Amex Rental Car Insurance Coverage

American Express (Amex) is a renowned financial services company, widely known for its credit cards and travel-related benefits. One of the key perks that Amex offers to its cardholders is rental car insurance coverage, which provides an added layer of protection when renting a vehicle. This comprehensive Amex rental car insurance coverage guide will delve into the specifics, exploring the benefits, eligibility, exclusions, and all the essential details you need to know.

Understanding Amex Rental Car Insurance Coverage

Amex rental car insurance coverage is an automatic benefit that comes with select Amex credit cards. This coverage is designed to provide primary or secondary insurance for rental vehicles, offering protection against theft, collision, and damage. It’s a valuable benefit for frequent travelers and those who frequently rent cars, as it can save them from unexpected expenses and potential hassles.

Primary vs. Secondary Coverage

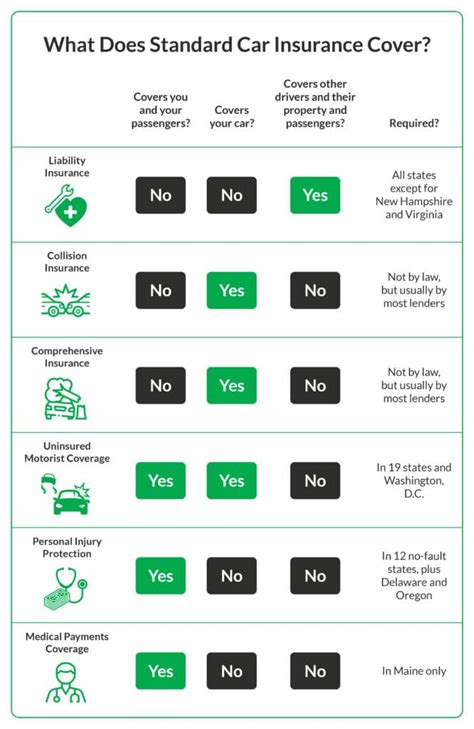

Amex rental car insurance coverage can act as either primary or secondary insurance. Primary coverage means that Amex’s insurance is the first line of defense, and the cardholder’s personal auto insurance policy is not involved. On the other hand, secondary coverage kicks in after the primary insurance (typically the personal auto insurance) has been exhausted. The type of coverage available depends on the specific Amex card and the country in which the rental car is located.

Eligible Amex Cards

Not all Amex cards offer rental car insurance coverage. The eligibility for this benefit varies depending on the card’s tier and the country of residence. Here’s a breakdown of some of the popular Amex cards that include rental car insurance coverage:

- The Platinum Card - This premium card offers primary rental car insurance coverage in the U.S. and secondary coverage worldwide. It's a comprehensive benefit, covering theft, collision, and damage to the rental vehicle.

- Gold Card - The Gold Card provides secondary rental car insurance coverage worldwide. While it's not primary coverage, it still offers a valuable layer of protection for cardholders.

- Green Card - Amex's Green Card offers secondary rental car insurance coverage in the U.S. and Canada. It's a great option for those who primarily rent cars in North America.

- Delta SkyMiles® Reserve American Express Card - This card offers primary rental car insurance coverage in the U.S. and secondary coverage worldwide. It's an excellent benefit for frequent travelers and those who often rent cars.

It's important to note that the coverage details and limitations may vary based on the specific card and the country of the rental. Always refer to your card's guide or contact Amex customer support for the most accurate and up-to-date information.

Coverage Details and Limitations

Amex rental car insurance coverage offers a range of benefits, but it’s crucial to understand the coverage limits and any exclusions that may apply. Here’s an in-depth look at the coverage details:

Coverage Limits

The coverage limits for Amex rental car insurance vary based on the card and the country of rental. Here are some general guidelines:

| Coverage Type | Coverage Limit |

|---|---|

| Collision Damage Waiver (CDW) | Up to $75,000 USD for the Platinum Card and up to $50,000 USD for other eligible cards. |

| Theft Protection | Covers the full value of the stolen vehicle, up to the CDW limit. |

| Loss Damage Waiver (LDW) | Similar to CDW, providing coverage for damage to the rental vehicle. |

It's important to note that these limits may vary based on the rental car company's policies and the specific country where the rental takes place. Always review the terms and conditions of your rental agreement to understand any additional fees or charges that may apply.

Coverage Exclusions

While Amex rental car insurance coverage is comprehensive, there are certain situations and vehicles that are not covered. Here are some key exclusions to be aware of:

- High-Risk Vehicles - Certain types of vehicles, such as antique cars, motorcycles, recreational vehicles (RVs), and off-road vehicles, are typically excluded from coverage.

- Driver Eligibility - Only authorized drivers listed on the rental agreement are covered. Any additional drivers not listed may not be covered by Amex's insurance.

- Rental Duration - The rental period must not exceed 31 consecutive days for coverage to apply. If the rental exceeds this duration, additional insurance may be required.

- Country Restrictions - While Amex rental car insurance covers rentals in many countries, there may be specific exclusions for certain high-risk countries or regions. Always check the terms for the latest information.

- Excessive Damage - Amex's insurance may not cover damage that is considered excessive or caused by gross negligence. This could include damage resulting from off-roading, racing, or other reckless behavior.

How to Maximize Amex Rental Car Insurance Benefits

To make the most of your Amex rental car insurance coverage, it’s essential to follow a few best practices. Here are some tips to ensure a smooth experience:

Rent from Authorized Agencies

Always rent your vehicle from authorized car rental agencies that accept Amex credit cards. Using authorized agencies ensures that you are eligible for the rental car insurance coverage offered by Amex.

Review the Rental Agreement

Before signing the rental agreement, carefully review the terms and conditions. Pay attention to any exclusions or additional fees that may apply. Ensure that the vehicle’s condition is noted accurately on the agreement to avoid any disputes later.

Decline Collision Damage Waiver (CDW)

When renting a car, you may be offered the option to purchase CDW or similar coverage from the rental agency. However, if you are using your eligible Amex card, you can often decline this additional coverage. Amex’s rental car insurance coverage typically includes CDW-like benefits, so purchasing it from the rental agency is unnecessary.

Use Your Eligible Amex Card

To activate the rental car insurance coverage, you must pay for the entire rental with your eligible Amex card. Using a different payment method may void the coverage, so ensure that you use the correct card.

Report Any Incidents Promptly

In the event of an accident, theft, or damage to the rental vehicle, report it to the rental agency immediately. Take detailed notes, photographs, and collect any necessary documentation. Prompt reporting is essential to ensure a smooth claims process.

Filing a Claim with Amex

Should you need to file a claim under your Amex rental car insurance coverage, here’s a step-by-step guide to help you through the process:

Step 1: Gather Documentation

Collect all relevant documentation related to the incident, including the rental agreement, police reports (if applicable), photographs, and any other supporting documents. Ensure that you have all the necessary information to support your claim.

Step 2: Contact Amex

Reach out to Amex’s customer support or claims department. Provide them with your card details and a comprehensive description of the incident. Be prepared to answer any questions they may have about the claim.

Step 3: Submit Your Claim

Follow the instructions provided by Amex to submit your claim. This may involve filling out a claim form and providing all the necessary documentation. Ensure that you meet the deadlines for submitting your claim and any supporting materials.

Step 4: Wait for Claim Processing

Once you’ve submitted your claim, Amex will review it and make a decision. The processing time can vary, but Amex aims to provide prompt and efficient service. Keep in touch with their claims team for updates on the status of your claim.

FAQs

Can I use Amex rental car insurance coverage for personal vehicles I own?

+No, Amex rental car insurance coverage is specifically designed for rental vehicles. It does not provide coverage for personal vehicles you own.

Does Amex rental car insurance cover personal injury or liability?

+No, Amex rental car insurance primarily covers damage to the rental vehicle itself. It does not provide personal injury or liability coverage. Consider purchasing separate insurance for these purposes.

Are there any countries where Amex rental car insurance coverage is not available?

+While Amex rental car insurance coverage is available in many countries, there may be specific exclusions for certain high-risk countries or regions. Always check the terms and conditions or contact Amex for the latest information.

How long does it typically take to process a claim with Amex rental car insurance coverage?

+The processing time for claims can vary. Amex aims to provide efficient service, but it may take several weeks to process and approve a claim. Keep in touch with their claims team for regular updates.

Amex rental car insurance coverage is a valuable benefit for cardholders, offering peace of mind and financial protection when renting vehicles. By understanding the eligibility, coverage details, and exclusions, you can make the most of this benefit and travel with confidence. Always review the terms and conditions, and don’t hesitate to reach out to Amex’s customer support for any questions or clarifications.