Affordable Car And Home Insurance

Insurance is an essential aspect of modern life, providing financial protection and peace of mind to individuals and families. However, finding affordable insurance coverage for your car and home can sometimes be a challenging task. In this comprehensive guide, we will delve into the world of insurance, exploring the factors that influence rates, the steps to secure the best deals, and the key considerations for ensuring adequate coverage without breaking the bank. Whether you're a seasoned homeowner or a first-time car buyer, this article will equip you with the knowledge to navigate the insurance landscape confidently and make informed decisions.

Understanding Car Insurance

Car insurance is a legal requirement in most countries and provides financial protection against potential risks associated with owning and operating a vehicle. It covers a range of scenarios, including accidents, theft, and damage to your vehicle or the property of others. The cost of car insurance can vary significantly based on several factors, and understanding these elements is crucial to finding an affordable policy.

Factors Influencing Car Insurance Rates

- Location: Insurance rates often vary by region due to differences in traffic density, crime rates, and the cost of living. Urban areas may have higher premiums due to increased accident risks and vehicle theft.

- Vehicle Type and Usage: The make, model, and age of your vehicle impact insurance costs. Sports cars and luxury vehicles generally have higher premiums due to their higher repair costs. Additionally, the purpose of the vehicle (e.g., personal, commercial) and the estimated annual mileage can affect rates.

- Driver Profile: Your driving history is a significant factor. A clean record with no accidents or violations can lead to lower premiums. Conversely, young drivers, especially males under 25, often face higher rates due to their higher risk profile.

- Coverage Levels: The level of coverage you choose affects your premium. Comprehensive coverage, which includes damage from events like fire, theft, and natural disasters, is more expensive than liability-only coverage, which only covers damage to others’ property or injuries caused by you.

- Insurance Company and Policy Features: Different insurance providers offer varying rates and policy features. Some may specialize in certain types of vehicles or driver profiles, while others may provide discounts for safety features or multiple policy bundles.

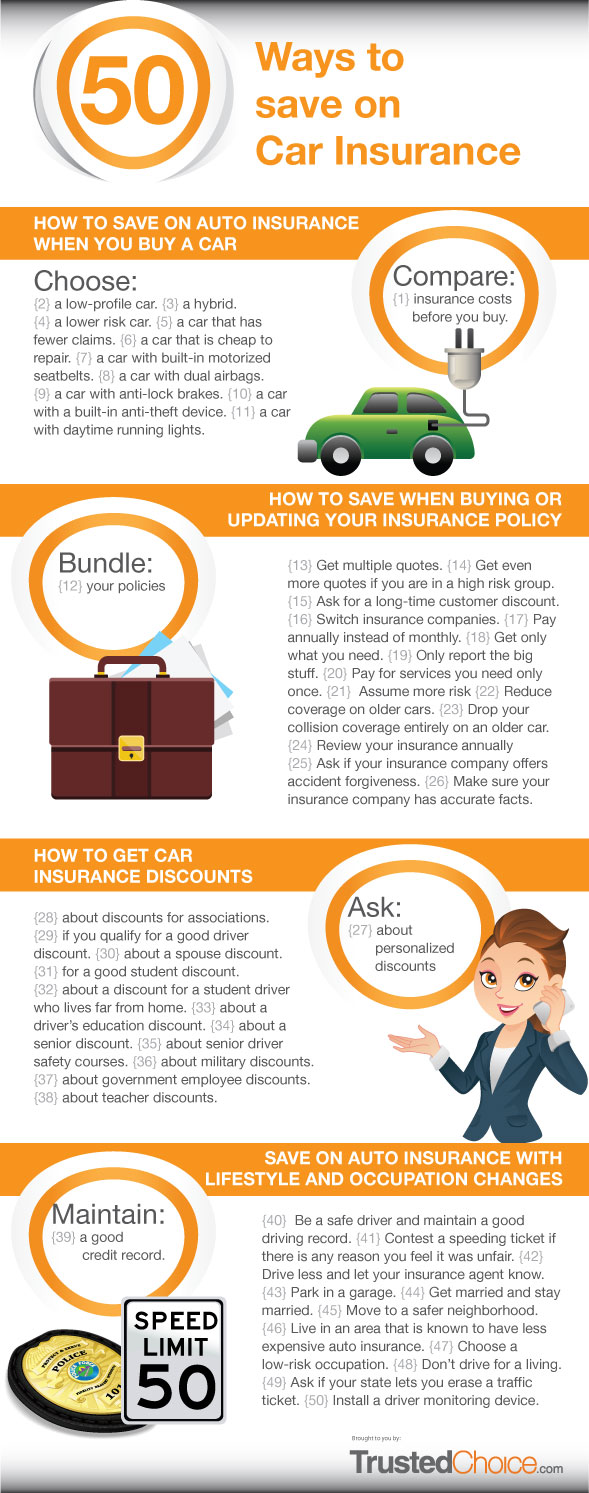

Tips for Finding Affordable Car Insurance

To secure affordable car insurance, consider the following strategies:

- Shop Around: Compare quotes from multiple insurance providers. Online comparison tools can be particularly useful for this. Remember, the cheapest option may not always offer the best value, so consider factors like customer service and policy features.

- Review Your Coverage: Regularly assess your coverage needs. If your vehicle is older or has low resale value, you may not need comprehensive coverage, which can significantly reduce your premium. Ensure your coverage levels are appropriate for your circumstances.

- Bundle Policies: If you have multiple vehicles or own a home, consider bundling your insurance policies with the same provider. Many insurers offer discounts for multiple policy holders, potentially saving you a substantial amount.

- Take Advantage of Discounts: Insurance companies often provide discounts for a range of factors, including good driving records, safety features in your vehicle, and safe driving habits (e.g., low mileage, defensive driving courses). Ask your insurer about available discounts and consider how you can qualify for them.

- Increase Your Deductible: Choosing a higher deductible (the amount you pay out of pocket before your insurance kicks in) can reduce your premium. However, this strategy should be approached with caution, as it means you’ll have to pay more in the event of a claim.

Home Insurance: Protecting Your Investment

Home insurance is a crucial aspect of safeguarding your property and belongings. It provides financial coverage for a range of scenarios, including damage to your home, theft, and liability for injuries that occur on your property. The cost of home insurance can vary widely, and several factors influence these rates.

Factors Impacting Home Insurance Rates

- Location: Similar to car insurance, home insurance rates can vary significantly by location. Areas prone to natural disasters like hurricanes, floods, or earthquakes may have higher premiums. Crime rates and the local cost of living can also impact rates.

- Home Value and Contents: The value of your home and its contents play a significant role in determining insurance rates. Higher-value homes or those with valuable possessions may require more extensive coverage, leading to higher premiums.

- Construction and Age of the Home: The type of construction and the age of your home can affect insurance costs. Older homes may have outdated electrical or plumbing systems, increasing the risk of accidents and subsequently the insurance rates. Homes built with fire-resistant materials or equipped with safety features may qualify for lower rates.

- Policy Coverage and Deductibles: The level of coverage you choose impacts your premium. Policies with broader coverage, such as those covering damage from natural disasters or providing replacement cost coverage for your belongings, tend to be more expensive. As with car insurance, selecting a higher deductible can reduce your premium.

- Claims History: Insurers consider your claims history when setting rates. Frequent claims can lead to higher premiums or even non-renewal of your policy. Maintaining a clean claims history can help keep your rates more affordable.

Strategies for Affordable Home Insurance

To find affordable home insurance, consider the following approaches:

- Compare Quotes: Obtain quotes from multiple insurers to find the best deal. Ensure you’re comparing policies with similar coverage levels to make an accurate comparison.

- Increase Your Deductible: As with car insurance, choosing a higher deductible can lower your premium. However, be mindful that this means you’ll have to pay more out of pocket in the event of a claim.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly assess your coverage to ensure it aligns with your current circumstances. If your home’s value or the value of your possessions has decreased, you may be overinsured, which can lead to unnecessary expenses.

- Consider Bundle Discounts: If you have multiple insurance policies, such as car and home insurance, bundling them with the same provider can often result in significant savings.

- Enhance Your Home’s Safety: Installing security systems, smoke detectors, and fire-resistant materials can reduce the risk of accidents and theft, potentially leading to lower insurance rates.

Performance Analysis and Future Implications

The insurance industry is dynamic, with rates and coverage options constantly evolving. Several factors contribute to these changes, including economic conditions, regulatory changes, and technological advancements. For instance, the increasing adoption of telematics in car insurance, which uses data from vehicles’ onboard computers to assess driving behavior, has the potential to revolutionize the industry by offering more personalized and affordable insurance options.

Additionally, the growing awareness of climate change and its impact on natural disasters has led to an increased focus on resilience and risk mitigation in the home insurance sector. This trend is likely to continue, with insurers offering incentives for homeowners to adopt sustainable and resilient practices.

| Insurance Type | Average Annual Premium (2023) |

|---|---|

| Car Insurance | $1,674 |

| Home Insurance | $1,312 |

In the context of car insurance, the increasing popularity of electric vehicles (EVs) and autonomous driving technologies is expected to bring about significant changes. Insurers are already offering specialized policies for EVs, recognizing the unique risks and benefits associated with this technology. As autonomous vehicles become more prevalent, the focus of car insurance may shift from driver behavior to vehicle performance and manufacturer liability.

Frequently Asked Questions

What is the difference between liability-only and comprehensive car insurance coverage?

+Liability-only coverage provides protection for damage you cause to others’ property or injuries to others in an accident. Comprehensive coverage, on the other hand, covers a broader range of scenarios, including damage to your vehicle from events like fire, theft, and natural disasters.

How does my driving record impact car insurance rates?

+A clean driving record with no accidents or violations is generally associated with lower insurance rates. Conversely, a history of accidents or traffic violations can lead to higher premiums, as it indicates a higher risk profile.

What factors contribute to the variation in home insurance rates by location?

+Home insurance rates can vary by location due to factors such as the risk of natural disasters (e.g., hurricanes, floods, earthquakes), crime rates, and the local cost of living. Areas with higher risks or a higher cost of living may have higher insurance premiums.