Affordable Care Act Health Insurance Exchange

The Affordable Care Act (ACA), often referred to as Obamacare, has revolutionized the health insurance landscape in the United States. One of its key components is the establishment of Health Insurance Exchanges, a fundamental element in the ACA's strategy to provide accessible and affordable healthcare coverage to millions of Americans. This article delves into the intricacies of the Health Insurance Exchange system, exploring its origins, structure, impact, and future implications.

The Genesis of Health Insurance Exchanges

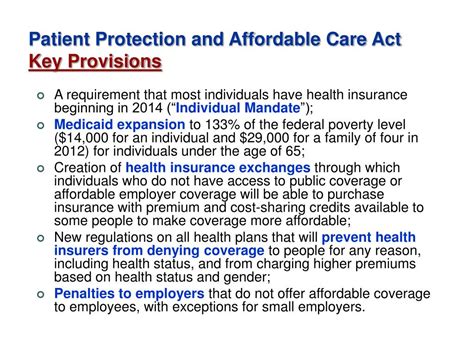

The concept of Health Insurance Exchanges was introduced as a central pillar of the Affordable Care Act, which was signed into law in 2010. The primary goal was to create a more competitive and transparent marketplace for health insurance, making it easier for individuals and small businesses to compare and purchase health plans.

Prior to the ACA, the health insurance market was often characterized by limited choices, high costs, and unequal access. Many Americans, particularly those with pre-existing conditions or low incomes, struggled to find affordable and comprehensive coverage. The ACA aimed to address these issues by introducing a set of regulations and reforms, with Health Insurance Exchanges as a key mechanism.

The ACA mandated the creation of these Exchanges, also known as Marketplaces, at both the state and federal levels. States were given the option to establish their own Exchanges or default to the federally facilitated Marketplace. This decentralized approach aimed to accommodate the diverse healthcare needs and regulatory environments of different states.

Understanding the Health Insurance Exchange System

Health Insurance Exchanges are essentially online platforms that serve as a one-stop shop for individuals and small businesses to browse, compare, and purchase health insurance plans. These Exchanges provide a user-friendly interface, allowing users to input their personal information, including age, location, and income, to receive a customized list of insurance options.

One of the critical features of the Exchanges is the implementation of income-based subsidies and tax credits. The ACA introduced a system where eligible individuals and families with moderate incomes could receive financial assistance to make their insurance premiums more affordable. This subsidy structure has been a pivotal factor in expanding coverage and making health insurance more accessible.

The Exchanges also facilitate the enrollment process by providing a centralized platform for applicants to complete and submit their applications. This streamlined approach has significantly reduced administrative burdens and made it easier for individuals to navigate the often complex world of health insurance.

Key Components of the Exchange System

- Open Enrollment Periods: Health Insurance Exchanges operate on a fixed schedule, with designated open enrollment periods. During these periods, individuals can select and enroll in health plans for the upcoming year. Outside of these windows, enrollment is typically limited to special enrollment periods triggered by qualifying life events.

- Plan Comparison Tools: The Exchanges provide robust comparison tools that allow users to evaluate different health plans based on factors such as premiums, deductibles, copayments, and provider networks. These tools empower consumers to make informed decisions about their healthcare coverage.

- Qualified Health Plans (QHPs): Only health insurance plans that meet specific standards and criteria are allowed to be offered on the Exchanges. These plans, known as Qualified Health Plans, must provide essential health benefits, follow consumer protection rules, and comply with the ACA’s regulations.

Impact and Achievements

Since their implementation, Health Insurance Exchanges have had a significant impact on the U.S. healthcare system. Here are some key achievements and impacts:

Increased Access to Healthcare

One of the most notable outcomes of the Exchanges has been the expansion of health insurance coverage. According to a study by the Kaiser Family Foundation, the number of uninsured Americans dropped significantly in the years following the implementation of the ACA. The Exchanges played a crucial role in connecting millions of previously uninsured individuals with affordable healthcare options.

The availability of income-based subsidies has been particularly beneficial for low- and middle-income households. These subsidies have made insurance premiums more manageable, reducing the financial burden of healthcare for many Americans.

Competition and Consumer Empowerment

The creation of Health Insurance Exchanges introduced a level of competition and transparency to the health insurance market. By allowing individuals to compare plans side by side, the Exchanges have empowered consumers to make choices that best fit their needs and budgets. This competitive environment has also incentivized insurance providers to offer more competitive rates and innovative plan designs.

The Exchanges have also fostered greater consumer engagement in the healthcare system. With easy access to information and comparison tools, individuals are more informed about their healthcare options and are actively involved in decision-making processes.

Data-Driven Healthcare

The data collected through the Exchanges has provided valuable insights into healthcare trends and consumer behavior. This data has been instrumental in shaping healthcare policies, identifying areas of improvement, and informing the development of new healthcare initiatives. The Exchanges have thus contributed to a more data-driven and evidence-based approach to healthcare governance.

Challenges and Future Prospects

While the Health Insurance Exchange system has achieved significant milestones, it has also faced challenges and criticisms. Some of the key considerations for the future of the Exchanges include:

Stability and Sustainability

The long-term sustainability of the Exchanges has been a topic of debate. Ensuring a stable risk pool, where healthy and unhealthy individuals are adequately represented, is crucial for the financial viability of the system. Efforts to encourage younger and healthier individuals to enroll in insurance plans through educational campaigns and outreach programs are ongoing.

Regulatory and Political Landscape

The political landscape has significantly influenced the trajectory of the Health Insurance Exchanges. Changes in administration and legislative priorities have led to policy shifts and uncertainty surrounding the future of the ACA. The Exchanges have had to adapt to these fluctuations, navigating regulatory changes and maintaining their operations despite potential policy overhauls.

Technology and Innovation

The digital nature of the Exchanges presents opportunities for technological advancements. Leveraging innovative technologies, such as artificial intelligence and machine learning, could enhance the user experience, improve data analysis, and streamline administrative processes. Continuous technological upgrades are essential to keeping the Exchanges relevant and efficient in the digital age.

Expanding Coverage and Access

Despite the progress made, there are still segments of the population that remain uninsured or underinsured. Expanding coverage further, particularly for vulnerable populations, is a critical goal for the future. This may involve exploring additional subsidy options, simplifying enrollment processes, and addressing barriers to access in underserved communities.

Table: Health Insurance Exchange Enrollment Statistics

| Year | Total Enrollment | Percentage of Uninsured Reduced |

|---|---|---|

| 2014 | 8.1 million | 3.7% |

| 2015 | 11.7 million | 5.1% |

| 2016 | 12.2 million | 5.3% |

| 2017 | 11.8 million | 4.9% |

| 2018 | 11.4 million | 4.6% |

What is the role of Health Insurance Exchanges in the Affordable Care Act?

+Health Insurance Exchanges, also known as Marketplaces, are a key feature of the Affordable Care Act. They provide a platform for individuals and small businesses to compare and purchase health insurance plans, making it easier to access affordable healthcare coverage. The Exchanges also facilitate the implementation of income-based subsidies and tax credits, expanding access to healthcare for low- and middle-income households.

How do the Exchanges promote competition in the health insurance market?

+The Health Insurance Exchanges create a competitive environment by allowing consumers to compare different health plans based on factors like premiums, deductibles, and provider networks. This transparency empowers individuals to make informed choices, driving insurance providers to offer more competitive rates and innovative plan designs.

What challenges have the Exchanges faced since their implementation?

+The Health Insurance Exchanges have encountered challenges such as maintaining a stable risk pool, adapting to changes in the political and regulatory landscape, and ensuring long-term sustainability. Additionally, there are ongoing efforts to expand coverage and address access barriers for vulnerable populations.