Best Auto And Home Insurance For Seniors

As we age, our insurance needs and priorities evolve. Senior citizens often seek insurance options that offer comprehensive coverage, peace of mind, and, most importantly, cost-effectiveness. This article delves into the world of auto and home insurance for seniors, exploring the best providers, coverage options, and strategies to ensure you're adequately protected during your golden years.

Understanding Senior Insurance Needs

Senior citizens often face unique challenges when it comes to insurance. Health concerns, retirement plans, and changing financial circumstances can influence the type and level of coverage required. Additionally, the aging process may impact driving abilities, leading to a need for specialized auto insurance policies.

Auto Insurance for Seniors

Choosing the right auto insurance is crucial for seniors. Here’s a breakdown of the key considerations:

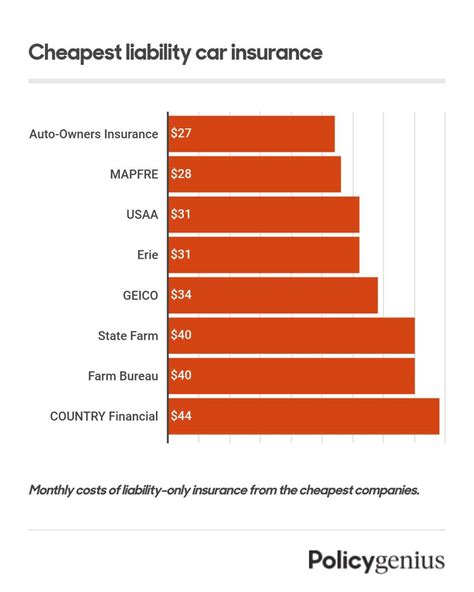

- Discounts and Senior-Friendly Policies: Many insurance companies offer senior-specific discounts. These can include age-related discounts, retirement discounts, or even safe driving bonuses. Look for providers who actively cater to the senior market with tailored policies.

- Medical Coverage: As seniors are more prone to injuries in accidents, adequate medical coverage is essential. Ensure your policy includes comprehensive medical coverage to cover potential treatment costs.

- Accident Forgiveness: This feature is especially beneficial for seniors. Accident forgiveness ensures that your insurance rates won't increase after your first at-fault accident, providing a safety net for any unforeseen incidents.

- Roadside Assistance: Having roadside assistance coverage is invaluable for seniors. It covers emergencies like flat tires, battery issues, or even towing, ensuring you're never stranded.

- Usage-Based Insurance (UBI): UBI policies can be advantageous for seniors who drive less frequently. These policies base premiums on actual driving habits, rewarding safe and low-mileage drivers with lower rates.

Home Insurance for Seniors

Home insurance is equally important for seniors. Consider the following when choosing a policy:

- Comprehensive Coverage: Opt for a policy that covers a wide range of potential risks, including natural disasters, theft, and liability. Ensure it includes adequate coverage for your personal belongings.

- Replacement Cost Coverage: This type of coverage ensures that, in the event of a total loss, your home and its contents will be replaced at current market value, providing essential financial protection.

- Personal Liability Protection: As a senior, you may face unique liability risks. Personal liability coverage protects you against lawsuits and medical payments if someone is injured on your property.

- Flood and Earthquake Coverage: Depending on your location, you may need additional coverage for natural disasters like floods or earthquakes. These policies provide an extra layer of protection.

- Discounts and Bundling: Many insurers offer discounts for seniors, especially if you bundle your home and auto insurance policies. This can lead to significant savings.

Top Auto and Home Insurance Providers for Seniors

Here’s an overview of some of the best insurance providers for seniors, along with their standout features:

| Provider | Auto Insurance Features | Home Insurance Features |

|---|---|---|

| State Farm | Offers Accident Forgiveness and Senior Discounts. Provides roadside assistance and has a reputation for excellent customer service. | Provides comprehensive coverage, including options for additional liability protection. Offers discounts for bundling policies. |

| GEICO | Known for its competitive rates and senior-specific discounts. Offers Accident Forgiveness and excellent online tools for policy management. | Provides flexible coverage options, including rental property insurance. Offers discounts for seniors and bundling. |

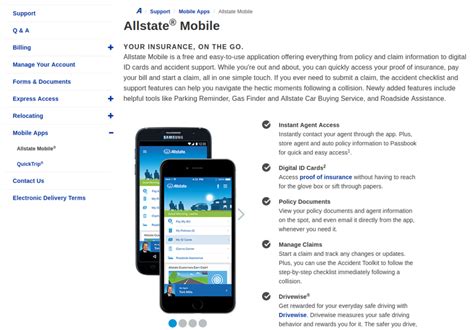

| Allstate | Offers a range of coverage options, including Usage-Based Insurance. Provides Accident Forgiveness and a Senior Driver Discount. | Provides replacement cost coverage and additional living expenses in case of a disaster. Offers discounts for seniors and home safety features. |

| Progressive | Offers Accident Forgiveness and a 5% discount for seniors. Provides flexible payment options and excellent customer service. | Offers comprehensive coverage, including identity theft protection. Provides discounts for seniors and home safety features. |

| USAA | Exclusively for military members and their families, offering competitive rates and a range of coverage options. Provides excellent customer service and military-specific discounts. | Offers comprehensive coverage, including rental property insurance. Provides discounts for multiple policies and home safety features. |

Tips for Choosing the Right Insurance Provider

When selecting an insurance provider, consider the following tips to ensure you get the best coverage:

- Compare Quotes: Obtain quotes from multiple providers to ensure you're getting the best rate for your needs.

- Read Reviews: Check online reviews and ratings to gauge customer satisfaction and potential issues with the provider.

- Check Financial Stability: Ensure the provider is financially stable to guarantee they can provide coverage in the long term.

- Understand Coverage Limits: Carefully review the coverage limits and ensure they align with your needs and potential risks.

- Consider Bundling: Bundling your auto and home insurance policies can often lead to significant savings.

Maximizing Your Insurance Coverage as a Senior

To get the most out of your insurance coverage, consider the following strategies:

- Review Your Policies Regularly: As your circumstances change, so might your insurance needs. Regularly review your policies to ensure they still meet your requirements.

- Take Advantage of Discounts: From safe driver discounts to senior-specific discounts, there are various ways to save. Ask your provider about available discounts and ensure you're taking advantage of them.

- Bundle Policies: Bundling your auto and home insurance policies can lead to substantial savings. Many providers offer discounts when you combine multiple policies.

- Consider Telematics: Telematics devices can monitor your driving habits, and some insurance companies offer discounts for safe driving behavior.

- Understand Your Deductibles: Higher deductibles can lower your insurance premiums. Assess your financial situation and choose a deductible that suits your needs.

Conclusion

Navigating the world of insurance as a senior can be complex, but with the right knowledge and tools, you can find the best coverage for your needs. By understanding your unique risks and taking advantage of senior-friendly policies and discounts, you can ensure your golden years are protected and financially secure. Remember to regularly review your policies and stay informed about the latest insurance options to make the most of your coverage.

What are the common challenges seniors face when it comes to insurance?

+

Seniors often face challenges like higher premiums due to age, health concerns impacting coverage, and potential driving ability changes affecting auto insurance.

How can seniors save on auto insurance premiums?

+

Seniors can save on auto insurance by taking advantage of senior discounts, considering accident forgiveness, and exploring usage-based insurance policies.

What should seniors prioritize in their home insurance policies?

+

Seniors should prioritize comprehensive coverage, replacement cost coverage, and personal liability protection in their home insurance policies.