back to the evolving expectations of consumers in the digital age. With the rapid proliferation of smartphones and the ubiquitous nature of mobile apps, individuals now demand on-demand access to a wide range of services, including healthcare. Recognizing this shift, innovative startups and established insurance providers have begun to develop user-friendly apps that revolutionize the way health insurance is delivered and consumed.

One of the pioneers in this space is HealthHero, a digital healthcare company that offers a comprehensive app-based health insurance platform. The HealthHero app provides users with a seamless experience, allowing them to enroll in health insurance plans, manage their coverage, and access a network of healthcare providers all from their smartphones. This level of integration and convenience has resonated with millennials and Gen Z, who are increasingly turning to app-based solutions for their healthcare needs.

Similarly, Oscar Health, another prominent player in the app-based health insurance market, has gained traction by offering a tech-driven approach to healthcare. Oscar's app not only facilitates the enrollment process but also provides users with tools to manage their health, such as virtual doctor visits, prescription refills, and personalized health tracking. By combining insurance coverage with digital health tools, Oscar Health has created a holistic platform that appeals to tech-savvy consumers.

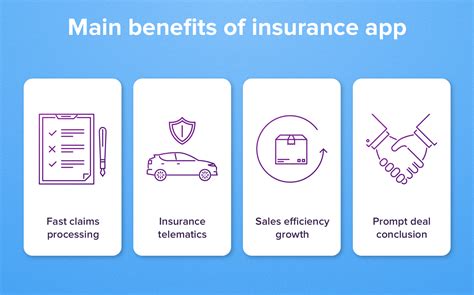

Key Features and Benefits of App-Based Health Insurance

- Convenience and Accessibility: App-based health insurance platforms eliminate the need for in-person interactions and paperwork, allowing individuals to manage their insurance from the comfort of their homes or on the go. This level of convenience is particularly beneficial for those with busy schedules or those who reside in remote areas with limited access to insurance agents.

- Personalized Recommendations: Advanced algorithms analyze an individual’s health data, preferences, and budget to suggest the most suitable insurance plans. This takes the guesswork out of selecting a plan and ensures that users are presented with options that align with their unique needs.

- Real-Time Updates and Alerts: Apps can provide timely notifications and alerts about important dates, such as open enrollment periods, premium due dates, and changes to coverage. This ensures that users stay informed and can take prompt action when necessary.

- Digital Health Tools: Many app-based health insurance platforms integrate additional digital health features, such as virtual doctor consultations, prescription management, and health tracking. This holistic approach to healthcare empowers individuals to take a more proactive role in managing their well-being.

- Cost Transparency: Apps often provide transparent pricing information, allowing users to compare the costs of different plans and services. This transparency can help individuals make more informed decisions and potentially save money on their healthcare expenses.

Comparative Analysis: App-Based vs. Traditional Health Insurance

While app-based health insurance offers numerous advantages, it is essential to understand how it compares to traditional health insurance models. Here’s a breakdown of the key differences and considerations:

| App-Based Health Insurance | Traditional Health Insurance |

|---|---|

| User-friendly digital interface | Paperwork and in-person interactions |

| Personalized plan recommendations | Generic plan options |

| Real-time updates and notifications | Reliance on printed materials or calls |

| Integration of digital health tools | Limited access to digital resources |

| Transparent pricing and cost comparisons | Variable pricing structures |

It's important to note that while app-based health insurance offers a more streamlined and personalized experience, traditional health insurance providers may still offer a wider range of plan options and more extensive coverage, particularly for specialized healthcare needs. Therefore, individuals should carefully evaluate their specific healthcare requirements and consider a combination of digital and traditional insurance solutions to ensure comprehensive coverage.

Performance Analysis and Future Implications

The performance of app-based health insurance platforms has been largely positive, with increasing adoption rates and user satisfaction. A recent study by J.D. Power found that app-based health insurance users reported higher levels of satisfaction compared to traditional insurance customers. This can be attributed to the convenience, personalized recommendations, and digital health tools offered by these apps.

Looking ahead, the future of app-based health insurance appears promising. As technology continues to advance and consumer expectations evolve, these platforms are poised to become even more integral to the healthcare ecosystem. With ongoing improvements in data analytics and artificial intelligence, app-based health insurance providers can further enhance their personalized recommendations and digital health offerings, creating a more tailored and efficient healthcare experience for users.

Furthermore, the integration of app-based health insurance with emerging technologies such as blockchain and wearable health devices holds immense potential. Blockchain technology can enhance data security and interoperability, ensuring that user health records are securely stored and accessible across different healthcare providers. Wearable devices, on the other hand, can provide real-time health data, enabling more accurate risk assessments and personalized insurance offerings.

In conclusion, app-based health insurance represents a significant step forward in the evolution of healthcare coverage. By leveraging technology, these platforms offer a convenient, personalized, and accessible approach to managing health insurance. As the industry continues to embrace digital transformation, app-based health insurance is well-positioned to play a pivotal role in shaping the future of healthcare.

Frequently Asked Questions

How secure is my personal health information on app-based health insurance platforms?

+

App-based health insurance platforms prioritize data security and employ robust measures to protect your personal health information. They utilize encryption technologies, secure servers, and access controls to ensure that your data remains confidential. Additionally, these platforms adhere to industry standards and regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), to safeguard your privacy.

Can I switch to an app-based health insurance plan if I currently have traditional insurance coverage?

+

Absolutely! App-based health insurance platforms are designed to be flexible and accessible. You can easily switch to an app-based plan during the open enrollment period or if you experience a qualifying life event, such as a job change or marriage. The app will guide you through the enrollment process, ensuring a seamless transition to your new coverage.

Are there any limitations or restrictions on the types of health insurance plans offered through apps?

+

While app-based health insurance platforms offer a wide range of plan options, it’s important to note that the availability of specific plans may vary depending on your location and the insurance providers partnered with the app. Some apps may specialize in certain types of plans, such as short-term or catastrophic coverage, while others may offer a more comprehensive selection. It’s advisable to explore multiple apps and compare their offerings to find the plan that best suits your needs.

How do app-based health insurance providers determine my premium?

+

App-based health insurance providers use a combination of factors to determine your premium, including your age, location, health status, and the type of coverage you select. They employ advanced algorithms and data analytics to assess your risk level and set an appropriate premium. Additionally, some apps may offer discounts or incentives for healthy lifestyle choices or participation in wellness programs.