General Liability Insurance For Small Businesses

In the world of small business ownership, navigating the complex landscape of insurance coverage is crucial. One of the most fundamental types of insurance that every small business should consider is General Liability Insurance. This type of coverage acts as a safety net, protecting businesses from various risks and potential liabilities that could arise during their day-to-day operations. In this comprehensive guide, we will delve into the intricacies of General Liability Insurance, exploring its significance, coverage details, and how it can be a vital asset for small businesses.

Understanding General Liability Insurance

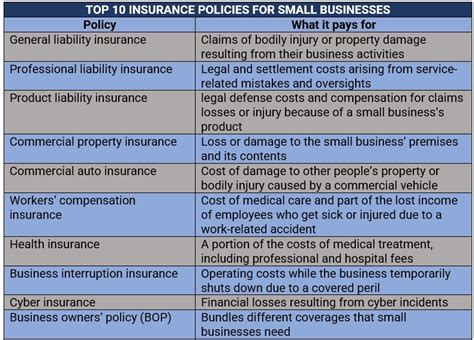

General Liability Insurance, often referred to as Commercial General Liability (CGL) Insurance, is a cornerstone of business insurance. It is designed to provide coverage for a wide range of common risks and liabilities that small businesses may encounter. These risks can include property damage, bodily injury, personal and advertising injury, and even certain types of legal defense costs.

Imagine a small café owner, Sarah, who takes immense pride in creating a cozy atmosphere for her customers. However, one day, an accident occurs when a customer trips over a loose rug and sustains an injury. In such a scenario, General Liability Insurance would step in to cover the costs associated with the customer's medical expenses and any potential legal fees if a lawsuit arises. This example highlights the critical role of General Liability Insurance in protecting small businesses from unforeseen circumstances.

Key Coverage Components

Property Damage and Bodily Injury

One of the primary aspects of General Liability Insurance is its coverage for property damage and bodily injury claims. This means that if a customer, client, or even a passerby is injured on your business premises or due to your products or services, the insurance policy will step in to provide financial protection.

Consider a hypothetical scenario where a delivery driver for a local bakery accidentally spills hot coffee on a customer during a delivery. The customer sustains burns and requires medical attention. In this case, General Liability Insurance would cover the medical expenses and any legal fees associated with the incident, offering a vital layer of protection for the bakery's operations.

Personal and Advertising Injury

General Liability Insurance also extends its coverage to personal and advertising injury claims. These claims typically involve issues such as copyright infringement, defamation, false advertising, or invasion of privacy. While these may seem less tangible than physical injuries, they can still have significant financial implications for small businesses.

For instance, a small tech startup creates an ad campaign featuring a catchy slogan. However, they later discover that the slogan is too similar to a registered trademark, leading to a lawsuit for trademark infringement. General Liability Insurance would cover the legal costs and any potential damages awarded in such a case, mitigating the financial burden on the startup.

Legal Defense Costs

A unique aspect of General Liability Insurance is its provision for legal defense costs. When a claim is made against your business, the insurance company will provide legal representation to defend your interests. This coverage ensures that small businesses have access to skilled legal professionals, even if they cannot afford substantial legal fees on their own.

In the event of a lawsuit, the insurance company's legal team will work diligently to protect your business's reputation and interests. This support is invaluable, as it allows business owners to focus on their core operations while knowing that their legal defense is in capable hands.

Customizing Coverage for Your Business

General Liability Insurance policies can be tailored to meet the specific needs of your small business. Insurance providers offer various coverage limits and additional endorsements to address unique risks. For instance, if your business involves working with vulnerable populations or specialized equipment, you can add endorsements to enhance your protection.

A construction company, for example, might opt for an endorsement that provides coverage for equipment rental, ensuring that if rented equipment is damaged, the insurance policy covers the costs. This customization allows businesses to create a comprehensive insurance plan that aligns with their specific operations and potential liabilities.

The Importance of Adequate Coverage

When selecting General Liability Insurance, it is crucial to choose coverage limits that are appropriate for your business. The last thing you want is to discover that your policy falls short when a significant claim arises. Insurance experts recommend assessing your business’s potential risks and selecting coverage limits that provide ample protection.

Consider a small retail store that sells various products. If a customer suffers an injury due to a defective product, the potential liability could be substantial. By opting for higher coverage limits, the store owner ensures that they have the financial resources to handle such situations effectively, protecting both their business and their customers.

Real-World Examples of General Liability Claims

To illustrate the practical application of General Liability Insurance, let’s explore a few real-world scenarios:

- A small bakery is sued for food poisoning after several customers become ill. General Liability Insurance covers the medical expenses and legal costs associated with the lawsuit.

- A local landscaping business damages a client's property while trimming trees. The insurance policy pays for the repairs and any additional expenses incurred.

- A tech company is accused of using copyrighted material in its marketing materials. General Liability Insurance steps in to cover the legal fees and any damages awarded.

Peace of Mind for Small Business Owners

General Liability Insurance is not just a legal requirement in many industries; it is a critical component of risk management for small businesses. By obtaining this coverage, business owners can focus on their core competencies and growth strategies without constant worry about unforeseen liabilities.

Consider the case of a small startup in the e-commerce space. With General Liability Insurance in place, the founders can dedicate their time and energy to developing innovative products and expanding their online presence, knowing that their business is protected from various risks that may arise in the course of their operations.

Conclusion

In the dynamic world of small business ownership, General Liability Insurance serves as a crucial safety net, providing protection against a wide range of liabilities and risks. From property damage and bodily injury claims to personal and advertising injury suits, this insurance policy offers a comprehensive defense for small businesses. By customizing coverage and selecting adequate limits, business owners can ensure they have the necessary protection in place to navigate the unpredictable landscape of business operations.

As we've explored through real-world examples and practical insights, General Liability Insurance is not just a financial safeguard; it is a cornerstone of responsible business management. With this coverage in place, small businesses can thrive, innovate, and grow, knowing that they have the support they need to weather any unexpected storms that may arise.

How much does General Liability Insurance typically cost for small businesses?

+The cost of General Liability Insurance can vary widely based on factors such as the nature of your business, its size, and the level of coverage you require. On average, small businesses can expect to pay anywhere from 300 to 1,000 annually for a basic policy. However, it’s essential to obtain quotes from multiple insurers to find the most competitive rates for your specific needs.

Are there any situations where General Liability Insurance may not be sufficient for my business?

+While General Liability Insurance provides broad coverage, it may not be enough for businesses with highly specialized risks or unique liabilities. In such cases, additional insurance policies, such as Professional Liability Insurance or Product Liability Insurance, may be necessary. It’s always advisable to consult with an insurance professional to ensure you have the right coverage for your specific business needs.

What should I consider when choosing a General Liability Insurance provider?

+When selecting a General Liability Insurance provider, it’s crucial to consider factors such as their financial stability, reputation, and customer service. Look for insurers with a solid track record of paying claims promptly and efficiently. Additionally, consider the level of customization they offer to tailor the policy to your business’s specific needs. Online reviews and recommendations from other business owners can also be valuable in making an informed decision.