What Is Renter's Insurance

Renters insurance is a type of property insurance that provides coverage for individuals who rent their living space, such as apartments, condos, or houses. It offers financial protection against various risks and liabilities commonly faced by renters, ensuring peace of mind and safeguarding personal belongings and legal interests. This comprehensive guide aims to delve into the world of renters insurance, exploring its benefits, coverage options, and how it can be tailored to meet the unique needs of renters.

Understanding the Need for Renters Insurance

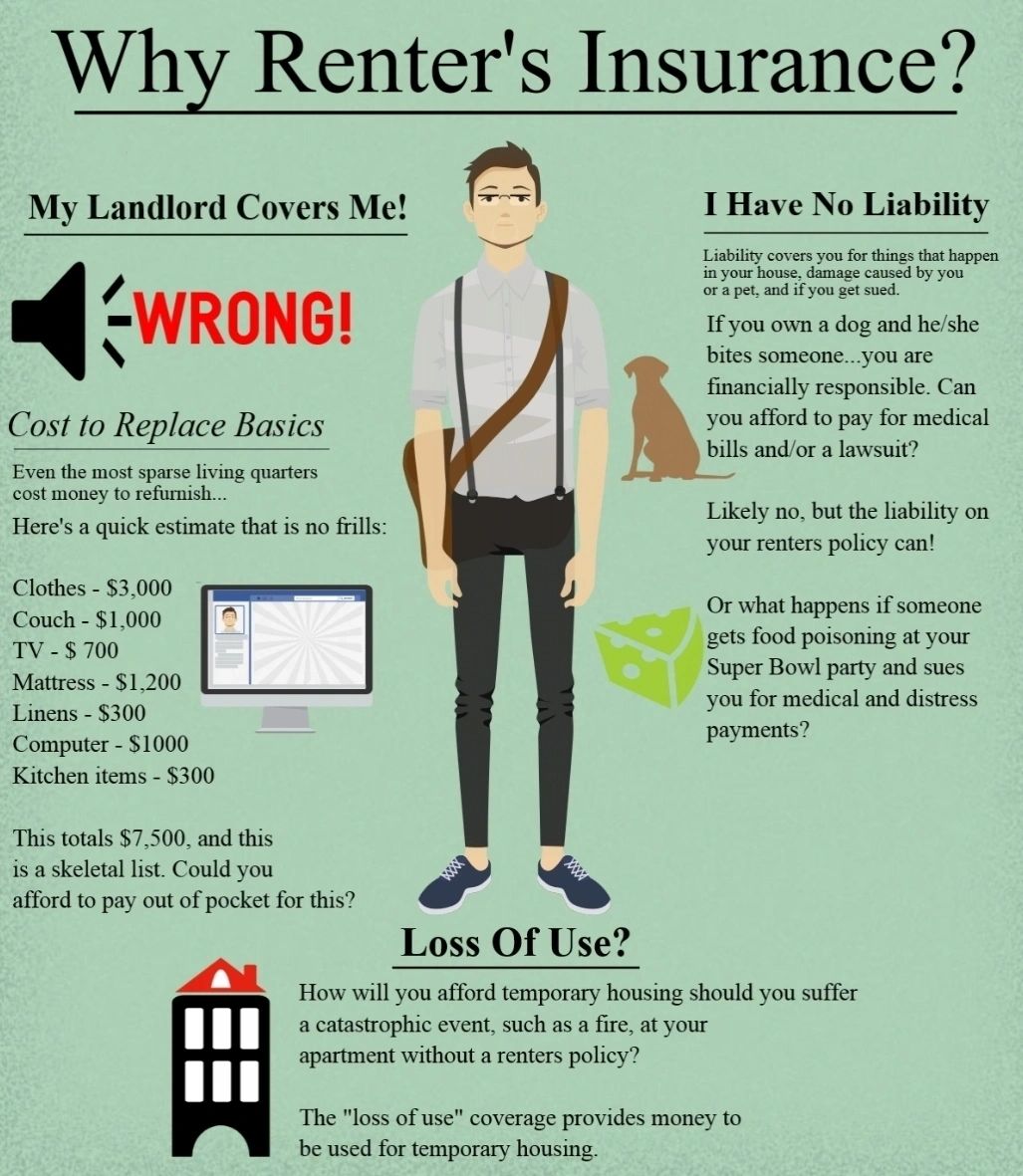

Renters often assume that their landlord’s insurance policy will cover any damages or losses that occur within the rented property. However, this is a common misconception. Landlord insurance primarily covers the structure and specific items owned by the landlord, such as appliances and fixtures. It does not extend to the tenant’s personal belongings or liability concerns.

Renters insurance steps in to fill this gap, providing coverage for personal property, liability, and additional living expenses. It ensures that renters are protected against unexpected events like theft, fire, or water damage, which can result in significant financial losses. Moreover, it offers liability protection, shielding renters from legal and financial responsibilities in case of accidents or injuries that occur within the rented premises.

Key Components of Renters Insurance

Personal Property Coverage

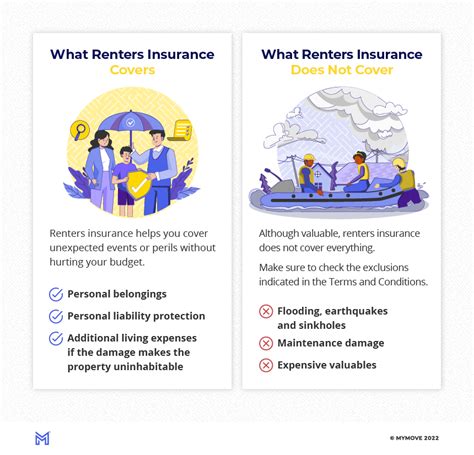

This is one of the primary benefits of renters insurance. It provides financial reimbursement for the loss or damage of personal belongings due to covered perils. Covered perils typically include events like fire, lightning, windstorms, theft, and vandalism. Renters can choose the level of coverage that suits their needs, ensuring adequate protection for their valuable possessions.

It's important to note that renters insurance typically covers the actual cash value of the lost or damaged items, which means the reimbursement is based on the current market value of the items, considering their depreciation over time. However, additional endorsements can be added to provide replacement cost coverage, ensuring renters receive the full cost of replacing their belongings without deducting for depreciation.

Liability Coverage

Liability coverage is a crucial aspect of renters insurance, as it protects renters from financial obligations arising from accidents or injuries that occur within their rented space. This coverage extends to situations where a guest is injured on the renter’s property or if the renter accidentally causes damage to a third party’s property.

For instance, if a visitor trips and falls in your apartment, resulting in medical expenses, renters insurance can provide coverage for these costs. Additionally, if your pet causes damage to a neighbor's property, liability coverage can help cover the repair or replacement expenses. This protection ensures that renters are not left financially burdened due to unexpected incidents.

Additional Living Expenses

Renters insurance also offers coverage for additional living expenses in the event that the rented property becomes uninhabitable due to a covered loss. This coverage reimburses renters for the increased costs of temporary housing, meals, and other necessary expenses incurred while their primary residence is being repaired or restored.

Suppose a fire breaks out in your apartment complex, rendering your unit unlivable. In such a scenario, renters insurance would provide coverage for the cost of staying in a hotel, eating at restaurants, and other reasonable expenses until your apartment is once again suitable for habitation.

Customizing Renters Insurance to Your Needs

Renters insurance policies can be tailored to meet the specific needs and circumstances of individual renters. Here are some key considerations when customizing your policy:

Coverage Limits

Renters should carefully assess the value of their personal belongings and choose coverage limits that align with their needs. It’s essential to strike a balance between adequate coverage and affordability. Underestimating the value of your possessions can leave you underinsured, while overestimating may result in unnecessary expenses.

Deductibles

Renters insurance policies typically come with deductibles, which are the amounts that the insured must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lower the premium, making the policy more affordable. However, it’s important to select a deductible that you can comfortably afford in the event of a claim.

Additional Coverages

Standard renters insurance policies provide basic coverage, but additional endorsements can be added to tailor the policy further. Some common additional coverages include:

- Personal Liability: Enhances the liability coverage beyond the standard policy limits.

- Replacement Cost Coverage: Ensures that personal belongings are replaced at their full cost, without deducting for depreciation.

- Identity Theft Coverage: Provides assistance and financial protection in the event of identity theft.

- High-Value Item Coverage: Covers valuable items like jewelry, fine art, or collectibles that may exceed the standard policy limits.

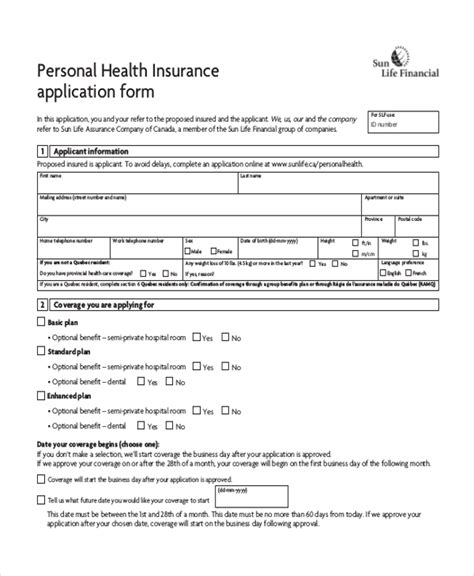

The Process of Obtaining Renters Insurance

Obtaining renters insurance is a straightforward process. Here’s a step-by-step guide:

- Research Insurance Providers: Start by researching reputable insurance companies that offer renters insurance policies. Consider factors like financial stability, customer service ratings, and policy features.

- Compare Policies: Obtain quotes from multiple providers and compare the coverage, limits, deductibles, and premiums. Ensure that you're comparing policies with similar coverage options to make an informed decision.

- Assess Your Needs: Evaluate your personal circumstances and the value of your belongings. Consider any specific coverage needs, such as high-value item coverage or additional liability protection.

- Choose a Policy: Select the policy that best aligns with your needs and budget. Review the policy documents carefully to understand the coverage, exclusions, and any endorsements you've added.

- Purchase the Policy: Contact the insurance provider or your chosen agent to purchase the policy. Provide accurate information about your rental property, personal belongings, and any additional coverages you've selected.

- Review and Update Regularly: Regularly review your renters insurance policy to ensure it continues to meet your needs. Life changes, such as acquiring new possessions or moving to a different rental property, may require adjustments to your coverage.

Frequently Asked Questions

Is renters insurance mandatory for all renters?

+Renters insurance is not legally mandatory for all renters. However, many landlords require their tenants to have renters insurance as a condition of the lease agreement. Additionally, having renters insurance is a wise financial decision to protect your personal belongings and liability interests.

Does renters insurance cover natural disasters like floods or earthquakes?

+Standard renters insurance policies typically do not cover damage caused by natural disasters such as floods or earthquakes. However, additional endorsements or separate policies can be purchased to provide coverage for these specific perils. It’s important to review your policy or consult with your insurance provider to understand your coverage options.

Can renters insurance be purchased for short-term rentals or Airbnb stays?

+Yes, renters insurance can be tailored to cover short-term rentals or Airbnb stays. Many insurance providers offer specialized policies or endorsements for individuals renting properties on a short-term basis. These policies provide coverage for personal belongings, liability, and additional living expenses, similar to traditional renters insurance.