Buy Medical Insurance

In today's fast-paced and unpredictable world, having a robust medical insurance plan is more crucial than ever. With rising healthcare costs and the ever-present risk of unforeseen medical emergencies, securing your health and financial well-being through comprehensive insurance coverage is an essential step towards peace of mind. This comprehensive guide aims to navigate you through the process of buying medical insurance, ensuring you make informed decisions tailored to your unique needs.

Understanding Your Medical Insurance Needs

Before diving into the world of medical insurance, it's vital to understand your specific requirements. Each individual or family has unique health needs, and thus, a tailored approach is necessary. Consider factors such as your age, current health status, family medical history, and any pre-existing conditions. Additionally, think about your financial situation and the level of coverage you can afford without straining your budget.

Here's a breakdown of some key considerations:

- Coverage Options: Medical insurance plans offer a range of coverage options, including individual, family, and group plans. Determine which type suits your needs best. Individual plans provide coverage for a single person, family plans cover the policyholder and their dependents, and group plans are often offered through employers or organizations.

- Pre-existing Conditions: If you have any pre-existing medical conditions, ensure that your insurance plan provides coverage for them. Some plans have waiting periods or exclusions for certain conditions, so it's essential to read the fine print.

- Network Providers: Insurance companies often have networks of healthcare providers they work with. Check if your preferred doctors, hospitals, or specialists are included in the network to ensure seamless coverage.

- Out-of-Pocket Expenses: Understand the out-of-pocket expenses associated with your plan, including deductibles, co-pays, and co-insurance. These can vary significantly between plans, so choose one that aligns with your financial comfort.

- Coverage Limits: Pay attention to the coverage limits of your plan. Some plans have lifetime maximums, while others may have annual or per-incident limits. Ensure these limits are sufficient for your potential healthcare needs.

- Benefits and Add-ons: Explore the additional benefits and add-ons offered by different plans. These can include dental, vision, prescription drug coverage, and even wellness programs. Assess which of these benefits are valuable to you.

Researching and Comparing Medical Insurance Plans

With a clear understanding of your needs, it's time to delve into the research phase. There's a vast array of medical insurance plans available, each with its own set of features, benefits, and costs. Take the time to compare and contrast these plans to find the one that best fits your requirements.

Start by considering the following:

- Insurance Companies: Research reputable insurance companies that offer medical insurance plans. Look for companies with a strong financial standing and a history of prompt claim settlements.

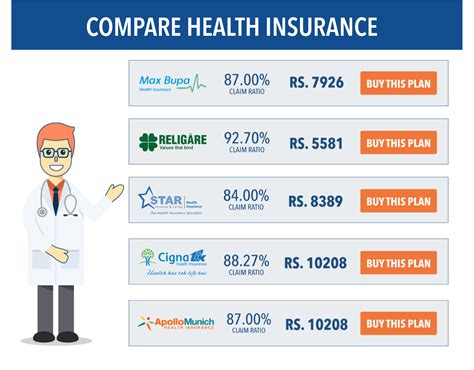

- Online Comparisons: Utilize online tools and websites that allow you to compare medical insurance plans side by side. These platforms provide detailed information on coverage, costs, and benefits, making it easier to make an informed choice.

- Broker Assistance: Consider working with an independent insurance broker. These professionals have extensive knowledge of the market and can guide you through the complexities of different plans, ensuring you find the best fit.

- Read Reviews and Feedback: Seek out reviews and feedback from current and past policyholders. This can give you valuable insights into the claim settlement process, customer service, and overall satisfaction with the insurance provider.

- Analyze Coverage and Costs: Carefully examine the coverage and costs of each plan. Compare deductibles, co-pays, and co-insurance across different plans. Assess the overall value and affordability of the plan, taking into account both the upfront costs and potential future expenses.

Assessing Your Financial Capacity and Choosing a Plan

Once you've narrowed down your options, it's time to assess your financial capacity and make a final decision. Remember, medical insurance is a long-term investment in your health and financial security, so choose a plan that aligns with your budget and provides the coverage you need.

Here are some key points to consider during this stage:

- Premium Payments: Evaluate the premium payments required for each plan. Assess whether you can afford the monthly, quarterly, or annual premiums without compromising your financial stability.

- Flexible Payment Options: Look for plans that offer flexible payment options. Some insurers provide the convenience of paying premiums through various methods, such as direct debit, credit card, or even online payment portals.

- Discounts and Savings: Explore opportunities for discounts and savings. Many insurance companies offer incentives such as family discounts, loyalty bonuses, or discounts for healthy lifestyle choices. These can help reduce your overall costs.

- Tax Benefits: Understand the tax benefits associated with your medical insurance plan. In many countries, medical insurance premiums are tax-deductible, providing an additional financial advantage.

- Policy Duration: Consider the duration of the policy. Some plans offer short-term coverage, while others provide long-term protection. Choose a plan that aligns with your anticipated healthcare needs and provides coverage for an adequate period.

Applying for Medical Insurance

Now that you've selected the ideal medical insurance plan, it's time to apply. The application process typically involves the following steps:

- Gather Required Documents: Collect all the necessary documents, such as identification proofs, income statements, and medical records (if applicable). Ensure you have everything ready before starting the application.

- Complete the Application Form: Fill out the application form accurately and truthfully. Provide all the required information, including your personal details, health history, and any pre-existing conditions.

- Submit the Application: Submit your application to the insurance company either online, through the mail, or in person. Double-check all the details to avoid any errors or omissions.

- Medical Examination (if required): In some cases, the insurance company may require a medical examination to assess your health status. This is especially common for older individuals or those with pre-existing conditions.

- Wait for Approval: Once your application is submitted, the insurance company will review it. This process can take a few days to a few weeks, depending on the complexity of your application.

- Pay the Initial Premium: After your application is approved, you'll need to pay the initial premium to activate your policy. Ensure you make the payment within the specified timeframe to avoid any delays in coverage.

Understanding Your Policy and Utilizing Benefits

Once your medical insurance policy is active, take the time to thoroughly understand its terms and conditions. Familiarize yourself with the coverage limits, exclusions, and the claim settlement process.

Here's a step-by-step guide to help you navigate your policy and maximize its benefits:

- Read the Policy Document: Carefully read through the policy document provided by the insurance company. Pay attention to the fine print, as this is where crucial details and exclusions are often mentioned.

- Know Your Coverage: Understand the scope of your coverage. Note down the specific conditions, treatments, and procedures that are covered under your plan. This knowledge will help you make informed decisions when seeking medical care.

- Network Providers: Ensure you have a list of in-network providers. These are the doctors, hospitals, and specialists that have an agreement with your insurance company. Using in-network providers can help you avoid unexpected out-of-pocket expenses.

- Pre-authorization: Some medical procedures or treatments may require pre-authorization from your insurance company. Familiarize yourself with the pre-authorization process and ensure you follow the necessary steps to avoid any delays in coverage.

- Claim Settlement Process: Understand how to file a claim and the steps involved in the claim settlement process. Keep the necessary documents and receipts ready to facilitate a smooth claim process.

- Utilize Additional Benefits: Explore the additional benefits and perks offered by your insurance plan. These can include wellness programs, health tracking apps, or even discounts on fitness memberships. Taking advantage of these benefits can enhance your overall health and well-being.

Renewing and Managing Your Medical Insurance

Medical insurance policies typically have a defined term, often a year. As the renewal date approaches, it's important to assess your coverage needs and make any necessary adjustments to your plan.

Consider the following when managing and renewing your medical insurance:

- Review Your Coverage: Evaluate whether your current coverage still meets your needs. Consider any changes in your health status, family situation, or financial circumstances. If needed, explore options for increasing or decreasing your coverage limits.

- Compare Alternative Plans: Even if you're satisfied with your current plan, it's always beneficial to compare it with other available options. Insurance companies often update their plans and introduce new features, so staying informed can help you make the best choice.

- Negotiate Renewals: When it's time to renew your policy, consider negotiating with your insurance company. You can ask for a review of your premiums or explore the possibility of adding additional benefits or coverage.

- Stay Informed: Keep yourself updated on any changes or updates to your insurance plan. Read the policy documents carefully each year to ensure you understand any modifications made by the insurance company.

- Manage Your Health: Medical insurance is not just about financial protection; it's also about taking care of your health. Utilize the preventive care benefits offered by your plan and stay proactive in maintaining your well-being.

Frequently Asked Questions

How much does medical insurance typically cost?

+

The cost of medical insurance varies widely depending on factors such as age, location, coverage limits, and the chosen insurance company. On average, individual plans can range from 200 to 1,000 per month, while family plans may cost upwards of 500 to 2,000 per month. It’s essential to shop around and compare plans to find the best value for your needs.

Can I get medical insurance if I have a pre-existing condition?

+

Yes, it is possible to obtain medical insurance with a pre-existing condition. However, some insurance companies may impose waiting periods or exclusions for certain conditions. It’s crucial to carefully review the policy terms and conditions to understand how your pre-existing condition is covered.

What happens if I need to make a claim on my medical insurance policy?

+

Making a claim on your medical insurance policy involves submitting the necessary documentation, such as medical bills and receipts, to your insurance company. The claim settlement process can vary depending on the insurer and the complexity of the claim. It’s advisable to familiarize yourself with the claim process and keep all relevant documents organized.

Can I switch medical insurance plans if I’m not satisfied with my current provider?

+

Absolutely! You have the freedom to switch medical insurance plans if you’re dissatisfied with your current provider or if your needs change. However, it’s important to note that pre-existing condition exclusions may apply when switching plans. It’s recommended to carefully compare new plans and understand the potential impact on your coverage before making a switch.

Are there any tax benefits associated with medical insurance?

+

Yes, in many countries, medical insurance premiums are tax-deductible. This means that you can reduce your taxable income by the amount of premiums you pay for your medical insurance policy. It’s always advisable to consult with a tax professional to understand the specific tax benefits available in your jurisdiction.