What Is The Premium Of Insurance

In the realm of financial planning and risk management, insurance plays a pivotal role, offering protection and peace of mind against various uncertainties. The concept of insurance premiums is fundamental to understanding how this system functions. This article aims to delve into the intricate details of insurance premiums, exploring their purpose, calculation, and significance in the broader context of insurance policies.

Understanding Insurance Premiums

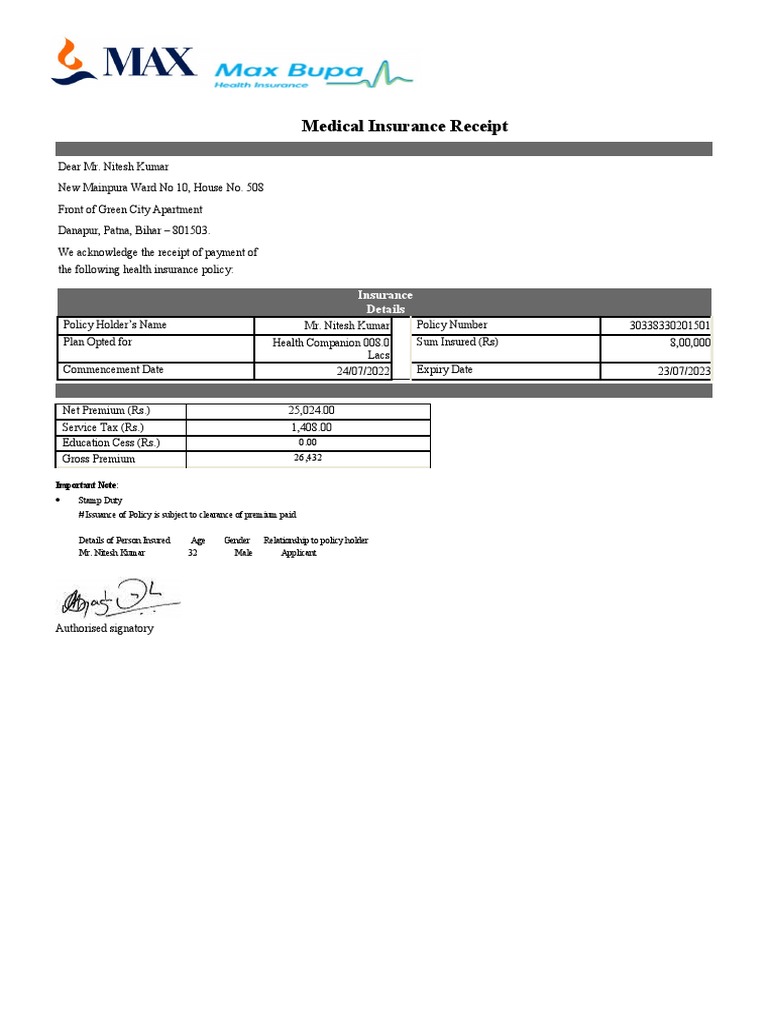

At its core, an insurance premium represents the monetary amount that an individual or entity pays to an insurance company for a specific period to secure coverage against potential risks. This payment acts as a contract between the insured and the insurer, guaranteeing financial support in the event of an insured loss or claim.

The premium serves as the foundation of the insurance relationship, and its calculation is a nuanced process, influenced by various factors. Understanding these factors provides insight into how insurance companies assess risk and determine the cost of coverage.

Factors Influencing Premium Calculation

Insurance premiums are not uniform across policies or individuals. They are tailored to reflect the specific risks and circumstances of each insured party. Here are some key factors that insurance companies consider when determining premiums:

Risk Assessment

The primary determinant of insurance premiums is the level of risk associated with the insured. This assessment involves evaluating the likelihood and potential impact of various events or losses. For instance, a driver with a history of accidents may face higher auto insurance premiums due to the increased risk of claims.

Coverage Amount

The amount of coverage desired by the insured also influences the premium. Higher coverage limits typically result in higher premiums, as the insurer assumes more financial responsibility.

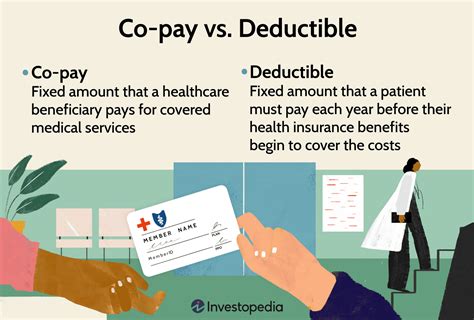

Deductibles and Co-Payments

The insured’s choice of deductibles and co-payments can impact the premium. Higher deductibles often lead to lower premiums, as the insured assumes more financial risk upfront. Conversely, lower deductibles may result in higher premiums.

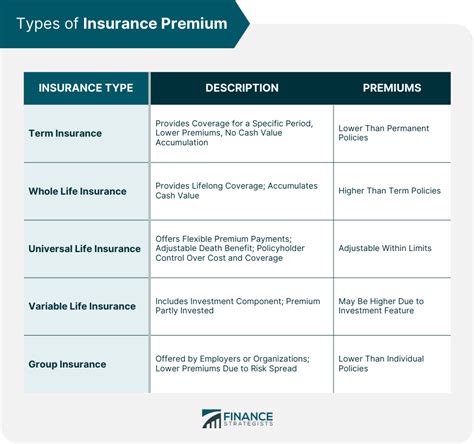

Policy Type and Coverage Type

Different types of insurance policies, such as life, health, property, or liability, have distinct premium structures. Within these categories, the specific coverage type (e.g., comprehensive, collision, or liability-only auto insurance) can also affect the premium.

Location and Geographical Factors

Geographical location plays a significant role in premium calculation. Regions with higher rates of natural disasters, crime, or accidents may experience higher insurance costs. For example, homeowners in areas prone to hurricanes may face higher premiums due to the increased risk of property damage.

Personal Factors

In certain types of insurance, personal characteristics and behaviors can influence premiums. For health insurance, factors like age, gender, and health status are considered. Lifestyle choices, such as smoking or engaging in high-risk activities, can also impact premiums.

Historical Claims Data

Insurance companies analyze historical claims data to assess the likelihood of future claims. If an insured party has a history of frequent or costly claims, their premiums may be adjusted accordingly.

| Factor | Impact on Premium |

|---|---|

| Risk Assessment | Higher Risk = Higher Premium |

| Coverage Amount | Higher Coverage = Higher Premium |

| Deductibles and Co-Payments | Higher Deductibles = Lower Premium |

| Policy and Coverage Type | Varies by Policy and Coverage |

| Location and Geographical Factors | Higher Risk Areas = Higher Premium |

| Personal Factors | Varies by Insurance Type (e.g., Health, Auto) |

| Historical Claims Data | Frequent Claims = Higher Premium |

The Role of Premiums in Insurance

Insurance premiums are more than just a monetary transaction; they represent a vital aspect of the insurance ecosystem. Here’s how premiums contribute to the overall insurance process:

Risk Transfer

The primary purpose of insurance is to transfer risk from individuals or entities to the insurance company. By paying premiums, policyholders effectively shift the financial burden of potential losses to the insurer.

Risk Pooling

Insurance companies pool premiums from a large number of policyholders. This pooling mechanism spreads the risk across a diverse group, ensuring that funds are available to cover losses when they occur. It’s a collective effort to manage risk effectively.

Cost of Coverage

Premiums cover the cost of providing insurance coverage. This includes administrative expenses, claim settlements, and the insurer’s profit margin. Insurance companies must carefully balance their premiums to ensure they can cover expenses and remain financially solvent.

Incentivizing Safe Behavior

Premiums can also serve as an incentive for policyholders to adopt safer behaviors. For example, auto insurance companies may offer discounts to drivers who maintain a clean driving record or install safety features in their vehicles.

Access to Financial Protection

Insurance premiums provide policyholders with access to financial protection and peace of mind. In the event of a covered loss, the insurance company steps in to provide compensation, helping individuals and businesses recover from unexpected events.

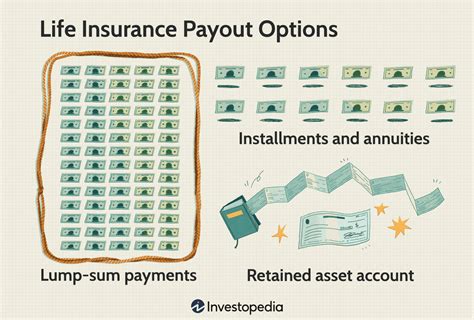

Premium Payment Options and Flexibility

Insurance companies offer various payment options to accommodate the financial needs of their policyholders. These options include:

- Monthly Payments: Many insurers allow policyholders to pay their premiums in monthly installments, making insurance more accessible and manageable.

- Annual or Semi-Annual Payments: Some policyholders prefer to pay their premiums in full for the entire policy period, often at a discounted rate.

- Payment Plans: Insurers may offer customized payment plans to suit individual financial circumstances.

Conclusion: The Premium’s Impact

Insurance premiums are a cornerstone of the insurance industry, playing a pivotal role in risk management and financial protection. Understanding how premiums are calculated and their significance empowers individuals to make informed decisions about their insurance coverage. By considering the various factors that influence premiums, policyholders can choose policies that align with their needs and budgets, ensuring they are adequately protected against life’s uncertainties.

How do insurance companies determine premiums for different policyholders?

+Insurance companies use a combination of risk assessment factors, including historical claims data, personal characteristics, and coverage needs, to calculate premiums. This process ensures that premiums are fair and reflect the actual risk posed by each policyholder.

Can premiums change over time for existing policyholders?

+Yes, premiums can change based on various factors. Insurance companies may adjust premiums annually or upon policy renewal to reflect changes in risk, claims data, or coverage needs. Policyholders should review their policies regularly to understand any potential changes.

Are there ways to lower insurance premiums?

+Policyholders can explore options to reduce their premiums, such as increasing deductibles, maintaining a clean claims history, and taking advantage of discounts for safe behavior or multiple policy coverage. Shopping around for different insurance providers can also lead to more competitive rates.