Affordable Flood Insurance

Flooding is a natural disaster that can have devastating impacts on homes, businesses, and communities. It is an ever-present threat in many regions, and the rising costs of flood damage have prompted a growing awareness of the need for comprehensive flood insurance coverage. Affordable flood insurance is a critical component of financial protection for homeowners and business owners alike. In this expert-level journal article, we delve into the world of flood insurance, exploring its significance, the challenges it presents, and strategies to make it more accessible and beneficial for those in vulnerable areas.

The Significance of Flood Insurance: Protecting Your Investments

Floods are among the most common and costly natural disasters worldwide. The financial consequences of flooding can be devastating, often resulting in substantial property damage, loss of valuable possessions, and significant disruption to daily life and business operations. This is where flood insurance steps in as a crucial safeguard.

Flood insurance provides a safety net for property owners, offering financial protection against flood-related damages. It covers a range of expenses, including repairs to structures, replacement of personal belongings, and even temporary living expenses if a home becomes uninhabitable due to floodwaters. By purchasing flood insurance, individuals and businesses can mitigate the financial risks associated with flooding and ensure they have the resources to rebuild and recover.

Understanding the Need for Flood Insurance

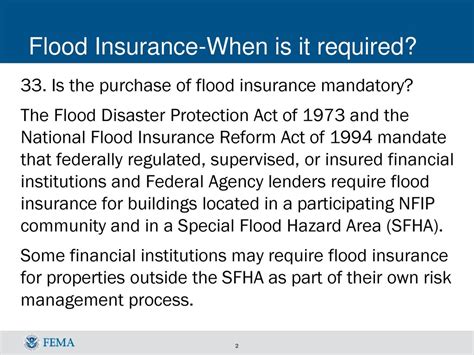

Flood insurance is particularly important for those residing in high-risk areas, such as coastal regions, floodplains, or areas prone to heavy rainfall and storm surges. Even properties located outside designated flood zones can be at risk, as heavy rainfall or rapid snowmelt can lead to flash floods and riverine flooding.

Many homeowners and business owners are often unaware of the true extent of their flood risk. They may assume that their standard property insurance policies cover flood damage, but this is not the case. Traditional home and business insurance policies typically exclude flood-related claims, leaving policyholders vulnerable to significant financial losses.

Additionally, the costs of flood damage can be exceptionally high. According to recent statistics, the average flood claim in the United States exceeds $40,000. Without flood insurance, these expenses can quickly become unmanageable, leading to financial strain and even bankruptcy for some individuals and businesses.

The Challenge of Affordability: Overcoming Barriers to Coverage

While the importance of flood insurance is clear, one of the primary challenges is making it affordable and accessible to those who need it most. Flood insurance policies can be expensive, particularly for properties located in high-risk areas, where the potential for severe flooding is greatest.

Several factors contribute to the high cost of flood insurance. Firstly, the likelihood of a flood event occurring in high-risk areas is significantly higher, which means insurers face a greater risk of paying out claims. This increased risk is reflected in the premiums charged to policyholders.

Secondly, the costs of repairing and rebuilding flood-damaged properties can be substantial. The average cost of repairing a home damaged by flooding is upwards of $50,000. This high cost of repairs, combined with the increased likelihood of claims, drives up the premiums for flood insurance policies.

Additionally, the complexity of flood modeling and the limited availability of historical flood data in some regions can make it challenging for insurers to accurately assess risk and set appropriate premiums. This uncertainty can further drive up the cost of coverage.

Strategies for Making Flood Insurance More Affordable

Addressing the affordability challenge is crucial to ensuring that flood insurance is accessible to a wider range of property owners. Here are some strategies that are being implemented and explored to make flood insurance more affordable:

- Government Subsidies and Programs: Governments at various levels are implementing programs to subsidize flood insurance premiums for those in high-risk areas. These subsidies can significantly reduce the cost of coverage, making it more accessible to homeowners and businesses.

- Community-Based Programs: Some communities are developing their own flood insurance programs, often in partnership with local insurers. These community-based programs can be tailored to the specific flood risks and needs of the area, potentially resulting in more affordable premiums.

- Risk Mitigation Measures: Encouraging and supporting property owners to implement flood risk mitigation measures can lead to reduced premiums. Examples include elevating structures above the base flood elevation, installing flood barriers, or implementing proper drainage systems.

- Public-Private Partnerships: Collaborations between government agencies and private insurers can help spread the risk and make flood insurance more affordable. These partnerships can involve shared risk models or reinsurance programs.

- Improved Flood Mapping and Data: Enhancing the accuracy and availability of flood maps and data can help insurers better understand and assess flood risks. This improved understanding can lead to more accurate premiums and potentially lower costs for policyholders.

The Role of Technology in Flood Insurance

Advancements in technology are playing a pivotal role in transforming the flood insurance landscape. Innovative solutions are being developed to improve risk assessment, enhance flood modeling, and streamline the claims process, ultimately making flood insurance more accessible and efficient.

Innovative Risk Assessment Tools

Traditional flood maps, while valuable, often provide a static view of flood risk. Innovative risk assessment tools, powered by advanced technologies such as LiDAR (Light Detection and Ranging) and satellite imagery, offer a more dynamic and precise understanding of flood hazards.

These tools can analyze historical flood data, topographical features, and weather patterns to create highly detailed flood risk models. By incorporating real-time data and advanced algorithms, insurers can gain a more accurate and up-to-date understanding of flood risks, allowing for more precise premium calculations.

| Advanced Risk Assessment Tools | Benefits |

|---|---|

| LiDAR Technology | High-resolution mapping of terrain and floodplains, improving risk assessment accuracy. |

| Satellite Imagery | Real-time monitoring of flood events and rapid damage assessment. |

| AI-Driven Flood Models | Advanced flood simulation and prediction, aiding in better risk management. |

Streamlining the Claims Process with Technology

The claims process following a flood event can be complex and time-consuming. However, technology is transforming this process, making it faster, more efficient, and less burdensome for policyholders.

Insurers are adopting digital platforms and mobile apps to streamline the claims process. Policyholders can now submit claims and provide supporting documentation electronically, reducing the need for in-person inspections and speeding up the claims settlement process.

Additionally, the use of drones and satellite imagery in assessing flood damage is revolutionizing the post-flood claims process. Drones can quickly and safely survey large areas, capturing high-resolution images of damaged properties. This technology enables insurers to remotely assess the extent of damage, expediting the claims process and providing policyholders with faster access to their insurance benefits.

The Future of Affordable Flood Insurance

The landscape of flood insurance is evolving, driven by a combination of technological advancements, improved risk assessment, and a growing awareness of the importance of financial protection against flooding. As we look to the future, several key trends and developments are shaping the affordability and accessibility of flood insurance.

Personalized Flood Insurance Products

The use of advanced risk assessment tools and data analytics is paving the way for the development of personalized flood insurance products. These products are tailored to the unique flood risks and needs of individual properties, offering policyholders more flexibility and potentially lower premiums.

Insurers are leveraging big data and machine learning algorithms to analyze a wide range of factors, including property characteristics, historical flood data, and even individual behavior. By understanding the specific risks associated with each property, insurers can offer more precise coverage options, ensuring that policyholders only pay for the protection they truly need.

Incentivizing Risk Mitigation

Encouraging property owners to implement flood risk mitigation measures is a key strategy for reducing the overall risk of flooding and, consequently, the cost of flood insurance. Many insurers are now offering premium discounts to policyholders who take proactive steps to mitigate flood risks.

For instance, policyholders who elevate their homes above the base flood elevation or install flood barriers may be eligible for significant premium discounts. These incentives not only reduce the financial burden on policyholders but also contribute to a safer and more resilient community, as these mitigation measures can significantly reduce the impact of flooding.

Collaboration and Data Sharing

Collaboration between insurers, government agencies, and academic institutions is crucial for advancing flood risk assessment and management. By sharing data and insights, these stakeholders can collectively enhance our understanding of flood hazards and develop more effective risk mitigation strategies.

Additionally, the establishment of centralized data repositories and flood risk models can benefit the entire insurance industry. Insurers can leverage this shared data to improve their risk assessment processes, leading to more accurate premiums and potentially lower costs for policyholders.

Expanding Access to Flood Insurance

Efforts are underway to expand the availability of flood insurance to a wider range of property owners, including those in underserved communities and high-risk areas. Government initiatives and community-based programs are working to bridge the gap in flood insurance coverage, ensuring that more individuals and businesses have access to this vital financial protection.

These initiatives often involve partnerships between government agencies, insurers, and community organizations. By offering subsidies, providing education and awareness campaigns, and simplifying the insurance purchasing process, these programs aim to make flood insurance more accessible and affordable for all.

Conclusion

Affordable flood insurance is a critical component of financial resilience and protection for homeowners and businesses in flood-prone areas. While challenges remain, particularly in making insurance accessible and affordable, advancements in technology, risk assessment, and collaborative efforts are paving the way for a more sustainable and equitable flood insurance landscape.

As we continue to innovate and adapt, flood insurance will become increasingly tailored, efficient, and accessible. By embracing these advancements and working together, we can better protect our communities and ensure a more resilient future in the face of the ever-present threat of flooding.

How can I determine if my property is located in a flood-prone area?

+You can start by checking official flood maps provided by your local government or regulatory agencies. These maps identify areas with varying levels of flood risk. Additionally, you can consult with a professional flood risk assessor or insurance broker who can evaluate your property’s specific flood risk factors.

Are there any government programs that offer flood insurance subsidies or assistance?

+Yes, many governments have programs in place to assist individuals and businesses in obtaining flood insurance. These programs often provide subsidies or premium discounts for those living in high-risk areas. It’s worth researching and contacting your local government or insurance provider to learn more about available programs and eligibility criteria.

Can I reduce my flood insurance premiums by taking certain actions?

+Absolutely! Implementing flood risk mitigation measures can lead to reduced premiums. Actions such as elevating your home, installing flood barriers, or improving drainage systems can significantly lower your flood risk and qualify you for premium discounts. Consult with your insurance provider to understand the specific measures that can result in savings.