All Insurance

Welcome to the comprehensive guide on All Insurance, a leading provider of insurance solutions tailored to meet the diverse needs of individuals and businesses. In today's complex and ever-evolving world, navigating the insurance landscape can be daunting. That's where All Insurance steps in, offering a wide range of coverage options to ensure you and your assets are protected. This article aims to delve deep into the world of All Insurance, exploring its services, benefits, and impact on policyholders.

Understanding All Insurance: A Comprehensive Overview

All Insurance is an established insurance company with a rich history spanning over three decades. Founded on the principles of integrity, innovation, and customer satisfaction, the company has grown to become a trusted partner for millions of clients worldwide. With a strong focus on personalized service and cutting-edge technology, All Insurance offers a seamless and efficient insurance experience.

The company's mission is straightforward: to empower individuals and businesses with the confidence that comes from comprehensive insurance coverage. By understanding the unique needs of each client, All Insurance provides tailored solutions that go beyond basic protection, offering peace of mind and financial security.

The All Insurance Portfolio: A Diverse Range of Coverage

One of the standout features of All Insurance is its extensive product portfolio. The company offers a comprehensive suite of insurance policies designed to cater to a wide range of requirements. From auto insurance to homeowners’ coverage, life insurance, and business insurance, All Insurance has a policy for every stage of life and every aspect of business.

Let's take a closer look at some of the key insurance offerings:

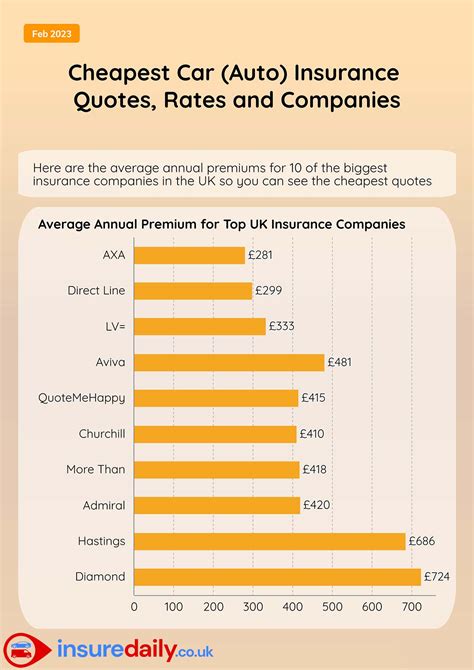

- Auto Insurance: All Insurance provides customizable auto insurance plans, offering protection against accidents, theft, and other unforeseen events. With competitive rates and flexible payment options, policyholders can rest assured knowing their vehicles are protected.

- Homeowners' Insurance: This coverage is designed to safeguard your home and its contents. All Insurance offers various policies, covering everything from natural disasters to theft and vandalism, ensuring your most valuable asset is protected.

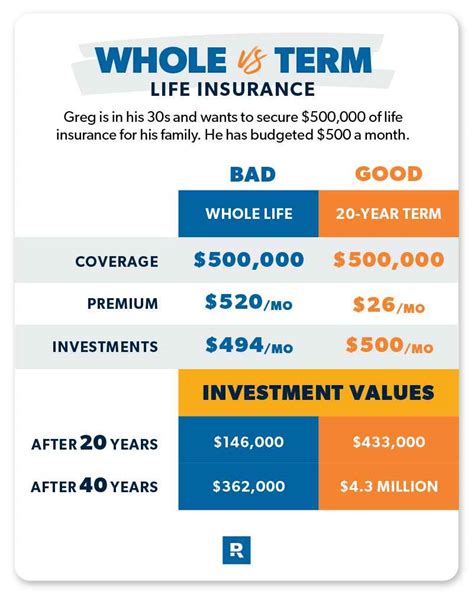

- Life Insurance: A crucial aspect of financial planning, life insurance from All Insurance provides a safety net for your loved ones. With a range of term and whole life policies, clients can choose coverage that aligns with their goals and budget.

- Business Insurance: All Insurance understands the unique risks faced by businesses. Their business insurance policies offer comprehensive coverage, including liability, property, and workers' compensation insurance, to help businesses thrive and mitigate potential losses.

In addition to these core offerings, All Insurance also provides specialized coverage for unique situations, such as travel insurance, pet insurance, and umbrella insurance, ensuring that no stone is left unturned when it comes to protecting what matters most.

The All Insurance Advantage: Going Beyond Basic Coverage

What sets All Insurance apart from its competitors is its commitment to delivering exceptional value to its policyholders. Here are some key advantages that make All Insurance a preferred choice:

- Personalized Service: All Insurance believes in building long-lasting relationships with its clients. Their team of dedicated insurance professionals takes the time to understand each client's unique needs, offering tailored advice and customized solutions.

- Competitive Rates: The company prides itself on offering competitive pricing without compromising on quality. By leveraging its extensive network and expertise, All Insurance secures the best rates for its policyholders, ensuring maximum value for their investment.

- Innovative Technology: Embracing the latest advancements, All Insurance utilizes cutting-edge technology to streamline the insurance process. From online policy management to mobile apps, clients can access their insurance information and make adjustments conveniently and securely.

- Claims Handling: In the event of a claim, All Insurance's efficient and empathetic claims process ensures a smooth and stress-free experience. With a dedicated claims team, policyholders can rest assured that their claims will be handled promptly and fairly.

- Educational Resources: All Insurance understands the importance of insurance literacy. The company provides a wealth of educational resources, including articles, guides, and webinars, to help clients make informed decisions and maximize the benefits of their insurance policies.

By combining personalized service, competitive rates, and innovative technology, All Insurance delivers an exceptional insurance experience that goes beyond basic coverage.

All Insurance’s Impact: Protecting What Matters Most

The impact of All Insurance extends far beyond the company’s bottom line. By providing comprehensive insurance coverage, the company empowers individuals and businesses to protect their most valuable assets and plan for a secure future.

For individuals, All Insurance's policies offer financial security and peace of mind. Whether it's protecting their homes, vehicles, or providing for their loved ones, policyholders can rest assured knowing they have the necessary coverage in place. Life's unexpected events become more manageable with the support of All Insurance's comprehensive plans.

Businesses, too, benefit greatly from All Insurance's expertise. With comprehensive business insurance, companies can focus on growth and innovation, knowing they are protected against potential risks. From liability claims to property damage, All Insurance's policies provide the stability and security businesses need to thrive.

Case Studies: Real-World Success Stories

To illustrate the impact of All Insurance’s services, let’s explore a couple of real-world case studies:

Case Study 1: Protecting Your Home and Family

Meet the Jones family, who recently experienced a severe storm that caused significant damage to their home. Thanks to their All Insurance homeowners’ policy, they were able to file a claim and receive the necessary funds to repair the damage. The process was seamless, and the Jones family was impressed by the quick response and support they received from the All Insurance team.

With their home restored and their family protected, the Joneses can now focus on rebuilding and creating new memories in their beloved home.

Case Study 2: Business Resilience and Growth

Imagine a small business owner, Ms. Smith, who relied on All Insurance’s business insurance to protect her thriving retail store. One day, an unfortunate incident led to a fire that damaged her property. However, with All Insurance’s comprehensive coverage, Ms. Smith was able to quickly recover and reopen her store.

The efficient claims process and support from All Insurance allowed Ms. Smith to minimize downtime and get back to serving her customers. This experience not only reinforced her trust in All Insurance but also highlighted the importance of comprehensive business insurance in ensuring business continuity.

The Future of All Insurance: Embracing Innovation and Growth

As the insurance industry continues to evolve, All Insurance remains committed to staying at the forefront of innovation. The company is dedicated to leveraging technology and industry insights to enhance its services and meet the evolving needs of its clients.

Looking ahead, All Insurance plans to:

- Expand its product offerings to cater to emerging trends and changing consumer needs.

- Invest in research and development to stay ahead of industry advancements and offer cutting-edge solutions.

- Strengthen its digital presence and enhance its online platforms to provide even more convenient and accessible services.

- Foster a culture of continuous learning and development among its employees, ensuring they remain knowledgeable and equipped to deliver exceptional service.

By embracing these initiatives, All Insurance aims to solidify its position as a leading insurance provider, delivering innovative solutions and exceptional value to its policyholders.

Conclusion: The All Insurance Difference

In a competitive insurance landscape, All Insurance stands out as a trusted partner, offering a comprehensive suite of insurance policies tailored to meet individual and business needs. With a focus on personalized service, competitive rates, and innovative technology, All Insurance delivers an exceptional insurance experience.

Whether you're an individual looking to protect your assets or a business aiming to mitigate risks, All Insurance is here to guide you every step of the way. With their expertise and commitment to customer satisfaction, All Insurance empowers you to navigate life's uncertainties with confidence and peace of mind.

FAQ

How can I get a quote for All Insurance’s policies?

+

Obtaining a quote from All Insurance is simple and convenient. You can start by visiting their official website and using their online quote tool. Alternatively, you can reach out to their customer service team via phone or email, and a dedicated representative will assist you in getting a personalized quote based on your specific needs.

What sets All Insurance apart from other insurance providers?

+

All Insurance distinguishes itself through its commitment to personalized service, competitive rates, and a diverse range of insurance policies. The company’s focus on understanding individual needs and delivering tailored solutions sets it apart, ensuring clients receive the right coverage at the best value.

Can I customize my insurance policy with All Insurance?

+

Absolutely! All Insurance believes in offering flexible and customizable insurance solutions. Whether you’re an individual or a business owner, you can work with their team of experts to create a policy that aligns with your specific requirements, ensuring you receive the coverage you need without unnecessary add-ons.

How does All Insurance handle claims?

+

All Insurance takes a proactive and empathetic approach to claims handling. Their dedicated claims team works diligently to process claims promptly and fairly. With a focus on customer satisfaction, All Insurance aims to make the claims process as smooth and stress-free as possible, providing support and guidance every step of the way.

What educational resources does All Insurance provide?

+

All Insurance understands the importance of insurance literacy. To empower their clients, they offer a range of educational resources, including informative articles, easy-to-understand guides, and interactive webinars. These resources cover various insurance topics, helping clients make informed decisions and maximize the benefits of their policies.