Bodily Injury Liability Insurance

Bodily Injury Liability Insurance is a crucial aspect of vehicle insurance coverage that often goes unnoticed until it's needed. This type of insurance provides financial protection for policyholders in the event they are found legally responsible for causing bodily harm or injuries to others in an accident. In today's fast-paced world, where road accidents are a common occurrence, understanding the intricacies of bodily injury liability insurance is essential for every vehicle owner. This comprehensive guide aims to shed light on this critical aspect of insurance, providing an in-depth analysis and practical insights to help readers make informed decisions.

Understanding Bodily Injury Liability Insurance

Bodily Injury Liability Insurance, often referred to as BI Liability, is designed to protect individuals and businesses from the financial risks associated with causing bodily harm or injuries to others. In the context of vehicle insurance, this coverage kicks in when a policyholder’s vehicle is involved in an accident that results in physical injuries to other individuals, such as pedestrians, cyclists, or occupants of other vehicles. The insurance provider then steps in to cover the costs associated with these injuries, which can include medical expenses, rehabilitation costs, and even lost wages for the injured parties.

The primary purpose of BI Liability is to provide a financial safety net for policyholders, ensuring they are not personally responsible for paying exorbitant medical bills or compensation claims that can quickly spiral out of control. By transferring the financial burden to the insurance company, policyholders can focus on dealing with the aftermath of an accident without the added stress of potential financial ruin.

Key Components of Bodily Injury Liability Coverage

Bodily Injury Liability Insurance typically consists of two main components, each covering a specific aspect of the potential costs associated with causing bodily harm in an accident:

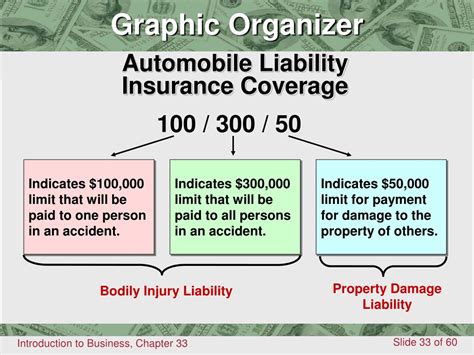

- Bodily Injury Liability per Person: This component covers the costs associated with the injuries sustained by an individual in an accident. It includes medical expenses, rehabilitation costs, and other related expenses. The coverage limit per person is usually expressed as a dollar amount, such as $100,000 per person.

- Bodily Injury Liability per Accident: This component extends the coverage to cover the costs associated with injuries sustained by multiple individuals in the same accident. It includes the aggregate of all injury-related costs, such as medical bills, rehabilitation, and lost wages. The coverage limit per accident is usually higher than the per-person limit and is expressed as a separate dollar amount, such as $300,000 per accident.

For example, if an insured driver causes an accident resulting in injuries to two people, the insurance company would cover the medical expenses and other related costs for both individuals, up to the per-person limit. However, if the total costs exceed the per-person limit, the per-accident limit comes into play, ensuring that the policyholder is not held personally liable for the excess amount.

Importance of Adequate Coverage

Having adequate bodily injury liability insurance is crucial for several reasons. Firstly, it provides a necessary layer of protection for policyholders, ensuring they can continue to operate their vehicles without the fear of financial ruin in the event of an accident. Secondly, it demonstrates a sense of responsibility and ethical conduct, as it ensures that the injured parties receive the necessary medical care and compensation without having to bear the burden themselves.

In many jurisdictions, having a minimum level of bodily injury liability insurance is a legal requirement for vehicle owners. Failure to comply with these regulations can result in severe penalties, including the suspension of driving privileges and even criminal charges in some cases. Additionally, having insufficient coverage can lead to significant out-of-pocket expenses if an accident results in severe injuries or multiple claimants.

Factors Affecting Bodily Injury Liability Coverage

The cost and coverage limits of bodily injury liability insurance can vary significantly depending on several factors, including:

- Location: Insurance rates and coverage limits can vary based on the state or region where the policy is purchased. This is due to variations in local laws, regulations, and the average cost of medical care in the area.

- Driving Record: Policyholders with a clean driving record and no history of accidents or claims are often offered more favorable rates and higher coverage limits. On the other hand, those with a history of accidents or traffic violations may face higher premiums and reduced coverage limits.

- Vehicle Type: The type of vehicle being insured can also impact the cost and coverage limits. High-performance sports cars or luxury vehicles, for example, may attract higher premiums due to their increased risk of involvement in accidents or higher repair costs.

- Insurance Provider: Different insurance companies offer varying levels of coverage and pricing structures. It's essential to shop around and compare policies to find the best combination of coverage and cost.

Real-World Examples and Case Studies

To better understand the impact and importance of bodily injury liability insurance, let’s explore a couple of real-world examples and case studies:

Example 1: A Minor Fender Bender with Major Consequences

Imagine a scenario where an insured driver, let’s call them Driver A, is involved in a minor fender bender with another vehicle. Initially, it seems like a simple accident with no visible injuries. However, a few days later, the occupants of the other vehicle start experiencing neck pain and seek medical attention. Diagnostic tests reveal that they have suffered whiplash injuries, requiring extensive physical therapy and rehabilitation.

In this case, Driver A's bodily injury liability insurance would come into play. The insurance company would cover the medical expenses and rehabilitation costs for the injured parties, up to the per-person and per-accident limits specified in the policy. This ensures that Driver A is not personally responsible for these costs, which can quickly add up to tens of thousands of dollars.

Example 2: A Serious Accident with Multiple Claimants

In a more severe accident, let’s consider a scenario where an insured driver, Driver B, is involved in a head-on collision with another vehicle. The impact is significant, resulting in severe injuries to both the driver and passenger of the other vehicle. Additionally, a pedestrian who was crossing the road at the time of the accident also sustains injuries.

In this case, Driver B's bodily injury liability insurance would be crucial in covering the medical expenses, rehabilitation costs, and potential lost wages for all three injured parties. The insurance company would manage the claims process, ensuring that the injured individuals receive the necessary compensation without placing a financial burden on Driver B. However, if the total costs exceed the per-accident limit, Driver B may be held personally liable for the excess amount, highlighting the importance of having adequate coverage.

Performance Analysis and Industry Insights

Bodily Injury Liability Insurance plays a critical role in the vehicle insurance industry, providing a necessary safety net for policyholders and ensuring the protection of injured parties. Here’s a closer look at some key performance indicators and industry trends related to BI Liability:

Claims Frequency and Severity

The frequency and severity of bodily injury claims vary depending on several factors, including geographic location, driving conditions, and demographic factors. In general, areas with higher population density and more congested roads tend to have a higher frequency of accidents and bodily injury claims. Additionally, factors such as speeding, distracted driving, and poor weather conditions can contribute to more severe accidents and higher claim severity.

According to industry data, the average severity of bodily injury claims has been steadily increasing over the past decade. This is attributed to several factors, including rising medical costs, an aging population, and the increasing complexity of modern medical treatments. As a result, insurance companies are continually adjusting their coverage limits and premiums to ensure they can adequately manage the rising costs of bodily injury claims.

Coverage Limits and Adequacy

The adequacy of bodily injury liability coverage is a critical consideration for policyholders. While state laws typically mandate a minimum level of coverage, these limits may not always be sufficient to cover the potential costs of a severe accident. For instance, in many states, the minimum bodily injury liability coverage per person is $25,000, which may not be enough to cover the medical expenses of a single injured individual in a serious accident.

To address this issue, insurance companies often recommend policyholders opt for higher coverage limits, such as $100,000 or $300,000 per person. These higher limits provide a greater level of protection, ensuring that policyholders are not left personally liable for any excess costs. Additionally, some insurance providers offer umbrella policies, which provide additional liability coverage beyond the limits of a standard policy, offering an extra layer of financial protection.

Trends in Bodily Injury Liability Insurance

The vehicle insurance industry is continually evolving, and bodily injury liability insurance is no exception. Here are a few key trends to watch:

- Increased Use of Technology: Insurance companies are leveraging technology to improve the claims process and enhance customer service. This includes the use of mobile apps for reporting accidents and submitting claims, as well as the implementation of advanced analytics to better predict and manage the costs of bodily injury claims.

- Focus on Preventative Measures: In addition to providing financial protection, insurance companies are also investing in initiatives to reduce the frequency and severity of accidents. This includes partnering with driving schools and community organizations to promote safe driving practices and educate drivers on accident prevention.

- Personalized Insurance Options: With the advent of usage-based insurance (UBI) and telematics, insurance companies are offering more personalized insurance plans. These plans take into account individual driving habits and behaviors, providing customized coverage options and potentially lower premiums for safe drivers.

Future Implications and Industry Predictions

Looking ahead, the future of bodily injury liability insurance is likely to be shaped by several key factors and emerging trends. Here’s a glimpse into what the industry might look like in the years to come:

Advancements in Autonomous Vehicles

As autonomous vehicles become more prevalent on our roads, the role of bodily injury liability insurance is likely to evolve. While these vehicles are designed to reduce the frequency of accidents, there will still be a need for liability coverage in the event of an accident caused by a system malfunction or human error. Insurance companies will need to adapt their policies and coverage limits to account for the unique risks associated with autonomous vehicles.

Integration of Telematics and Usage-Based Insurance

The increasing adoption of telematics and usage-based insurance models is expected to have a significant impact on bodily injury liability insurance. These technologies allow insurance companies to gather real-time data on driving habits and behaviors, enabling them to offer more accurate and personalized coverage options. Policyholders who drive safely and responsibly may be rewarded with lower premiums, while those with riskier driving habits may face higher costs.

Focus on Injury Prevention and Rehabilitation

In addition to providing financial protection, insurance companies are expected to play a more active role in injury prevention and rehabilitation. This could involve partnering with healthcare providers and rehabilitation specialists to develop programs and resources that promote faster recovery and improved outcomes for injured individuals. By focusing on injury prevention and rehabilitation, insurance companies can not only reduce the financial burden of bodily injury claims but also improve the overall well-being of policyholders and their communities.

Conclusion

Bodily Injury Liability Insurance is an essential component of vehicle insurance coverage, providing financial protection for policyholders in the event of an accident causing bodily harm to others. Understanding the intricacies of this coverage, including its components, adequacy, and real-world implications, is crucial for every vehicle owner. By staying informed and proactive, policyholders can ensure they have the necessary coverage to protect themselves and others on the road.

What is the average cost of bodily injury liability insurance?

+The average cost of bodily injury liability insurance can vary widely depending on factors such as location, driving record, and vehicle type. On average, policyholders can expect to pay anywhere from 100 to 500 per year for this coverage. However, it’s important to note that this is just an estimate, and actual costs can be significantly higher or lower based on individual circumstances.

Can I increase my bodily injury liability coverage limits after purchasing a policy?

+Yes, many insurance companies allow policyholders to increase their bodily injury liability coverage limits after purchasing a policy. This can be done by contacting your insurance provider and requesting a policy update or adjustment. It’s important to review your coverage limits periodically to ensure they align with your needs and the potential costs of an accident.

What happens if I cause an accident and my bodily injury liability coverage limits are insufficient to cover the costs?

+If you cause an accident and your bodily injury liability coverage limits are insufficient to cover the costs, you may be held personally liable for the excess amount. This can result in significant out-of-pocket expenses, including medical bills, rehabilitation costs, and potential legal fees. It’s crucial to have adequate coverage to protect yourself from such financial risks.