Aarp Travel Insurance International

AARP travel insurance has become an essential companion for many travelers, offering peace of mind and comprehensive coverage for various trips. This article aims to delve into the specifics of AARP's travel insurance, particularly its international coverage, and explore how it can benefit those embarking on global adventures. By understanding the intricacies of this insurance, travelers can make informed decisions and ensure a seamless journey, no matter the destination.

Understanding AARP Travel Insurance: A Global Perspective

AARP, or the American Association of Retired Persons, has long been a trusted name in providing benefits and services to its members, and their travel insurance program is no exception. While AARP travel insurance is known for its domestic coverage, its international policies have gained recognition for their extensive benefits and tailored features for global travel.

The international travel insurance offered by AARP is designed to cater to the unique needs of travelers venturing beyond U.S. borders. This coverage aims to address the potential challenges and risks associated with international travel, such as medical emergencies, trip cancellations, and lost baggage.

Key Features of AARP International Travel Insurance

AARP’s international travel insurance plans offer a range of benefits and features that set them apart in the market. Here’s an in-depth look at some of the critical aspects of these policies:

- Medical Coverage: One of the most critical components of international travel insurance is medical coverage. AARP's plans typically provide coverage for emergency medical treatment, including hospital stays, doctor visits, and prescription medications. This coverage extends to pre-existing conditions for travelers over 70, which is a unique benefit not offered by many providers.

- Trip Cancellation and Interruption: International travel often involves significant financial investments, and AARP's insurance plans offer protection in case of trip cancellations or interruptions due to covered reasons. These reasons can include severe weather, natural disasters, or personal emergencies, ensuring travelers don't lose their investment in unforeseen circumstances.

- Baggage and Personal Effects: Lost or delayed luggage can be a significant inconvenience during international travel. AARP's insurance covers these instances, providing reimbursement for essential items purchased due to delayed baggage and offering compensation for lost or damaged personal belongings.

- Emergency Assistance: In an emergency situation abroad, having access to reliable assistance can be invaluable. AARP's plans include 24/7 emergency assistance services, offering support for medical emergencies, legal referrals, and even assistance with replacing lost travel documents.

- Rental Car Coverage: For those renting a car during their international travels, AARP's insurance provides collision damage waiver (CDW) and theft protection coverage. This ensures travelers are protected in case of accidents or theft, reducing potential financial burdens.

- Travel Delay Benefits: Delays are an unfortunate reality of travel, and AARP's insurance plans offer benefits to alleviate the financial burden of extended delays. These benefits can include meal and accommodation reimbursements, ensuring travelers are comfortable and well-cared for during unexpected holdups.

Performance Analysis and Real-World Examples

AARP’s international travel insurance has consistently demonstrated its value through numerous real-world scenarios. For instance, consider the story of Mr. Johnson, an AARP member who encountered a medical emergency during a trip to Europe. Thanks to his AARP insurance, he received prompt medical attention and had his expenses covered, ensuring he could focus on his recovery without financial strain.

Another case involves Ms. Smith, who experienced a trip delay due to severe weather conditions. AARP's insurance not only covered her additional accommodation and meal expenses but also provided assistance in rebooking her flights, ensuring a smooth continuation of her journey.

| Plan | Medical Coverage (USD) | Trip Cancellation (USD) | Baggage Coverage (USD) |

|---|---|---|---|

| Basic | 50,000 | 5,000 | 1,500 |

| Standard | 100,000 | 10,000 | 2,500 |

| Deluxe | 250,000 | 15,000 | 5,000 |

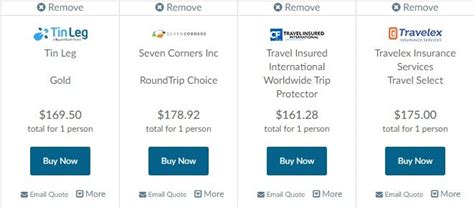

Comparative Analysis: AARP vs. Other Providers

When comparing AARP’s international travel insurance to other providers in the market, several key differences and advantages emerge. AARP’s plans are often more comprehensive, especially for older travelers, as they offer coverage for pre-existing conditions without age restrictions.

Furthermore, AARP's emergency assistance services are highly regarded for their prompt and efficient support, which can make a significant difference in critical situations. Additionally, the organization's commitment to customer service and satisfaction is evident in the positive feedback and reviews from its members.

Benefits of Choosing AARP

Apart from the comprehensive coverage and excellent customer service, AARP travel insurance offers several other benefits that make it an attractive choice for international travelers:

- Competitive Pricing: AARP's insurance plans are often more affordable compared to other providers, offering excellent value for the extensive coverage they provide.

- Member Discounts: AARP members can enjoy additional discounts on their travel insurance, making it even more cost-effective.

- Reputation and Trust: With a long-standing reputation for providing quality services to its members, AARP is a trusted name in the travel insurance industry.

- Customizable Options: AARP's plans can be tailored to individual needs, ensuring travelers only pay for the coverage they require.

Future Implications and Trends

As the travel industry continues to evolve, especially post-pandemic, the demand for comprehensive international travel insurance is expected to rise. AARP, with its focus on member benefits and comprehensive coverage, is well-positioned to meet these growing needs.

The organization is likely to continue enhancing its international travel insurance offerings, potentially expanding its benefits to include more specialized coverages, such as adventure sports activities or digital device protection. Additionally, AARP may explore partnerships with travel agencies or airlines to offer exclusive benefits and discounts, further enhancing the value of its insurance plans.

Conclusion

AARP’s international travel insurance stands out as a reliable and comprehensive solution for travelers embarking on global adventures. With its focus on medical coverage, trip protection, and emergency assistance, AARP ensures its members can explore the world with confidence and peace of mind. As the travel landscape continues to change, AARP’s commitment to innovation and member satisfaction positions it as a leading provider in the travel insurance market.

What is the age limit for AARP travel insurance?

+There is no age limit for AARP travel insurance. AARP offers travel insurance plans specifically tailored for older travelers, providing coverage for pre-existing conditions without age restrictions.

How much does AARP travel insurance cost?

+The cost of AARP travel insurance depends on various factors, including the duration of the trip, the traveler’s age, and the level of coverage chosen. Generally, AARP offers competitive pricing, and members can enjoy additional discounts.

Can I purchase AARP travel insurance if I’m not an AARP member?

+While AARP primarily serves its members, non-members can also purchase AARP travel insurance. However, members enjoy additional benefits and discounts, making membership a valuable consideration for travelers.