Whole Life Life Insurance Definition

Whole life insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage throughout an individual's lifetime. It offers a combination of financial protection, savings, and investment opportunities, making it a popular choice for those seeking both security and potential growth.

Unlike term life insurance, which provides coverage for a specified period, whole life insurance guarantees a death benefit to the beneficiaries regardless of when the insured person passes away. This makes it an attractive option for individuals who want to ensure their loved ones are financially protected, even in the event of an unexpected, early demise.

Understanding the Key Features of Whole Life Insurance

Whole life insurance policies are designed to offer a comprehensive financial solution, and their features can be categorized into three main components: protection, savings, and investment.

Protection

The primary purpose of any life insurance policy is to provide financial security to the insured's beneficiaries. In the case of whole life insurance, the death benefit is guaranteed, meaning the policy will pay out the full amount upon the insured's death, regardless of their age or the length of time the policy has been active.

This benefit is particularly valuable for those who wish to ensure their family's financial stability, cover outstanding debts, or provide for long-term goals, such as a child's education or retirement.

Savings

One unique aspect of whole life insurance is its cash value component. This is a savings portion of the policy that accumulates over time. Part of the premium payments made by the policyholder goes towards building this cash value, which grows on a tax-deferred basis.

Policyholders can access this cash value in various ways. They can borrow against it, withdraw it, or use it to pay future premiums. However, it's important to note that borrowing or withdrawing cash value may reduce the policy's death benefit and have tax implications.

Investment

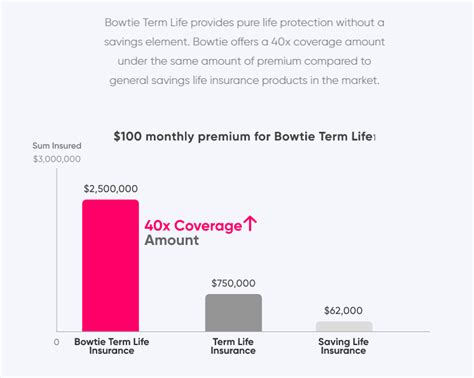

Whole life insurance policies often offer investment opportunities. The cash value portion of the policy is invested by the insurance company in a range of assets, such as stocks, bonds, and money market instruments. These investments are typically conservative and aimed at long-term growth, providing a steady rate of return.

Policyholders can choose between different investment options, often with varying levels of risk and potential reward. While the returns may be more modest compared to investing directly in the stock market, the security and stability provided by whole life insurance investments are appealing to many.

| Policy Component | Description |

|---|---|

| Death Benefit | A guaranteed payout to beneficiaries upon the insured's death. |

| Cash Value | A savings portion that accumulates tax-deferred over time. |

| Investment Options | A range of conservative investment choices offered by the insurance company. |

How Whole Life Insurance Works

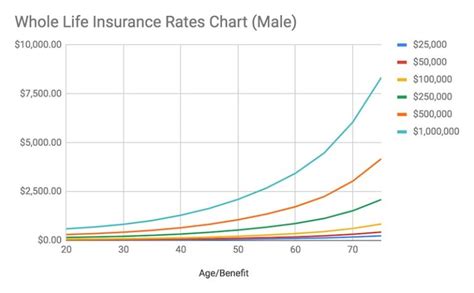

Whole life insurance policies are typically purchased for a specific face amount, which is the death benefit paid out to the beneficiaries. The insured person pays a premium, which is usually due annually, semi-annually, or monthly. The premium amount remains level throughout the policy's lifetime, providing stability and predictability.

A portion of the premium is used to cover the cost of insurance (COI), which is the price the insurance company charges to provide the death benefit. The COI is determined by various factors, including the insured's age, health, and lifestyle. The remaining premium goes towards building the cash value.

Over time, the cash value grows, and the COI decreases as the insured person ages. This means that a larger portion of the premium is dedicated to the cash value, allowing it to grow more rapidly. Policyholders can use this cash value in several ways:

- Borrowing: Policyholders can take out a loan against the cash value. This loan is interest-free as long as the policy remains active.

- Withdrawal: Policyholders can withdraw a portion of the cash value. However, this may have tax implications and reduce the death benefit.

- Premium Payment: The cash value can be used to pay for future premiums, ensuring the policy remains in force even if the insured person's financial situation changes.

It's important to note that whole life insurance policies often have surrender charges if the policy is canceled within the first few years. These charges are designed to discourage policyholders from treating the policy as a short-term investment vehicle.

Benefits and Considerations of Whole Life Insurance

Whole life insurance offers several advantages and considerations that potential policyholders should weigh when making a decision.

Advantages

- Guaranteed Death Benefit: The policy provides a guaranteed payout to beneficiaries, ensuring financial security regardless of the insured's age or health.

- Cash Value Growth: The cash value component allows policyholders to build savings over time, which can be used for various financial goals.

- Tax Advantages: The cash value grows on a tax-deferred basis, and if the policy is kept in force until the insured's death, the death benefit is typically tax-free.

- Long-Term Stability: Whole life insurance policies provide a level of stability with level premiums and a guaranteed death benefit, making them a reliable long-term solution.

Considerations

- Higher Premiums: Whole life insurance policies typically have higher premiums compared to term life insurance, as they offer a combination of protection, savings, and investment.

- Surrender Charges: Canceling the policy within the first few years may result in surrender charges, making it less flexible than other types of insurance.

- Limited Investment Options: While whole life insurance offers investment opportunities, the options are often more conservative and may not provide the same growth potential as direct market investments.

Real-World Examples of Whole Life Insurance

Let's explore a couple of real-world scenarios where whole life insurance can be beneficial.

Scenario 1: Financial Security for a Growing Family

John, a 35-year-old father of two, decides to purchase a whole life insurance policy to provide financial security for his family. He chooses a policy with a $500,000 death benefit and pays an annual premium of $5,000. Over time, the cash value component of his policy grows, allowing him to borrow against it to cover unexpected expenses or use it to pay for his children's education.

As John ages, the COI decreases, and more of his premium goes towards building the cash value. By the time he reaches retirement, the cash value has accumulated significantly, providing him with a substantial savings component to supplement his retirement income.

Scenario 2: Estate Planning and Business Continuity

Sarah, a successful entrepreneur, wants to ensure the continuity of her business and provide for her family in the event of her untimely death. She purchases a whole life insurance policy with a $1 million death benefit. The policy's cash value component allows her to pay for business expenses and provide a steady income for her family if needed.

Additionally, Sarah uses the policy's investment options to grow her wealth conservatively. By keeping the policy in force, she ensures that the death benefit will be paid out tax-free, providing a substantial financial boost to her family and business.

Conclusion

Whole life insurance is a valuable tool for those seeking long-term financial security and stability. Its combination of protection, savings, and investment opportunities makes it a versatile solution for a wide range of individuals and families. However, it's essential to carefully consider the policy's advantages and considerations to ensure it aligns with one's specific financial goals and needs.

By understanding the key features and real-world applications of whole life insurance, individuals can make informed decisions about their financial future and provide a solid foundation for their loved ones.

What is the difference between whole life and term life insurance?

+Whole life insurance provides coverage for the insured’s entire life, offering a guaranteed death benefit and cash value accumulation. Term life insurance, on the other hand, provides coverage for a specified period, typically 10, 20, or 30 years, and does not build cash value. Term life insurance is generally more affordable but only provides coverage during the term.

Can I access the cash value of my whole life insurance policy?

+Yes, you can access the cash value of your whole life insurance policy through various methods, including borrowing against it, withdrawing funds, or using it to pay future premiums. However, it’s important to consider the potential impact on your death benefit and the possible tax implications.

Is whole life insurance suitable for everyone?

+Whole life insurance can be a great option for those seeking long-term financial security and stability. However, it’s important to consider your specific needs and financial goals. If you require more flexibility and lower premiums, term life insurance might be a better fit. Consulting with a financial advisor can help you make an informed decision.