Allstate Allstate Insurance

Welcome to a comprehensive guide on Allstate Insurance, a well-known name in the insurance industry. With a rich history spanning decades, Allstate has established itself as a trusted provider, offering a wide range of insurance services to individuals and businesses. In this expert-level journal article, we will delve into the world of Allstate, exploring its origins, key offerings, and the impact it has had on the insurance landscape.

The Rise of Allstate Insurance: A Historical Perspective

Allstate Insurance Company, often simply referred to as Allstate, was founded in 1931 during the depths of the Great Depression. The company’s origins can be traced back to the vision of two innovative entrepreneurs, Charles D. “Dad” Walker and Robert E. Wood, who recognized the need for reliable and accessible insurance solutions for the American public.

Headquartered in Northbrook, Illinois, Allstate began its journey with a focus on auto insurance, quickly establishing a reputation for offering comprehensive coverage at competitive rates. Over the years, the company expanded its reach, diversifying its product portfolio to include homeowners, renters, life, and business insurance, among other offerings.

One of the key milestones in Allstate's history was its acquisition by the Sears, Roebuck and Company in 1937. This strategic move not only provided Allstate with a wider customer base but also positioned the company as a trusted partner for Sears' extensive network of retail stores. Allstate's presence in Sears stores across the country allowed it to reach a broader audience and establish itself as a household name.

In the post-World War II era, Allstate experienced significant growth, becoming one of the leading insurance providers in the United States. The company's commitment to innovation and customer satisfaction drove its success, as it continuously adapted to the changing needs of its policyholders.

Key Offerings and Services

Allstate’s comprehensive suite of insurance products caters to a diverse range of individuals and businesses. Here’s an overview of some of its key offerings:

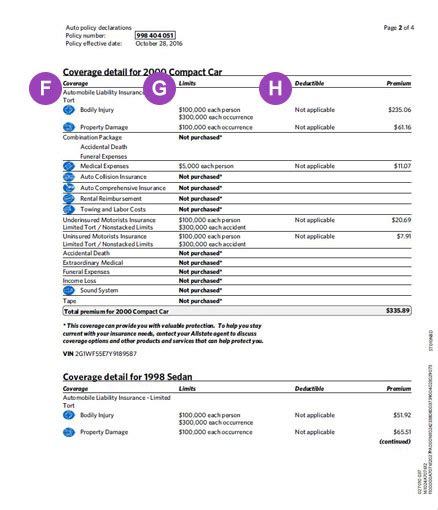

Auto Insurance

Allstate’s auto insurance policies are designed to provide protection for drivers and their vehicles. The company offers a range of coverage options, including liability, collision, comprehensive, and medical payments insurance. Allstate’s unique Drivewise program encourages safe driving by tracking driving habits and offering potential discounts based on responsible behavior.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage caused to others in an accident. |

| Collision Coverage | Pays for repairs or replacements if your vehicle is damaged in an accident. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, or natural disasters. |

| Medical Payments | Covers medical expenses for you and your passengers, regardless of fault. |

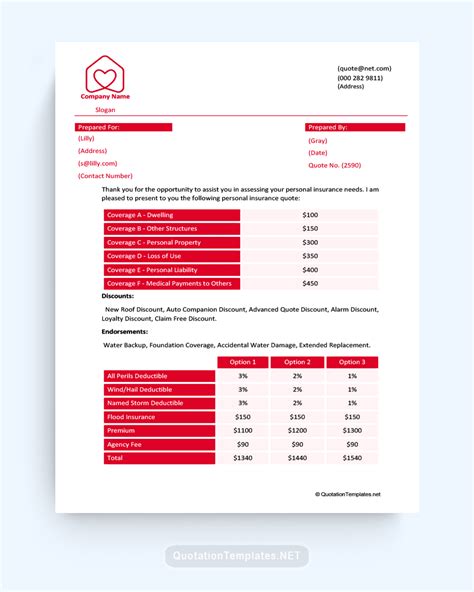

Homeowners Insurance

Allstate’s homeowners insurance policies provide coverage for various types of dwellings, including single-family homes, condominiums, and rental properties. The policies offer protection against damage caused by fire, theft, vandalism, and natural disasters, among other perils. Additionally, Allstate’s homeowners insurance includes liability coverage to protect policyholders against lawsuits.

Renters Insurance

Renters insurance is a vital offering for individuals who rent their living spaces. Allstate’s renters insurance policies provide coverage for personal belongings, liability protection, and additional living expenses in the event of a covered loss. This type of insurance is particularly beneficial for renters as it protects their possessions and provides peace of mind.

Life Insurance

Allstate offers a range of life insurance products to help individuals and families secure their financial future. Term life insurance provides coverage for a specified period, while permanent life insurance, such as whole life or universal life, offers lifelong protection with the added benefit of cash value accumulation. Allstate’s life insurance policies can be tailored to meet individual needs and provide financial security for loved ones.

Business Insurance

Allstate understands the unique risks faced by businesses, and its business insurance offerings are designed to provide comprehensive protection. From general liability insurance to property insurance and workers’ compensation, Allstate helps businesses mitigate risks and ensure continuity. The company’s business insurance policies can be customized to meet the specific needs of various industries.

Allstate’s Impact on the Insurance Industry

Allstate’s influence on the insurance industry is profound and far-reaching. The company’s innovative approach to insurance has shaped the way insurance products are developed and delivered. Allstate’s focus on customer-centric solutions and its commitment to technological advancements have set a high standard for the industry.

One of Allstate's notable contributions is its emphasis on digital transformation. The company has embraced technology to enhance the customer experience, making it easier for policyholders to manage their insurance needs online or through mobile apps. This digital approach has not only improved efficiency but has also made insurance more accessible and convenient for customers.

Additionally, Allstate's commitment to social responsibility and community engagement has left a positive impact. The company actively supports various initiatives aimed at improving road safety, promoting financial literacy, and contributing to disaster relief efforts. Allstate's involvement in these areas demonstrates its dedication to making a difference beyond its core business operations.

Future Outlook and Innovations

As the insurance landscape continues to evolve, Allstate remains at the forefront, embracing new technologies and trends. The company’s focus on innovation is evident in its exploration of artificial intelligence, machine learning, and data analytics to enhance its underwriting processes and risk assessment capabilities.

Allstate is also investing in sustainable practices and environmental initiatives. The company recognizes the impact of climate change on the insurance industry and is committed to reducing its carbon footprint. By adopting sustainable business practices and supporting renewable energy projects, Allstate is positioning itself as a leader in responsible business conduct.

Furthermore, Allstate is expanding its digital capabilities to meet the evolving expectations of its customers. The company is developing innovative digital tools and platforms to streamline the insurance experience, making it more efficient and user-friendly. This includes enhancing its online quote process, improving claim management systems, and integrating advanced analytics to offer personalized insurance solutions.

Conclusion

Allstate Insurance has established itself as a trusted and innovative force in the insurance industry. With a rich history spanning over eight decades, the company has consistently adapted to meet the changing needs of its customers. Allstate’s comprehensive range of insurance products, combined with its focus on customer satisfaction and technological advancements, positions it as a leader in the industry.

As Allstate continues to evolve, its commitment to innovation and social responsibility ensures that it will remain a prominent player in the insurance market. The company's impact on the industry and its contributions to the communities it serves make it a valuable partner for individuals and businesses seeking reliable insurance solutions.

How can I get a quote for Allstate insurance policies?

+To obtain a quote for Allstate insurance policies, you can visit their official website or contact an Allstate agent. The website provides an online quote tool where you can input your details and receive a personalized quote. Alternatively, you can reach out to an Allstate agent who can guide you through the process and offer expert advice tailored to your needs.

What makes Allstate’s auto insurance policies unique?

+Allstate’s auto insurance policies stand out due to their innovative Drivewise program. This program uses telematics technology to track driving habits, rewarding safe drivers with potential discounts. It encourages responsible driving and provides a unique way to personalize insurance premiums based on individual driving behaviors.

How does Allstate’s homeowners insurance compare to competitors?

+Allstate’s homeowners insurance offers comprehensive coverage for various dwelling types. The policies include protection against a wide range of perils, including fire, theft, and natural disasters. Additionally, Allstate’s liability coverage provides added protection against lawsuits. Compared to competitors, Allstate’s homeowners insurance often stands out for its personalized approach and customer-centric features.