Workers Comp Insurance

Workers' Compensation Insurance is a critical aspect of any business, ensuring the well-being and financial security of employees in the event of workplace injuries or illnesses. This insurance coverage is designed to provide medical benefits, wage replacement, and rehabilitation services to workers who suffer work-related injuries or illnesses. It also protects employers from potential lawsuits and provides a safety net for employees, promoting a harmonious and secure work environment. In this comprehensive guide, we will delve into the intricacies of Workers' Compensation Insurance, exploring its purpose, coverage, benefits, and the steps employers can take to obtain this essential protection.

Understanding Workers’ Compensation Insurance

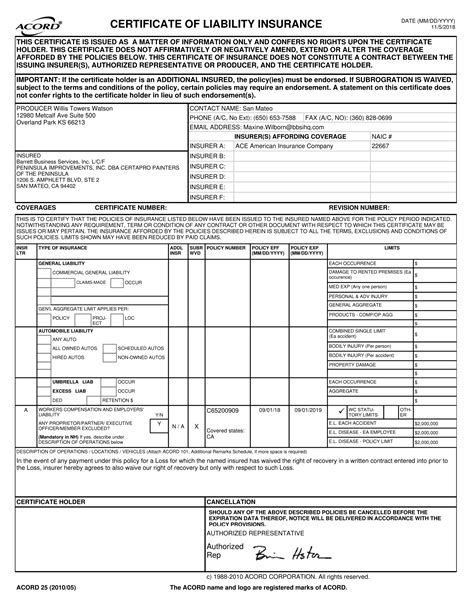

Workers’ Compensation Insurance, often simply referred to as “Workers’ Comp,” is a state-mandated insurance program that offers financial protection to both employees and employers in the event of work-related injuries or illnesses. It is a fundamental component of the employer-employee relationship, ensuring that workers are compensated fairly and promptly for their injuries, and that employers are protected from potential financial burdens and legal liabilities.

The primary purpose of Workers' Compensation Insurance is to provide a no-fault system, meaning that regardless of who is at fault for the injury or illness, the injured worker is entitled to receive benefits. This system promotes a swift and efficient recovery process, allowing employees to focus on their health and well-being without the added stress of financial worries. Additionally, it helps employers maintain a positive reputation and avoid costly legal battles.

Key Components of Workers’ Compensation Coverage

Workers’ Compensation Insurance typically covers a wide range of injuries and illnesses, including those resulting from accidents, occupational diseases, and even certain pre-existing conditions aggravated by work activities. Here are some key components of a comprehensive Workers’ Compensation policy:

- Medical Benefits: This includes coverage for medical expenses related to the work injury or illness, such as doctor visits, hospital stays, surgeries, medications, and rehabilitation services. The insurance provider typically has a network of preferred healthcare providers, ensuring quality care for injured workers.

- Wage Replacement: Workers' Comp provides wage replacement benefits to employees who are unable to work due to their injuries. These benefits typically replace a portion of the worker's regular wages, helping to maintain their financial stability during their recovery period.

- Vocational Rehabilitation: In cases where an injured worker cannot return to their previous job due to permanent disabilities, Workers' Compensation may provide vocational rehabilitation services. These services aim to retrain and reintegrate the worker into the workforce, helping them find suitable employment that matches their new physical capabilities.

- Death Benefits: Sadly, in the event of a work-related fatality, Workers' Compensation Insurance provides financial support to the deceased worker's dependents, including funeral expenses and ongoing financial assistance to help cover living expenses.

The Benefits of Workers’ Compensation Insurance

Workers’ Compensation Insurance offers a multitude of benefits to both employees and employers. Let’s explore some of the key advantages:

Protection for Employees

Workers’ Comp provides a safety net for employees, ensuring that they receive the necessary medical care and financial support during their recovery. It promotes a sense of security and peace of mind, knowing that their well-being is prioritized by their employer. Additionally, the no-fault system eliminates the need for lengthy legal battles, allowing employees to focus on their recovery without the added stress of proving fault.

Financial Stability for Employers

For employers, Workers’ Compensation Insurance is a vital risk management tool. It helps protect the business from potential financial ruin in the event of a serious workplace injury or illness. By having this insurance in place, employers can avoid costly medical bills, wage replacement expenses, and legal fees that may arise from a work-related accident. Additionally, it demonstrates a commitment to employee welfare, which can boost morale and productivity in the workplace.

Compliance with Legal Requirements

Workers’ Compensation Insurance is mandated by state laws, and employers are legally required to have this coverage in place. By obtaining Workers’ Comp, employers ensure they are in compliance with these regulations, avoiding potential fines and legal penalties. It also provides a layer of protection against potential lawsuits from injured workers, as the insurance coverage typically covers the costs associated with legal settlements or verdicts.

Obtaining Workers’ Compensation Insurance

The process of obtaining Workers’ Compensation Insurance involves several key steps. Here’s a breakdown of the process:

Assessing Your Business Needs

Before obtaining Workers’ Comp, it’s essential to assess your business’s specific needs and risks. Consider factors such as the nature of your business, the number of employees, the type of work performed, and the potential hazards associated with your industry. This assessment will help you determine the appropriate level of coverage and any additional endorsements or policies you may require.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial to ensure you receive the best coverage and service. Research and compare different providers, considering their reputation, financial stability, and customer satisfaction ratings. Look for providers who specialize in Workers’ Compensation Insurance and have a strong understanding of the unique needs of your industry. Consider factors such as their claims handling process, customer support, and any additional value-added services they may offer.

Understanding Your Policy and Coverage

Once you’ve chosen an insurance provider, carefully review your Workers’ Compensation policy. Understand the specific coverage limits, exclusions, and any additional endorsements or riders you may have added. Ensure that the policy aligns with your business’s needs and that you fully comprehend the terms and conditions. If you have any questions or concerns, don’t hesitate to reach out to your insurance provider for clarification.

Implementing Safety Measures and Loss Control

While Workers’ Compensation Insurance provides financial protection, it’s essential to prioritize workplace safety to reduce the likelihood of injuries and illnesses. Implement robust safety measures and training programs to minimize risks and create a culture of safety within your organization. By reducing the number of workplace incidents, you can not only protect your employees but also potentially lower your insurance premiums.

Regular Policy Reviews and Adjustments

As your business grows and evolves, it’s important to periodically review your Workers’ Compensation policy. Assess whether your coverage limits and endorsements still align with your business’s needs. Consider any changes in your workforce, operations, or industry regulations that may impact your insurance requirements. Regular policy reviews ensure that your coverage remains adequate and up-to-date, providing the necessary protection for your business and employees.

Real-World Examples and Case Studies

To illustrate the importance and impact of Workers’ Compensation Insurance, let’s explore a few real-world examples and case studies:

Case Study: Manufacturing Plant Injury

In a manufacturing plant, an employee sustained a severe hand injury while operating a machine. The employee required immediate medical attention, including surgery and physical therapy. With Workers’ Compensation Insurance in place, the employee received prompt medical treatment, had their medical expenses covered, and received wage replacement benefits during their recovery period. The insurance coverage also provided the necessary financial support for the employee’s rehabilitation, allowing them to regain their strength and return to work.

Case Study: Construction Site Accident

At a construction site, a worker fell from a ladder, resulting in multiple fractures and a concussion. The worker was rushed to the hospital and required extensive medical treatment, including surgery and a lengthy rehabilitation process. Workers’ Compensation Insurance stepped in to cover the worker’s medical expenses, providing financial stability during their recovery. Additionally, the insurance coverage helped the worker access specialized rehabilitation services, ensuring they received the necessary support to regain their physical capabilities and return to work safely.

Case Study: Occupational Disease

An employee working in a chemical plant developed a severe respiratory illness due to prolonged exposure to hazardous materials. The employee’s condition deteriorated, requiring ongoing medical treatment and time off work. Workers’ Compensation Insurance recognized the occupational nature of the illness and provided the employee with medical benefits, wage replacement, and access to specialized treatment. The insurance coverage allowed the employee to focus on their health and recovery, providing much-needed financial support during a challenging time.

The Future of Workers’ Compensation Insurance

As the world of work continues to evolve, so does the landscape of Workers’ Compensation Insurance. Here are some insights into the future of this critical insurance coverage:

Embracing Technology and Data Analytics

The insurance industry is increasingly leveraging technology and data analytics to enhance the efficiency and effectiveness of Workers’ Compensation Insurance. Insurers are utilizing advanced analytics to identify patterns, predict potential risks, and develop more targeted and personalized coverage options. Additionally, technology is being used to streamline the claims process, providing faster and more accurate assessments of injuries and illnesses.

Focus on Prevention and Early Intervention

The future of Workers’ Compensation Insurance is shifting towards a more proactive approach, emphasizing prevention and early intervention. Insurers are working closely with employers to implement robust safety measures and training programs to reduce workplace injuries and illnesses. By prioritizing prevention, insurers can help businesses create safer work environments, leading to reduced insurance premiums and improved overall workplace well-being.

Expanding Coverage for Emerging Risks

As new technologies and work arrangements emerge, Workers’ Compensation Insurance is evolving to address these changing dynamics. With the rise of remote work, gig economy workers, and technological advancements, insurers are developing coverage options to protect employees in these evolving work environments. This includes addressing risks associated with cyber security, mental health, and the unique challenges presented by remote and hybrid work arrangements.

| State | Workers' Compensation Insurance Coverage |

|---|---|

| California | California requires most employers to provide workers' compensation insurance. Coverage includes medical benefits, temporary disability, permanent disability, and death benefits. Employers can choose to self-insure or purchase insurance from authorized carriers. |

| Texas | In Texas, employers with more than three employees must provide workers' compensation coverage. Coverage includes medical expenses, income benefits, and rehabilitation services. Employers can opt for traditional insurance or participate in the Texas Workers' Compensation Insurance Fund. |

| New York | New York mandates workers' compensation insurance for most employers. Coverage includes medical care, wage replacement, and rehabilitation services. The New York State Insurance Fund provides coverage for employers who cannot obtain insurance through the voluntary market. |

| Florida | Florida employers with four or more employees must carry workers' compensation insurance. Coverage includes medical treatment, wage loss benefits, and death benefits. Employers can choose between private insurance carriers or the state-run Florida Workers' Compensation Joint Underwriting Association. |

| Illinois | Illinois requires employers with one or more employees to provide workers' compensation coverage. Coverage includes medical expenses, temporary total disability, permanent partial disability, and death benefits. Employers can purchase insurance from private carriers or through the Illinois Workers' Compensation Commission. |

How does Workers’ Compensation Insurance work in practice?

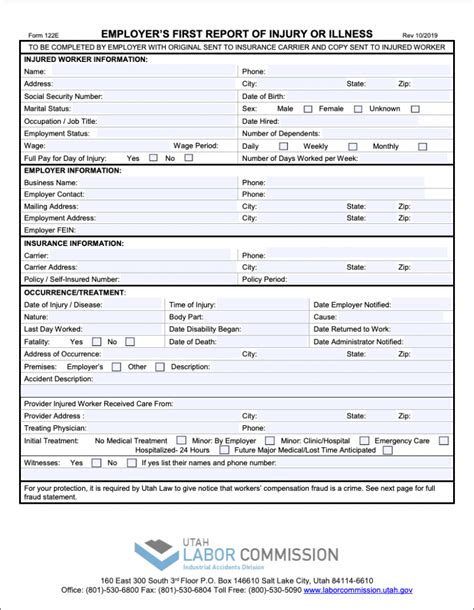

+Workers’ Compensation Insurance operates as a no-fault system, meaning that injured workers are entitled to benefits regardless of who is at fault for the injury. When an employee sustains a work-related injury or illness, they report it to their employer, who then initiates the claims process. The insurance provider assesses the claim, approves medical treatment, and provides wage replacement benefits as needed. The injured worker receives medical care and financial support, allowing them to focus on their recovery while the insurance coverage protects the employer from potential financial liabilities.

What happens if an employer doesn’t have Workers’ Compensation Insurance?

+Employers who fail to provide Workers’ Compensation Insurance as required by state laws can face significant consequences. They may be subject to fines, penalties, and even criminal charges. Injured workers may also have the right to sue their employer for damages, which can result in costly legal fees and settlements. Additionally, employers without Workers’ Comp coverage may struggle to attract and retain talent, as potential employees prioritize workplace safety and financial security.

Can Workers’ Compensation Insurance be customized to meet specific business needs?

+Yes, Workers’ Compensation Insurance policies can be customized to meet the unique needs of different businesses. Employers can work with insurance providers to tailor their coverage, including adjusting coverage limits, adding specific endorsements, or including additional policies to address unique risks. By assessing their business’s specific needs and risks, employers can ensure they have adequate coverage in place to protect their workforce and business operations.