Affordable Medical Insurance Plans For Individuals

Affordable Medical Insurance Plans: Navigating Options for Individual Coverage

Securing affordable health insurance is a paramount concern for many individuals, especially those navigating the complex landscape of medical coverage options. This comprehensive guide aims to shed light on the intricacies of affordable medical insurance plans, providing a roadmap for individuals to make informed choices that align with their unique healthcare needs and financial capabilities.

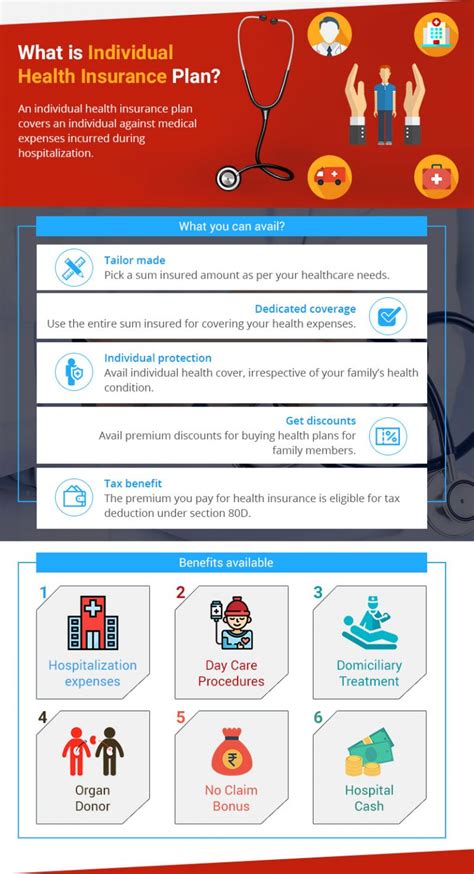

Understanding the Spectrum of Medical Insurance Plans

The market for medical insurance is diverse, offering a spectrum of plans tailored to cater to different demographics and healthcare requirements. From comprehensive health maintenance organization (HMO) plans to flexible preferred provider organization (PPO) options, each plan type presents a unique set of benefits, limitations, and cost structures. Understanding these distinctions is pivotal for individuals seeking to identify the plan that optimally meets their specific needs.

Health Maintenance Organization (HMO) Plans

HMOs are known for their cost-effectiveness and comprehensive coverage. These plans typically require members to select a primary care physician (PCP) who coordinates all healthcare services, including referrals to specialists. While HMOs may have a more restrictive network of providers, they often offer lower out-of-pocket costs and are ideal for individuals who prioritize affordability and preventative care.

| HMO Key Features | Details |

|---|---|

| Primary Care Physician (PCP) | Members choose a PCP who coordinates their care. |

| Network Restrictions | HMOs often have a narrower network of providers, but services outside the network may incur higher costs. |

| Lower Out-of-Pocket Costs | HMOs typically offer lower deductibles and copayments, making them more affordable for routine care. |

| Focus on Preventative Care | HMOs emphasize regular check-ups and preventative services, encouraging members to stay on top of their health. |

Preferred Provider Organization (PPO) Plans

PPOs offer greater flexibility in provider choice compared to HMOs. Members can visit in-network providers without a referral and may also seek care from out-of-network providers, albeit at a higher cost. PPOs are ideal for individuals who value the freedom to choose their healthcare providers and are willing to pay a premium for this flexibility.

| PPO Key Features | Details |

|---|---|

| Provider Flexibility | Members can choose from a wide network of in-network providers and have the option to visit out-of-network providers as well. |

| No Referrals Needed | PPO members can directly access specialists without a referral from their primary care physician. |

| Cost Structure | PPOs often have higher premiums and out-of-pocket costs but provide more flexibility in provider choice. |

| Travel Benefits | Some PPO plans offer coverage for out-of-town visits, which can be beneficial for individuals who travel frequently. |

Factors Influencing Affordability

The affordability of medical insurance plans is influenced by a multitude of factors, including individual health status, age, geographic location, and the chosen level of coverage. Understanding these variables is essential for individuals to make cost-effective decisions.

Health Status and Age

Individuals with pre-existing health conditions or those who anticipate significant medical needs may opt for plans with higher premiums but lower out-of-pocket costs. Conversely, younger and healthier individuals might consider catastrophic health plans, which offer lower premiums but higher deductibles, providing coverage primarily for unexpected major medical events.

Geographic Location

The cost of medical insurance can vary significantly based on regional healthcare market dynamics. Urban areas often have higher healthcare costs, while rural areas may offer more affordable options. Understanding the healthcare landscape in one’s region is crucial for making informed choices.

Level of Coverage

Medical insurance plans come with varying coverage levels, impacting both premiums and out-of-pocket costs. Plans with broader coverage and lower deductibles typically have higher premiums, whereas plans with limited coverage and higher deductibles may be more affordable but leave individuals vulnerable to higher costs for unexpected medical needs.

Navigating the Enrollment Process

The enrollment process for medical insurance plans can be complex, particularly for individuals unfamiliar with the healthcare industry. Fortunately, numerous resources are available to guide individuals through this process, ensuring they secure the coverage that best suits their needs.

Open Enrollment Periods

Most medical insurance plans have designated open enrollment periods, typically occurring annually. During these periods, individuals can enroll in a new plan, switch plans, or make changes to their existing coverage. It’s crucial to be aware of these timelines to avoid missing out on opportunities to optimize one’s insurance coverage.

Special Enrollment Periods

In addition to open enrollment periods, some plans offer special enrollment periods triggered by specific life events, such as marriage, divorce, birth of a child, or loss of existing coverage. These special enrollment periods allow individuals to make changes to their insurance coverage outside of the regular open enrollment window.

Assistance and Resources

Navigating the healthcare system and selecting the right insurance plan can be daunting. Fortunately, a wealth of resources and assistance programs are available to guide individuals through this process. These include online healthcare marketplaces, insurance brokers, and community health centers, all of which provide valuable information and support to ensure individuals make informed decisions.

Maximizing Benefits and Cost Savings

Securing an affordable medical insurance plan is just the first step. To truly optimize one’s healthcare coverage, individuals must actively engage with their insurance benefits and explore strategies to minimize costs.

Utilizing Preventative Care Services

Many medical insurance plans offer comprehensive preventative care services at little to no cost. These services, including annual check-ups, vaccinations, and screenings, are designed to help individuals stay healthy and catch potential health issues early on. By taking advantage of these services, individuals can maintain their well-being and potentially avoid more costly medical interventions down the line.

Understanding Cost-Sharing Arrangements

Medical insurance plans often involve cost-sharing arrangements, such as deductibles, copayments, and coinsurance. Understanding these cost structures is essential for individuals to make informed decisions about their healthcare. For instance, individuals may opt to pay a higher premium for a plan with a lower deductible, which can result in lower out-of-pocket costs for anticipated medical needs.

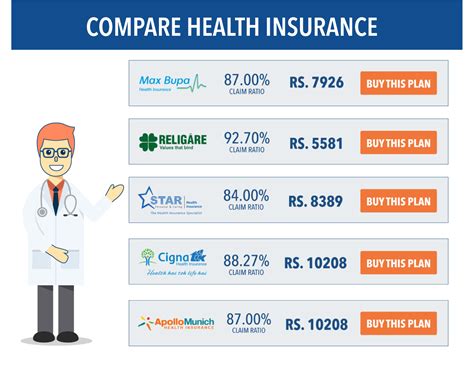

Exploring Discounts and Subsidies

Many medical insurance plans offer discounts and subsidies to make coverage more affordable. These can include employer-sponsored plans, which often come with reduced premiums, or government-subsidized plans for individuals with lower incomes. Exploring these options can significantly reduce the financial burden of medical insurance.

Future Implications and Industry Trends

The landscape of medical insurance is dynamic, with ongoing advancements and reforms shaping the industry. As we look to the future, several key trends and considerations emerge that will influence the availability and affordability of medical insurance plans.

Technological Advancements

The integration of technology into the healthcare industry is poised to revolutionize the way medical insurance operates. Telehealth services, for instance, offer convenient and cost-effective alternatives to traditional in-person care, potentially reducing the need for expensive hospital visits. Additionally, wearable health technology and digital health platforms are expected to play a significant role in preventative care and chronic disease management, improving health outcomes and reducing healthcare costs.

Policy and Regulatory Changes

Policy and regulatory changes at the federal and state levels can significantly impact the medical insurance landscape. Ongoing discussions around Medicare for All, for instance, propose a single-payer healthcare system that could dramatically alter the structure and cost of medical insurance. Similarly, state-level initiatives aimed at expanding access to affordable care, such as the Affordable Care Act (ACA) waivers, are expected to influence the availability and cost of insurance plans.

The Rise of Value-Based Care

The healthcare industry is increasingly shifting towards value-based care models, which focus on the quality and outcomes of care rather than the quantity of services provided. This shift is expected to drive down healthcare costs by incentivizing providers to deliver more efficient and effective care. As value-based care becomes more prevalent, individuals can anticipate more affordable and high-quality medical insurance plans.

What is the Affordable Care Act (ACA)?

+The Affordable Care Act (ACA), also known as Obamacare, is a federal law that aims to increase the quality and affordability of health insurance for Americans. It introduces reforms such as expanded Medicaid coverage, the creation of health insurance marketplaces, and the requirement for individuals to have health insurance or pay a penalty. The ACA has significantly impacted the availability and cost of medical insurance plans.

Can I purchase medical insurance outside of the open enrollment period?

+Yes, in certain circumstances. You may qualify for a Special Enrollment Period if you experience a qualifying life event, such as marriage, divorce, birth or adoption of a child, or loss of existing coverage. These events allow you to enroll in or change your insurance plan outside of the regular open enrollment window.

What are some tips for negotiating lower insurance premiums?

+Negotiating lower insurance premiums can be challenging, but there are strategies you can employ. One effective approach is to bundle multiple insurance policies with the same provider, such as combining health, life, and auto insurance. Additionally, maintaining a healthy lifestyle and a clean medical record can make you a lower-risk candidate, potentially leading to reduced premiums.