Allstate Car Insurance Claims Phone Number

When it comes to car insurance, having easy access to reliable support during the claims process is essential. Allstate, a leading insurance provider, understands the importance of prompt and efficient assistance for its customers. In this article, we will delve into the various aspects of Allstate's car insurance claims, including the dedicated phone number for claims assistance and the comprehensive support system they offer.

Allstate’s Commitment to Customer Service

Allstate has built a strong reputation in the insurance industry by prioritizing customer satisfaction and providing exceptional support. Their focus on customer service is evident in their claims process, which aims to make filing and managing claims as seamless and stress-free as possible.

One of the key aspects of Allstate's customer-centric approach is the availability of dedicated phone lines for different insurance needs. Whether you're looking to purchase a new policy, make changes to an existing one, or file a claim, Allstate ensures you can reach the right department quickly and efficiently.

The Allstate Car Insurance Claims Phone Number

To assist customers with car insurance claims, Allstate has established a dedicated phone number. This number serves as a direct line to their claims department, ensuring that policyholders receive prompt attention and support during the claims process.

The Allstate Car Insurance Claims Phone Number is 1-800-ALLSTATE (1-800-255-7828). By calling this number, you can connect with a knowledgeable claims representative who will guide you through the process, answer your questions, and provide the necessary assistance to ensure a smooth and efficient claims experience.

Allstate understands that accidents and vehicle-related issues can be stressful, and their goal is to make the claims process as hassle-free as possible. The claims representatives are trained to handle a wide range of scenarios, from minor fender benders to more complex accidents, and they will work with you to navigate the steps required to resolve your claim.

Benefits of Calling the Allstate Car Insurance Claims Number

By reaching out to the Allstate Car Insurance Claims department, policyholders can enjoy several benefits:

- Immediate Assistance: Calling the dedicated phone number ensures that you speak to a claims representative right away, without having to navigate through multiple departments or hold times.

- Personalized Support: Allstate’s claims team provides tailored assistance based on your unique situation. They will guide you through the specific steps and requirements for your claim, ensuring you understand the process and what is expected of you.

- 24⁄7 Availability: In the event of an accident or urgent claim-related matter, Allstate offers round-the-clock support. The claims department is accessible 24 hours a day, 7 days a week, providing peace of mind and timely assistance when you need it most.

- Expertise and Guidance: Allstate’s claims representatives are highly trained and experienced in handling a variety of claims. They can provide valuable insights, answer your questions, and offer guidance throughout the entire claims process, from initial reporting to final resolution.

The Allstate Claims Process

Allstate has designed a streamlined and efficient claims process to ensure policyholders receive prompt and fair settlements. Here’s an overview of what you can expect when filing a car insurance claim with Allstate:

Step 1: Report the Claim

The first step in the claims process is to report the incident to Allstate. You can do this by calling the dedicated claims phone number, using the Allstate mobile app, or visiting their website. When reporting a claim, you’ll need to provide details such as the date, time, location, and nature of the incident, as well as any relevant information about the other parties involved.

Step 2: Claim Investigation

Once your claim is reported, Allstate will initiate an investigation to gather all the necessary information and assess the extent of the damages. This step may involve gathering police reports, witness statements, and photographs of the accident scene and vehicle damage. The claims representative assigned to your case will guide you through the documentation process and keep you updated on the progress of the investigation.

Step 3: Assessment and Estimate

After the investigation, Allstate will assess the damages and provide an estimate for repairs or replacement costs. This estimate is based on the information gathered during the investigation and takes into account the terms and conditions of your insurance policy. The claims representative will discuss the estimate with you and answer any questions you may have about the coverage and potential costs.

Step 4: Repair or Settlement

Once the estimate is approved, Allstate will work with you to determine the next steps. If the damages are minor and can be repaired, they will guide you through the process of choosing a repair shop and obtaining the necessary approvals. For more extensive damages, Allstate may offer a settlement based on the estimate, allowing you to choose your preferred repair facility or explore other options.

Step 5: Claim Resolution

Throughout the claims process, Allstate aims to provide prompt and fair resolutions. They will keep you informed about the progress of your claim and work towards a timely settlement. If any additional information is required or if there are complexities in your claim, the claims representative will communicate with you and provide updates on the next steps.

Additional Support and Resources

Allstate understands that the claims process can be complex and may raise various questions or concerns. To ensure policyholders have the necessary support and resources, Allstate offers the following:

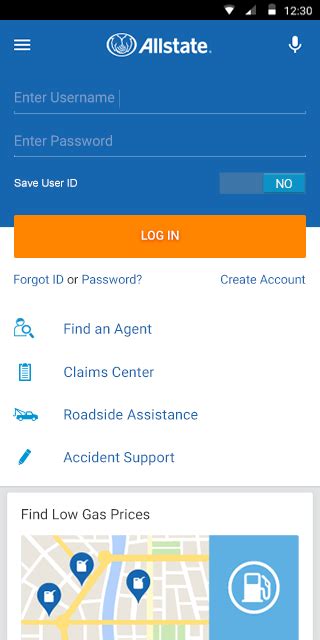

Allstate Digital Tools

Allstate provides a range of digital tools and resources to make the claims process more convenient and accessible. The Allstate mobile app, for example, allows policyholders to report claims, track their progress, and receive real-time updates. Additionally, the app offers features like accident checklists, repair shop locators, and other helpful resources to assist you throughout the claims journey.

Allstate Claim Specialists

Allstate employs a team of highly skilled claim specialists who are dedicated to providing expert guidance and support. These specialists have extensive knowledge of the insurance industry and can assist with complex claims, such as those involving multiple parties or legal complexities. They work closely with policyholders to ensure a thorough and fair resolution.

Allstate’s Network of Repair Shops

Allstate has established partnerships with a network of trusted repair shops across the country. These repair shops are carefully selected based on their quality of work, customer service, and commitment to timely repairs. When you choose a repair shop from Allstate’s network, you can have confidence in the repairs and know that Allstate will work with the shop to ensure a satisfactory outcome.

Frequently Asked Questions

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Exchange information with the other parties, including names, contact details, insurance information, and vehicle registration details. Take photographs of the accident scene and any visible damages. Then, contact Allstate’s claims department using the dedicated phone number to report the incident and receive further instructions.

Can I choose my own repair shop for repairs?

+Yes, you have the freedom to choose your preferred repair shop. Allstate encourages policyholders to select a repair shop that they trust and feel comfortable with. While Allstate has a network of recommended repair shops, you are not obligated to use them. However, choosing a shop from their network can provide additional benefits, such as streamlined claims processing and guaranteed repairs.

How long does it take to receive a settlement for my claim?

+The time it takes to receive a settlement can vary depending on the complexity of your claim and the extent of the damages. Allstate aims to provide prompt resolutions, and their goal is to settle claims within a reasonable timeframe. The claims representative assigned to your case will keep you informed about the progress and provide an estimated timeline for the settlement process.

Can I track the progress of my claim online or through the app?

+Absolutely! Allstate understands the importance of keeping policyholders informed throughout the claims process. You can track the progress of your claim online through the Allstate website or by using the Allstate mobile app. These digital tools provide real-time updates, allowing you to stay informed and engaged in the claims journey.

What if I have additional questions or concerns during the claims process?

+Allstate encourages policyholders to reach out with any questions or concerns they may have. The claims department is readily available to provide support and guidance. You can contact them through the dedicated phone number, use the live chat feature on the website, or send an email. Allstate aims to address your inquiries promptly and ensure a positive claims experience.

Remember, Allstate is committed to providing exceptional customer service and support throughout the car insurance claims process. By calling the dedicated Allstate Car Insurance Claims Phone Number and utilizing their digital tools and resources, you can navigate the claims journey with confidence and peace of mind.