Universal Life Insurance

Universal life insurance, a versatile and flexible form of permanent life insurance, has gained significant popularity due to its customizable features and potential for long-term financial security. This article aims to delve into the intricacies of universal life insurance, exploring its definition, key characteristics, benefits, and how it differs from other types of life insurance. By understanding the unique aspects of universal life insurance, individuals can make informed decisions about their financial planning and ensure adequate protection for themselves and their loved ones.

Understanding Universal Life Insurance

Universal life insurance is a type of permanent life insurance policy that provides lifelong coverage, ensuring that the insured individual’s beneficiaries receive a payout upon their death. Unlike term life insurance, which offers coverage for a specific period, universal life insurance remains in force throughout the insured’s lifetime, as long as the policy is properly maintained.

One of the defining features of universal life insurance is its flexibility. Policyholders have the ability to adjust certain aspects of their policy, such as the death benefit, premium payments, and cash value accumulation. This adaptability allows individuals to tailor their coverage to meet their changing financial needs and goals over time.

Key Characteristics of Universal Life Insurance

Universal life insurance policies possess several key characteristics that set them apart from other forms of life insurance:

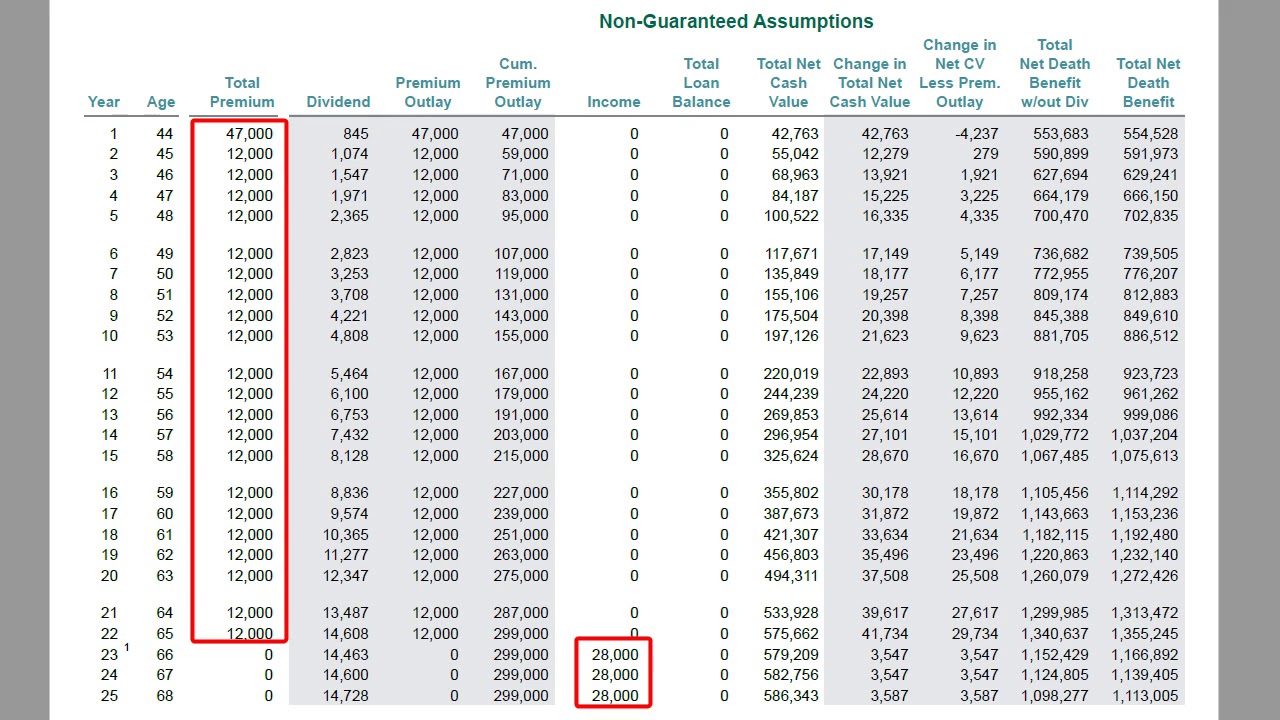

- Cash Value Accumulation: Universal life insurance policies build cash value over time. A portion of the premiums paid goes towards the death benefit, while another portion is invested in a separate account. This cash value grows tax-deferred and can be accessed through policy loans or withdrawals.

- Flexible Premiums: Policyholders have the option to adjust their premium payments within certain limits. This flexibility allows individuals to increase or decrease their premiums based on their financial circumstances, providing a level of control over their insurance coverage.

- Adjustable Death Benefit: The death benefit, which is the amount paid to the beneficiaries upon the insured's death, can be increased or decreased. This feature enables policyholders to adapt their coverage to meet changing needs, such as providing for a growing family or covering additional financial obligations.

- Investment Options: Many universal life insurance policies offer a range of investment options for the cash value component. Policyholders can choose from various investment vehicles, such as mutual funds, stocks, or bonds, allowing them to align their investments with their risk tolerance and financial goals.

| Policy Feature | Description |

|---|---|

| Cash Value | Builds over time, offering tax-deferred growth and access to funds through loans or withdrawals. |

| Flexible Premiums | Policyholders can adjust premium payments within limits, providing financial flexibility. |

| Adjustable Death Benefit | The death benefit can be increased or decreased to meet changing needs and financial obligations. |

| Investment Options | A range of investment vehicles, including mutual funds, stocks, and bonds, are available for cash value accumulation. |

Benefits of Universal Life Insurance

Universal life insurance offers a range of benefits that make it an appealing choice for many individuals:

Lifetime Coverage

As a form of permanent life insurance, universal life provides lifelong coverage. This ensures that the insured individual’s beneficiaries will receive a payout regardless of when the insured passes away, providing long-term financial security.

Cash Value Accumulation

The cash value component of universal life insurance policies allows policyholders to build wealth over time. This tax-deferred growth can be utilized for various financial goals, such as funding retirement, paying for a child’s education, or supplementing income during retirement.

Flexible Premiums and Death Benefit

The ability to adjust premium payments and the death benefit provides policyholders with a high degree of control over their insurance coverage. This flexibility allows individuals to align their policy with their financial situation, ensuring that their insurance needs are met at every stage of life.

Investment Opportunities

Universal life insurance policies offer a range of investment options, providing policyholders with the potential for higher returns on their cash value. By carefully selecting investment vehicles, individuals can pursue their financial goals and maximize the growth of their policy’s cash value.

Differences from Other Life Insurance Types

While universal life insurance shares some similarities with other forms of life insurance, it also possesses distinct differences that set it apart:

Compared to Term Life Insurance

- Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. In contrast, universal life insurance offers lifelong coverage, ensuring protection for the insured’s entire lifetime.

- Term life insurance policies have fixed premiums for the term of the policy. Universal life insurance, on the other hand, allows policyholders to adjust their premiums, providing more flexibility in managing their financial obligations.

- Term life insurance does not build cash value, whereas universal life insurance accumulates cash value over time, offering the potential for wealth accumulation.

Compared to Whole Life Insurance

- Whole life insurance is another form of permanent life insurance. While both universal and whole life insurance offer lifelong coverage, universal life insurance provides more flexibility in terms of premium payments and death benefit adjustments.

- Whole life insurance policies typically have fixed premiums and a guaranteed death benefit. Universal life insurance, on the other hand, allows policyholders to adjust these aspects based on their changing financial needs.

- Whole life insurance policies often have a lower internal rate of return on the cash value compared to universal life insurance, making the latter a potentially more attractive option for individuals seeking higher investment returns.

Considerations and Potential Drawbacks

While universal life insurance offers numerous benefits, there are some considerations and potential drawbacks to keep in mind:

Investment Risk

The investment component of universal life insurance policies carries a certain level of risk. If the investments perform poorly, the policy’s cash value may not grow as expected, impacting the overall value of the policy and potentially affecting the death benefit.

Policy Lapses

Universal life insurance policies require regular premium payments to remain in force. If policyholders fail to make premium payments or if the cash value is insufficient to cover the policy’s expenses, the policy may lapse, resulting in the loss of coverage and any accumulated cash value.

Cost

Universal life insurance policies generally have higher premiums compared to term life insurance. The flexibility and potential for cash value accumulation come at a cost, making it important for individuals to carefully assess their financial situation and determine if universal life insurance aligns with their needs and budget.

Choosing the Right Policy

When considering universal life insurance, it is essential to evaluate your financial goals, risk tolerance, and long-term needs. Consulting with a financial advisor or insurance professional can help you navigate the various options and select a policy that best suits your circumstances.

Some key factors to consider when choosing a universal life insurance policy include:

- Your financial goals and objectives

- The level of coverage you require

- Your risk tolerance and investment preferences

- The flexibility and control you desire over your premiums and death benefit

- The potential for cash value accumulation and its alignment with your financial plans

By carefully assessing these factors and seeking professional guidance, you can make an informed decision about whether universal life insurance is the right choice for your financial security and long-term planning.

What is the difference between universal life insurance and term life insurance?

+

Universal life insurance provides lifelong coverage and offers flexible premiums and death benefit adjustments. Term life insurance, on the other hand, offers coverage for a specific term, typically 10-30 years, and has fixed premiums. Universal life insurance builds cash value, while term life insurance does not.

How does the cash value component work in universal life insurance?

+

The cash value component of universal life insurance policies allows a portion of the premiums to be invested and grow tax-deferred. This cash value can be accessed through policy loans or withdrawals and can be utilized for various financial goals.

Can I adjust the premiums and death benefit in a universal life insurance policy?

+

Yes, one of the key advantages of universal life insurance is its flexibility. Policyholders can adjust their premium payments within certain limits and increase or decrease the death benefit to meet their changing financial needs.