Purchase Term Life Insurance

Term life insurance is a popular and straightforward form of life insurance that offers financial protection for a specified period, typically ranging from 10 to 30 years. Unlike permanent life insurance policies, which provide coverage for an individual's entire life, term life insurance is designed to offer temporary protection during specific life stages or when certain financial responsibilities are most prominent. This article will delve into the intricacies of term life insurance, exploring its benefits, how it works, and why it might be the right choice for your unique circumstances.

Understanding Term Life Insurance

Term life insurance, as the name suggests, is a temporary insurance solution. It provides a death benefit to your named beneficiaries if you pass away during the specified term of the policy. The coverage period can be tailored to match your needs, whether you’re looking for protection while your children are young, during your peak earning years, or while you have significant financial obligations.

One of the key advantages of term life insurance is its affordability. Compared to permanent life insurance policies like whole life or universal life insurance, term life insurance premiums are generally much lower. This makes it an accessible option for individuals and families seeking financial protection without a substantial financial commitment.

How Term Life Insurance Works

When you purchase a term life insurance policy, you agree to pay a premium, usually on a monthly or annual basis, to the insurance company. In return, the insurer promises to pay a specified amount (the death benefit) to your beneficiaries if you pass away during the policy’s term. The death benefit can be used to cover a variety of expenses, including funeral costs, outstanding debts, or to provide income replacement for your loved ones.

The application process for term life insurance typically involves providing personal information, such as your age, health status, and lifestyle habits. Based on this information, the insurance company will assess your risk level and determine your premium amount. It's important to note that individuals with higher risk profiles, such as those with pre-existing health conditions or high-risk occupations, may pay higher premiums or may not be eligible for coverage.

| Term Length | Premium Type | Death Benefit |

|---|---|---|

| 10-30 years | Fixed or Level | Specified Amount |

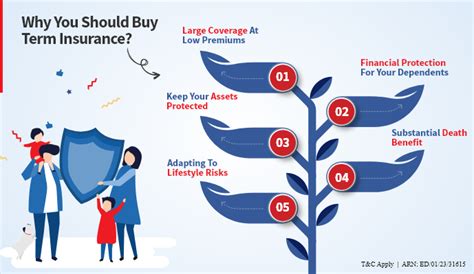

Key Benefits of Term Life Insurance

Affordability

One of the most significant advantages of term life insurance is its cost-effectiveness. Premiums are generally much lower compared to permanent life insurance policies, making it an accessible option for those on a budget. For instance, a 30-year-old non-smoker might pay as little as 15 per month for a 500,000 term life insurance policy.

Flexibility

Term life insurance policies offer a high degree of flexibility. You can choose the length of the term that aligns with your financial goals and obligations. Whether you need coverage for a few years or several decades, there’s a term length to suit your needs. Additionally, some insurers offer the option to renew your policy or convert it to a permanent life insurance policy as your circumstances change.

Customizable Coverage

Term life insurance allows you to tailor your coverage to meet your specific needs. You can choose the death benefit amount that aligns with your financial responsibilities, whether it’s covering mortgage payments, funding your children’s education, or providing income replacement for your family.

Peace of Mind

By purchasing term life insurance, you can rest assured knowing that your loved ones will be financially protected in the event of your untimely passing. This peace of mind is invaluable, especially during life’s crucial stages when financial obligations are at their peak.

Who Should Consider Term Life Insurance

Term life insurance is an excellent choice for individuals and families who are seeking temporary financial protection. Here are some scenarios where term life insurance might be the right fit:

- Young Families: If you have young children and are the primary income earner, term life insurance can provide a financial safety net to ensure your family's financial stability if something were to happen to you.

- Mortgage Holders: Term life insurance can be a cost-effective way to cover your mortgage balance in the event of your death, ensuring your loved ones can remain in the family home.

- Business Owners: Business owners can use term life insurance to protect their business interests. For example, if you have a partner in your business, a term life insurance policy can provide funds to buy out your share in the event of your death, ensuring business continuity.

- Those with Specific Financial Obligations: If you have outstanding debts or financial commitments that you want to ensure are covered in the event of your death, term life insurance can provide the necessary protection.

Choosing the Right Term Length

When selecting a term life insurance policy, one of the critical decisions you’ll make is determining the length of the term. The term length should align with your specific financial needs and goals. Here are some considerations to help you choose the right term:

Short-Term Coverage

If you’re looking for coverage for a specific, short-term financial obligation, such as paying off a car loan or covering a few years of college tuition, a shorter term length (e.g., 5-10 years) might be sufficient. Short-term policies are generally more affordable, making them an attractive option for those with limited financial obligations.

Long-Term Protection

For individuals who want coverage during their peak earning years or to protect their family until their children are financially independent, a longer term length (e.g., 20-30 years) is often recommended. This ensures that your loved ones are protected during the most financially demanding periods of your life.

Renewable and Convertible Policies

Some term life insurance policies offer the option to renew the policy at the end of the term or convert it to a permanent life insurance policy. Renewable policies allow you to extend the coverage period, often at a higher premium due to the increased risk associated with aging. Convertible policies, on the other hand, provide the flexibility to transition to a permanent life insurance policy, which can be beneficial if your financial needs change over time.

Applying for Term Life Insurance

The application process for term life insurance typically involves the following steps:

- Research and Compare: Start by researching different insurers and comparing their term life insurance offerings. Consider factors like premium costs, policy features, and the financial strength of the company.

- Choose Your Term and Coverage Amount: Decide on the term length that aligns with your financial goals and select a death benefit amount that adequately covers your financial obligations.

- Provide Personal Information: You'll need to provide personal details, such as your age, gender, health status, and lifestyle habits. This information is used to assess your risk level and determine your premium.

- Medical Examination (Optional): Depending on the insurer and the coverage amount, you may be required to undergo a medical examination. This helps the insurer assess your health status and determine your risk level.

- Review and Accept the Policy: Once your application is approved, carefully review the policy details, including the coverage amount, term length, and premium payments. Ensure that the policy meets your expectations and needs.

Making a Claim on a Term Life Insurance Policy

In the unfortunate event of your passing during the policy term, your beneficiaries can make a claim on your term life insurance policy. Here’s a general overview of the claims process:

- Notification: When a policyholder passes away, the insurance company should be notified as soon as possible. The notification can be made by the beneficiary or a representative.

- Documentation: The beneficiary will need to provide certain documents to support the claim. This typically includes a certified copy of the death certificate, the original policy, and any other relevant documents, such as a marriage certificate or proof of relationship.

- Review and Approval: The insurance company will review the claim to ensure it meets the policy's terms and conditions. If the claim is approved, the beneficiary will receive the death benefit as specified in the policy.

- Payment: The death benefit is usually paid as a lump sum, but some policies offer the option to receive payments over a period of time or as an annuity.

Term Life Insurance vs. Permanent Life Insurance

When deciding between term life insurance and permanent life insurance, it’s essential to understand the key differences between the two. Here’s a breakdown of their main characteristics:

| Characteristic | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Period | Temporary, typically 10-30 years | Lifetime coverage |

| Premium Costs | Generally lower, especially for younger individuals | Higher premiums, but remain fixed throughout the policy |

| Death Benefit | Specified amount payable if the insured passes away during the term | Specified amount payable at any time, with cash value accumulation |

| Flexibility | Offers flexibility in term length and coverage amount | Provides guaranteed coverage and cash value accumulation |

| Suitable For | Individuals with specific, temporary financial needs or obligations | Those seeking lifelong coverage and cash value accumulation |

Conclusion

Term life insurance is a valuable tool for individuals and families seeking financial protection during specific life stages. Its affordability, flexibility, and customizable coverage make it an attractive option for those with temporary financial obligations. By carefully considering your needs and goals, you can choose the right term life insurance policy to provide peace of mind and ensure your loved ones are financially protected.

Can I purchase term life insurance if I have a pre-existing medical condition?

+Yes, individuals with pre-existing medical conditions can often purchase term life insurance. However, the premium may be higher, and you may be required to undergo a medical examination. It’s best to disclose your health status during the application process to ensure accurate coverage.

What happens if I outlive the term of my policy?

+If you outlive the term of your policy, your coverage will expire, and you will no longer be protected. However, some policies offer the option to renew or convert your term life insurance into a permanent life insurance policy, allowing you to maintain coverage.

Can I change the beneficiaries on my term life insurance policy?

+Yes, you can typically change the beneficiaries on your term life insurance policy at any time. It’s important to keep your beneficiary information up-to-date to ensure your wishes are honored.