Permanent Life Insurance Policy

Permanent life insurance is a long-term insurance solution designed to provide coverage throughout an individual's lifetime. Unlike term life insurance, which offers coverage for a specified period, permanent life insurance remains in force as long as the policyholder pays the premiums. This type of insurance not only guarantees financial protection for beneficiaries but also accumulates cash value over time, making it a versatile financial tool.

Understanding Permanent Life Insurance

Permanent life insurance, often referred to as cash value life insurance, is a comprehensive financial product that serves multiple purposes. It provides a death benefit to the policyholder’s beneficiaries upon their passing, offering financial security and peace of mind. Additionally, permanent life insurance policies build cash value, which can be accessed through loans, withdrawals, or even surrender of the policy.

The cash value component of permanent life insurance is a key differentiator from term life insurance. It functions as a savings account within the policy, earning interest and growing tax-deferred. This cash value can be utilized for various financial needs, such as funding retirement, covering unexpected expenses, or supplementing income.

Key Features of Permanent Life Insurance

- Guaranteed Death Benefit: Permanent life insurance ensures that your beneficiaries receive a predetermined sum upon your passing, regardless of when that occurs.

- Cash Value Accumulation: Over time, your policy builds cash value, which can be accessed for various financial purposes without affecting the death benefit.

- Flexible Premiums: Many permanent life insurance policies offer the flexibility to adjust premium payments, providing options for policyholders with varying financial situations.

- Tax Advantages: The cash value within the policy grows tax-deferred, and withdrawals or loans from the cash value are generally tax-free as long as they don’t exceed the cost basis.

- Policy Loans: Policyholders can borrow against the cash value of their policy, offering a source of funds without the need for additional collateral.

Types of Permanent Life Insurance

Permanent life insurance is an umbrella term encompassing several specific types of policies, each with unique features and benefits. The three primary types are:

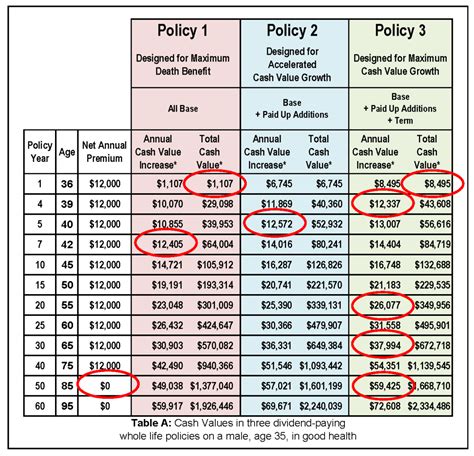

- Whole Life Insurance: This is the most basic form of permanent life insurance. It offers a guaranteed death benefit and consistent premium payments throughout the policyholder’s life. The cash value within a whole life policy grows at a fixed rate, providing stable, predictable growth.

- Universal Life Insurance: Universal life policies offer more flexibility than whole life. Policyholders can adjust their premium payments and death benefits within certain limits. The cash value within a universal life policy is invested in the market, providing the potential for higher returns but also carrying investment risk.

- Variable Life Insurance: Similar to universal life, variable life insurance policies allow policyholders to allocate their premium payments among various investment options, such as stocks, bonds, and money market funds. The death benefit and cash value fluctuate based on the performance of these investments, offering the potential for higher returns but also increased risk.

| Type of Permanent Life Insurance | Key Features |

|---|---|

| Whole Life | Guaranteed death benefit, fixed premium payments, steady cash value growth |

| Universal Life | Flexible premiums and death benefits, market-linked cash value growth |

| Variable Life | Premium payments allocated to investment options, potential for higher returns, carries investment risk |

The Benefits of Permanent Life Insurance

Permanent life insurance offers a range of advantages that make it an attractive financial tool for many individuals and families.

Financial Protection for Beneficiaries

The primary purpose of life insurance is to provide financial security to your loved ones after your passing. Permanent life insurance ensures that your beneficiaries receive a substantial sum, which can be used to cover immediate expenses, pay off debts, or fund long-term financial goals.

For instance, consider a family with a mortgage and dependent children. In the event of the primary earner's passing, the death benefit from a permanent life insurance policy could cover the remaining mortgage payments, ensuring the family can stay in their home. It could also provide funds for the children's education or other long-term financial needs.

Long-Term Savings and Investment Vehicle

The cash value component of permanent life insurance serves as a valuable savings and investment tool. Over time, this cash value grows, offering policyholders a source of funds for various financial needs.

For example, imagine a business owner who uses the cash value of their permanent life insurance policy to fund their retirement. They can take loans or withdrawals from the policy, providing a steady income stream without depleting their savings or selling business assets.

Tax Advantages

Permanent life insurance offers several tax advantages that can significantly enhance its value. The cash value within the policy grows tax-deferred, meaning it is not taxed as it accumulates. Additionally, withdrawals or loans from the cash value are generally tax-free as long as they don’t exceed the cost basis of the policy.

This tax-efficient structure makes permanent life insurance an attractive option for high-net-worth individuals or business owners looking to minimize their tax liabilities while maximizing their financial resources.

Flexibility and Customization

Permanent life insurance policies, particularly universal and variable life, offer a high degree of flexibility and customization. Policyholders can adjust their premium payments and death benefits to align with their changing financial circumstances and goals.

This flexibility allows individuals to adapt their insurance coverage as their needs evolve. For instance, a policyholder may increase their death benefit to cover the cost of their child's education or decrease it as their children become financially independent.

Real-World Applications of Permanent Life Insurance

Permanent life insurance has a wide range of applications and can be tailored to meet various financial needs and goals.

Business Planning

For business owners, permanent life insurance can be a valuable tool for business continuity and succession planning. By insuring key individuals within the business, owners can ensure that the business has the financial resources to continue operating in the event of a key person’s death.

For example, a small business owner may purchase a permanent life insurance policy on themselves, naming the business as the beneficiary. This provides the business with funds to cover any immediate expenses, pay off debts, or fund a smooth transition of ownership if the owner passes away unexpectedly.

Estate Planning

Permanent life insurance is a common component of estate planning strategies. The death benefit from a permanent life insurance policy can be used to pay estate taxes, ensuring that the assets of the estate pass to the intended beneficiaries without being diminished by tax liabilities.

Additionally, the cash value within a permanent life insurance policy can be used to fund charitable gifts or trusts, providing a way to leave a lasting legacy while also reducing the taxable value of the estate.

Supplementing Retirement Income

In retirement, many individuals face the challenge of generating a consistent income stream to cover their expenses. Permanent life insurance can be a valuable source of retirement income, particularly for those who have built substantial cash value within their policies.

By taking loans or withdrawals from the cash value of their permanent life insurance policy, retirees can supplement their income without depleting their savings or incurring significant tax liabilities. This can provide a steady stream of funds to cover living expenses, travel, or other retirement pursuits.

Considerations and Potential Drawbacks

While permanent life insurance offers a range of benefits, it’s important to consider potential drawbacks and make an informed decision based on your specific financial situation and goals.

Cost

Permanent life insurance policies generally have higher premium costs than term life insurance. This is because permanent life insurance provides coverage for the policyholder’s entire life and also includes the cash value accumulation component. As a result, it may not be the most cost-effective option for individuals who have limited financial resources or are on a tight budget.

Investment Risk

Variable life and universal life insurance policies carry investment risk. The cash value within these policies is tied to market performance, which can lead to fluctuations in the policy’s value. In a downturn, the cash value may decrease, potentially impacting the policy’s overall value and the policyholder’s ability to access funds.

Complexity

Permanent life insurance policies can be complex, with numerous features and options that may not be immediately apparent to the average consumer. It’s important to thoroughly understand the terms and conditions of your policy, including the potential fees, penalties, and limitations, to ensure it aligns with your financial goals and circumstances.

Potential for Misuse

While permanent life insurance can be a valuable financial tool, it’s essential to use it wisely. Misusing the policy, such as taking excessive loans or withdrawals from the cash value, can lead to policy lapse or reduced benefits. It’s important to carefully consider your financial needs and seek professional advice to ensure you’re utilizing your permanent life insurance policy effectively.

Expert Insights and Tips

💡 When considering permanent life insurance, it’s crucial to evaluate your financial goals and needs. If your primary objective is to provide financial protection for your beneficiaries, term life insurance may be a more cost-effective option. However, if you’re looking for a long-term financial tool that offers both protection and savings, permanent life insurance could be a suitable choice.

<p>It's also essential to work with a qualified financial advisor who can help you navigate the complexities of permanent life insurance and ensure that your policy aligns with your financial goals. They can guide you through the various types of policies, help you understand the associated fees and limitations, and provide valuable insights into the potential benefits and drawbacks.</p>

<p>Remember, permanent life insurance is a long-term commitment, and it's important to choose a policy that provides the flexibility and customization you may need as your financial circumstances evolve. By carefully considering your options and seeking professional advice, you can make an informed decision that best serves your financial well-being and the needs of your loved ones.</p>

Conclusion

Permanent life insurance is a versatile financial tool that offers both protection and savings for individuals and families. By providing a guaranteed death benefit and accumulating cash value, it serves as a valuable component of financial planning, estate planning, and retirement income strategies.

While permanent life insurance may not be the right choice for everyone, for those with specific financial needs and goals, it can be an essential part of a well-rounded financial plan. By understanding the various types of permanent life insurance policies, their features and benefits, and working with a qualified financial advisor, you can make an informed decision that aligns with your unique financial situation.

How does permanent life insurance differ from term life insurance?

+Permanent life insurance offers coverage throughout the policyholder’s lifetime, while term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. Permanent life insurance also accumulates cash value, which can be accessed for various financial needs, whereas term life insurance does not offer this feature.

What is the cash value in a permanent life insurance policy, and how does it grow?

+The cash value in a permanent life insurance policy is a savings component that grows over time. It functions like a tax-deferred savings account within the policy. The growth rate of the cash value depends on the type of permanent life insurance policy. Whole life policies offer fixed cash value growth, while universal and variable life policies offer market-linked growth.

Can I access the cash value in my permanent life insurance policy?

+Yes, you can access the cash value in your permanent life insurance policy through loans, withdrawals, or even surrender of the policy. Loans and withdrawals allow you to utilize the cash value without affecting the death benefit. However, it’s important to note that loans and withdrawals may have tax implications and can impact the overall value of your policy.

What are the potential drawbacks of permanent life insurance?

+Permanent life insurance policies generally have higher premium costs than term life insurance. Additionally, variable life and universal life policies carry investment risk, as the cash value is tied to market performance. It’s important to carefully consider your financial needs and goals to ensure permanent life insurance aligns with your circumstances.