Where To Buy Health Insurance

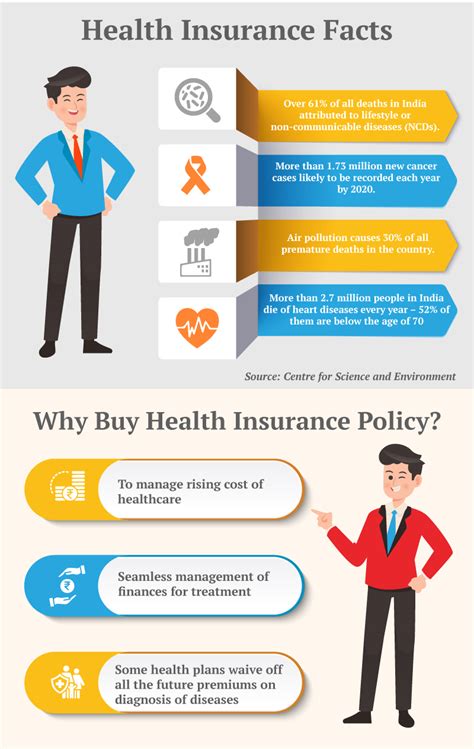

In today's world, health insurance is an essential aspect of financial planning and risk management. With rising healthcare costs, having adequate coverage can provide peace of mind and protect individuals and families from the financial burden of unexpected medical expenses. This comprehensive guide will navigate you through the process of purchasing health insurance, exploring various options, and highlighting key considerations to ensure you make an informed decision.

Understanding Health Insurance Plans

Health insurance plans come in various forms, each with its own set of features and benefits. The first step is to familiarize yourself with the different types of plans available in your region or country.

Public vs. Private Health Insurance

The most basic distinction is between public and private health insurance. Public health insurance is typically provided by the government and may offer comprehensive coverage with little to no cost, especially for low-income individuals. Private health insurance, on the other hand, is purchased from insurance companies and offers a wide range of plans with varying levels of coverage and premium costs.

Types of Private Health Insurance Plans

Within the realm of private health insurance, there are several popular plan types to consider:

- Indemnity Plans: Also known as fee-for-service plans, indemnity plans allow you to choose any doctor or hospital and provide coverage for a wide range of medical services. You typically pay a deductible and a percentage of the cost of services, with the insurance company covering the rest.

- Managed Care Plans: These plans offer a more structured approach to healthcare. They include health maintenance organizations (HMOs) and preferred provider organizations (PPOs). HMOs usually require you to select a primary care physician (PCP) and obtain referrals for specialist visits. PPOs offer more flexibility, allowing you to choose in-network providers without referrals but often with higher out-of-pocket costs.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but lack coverage for out-of-network care, except in emergencies.

- Point-of-Service (POS) Plans: POS plans combine elements of HMOs and PPOs. You can choose an in-network PCP and receive coverage for out-of-network services, but typically at a higher cost.

- Catastrophic Plans: Catastrophic health plans are designed for young, healthy individuals. They offer limited coverage for basic services but provide protection against high medical costs in case of a serious illness or accident. These plans usually have low premiums but high deductibles.

Each type of plan has its advantages and disadvantages, and the best option for you will depend on your specific healthcare needs, preferences, and financial situation.

Researching and Comparing Insurance Providers

Once you have a basic understanding of the different types of health insurance plans, it’s time to research and compare insurance providers to find the best fit for your needs.

Online Insurance Marketplaces

Online insurance marketplaces, such as Healthcare.gov in the United States, provide a convenient way to compare plans from multiple insurance companies. These marketplaces offer a comprehensive overview of plan options, including details on coverage, costs, and provider networks. You can filter plans based on your specific requirements, such as prescription drug coverage, maternity benefits, or mental health services.

Directly Through Insurance Companies

You can also purchase health insurance directly from insurance companies. Major insurance providers often have websites where you can explore their offerings, get quotes, and enroll in plans. Some companies even provide personalized recommendations based on your health history and preferences.

Comparative Analysis

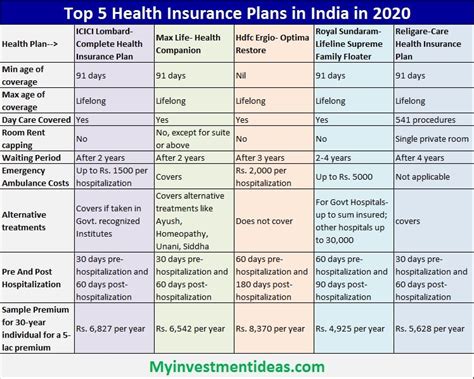

When comparing insurance providers, consider the following factors:

- Coverage and Benefits: Review the plan's coverage for essential health benefits, such as doctor visits, hospital stays, prescription drugs, and preventive care. Ensure that the plan covers your specific healthcare needs, including any pre-existing conditions or chronic illnesses.

- Provider Networks: Check the list of in-network doctors, hospitals, and specialists covered by the plan. Consider whether your preferred healthcare providers are included in the network. Out-of-network care can be significantly more expensive.

- Premiums and Deductibles: Evaluate the monthly premium costs and the annual deductible amounts. A lower premium may seem appealing, but it often comes with a higher deductible, meaning you'll pay more out of pocket before the insurance coverage kicks in.

- Co-pays and Co-insurance: Understand the co-payment amounts for doctor visits and the percentage of costs you'll be responsible for (co-insurance) when receiving medical services. These can vary significantly between plans.

- Maximum Out-of-Pocket Limits: Look for plans with lower maximum out-of-pocket limits, as these protect you from excessive financial burdens in case of major medical events.

- Additional Benefits: Some plans offer extra benefits, such as dental or vision coverage, wellness programs, or coverage for alternative therapies. Consider whether these add-ons are valuable to you.

Evaluating Your Personal Needs

Choosing the right health insurance plan involves carefully assessing your personal healthcare needs and financial situation.

Healthcare Needs

Consider your current and potential future healthcare requirements. Do you have any ongoing medical conditions or chronic illnesses? Are you planning to start a family soon? Do you engage in activities that could lead to sports-related injuries? Understanding your healthcare needs will help you select a plan that provides adequate coverage.

Financial Considerations

Health insurance is a significant financial commitment. Evaluate your budget and determine how much you can afford to spend on premiums, deductibles, and out-of-pocket costs. Remember that while a lower premium may be tempting, it could result in higher costs if you frequently need medical care.

Flexibility and Portability

If you frequently change jobs or plan to move to a different region or country, consider the portability of the health insurance plan. Some plans may not be transferable, leaving you without coverage during a transition period.

Provider and Facility Preferences

If you have a strong preference for certain healthcare providers or facilities, ensure that they are included in the plan’s network. Being able to continue seeing your trusted doctors and specialists can be crucial for consistent and personalized care.

Obtaining Quotes and Enrolling

Once you’ve narrowed down your options, it’s time to obtain quotes from the insurance providers you’re considering. Many online marketplaces and insurance company websites offer instant quotes based on your personal details and preferred plan type.

When you're ready to enroll, follow the provider's enrollment process, which typically involves completing an application and providing necessary personal and health-related information. Ensure that you understand the terms and conditions of the plan, including any waiting periods or exclusions.

FAQs

Can I purchase health insurance outside of the annual open enrollment period?

+In many countries, there is a designated open enrollment period when individuals can purchase health insurance. However, certain life events, such as losing your job or getting married, may qualify you for a special enrollment period, allowing you to enroll outside of the regular timeframe. Check with your local insurance regulator or a trusted insurance advisor for more information.

What if I have a pre-existing medical condition? Will I be able to get health insurance?

+In many regions, insurance companies are prohibited from denying coverage based solely on pre-existing conditions. However, the specifics can vary. Some plans may have waiting periods or exclusions for certain conditions. It’s essential to carefully review the plan’s terms and conditions and consult with the insurance provider to understand how your pre-existing condition will be covered.

How do I know if a health insurance plan is accredited or reputable?

+Accreditation and reputation are crucial when choosing a health insurance provider. Look for accreditation from recognized organizations in your region, such as the National Committee for Quality Assurance (NCQA) in the United States. You can also research customer reviews and ratings online to gauge the provider’s reliability and customer satisfaction.

Purchasing health insurance is a crucial decision that can impact your financial well-being and access to quality healthcare. By understanding the different plan types, researching providers, and evaluating your personal needs, you can make an informed choice. Remember to carefully review the plan’s details, ask questions, and seek advice from trusted sources to ensure you select the right health insurance coverage for your unique circumstances.