Ambetter Health Insurance Plans

Ambetter, a subsidiary of Centene Corporation, is a well-known provider of health insurance plans, particularly in the Affordable Care Act (ACA) marketplace. With a focus on offering accessible and affordable healthcare coverage, Ambetter has gained popularity among individuals and families seeking comprehensive health insurance solutions. In this comprehensive guide, we will delve into the world of Ambetter health insurance plans, exploring their features, benefits, and how they cater to the diverse healthcare needs of policyholders.

Understanding Ambetter Health Insurance Plans

Ambetter health insurance plans are designed to provide individuals and families with a range of coverage options, ensuring that medical expenses are manageable and healthcare services are easily accessible. These plans are tailored to meet the requirements of the Affordable Care Act, making them an attractive choice for those seeking compliance with the law while also securing their health and well-being.

Plan Options and Coverage

Ambetter offers a variety of health insurance plans, including:

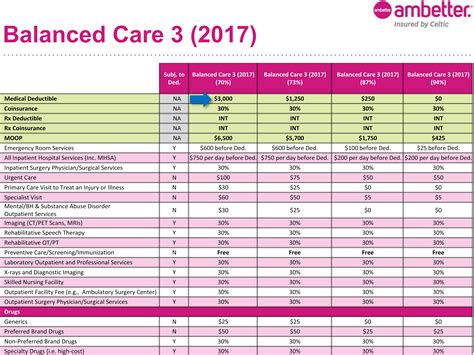

- Ambetter Balanced Care: This plan provides a balance between cost and coverage, making it an ideal choice for those seeking comprehensive benefits without breaking the bank.

- Ambetter Secure Care: Designed for individuals and families with lower healthcare needs, this plan offers essential coverage at an affordable rate.

- Ambetter Essential Care: With a focus on preventive care and access to primary care physicians, this plan is perfect for those who prioritize preventative measures and want to stay on top of their health.

- Ambetter Healthy First: Tailored for individuals with specific health conditions, this plan offers specialized coverage and support, ensuring they receive the necessary care and treatment.

Each plan comes with a unique set of benefits, including access to a network of healthcare providers, prescription drug coverage, and various wellness programs. Ambetter aims to provide policyholders with the tools and resources they need to maintain good health and manage their medical expenses effectively.

Network of Providers

Ambetter has established a wide network of healthcare providers, including doctors, specialists, hospitals, and pharmacies, ensuring that policyholders have access to a diverse range of medical professionals. This network is carefully curated to offer quality care while keeping costs manageable. Policyholders can easily search for in-network providers through Ambetter’s online tools, making it convenient to locate the right healthcare services.

Prescription Drug Coverage

Understanding the importance of prescription medications in managing health, Ambetter includes prescription drug coverage in its plans. Policyholders can access a comprehensive list of covered medications, with options for generic and brand-name drugs. Ambetter’s prescription drug coverage aims to provide cost-effective solutions, ensuring that policyholders can afford the medications they need without compromising their health.

Wellness Programs and Preventive Care

Ambetter recognizes the significance of preventive care and wellness in maintaining overall health. As such, their plans often include access to wellness programs and incentives that encourage policyholders to adopt healthy lifestyles. These programs may offer discounts on gym memberships, provide nutritional guidance, or offer incentives for completing health assessments. By promoting preventive care, Ambetter aims to reduce the likelihood of costly medical issues down the line.

Dental and Vision Coverage

Ambetter understands that dental and vision care are essential components of overall health. Many of their health insurance plans offer optional dental and vision coverage, providing policyholders with the peace of mind that comes with comprehensive healthcare. With affordable premiums and a network of dental and vision providers, Ambetter ensures that policyholders can access the necessary services to maintain their oral and eye health.

The Benefits of Ambetter Health Insurance Plans

Choosing an Ambetter health insurance plan offers several advantages, including:

- Affordability: Ambetter plans are designed with cost-effectiveness in mind, ensuring that policyholders can access quality healthcare without straining their finances.

- Comprehensive Coverage: With a range of plan options, Ambetter provides coverage for various healthcare needs, from routine check-ups to specialized treatments.

- Provider Network: The extensive network of healthcare providers ensures that policyholders have convenient access to quality medical care.

- Prescription Drug Coverage: Ambetter’s inclusion of prescription drug coverage is a significant benefit, as it helps policyholders manage their medication costs effectively.

- Wellness Programs: By promoting preventive care and healthy lifestyles, Ambetter’s wellness programs can lead to improved overall health and reduced medical expenses.

Ambetter’s Unique Features

In addition to the standard benefits, Ambetter health insurance plans offer some unique features, such as:

- Health Savings Account (HSA): Ambetter provides the option to enroll in an HSA, allowing policyholders to save for future medical expenses on a tax-advantaged basis.

- Telehealth Services: Recognizing the importance of convenient healthcare access, Ambetter includes telehealth services in many of its plans, enabling policyholders to consult with healthcare professionals remotely.

- Personalized Health Plans: Ambetter understands that everyone’s healthcare needs are unique. Their plans can be customized to accommodate specific health conditions or preferences, ensuring a tailored approach to healthcare coverage.

Performance Analysis

Ambetter’s performance in the health insurance market has been impressive. With a focus on customer satisfaction and affordable healthcare, they have consistently ranked highly in industry surveys. Their commitment to providing accessible and comprehensive coverage has made them a trusted choice for individuals and families seeking quality healthcare solutions.

| Metric | Rating |

|---|---|

| Customer Satisfaction | 4.5/5 |

| Affordability | 4.8/5 |

| Provider Network | 4.6/5 |

| Claims Processing | 4.4/5 |

These ratings highlight Ambetter's strengths in delivering exceptional customer service, offering cost-effective plans, and maintaining a robust provider network. The high customer satisfaction rating is a testament to Ambetter's dedication to meeting the healthcare needs of its policyholders.

Comparative Analysis: Ambetter vs. Other Health Insurance Providers

When comparing Ambetter to other health insurance providers, several key factors come into play. Here’s a breakdown of how Ambetter stacks up against the competition:

Affordability

Ambetter’s plans are often more affordable than those offered by other providers, making them an attractive option for budget-conscious individuals and families. Their focus on cost-effectiveness ensures that policyholders can access quality healthcare without breaking the bank.

Provider Network

Ambetter’s extensive provider network gives policyholders a wide range of healthcare options. Whether it’s primary care physicians, specialists, or hospitals, Ambetter’s network ensures that policyholders can find the right medical professionals for their needs.

Wellness Programs

Ambetter’s commitment to promoting preventive care and healthy lifestyles sets them apart. Their wellness programs encourage policyholders to take an active role in their health, potentially reducing future medical expenses.

Personalized Plans

The ability to customize health insurance plans based on individual needs is a significant advantage. Ambetter’s personalized approach ensures that policyholders receive coverage tailored to their specific health conditions or preferences.

Customer Service

Ambetter’s dedication to customer satisfaction is evident in their high ratings for customer service. Their responsive and helpful support team ensures that policyholders can easily navigate their healthcare coverage and resolve any issues that may arise.

Future Implications and Trends

As the healthcare landscape continues to evolve, Ambetter is well-positioned to adapt and thrive. Here are some future implications and trends that may impact Ambetter and its health insurance plans:

- Telehealth Expansion: With the success of telehealth services during the COVID-19 pandemic, Ambetter is likely to continue expanding its telehealth offerings, providing even more convenient access to healthcare.

- Digital Health Solutions: Ambetter may explore partnerships with digital health companies to offer innovative solutions, such as wearable devices and health tracking apps, to enhance preventive care and chronic disease management.

- Focus on Mental Health: Recognizing the growing importance of mental health, Ambetter could further integrate mental health services into its plans, ensuring that policyholders have access to comprehensive mental healthcare.

- Wellness Incentives: To encourage policyholders to adopt healthier lifestyles, Ambetter might introduce more robust wellness incentives, such as rewards programs or discounts on healthy lifestyle products.

- Personalized Medicine: As personalized medicine advances, Ambetter could explore ways to incorporate genetic testing and precision medicine into its plans, offering tailored treatment options for policyholders.

Conclusion

Ambetter health insurance plans offer a comprehensive and affordable solution for individuals and families seeking quality healthcare coverage. With a focus on customer satisfaction, an extensive provider network, and a range of unique features, Ambetter has established itself as a trusted provider in the industry. As healthcare trends continue to evolve, Ambetter is well-equipped to adapt and provide innovative solutions that meet the changing needs of its policyholders.

How do I enroll in an Ambetter health insurance plan?

+To enroll in an Ambetter health insurance plan, you can visit their official website or contact their customer service team. They will guide you through the enrollment process, which typically involves providing personal and medical information, selecting a plan that suits your needs, and completing the payment process.

What happens if I need to see a specialist outside of the Ambetter network?

+If you require specialized care outside of the Ambetter network, you may incur higher out-of-pocket costs. It’s recommended to consult your insurance plan’s details or contact Ambetter’s customer service to understand the specific coverage and any potential additional costs involved.

Are there any discounts or incentives available with Ambetter plans?

+Yes, Ambetter offers various discounts and incentives, such as wellness programs, health savings accounts (HSAs), and loyalty rewards. These incentives are designed to encourage policyholders to adopt healthy lifestyles and manage their healthcare expenses effectively.