How Much Car Insurance Do I Need

Determining the right amount of car insurance coverage is a crucial step in ensuring you're adequately protected on the road. The amount of car insurance you need depends on various factors, including your financial situation, the value of your vehicle, state regulations, and your personal risk tolerance. This comprehensive guide will walk you through the key considerations and help you make an informed decision about your car insurance coverage.

Understanding Your Coverage Options

Car insurance policies typically offer a range of coverage types, each designed to address specific risks and financial liabilities. Here’s a breakdown of the common coverage options:

Liability Coverage

Liability insurance is a fundamental component of any car insurance policy. It protects you from financial losses if you’re found at fault in an accident. This coverage typically includes:

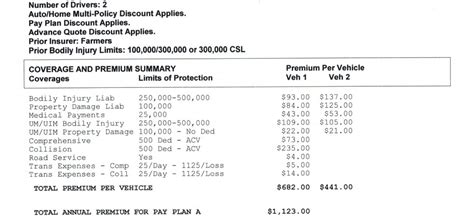

- Bodily Injury Liability: Covers medical expenses and lost wages for injured parties in an accident you caused.

- Property Damage Liability: Pays for damages to other people’s property, such as their vehicles or personal belongings, in an accident you’re responsible for.

Most states require a minimum amount of liability coverage, often referred to as the state's minimum liability limits. These limits vary by state, so it's essential to understand the specific requirements where you reside. While the state minimums provide a baseline, many experts recommend opting for higher limits to ensure more comprehensive protection.

Collision and Comprehensive Coverage

These two coverage types offer protection for your own vehicle:

- Collision Coverage: Pays for repairs or the replacement cost of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals.

Collision and comprehensive coverage are optional, but they're highly recommended, especially if your vehicle is still under a loan or lease. These coverages ensure that you're not left with the full financial burden in the event of an unexpected incident.

Additional Coverages

Beyond the basic coverages, car insurance policies may offer additional options to enhance your protection. These can include:

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance to cover the damages.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault, following an accident.

- Rental Car Coverage: Provides temporary rental vehicle coverage if your car is being repaired or is deemed a total loss.

- Gap Coverage: Bridges the gap between the actual cash value of your vehicle and the remaining balance on your loan or lease in the event of a total loss.

The availability and cost of these additional coverages vary by insurer and state. It's essential to carefully review your policy options and choose the coverages that best align with your needs and budget.

Assessing Your Insurance Needs

Determining the appropriate level of car insurance coverage involves a thoughtful evaluation of several factors. Here’s a step-by-step guide to help you assess your insurance needs:

1. Evaluate Your Financial Situation

Consider your financial stability and ability to cover potential out-of-pocket expenses. If you have significant assets or a high income, you may want to opt for higher liability limits to protect your financial well-being. On the other hand, if you have limited financial resources, you might prioritize more affordable coverage options.

2. Determine the Value of Your Vehicle

The value of your car plays a significant role in your insurance needs. If you own an older vehicle with low resale value, you might choose to forgo collision and comprehensive coverage to save on premiums. However, if you drive a newer, more expensive vehicle, these coverages become essential to protect your investment.

3. Consider State Requirements

As mentioned earlier, each state has its own minimum liability coverage requirements. It’s crucial to understand these limits and ensure you meet or exceed them. While state minimums provide a legal baseline, they may not be sufficient to cover all potential damages in an accident.

4. Assess Your Risk Profile

Evaluate your driving habits and history. If you have a clean driving record and a low-risk profile, you might feel comfortable with lower coverage limits. However, if you’ve had accidents or traffic violations in the past, opting for higher coverage limits can provide peace of mind and better protection.

5. Evaluate Your Personal Risk Tolerance

Think about how comfortable you are with the financial risks associated with driving. If you’re risk-averse, you might opt for higher coverage limits and additional endorsements to ensure comprehensive protection. On the other hand, if you’re more comfortable with taking on some risk, you might choose lower limits to keep premiums affordable.

Balancing Coverage and Cost

Finding the right balance between the coverage you need and the cost of your car insurance policy is essential. Here are some strategies to help you achieve this balance:

1. Shop Around

Get quotes from multiple insurance providers. Car insurance rates can vary significantly between companies, so shopping around can help you find the best coverage at the most competitive price.

2. Adjust Coverage Limits

Evaluate your coverage limits and consider whether you can increase or decrease them to better align with your needs. For example, you might opt for higher liability limits while reducing your collision and comprehensive deductibles to save on premiums.

3. Explore Discounts

Insurance companies often offer discounts for various factors, such as good driving records, safety features in your vehicle, bundling policies, or maintaining a certain grade point average (for students). Ask your insurer about available discounts and consider whether you’re eligible for any of them.

4. Consider Usage-Based Insurance

Some insurance providers offer usage-based insurance programs that track your driving habits and provide discounts based on safe driving behavior. These programs can be a great way to save money while incentivizing safer driving practices.

5. Review Your Policy Regularly

Your insurance needs may change over time. Regularly review your policy to ensure it still aligns with your current situation. Life events like getting married, having children, or purchasing a new vehicle can all impact your insurance requirements.

The Importance of Adequate Coverage

Having adequate car insurance coverage is not just a legal requirement; it’s a financial safeguard. Here are some key reasons why ensuring you have sufficient coverage is crucial:

1. Legal Protection

Meeting your state’s minimum liability coverage requirements is essential to avoid legal penalties. Insufficient coverage can lead to fines, license suspension, or even legal action against you if you’re involved in an accident.

2. Financial Security

Adequate coverage protects your financial well-being in the event of an accident. Without sufficient liability insurance, you could be held personally responsible for medical bills, property damage, and other expenses resulting from an accident you caused. This can lead to significant financial strain or even bankruptcy.

3. Peace of Mind

Knowing you have the right amount of car insurance coverage provides peace of mind. You can drive with confidence, knowing that you’re protected from unexpected financial burdens and that your vehicle is adequately insured against various risks.

4. Long-Term Savings

While higher coverage limits may result in slightly higher premiums, they can also save you money in the long run. By choosing sufficient coverage, you reduce the likelihood of having to pay out-of-pocket for damages or repairs, which can be far more costly than the incremental increase in your insurance premiums.

Expert Tips for Optimizing Your Coverage

To further enhance your car insurance coverage and potentially save money, consider these expert tips:

1. Bundle Policies

If you have multiple insurance needs, such as auto, home, or renters insurance, bundling these policies with the same insurer can often result in significant discounts.

2. Maintain a Clean Driving Record

A clean driving record is not only important for insurance discounts but also for keeping your premiums low. Avoid accidents and traffic violations to maintain a positive record and qualify for better rates.

3. Compare Quotes Regularly

Insurance rates can change over time, so it’s a good practice to compare quotes from different insurers every few years or whenever you renew your policy. This ensures you’re always getting the best deal for your coverage needs.

4. Understand Your Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Consider increasing your deductibles to lower your premiums, but ensure the deductible amount is manageable in case you need to make a claim.

5. Stay Informed About State Laws

Keep yourself updated on any changes to your state’s insurance laws and requirements. Being aware of these changes can help you ensure you’re always meeting the necessary coverage limits and avoiding potential penalties.

Conclusion: Tailoring Your Coverage

Determining how much car insurance you need is a personalized decision that depends on your unique circumstances. By carefully evaluating your financial situation, vehicle value, state requirements, and risk profile, you can tailor your coverage to provide the protection you need without paying for coverage you don’t require. Remember, while saving money on insurance is important, ensuring you have adequate coverage to protect yourself and others on the road is paramount.

What is the minimum car insurance coverage required by law?

+The minimum car insurance coverage required by law varies by state. It typically includes bodily injury liability and property damage liability coverage. Check your state’s specific requirements to ensure you meet the necessary limits.

How can I lower my car insurance premiums without sacrificing coverage?

+You can explore options like increasing your deductibles, taking advantage of available discounts, and maintaining a clean driving record. Additionally, comparing quotes from multiple insurers can help you find the best rates for your coverage needs.

Is it worth getting comprehensive and collision coverage for an older vehicle?

+While comprehensive and collision coverage can be beneficial for older vehicles, it’s essential to consider the vehicle’s value and your financial situation. If the cost of the coverage is more than the vehicle’s value, it might not be worth it. Assess your risk tolerance and potential financial impact to make an informed decision.