Aflac Dental Insurance Coverage

Aflac, a well-known name in the insurance industry, has expanded its portfolio to offer comprehensive dental insurance plans. Aflac Dental Insurance aims to provide individuals and families with accessible and affordable dental care, covering a wide range of services to promote good oral health. This article delves into the details of Aflac's dental insurance coverage, exploring its features, benefits, and how it can help individuals maintain their dental health.

Understanding Aflac Dental Insurance Plans

Aflac Dental Insurance offers a variety of plans designed to cater to different needs and budgets. These plans typically fall into two main categories: Indemnity Plans and Discount Plans.

Indemnity Plans

Aflac’s indemnity dental plans are traditional insurance policies that reimburse policyholders for a percentage of their dental expenses. These plans offer a more comprehensive coverage option and are suitable for individuals who anticipate regular and extensive dental care needs. Here’s a breakdown of the key features of Aflac’s indemnity plans:

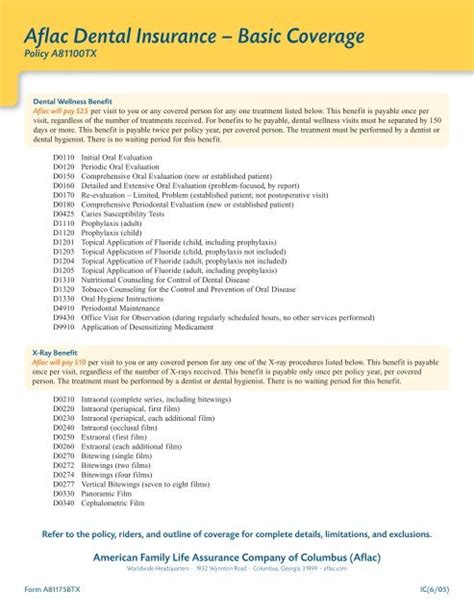

- Coverage for Basic Procedures: Indemnity plans cover routine dental services such as cleanings, check-ups, and x-rays. These are essential for maintaining good oral hygiene and catching potential issues early on.

- Major Procedure Coverage: In addition to basic procedures, these plans also cover more complex and costly treatments like root canals, dental crowns, and bridges. This ensures that policyholders have access to necessary restorative dental care.

- Orthodontic Coverage: Some Aflac indemnity plans include coverage for orthodontic treatments, including braces and Invisalign. This is a significant benefit for individuals seeking to improve their dental alignment and overall smile.

- Annual Maximums and Deductibles: Like most insurance plans, Aflac’s indemnity policies have annual maximum coverage limits and deductibles. The specific amounts can vary based on the chosen plan and the individual’s needs.

- Network Providers: Indemnity plans often have a network of preferred dental providers. Policyholders may receive higher reimbursement rates when visiting these in-network dentists. Out-of-network care is typically covered at a lower rate.

Discount Plans

Aflac’s discount dental plans offer an alternative to traditional insurance. Instead of reimbursing policyholders for their expenses, these plans provide discounted rates on dental services. Here’s an overview of the key aspects of Aflac’s discount plans:

- Fixed Discounts: With discount plans, policyholders pay a set fee for the plan, and in return, they receive discounted rates on a wide range of dental procedures. These discounts can range from 15% to 50% off the regular cost of services.

- No Annual Limits: Unlike indemnity plans, discount plans do not have annual maximums or deductibles. This means that policyholders can continue to receive discounts on dental care without reaching a coverage limit.

- No Claims Process: One of the main advantages of discount plans is their simplicity. Policyholders do not need to submit claims or wait for reimbursement. They simply present their plan membership card to the participating dentist and pay the discounted rate.

- Broad Network: Aflac’s discount plans have an extensive network of participating dentists, ensuring that policyholders have a wide range of options for their dental care.

Benefits of Aflac Dental Insurance

Aflac Dental Insurance offers several advantages to individuals seeking to maintain their oral health and manage their dental care expenses effectively.

1. Comprehensive Coverage

Aflac’s indemnity plans provide comprehensive coverage for a wide range of dental services. From routine check-ups and cleanings to major procedures and orthodontic treatments, policyholders can access the care they need without worrying about excessive out-of-pocket expenses.

2. Affordable Premiums

Aflac is known for offering competitive premiums for its dental insurance plans. Whether it’s an indemnity or discount plan, policyholders can choose a plan that fits their budget without compromising on essential dental care.

3. Flexibility

Aflac offers a variety of plan options, allowing individuals to tailor their coverage to their specific needs. Whether it’s prioritizing routine care or seeking extensive coverage for more complex treatments, Aflac’s plans provide the flexibility to choose the right fit.

4. Network of Dentists

Both indemnity and discount plans have access to a broad network of participating dentists. This ensures that policyholders have convenient access to high-quality dental care without having to travel far or compromise on their choice of providers.

5. Preventive Care Emphasis

Aflac’s plans place a strong emphasis on preventive dental care. By covering routine check-ups, cleanings, and x-rays, the plans encourage policyholders to maintain good oral hygiene and detect potential issues early on, potentially saving them from more costly treatments down the line.

Performance Analysis and Customer Satisfaction

Aflac’s dental insurance plans have received positive feedback from customers. Policyholders appreciate the comprehensive coverage, especially for major procedures and orthodontic treatments, which can be costly without insurance. The affordability of premiums and the flexibility to choose from a range of plans are also highly regarded features.

The network of participating dentists is another significant advantage, ensuring that policyholders have easy access to quality dental care. Additionally, the emphasis on preventive care aligns with the goal of maintaining good oral health and preventing more serious dental issues.

While some policyholders have noted that the indemnity plans' annual maximums and deductibles can be limiting, the discount plans offer an appealing alternative with their straightforward, no-claims process and unlimited discounts.

| Plan Type | Key Benefits |

|---|---|

| Indemnity Plans | Comprehensive coverage, including major procedures and orthodontics; network of preferred providers; annual maximums and deductibles. |

| Discount Plans | Fixed discounts on a wide range of procedures; no annual limits or claims process; broad network of participating dentists. |

Future Implications and Industry Insights

Aflac’s expansion into the dental insurance market is a strategic move that aligns with the growing awareness of the importance of oral health. With a focus on both preventive care and comprehensive coverage, Aflac is well-positioned to meet the needs of individuals seeking accessible and affordable dental insurance.

As the dental insurance market continues to evolve, Aflac's plans are likely to adapt and innovate to stay competitive. This may include further enhancements to their network of providers, additional coverage options, and potentially even more affordable premiums to attract a wider range of policyholders.

Furthermore, with the increasing popularity of discount plans, Aflac's offering in this space could see significant growth. The simplicity and affordability of these plans make them an attractive option for individuals who may not require extensive coverage but still want access to discounted dental services.

In conclusion, Aflac's dental insurance plans provide a comprehensive and affordable solution for individuals seeking to maintain their oral health. With a range of plan options and a focus on preventive care, Aflac is well-equipped to meet the diverse needs of its policyholders. As the industry continues to evolve, Aflac's dental insurance is poised to play a significant role in shaping the future of oral healthcare accessibility and affordability.

What is the difference between Aflac’s Indemnity and Discount Dental Plans?

+Indemnity plans reimburse policyholders for a percentage of their dental expenses, while discount plans provide fixed discounts on a wide range of dental procedures. Indemnity plans have annual maximums and deductibles, while discount plans offer unlimited discounts without any claims process.

How do I choose the right Aflac Dental Insurance Plan for me?

+Consider your current and future dental care needs. If you anticipate regular dental visits and potential major procedures, an indemnity plan may be more suitable. If you prioritize affordability and simplicity, a discount plan could be a better fit. It’s also important to review the network of participating dentists to ensure convenient access to care.

Does Aflac Dental Insurance cover cosmetic dentistry procedures?

+Coverage for cosmetic dentistry procedures can vary depending on the plan. Some indemnity plans may cover certain cosmetic procedures, but it’s essential to review the specific plan details to understand the extent of coverage. Discount plans typically do not cover purely cosmetic procedures.