What Is The Cheapest Car Insurance

When it comes to finding the cheapest car insurance, it's important to understand that insurance rates can vary significantly depending on numerous factors. These factors include your personal circumstances, the type of vehicle you drive, your driving history, and the coverage options you choose. While it's challenging to pinpoint an exact dollar amount for the cheapest car insurance, we can delve into the key aspects that influence pricing and provide valuable insights to help you secure the most affordable coverage.

Factors Influencing Car Insurance Costs

Car insurance premiums are influenced by a combination of personal and vehicle-related factors. Let’s explore some of the key elements that insurance providers consider when calculating your rates.

1. Personal Factors

Your age, gender, marital status, and location can impact your insurance premiums. Generally, younger drivers and those residing in urban areas tend to pay higher rates due to the increased risk associated with these demographics. Additionally, your driving record plays a crucial role. A clean driving history with no accidents or violations can lead to more favorable rates. Insurance companies also consider your credit score, as it is often used as an indicator of financial responsibility.

2. Vehicle Factors

The type of car you drive and its features can significantly affect your insurance costs. Certain vehicle models, especially those with high-performance engines or expensive parts, may be more prone to accidents or theft, resulting in higher premiums. Safety ratings and the availability of advanced safety features can also influence insurance rates. Moreover, the age and condition of your vehicle impact its replacement and repair costs, which in turn affect your insurance premiums.

3. Coverage Options

The level of coverage you choose is a major determinant of your insurance costs. Comprehensive and collision coverage, which provide protection for your vehicle in the event of accidents, theft, or natural disasters, tend to be more expensive. On the other hand, liability-only coverage, which covers damages to others but not your own vehicle, is typically more affordable. It’s essential to strike a balance between your budget and the level of protection you require.

Strategies to Find Affordable Car Insurance

Now that we’ve explored the factors that influence car insurance costs, let’s discuss some strategies to help you secure the most cost-effective coverage:

1. Compare Quotes

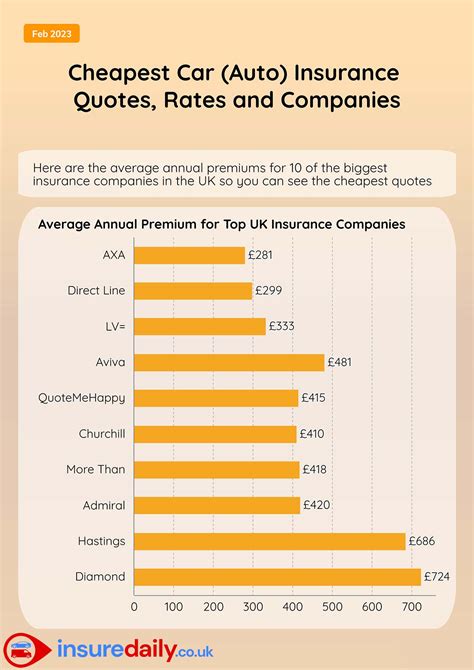

Obtaining quotes from multiple insurance providers is crucial. Each insurer has its own rating system and pricing structure, so comparing quotes can reveal significant differences. Online quote comparison tools can simplify this process, allowing you to gather multiple quotes quickly and easily. Make sure to provide accurate and consistent information to ensure fair comparisons.

2. Review Your Coverage

Regularly reviewing your insurance coverage and making necessary adjustments can help keep costs down. Assess your current coverage limits and consider if they align with your current needs and financial situation. For instance, if you have an older vehicle, you might consider reducing comprehensive and collision coverage to save on premiums.

3. Bundle Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. Bundling policies with the same insurer can result in significant savings, as it demonstrates loyalty and reduces administrative costs for the insurer.

4. Maintain a Clean Driving Record

A clean driving record is essential for keeping your insurance costs low. Avoid accidents, violations, and speeding tickets, as these can lead to increased premiums. Additionally, consider enrolling in a defensive driving course, which can not only enhance your driving skills but also potentially qualify you for insurance discounts.

5. Explore Discounts

Insurance companies offer various discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-car discounts. Be sure to inquire about the discounts available with each insurer and provide any necessary documentation to qualify.

6. Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially assuming more financial responsibility in the event of a claim, which can result in lower monthly premiums.

Case Study: Analyzing Real-World Insurance Rates

To illustrate the variations in insurance rates, let’s consider a hypothetical case study. Imagine we have two drivers, John and Sarah, both residing in the same city. John is a 25-year-old male with a clean driving record, while Sarah is a 35-year-old female with a minor traffic violation on her record.

| Driver | Age | Gender | Driving Record | Insurance Rate |

|---|---|---|---|---|

| John | 25 | Male | Clean | $1,200 annually |

| Sarah | 35 | Female | Minor Violation | $1,050 annually |

In this case, despite John's clean driving record, his younger age and male gender contribute to a slightly higher insurance rate compared to Sarah. However, the difference is not significant, highlighting the influence of various factors on insurance costs.

Future Implications and Industry Trends

The car insurance industry is evolving, and several trends are shaping the future of insurance pricing. Here are some key developments to consider:

1. Usage-Based Insurance (UBI)

UBI programs use telematics technology to monitor driving behavior and reward safe drivers with lower premiums. These programs analyze factors such as mileage, speed, and time of day, providing insurance companies with more accurate risk assessments. UBI has the potential to revolutionize the insurance industry by offering personalized rates based on individual driving habits.

2. Data-Driven Pricing

Advancements in data analytics and machine learning enable insurance companies to gather and analyze vast amounts of data. This data-driven approach allows insurers to more accurately assess risk and set prices. By considering a wide range of factors, including driving behavior, vehicle usage patterns, and even weather conditions, insurance companies can offer more tailored and competitive rates.

3. Telematics and Connected Cars

The integration of telematics and connected car technologies is transforming the insurance industry. These technologies provide real-time data on vehicle performance, driver behavior, and even road conditions. Insurance companies can leverage this data to offer more precise and dynamic pricing, potentially leading to more affordable coverage for safer drivers.

4. Artificial Intelligence (AI)

AI is playing an increasingly significant role in the insurance industry. AI algorithms can analyze vast datasets and identify patterns that may not be apparent to human analysts. This enables insurance companies to make more informed decisions about risk assessment and pricing, ultimately benefiting consumers with more accurate and competitive rates.

Conclusion

While it’s challenging to pinpoint an exact dollar amount for the cheapest car insurance, understanding the factors that influence rates and adopting strategies to secure affordable coverage is essential. By comparing quotes, reviewing coverage, exploring discounts, and considering usage-based insurance programs, you can make informed decisions to find the most cost-effective car insurance. Additionally, staying abreast of industry trends and technological advancements can help you navigate the evolving landscape of car insurance and potentially benefit from more personalized and affordable coverage options.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever there are significant changes in your personal or vehicle circumstances. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any available discounts or adjustments.

Can I switch insurance providers to save money?

+Absolutely! Shopping around and comparing quotes from different insurance providers is a great way to find more affordable coverage. Don’t hesitate to switch insurers if you find a better deal that meets your needs.

What is the difference between liability-only and comprehensive coverage?

+Liability-only coverage provides protection for damages you cause to others but does not cover your own vehicle. Comprehensive coverage, on the other hand, offers broader protection, including coverage for your vehicle in the event of accidents, theft, or natural disasters.