Bundling With Auto Insurance

In the ever-evolving world of insurance, bundling services is a strategic move that offers both insurers and policyholders significant advantages. One of the most common and beneficial bundles in the insurance industry is the combination of auto insurance and other related services. This comprehensive approach to insurance not only simplifies the lives of customers but also provides a unique opportunity for insurers to offer tailored, cost-effective solutions. Let's delve into the world of bundling with auto insurance, exploring its benefits, how it works, and its potential impact on the insurance landscape.

The Benefits of Bundling with Auto Insurance

Bundling auto insurance with other services is a strategy that has gained popularity due to its myriad benefits for both insurers and policyholders. For insurers, it offers a chance to build stronger relationships with customers and increase customer retention. By offering a suite of services under one policy, insurers can provide a more personalized experience, catering to the unique needs of each customer.

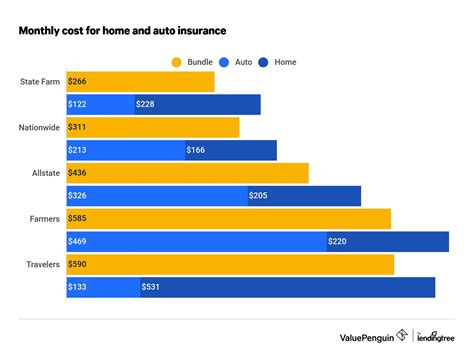

For policyholders, the advantages are equally compelling. Firstly, bundling often leads to significant cost savings. Insurers frequently offer discounts when customers opt for multiple services under one policy. These discounts can add up, making insurance more affordable and providing real value for money. Secondly, bundling simplifies the insurance process, reducing the administrative burden on policyholders. Instead of managing multiple policies and providers, customers can enjoy the convenience of a single point of contact for all their insurance needs.

Enhanced Coverage Options

One of the key advantages of bundling auto insurance is the opportunity to expand coverage options. Insurers can offer a range of additional services, such as homeowners, renters, or even life insurance, under the same policy. This not only provides comprehensive protection for policyholders but also allows insurers to cross-sell their products effectively. For instance, a customer who already has auto insurance may be more inclined to consider other insurance options, knowing they can receive tailored coverage and potential discounts.

Improved Risk Assessment

Bundling also enables insurers to improve their risk assessment capabilities. By analyzing a customer’s entire insurance portfolio, insurers can gain a more holistic view of their risk profile. This detailed understanding can lead to more accurate pricing and coverage options, ensuring that policyholders receive fair and competitive rates.

How Bundling with Auto Insurance Works

The process of bundling auto insurance with other services is designed to be straightforward and customer-friendly. Insurers typically offer a range of bundled packages, each tailored to meet the diverse needs of their customers. These packages often include a combination of auto insurance and one or more additional services, such as homeowners or renters insurance.

When a customer opts for a bundled package, they receive a single policy that covers all the included services. This policy will outline the specific coverage limits, deductibles, and any additional benefits or discounts applied. The beauty of bundling is that it streamlines the insurance process, making it easier for customers to understand and manage their coverage.

The Role of Technology

In today’s digital age, technology plays a pivotal role in facilitating the bundling process. Many insurers utilize online platforms and mobile apps to enable customers to easily compare and choose bundled packages. These digital tools often provide real-time quotes, allowing customers to quickly assess the potential savings and benefits of bundling.

Additionally, data analytics is increasingly being used to personalize bundled packages. By analyzing customer data and behavior, insurers can offer tailored bundles that meet the specific needs and preferences of each individual. This level of customization enhances the customer experience and further underscores the benefits of bundling.

Real-World Examples and Success Stories

The concept of bundling auto insurance has been successfully implemented by numerous insurance providers, resulting in enhanced customer satisfaction and business growth. Let’s explore a couple of real-world examples that highlight the success and impact of bundling.

Case Study: Allstate’s Multi-Policy Discount

Allstate, one of the leading insurance providers in the United States, offers a Multi-Policy Discount as part of its bundling strategy. This discount applies when customers bundle their auto insurance with other policies, such as homeowners or renters insurance. By offering this discount, Allstate has incentivized customers to consider its other services, leading to increased policy sales and customer loyalty.

Case Study: Progressive’s Snapshot Program

Progressive Insurance has taken a unique approach to bundling with its Snapshot Program. This program uses telematics technology to monitor a customer’s driving behavior. Based on this data, Progressive offers discounts on auto insurance premiums. However, the program doesn’t stop there. Progressive also encourages customers to bundle their auto insurance with other services, such as homeowners insurance, providing further discounts and a more comprehensive coverage portfolio.

The Future of Bundling with Auto Insurance

As the insurance industry continues to evolve, the practice of bundling is expected to play an even more significant role. With the increasing demand for personalized and cost-effective insurance solutions, bundling will become a key strategy for insurers to meet customer expectations.

Emerging Trends

One emerging trend in bundling is the integration of lifestyle and wellness services into insurance packages. Insurers are beginning to offer discounts or incentives for customers who adopt healthy lifestyles or engage in certain wellness activities. This trend is particularly relevant in the health and life insurance sectors, where insurers are incentivizing customers to take proactive steps towards better health.

The Role of Data Analytics

The continued advancement of data analytics will further enhance the bundling process. Insurers will be able to leverage customer data to create even more personalized bundles, ensuring that each customer receives a unique and tailored insurance solution. Additionally, data analytics will enable insurers to refine their risk assessment models, leading to more accurate pricing and coverage recommendations.

Expanding Coverage Options

Bundling is also expected to drive the expansion of coverage options beyond traditional insurance services. Insurers may begin to offer bundled packages that include services like identity theft protection, travel insurance, or even pet insurance. By expanding the range of services available for bundling, insurers can further differentiate themselves and provide comprehensive solutions for their customers.

Conclusion: Embracing the Benefits of Bundling

Bundling auto insurance with other services is a strategic move that offers a host of benefits for both insurers and policyholders. It simplifies the insurance process, provides cost savings, and allows for more personalized coverage options. As the insurance industry continues to evolve, bundling will remain a key strategy for insurers to stay competitive and meet the evolving needs of their customers.

By understanding the benefits and potential of bundling, insurers can position themselves to thrive in a dynamic and customer-centric market. For policyholders, embracing the advantages of bundling can lead to a more comprehensive and cost-effective insurance portfolio. Ultimately, the future of insurance is moving towards a more holistic and tailored approach, and bundling is a key component of this transformation.

What are the key benefits of bundling auto insurance with other services?

+Bundling auto insurance offers several advantages, including cost savings through discounts, simplified insurance management with a single policy, and expanded coverage options. It also allows insurers to better assess risk and provide tailored solutions.

How does bundling work in practice?

+Insurers offer bundled packages, typically including auto insurance and one or more additional services like homeowners or renters insurance. Customers receive a single policy covering all services, with potential discounts and tailored coverage.

What role does technology play in the bundling process?

+Technology, such as online platforms and mobile apps, simplifies the bundling process by providing real-time quotes and personalized bundles based on customer data and preferences.

What are some real-world examples of successful bundling strategies?

+Allstate’s Multi-Policy Discount and Progressive’s Snapshot Program are successful examples of bundling strategies. Both offer discounts and incentives for customers who bundle their auto insurance with other services, leading to increased sales and customer loyalty.