Medicare And Dental Insurance

In the world of healthcare, navigating the intricacies of insurance coverage can be a daunting task. One area that often raises questions and concerns is dental care, especially for individuals relying on Medicare as their primary health insurance. This comprehensive guide aims to shed light on the relationship between Medicare and dental insurance, providing a clear understanding of the coverage options available and how to access essential dental services.

Understanding Medicare’s Dental Coverage

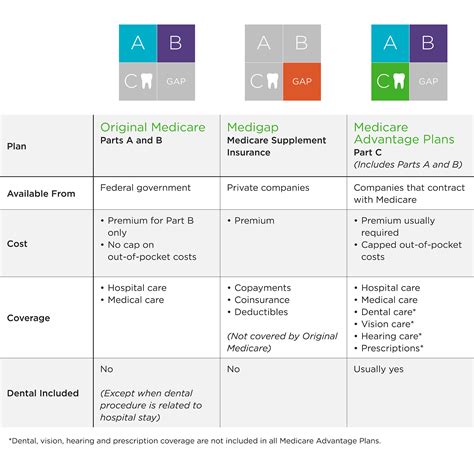

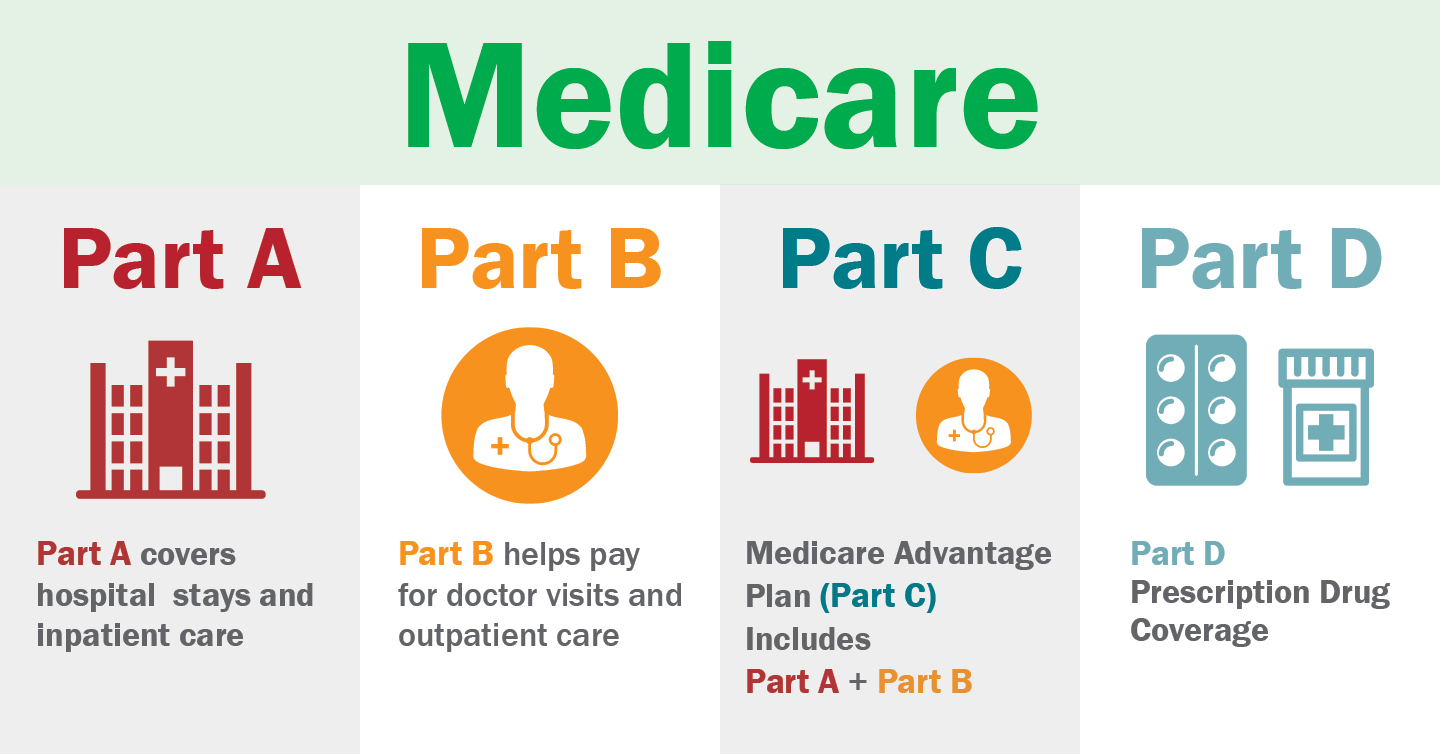

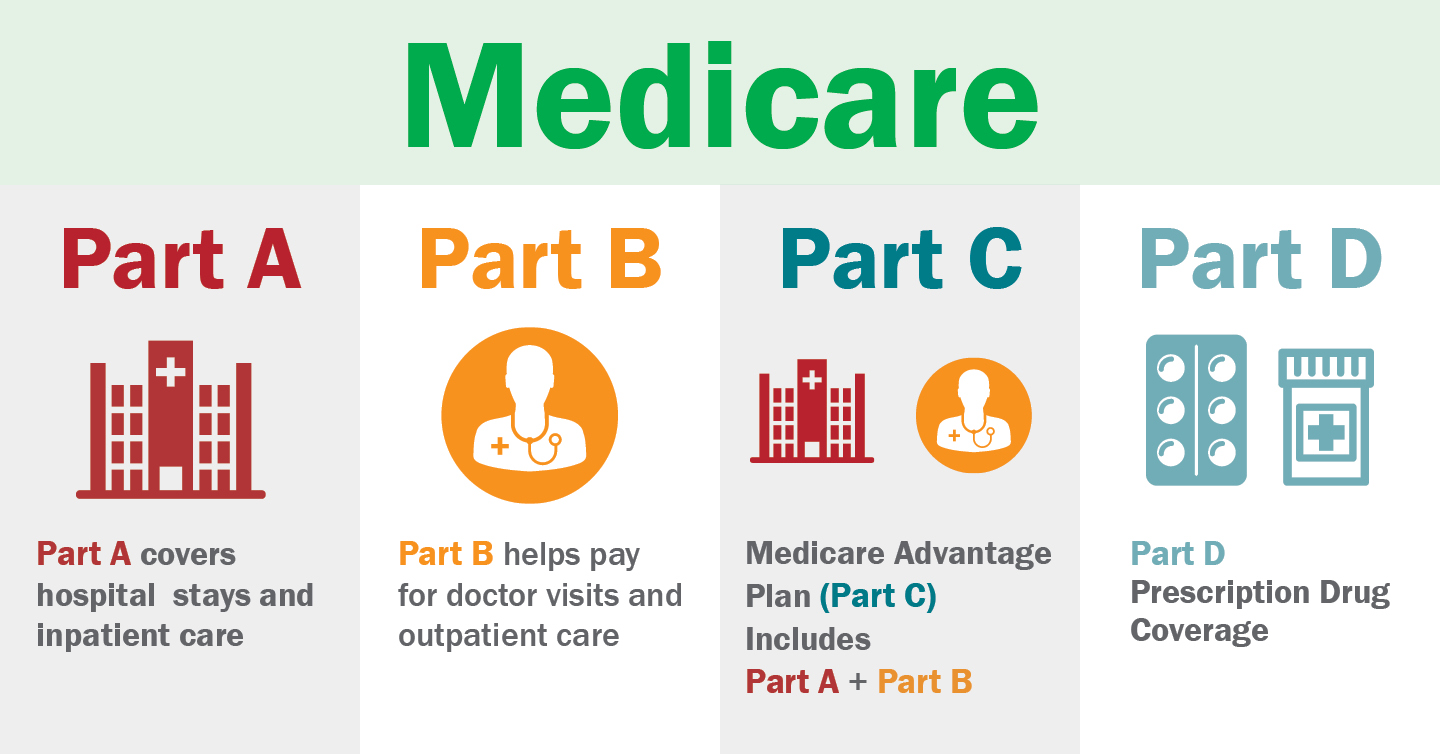

While Medicare, the federal health insurance program for individuals aged 65 and older, offers extensive coverage for a wide range of medical services, its dental coverage is somewhat limited. Medicare Part A and Part B, the primary components of the program, do not generally cover most routine dental care, including dental exams, cleanings, fillings, and other common dental procedures. This can leave many Medicare beneficiaries searching for alternative options to ensure their oral health needs are met.

The Role of Medicare Advantage Plans

One potential solution lies in Medicare Advantage plans, also known as Medicare Part C. These plans are offered by private insurance companies approved by Medicare, and they are required to offer at least the same level of coverage as Original Medicare (Parts A and B). Many Medicare Advantage plans go beyond the basic coverage and include additional benefits, such as dental, vision, and hearing services. These plans often have a network of preferred providers, so it’s essential to choose a plan that has dentists you are comfortable with and provides the level of coverage you require.

When selecting a Medicare Advantage plan with dental coverage, consider the following:

- Check the plan's dental benefits: Different plans may offer varying levels of coverage for different dental procedures. Some plans might only cover preventive care, while others could also include restorative procedures like fillings or root canals.

- Understand the network: In-network dentists are usually preferred, as they agree to accept the plan's payment as full payment for covered services. Out-of-network dentists may require additional out-of-pocket costs.

- Review the plan's annual maximum: This is the limit on the amount the plan will pay for dental services in a year. Ensure that the plan's annual maximum aligns with your expected dental needs.

- Consider additional benefits: Some Medicare Advantage plans may also offer coverage for dental appliances, such as dentures or dental implants, which are not typically covered by Original Medicare.

Supplemental Dental Insurance Options

For those who choose to remain with Original Medicare (Parts A and B) or if their Medicare Advantage plan does not offer sufficient dental coverage, supplemental dental insurance policies can be a viable option. These policies are designed to fill the gaps in Medicare coverage and provide specific dental benefits.

Dental Discount Plans

Dental discount plans, sometimes called dental savings plans, are not traditional insurance policies. Instead, they provide members with access to a network of dentists who have agreed to offer discounted rates on their services. Members pay a yearly fee for the plan and then receive discounts on various dental procedures when visiting in-network dentists. The advantage of these plans is that they often have low out-of-pocket costs and no annual limits. However, the level of savings can vary depending on the dentist and the specific procedures.

| Dental Discount Plan Benefits | Details |

|---|---|

| Discounted Rates | Members receive reduced fees for dental services. |

| No Annual Limits | Unlike traditional insurance, there are no caps on the amount the plan will pay out annually. |

| No Claims Process | Members pay the discounted fee directly to the dentist, simplifying the process. |

| Variety of Plans | Plans can be tailored to individual needs, offering discounts on specific procedures or overall dental care. |

Dental Insurance Policies

Dental insurance policies are more traditional insurance products. These policies typically cover a percentage of the cost of dental procedures, with the insured individual responsible for paying the remaining cost, often through a combination of deductibles, co-pays, and co-insurance. The specific coverage and out-of-pocket costs can vary significantly depending on the plan chosen.

Key considerations when selecting a dental insurance policy include:

- Coverage: Understand what procedures are covered and at what percentage. Some plans may only cover preventive care, while others could include more extensive procedures like crowns or bridges.

- Annual Maximum: This is the limit on the amount the insurance company will pay for covered services in a year. Ensure this aligns with your expected dental needs.

- Waiting Periods: Some insurance policies have waiting periods before certain procedures are covered. For instance, there might be a 6-month waiting period for major restorative work.

- Network Restrictions: Like Medicare Advantage plans, dental insurance policies often have networks of preferred providers. It's essential to choose a plan with a network that includes dentists you prefer.

Maximizing Your Dental Benefits

Whether you opt for a Medicare Advantage plan with dental coverage or a supplemental dental insurance policy, there are strategies to ensure you maximize your benefits and get the most out of your coverage.

Regular Dental Check-Ups

One of the best ways to optimize your dental coverage is by maintaining regular dental check-ups. Preventive care, such as dental exams and cleanings, is often covered at a higher percentage or even 100% by many insurance plans. By staying on top of your dental health, you can catch potential issues early, often preventing more costly and extensive procedures down the line.

Understanding Your Plan’s Coverage

Take the time to thoroughly understand your plan’s coverage. This includes knowing what procedures are covered, the level of coverage for each, and any limitations or exclusions. Being well-informed can help you make the most of your benefits and avoid unexpected out-of-pocket costs.

Choosing In-Network Providers

Whenever possible, choose dentists that are in your plan’s network. In-network providers have agreed to accept the plan’s payment as full payment for covered services, which can significantly reduce your out-of-pocket expenses. If you need to see an out-of-network provider, be prepared for potential additional costs.

Planning for Major Procedures

If you know you will need a major dental procedure, such as a root canal or dental implants, plan ahead. Many insurance policies have waiting periods for these procedures, so understanding these periods and scheduling your treatment accordingly can ensure you maximize your coverage.

Utilizing Additional Benefits

Beyond basic dental coverage, some plans offer additional benefits such as discounts on dental appliances, orthodontic care, or even alternative dental treatments like dental implants. Take advantage of these benefits if they are included in your plan.

Conclusion

While Medicare may not provide extensive dental coverage, there are several options available to ensure individuals can access the dental care they need. Whether through Medicare Advantage plans with built-in dental coverage or supplemental dental insurance policies, there are strategies to manage the cost of dental care and maintain good oral health. By understanding the available options and making informed choices, individuals can navigate the complexities of dental insurance and Medicare to find the coverage that best suits their needs.

Can I get dental coverage if I only have Original Medicare (Parts A and B)?

+Yes, you can purchase supplemental dental insurance policies or dental discount plans to fill the gaps in Original Medicare’s coverage. These policies can provide specific dental benefits, allowing you to access necessary dental care.

What if I want to change my Medicare Advantage plan’s dental coverage?

+You can switch to a different Medicare Advantage plan during the annual enrollment period or if you qualify for a Special Enrollment Period due to a specific life event. Be sure to review the new plan’s benefits and network to ensure it meets your dental needs.

Are there any low-cost dental care options for those with limited income?

+Some states offer Medicaid dental benefits for adults, which can provide comprehensive dental coverage. Additionally, dental schools and community clinics often provide low-cost or free dental care services. Local dental societies may also offer resources for affordable dental care.