What Is Covered By Renters Insurance

Renters insurance, also known as tenant insurance, is a vital aspect of protecting your possessions and yourself while living in a rental property. It provides financial coverage for various aspects of your life as a renter, offering peace of mind and security. In this comprehensive guide, we will delve into the world of renters insurance, exploring what it covers, how it works, and why it is an essential consideration for anyone living in a rented space.

Understanding Renters Insurance: A Comprehensive Overview

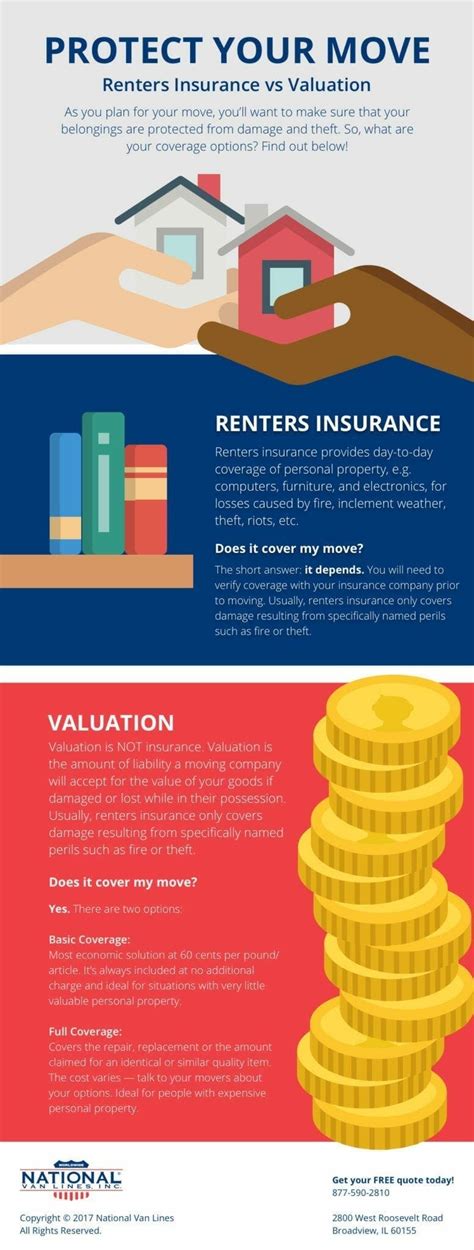

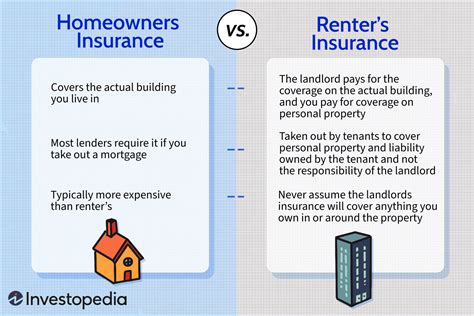

Renters insurance is a specialized type of insurance policy designed specifically for individuals who rent their homes, apartments, or other residential properties. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on the possessions and personal liability of the tenant. It is a crucial safety net that safeguards your belongings and provides protection against unexpected events that could lead to financial loss.

Coverage for Personal Property

One of the primary benefits of renters insurance is the coverage it provides for your personal belongings. Whether you have a spacious apartment filled with furniture and electronics or a cozy studio with a few essential items, renters insurance ensures that your possessions are protected. Here's a closer look at what it covers:

- Furniture and Appliances: From your comfortable couch to the fridge that keeps your food fresh, renters insurance covers a wide range of household items. This includes furniture, appliances, and even electronics like TVs and laptops.

- Clothing and Personal Items: Your wardrobe, shoes, and other personal belongings are also covered. Renters insurance ensures that if these items are damaged or lost due to a covered event, you can receive compensation to replace them.

- Jewelry and Valuables: Renters insurance often includes coverage for valuable items such as jewelry, artwork, and collectibles. However, it's important to note that there may be limits or additional endorsements required for high-value items.

- Sporting Goods and Hobbies: Whether you're an avid cyclist, skier, or have a collection of musical instruments, renters insurance can provide coverage for these recreational items. It ensures that your hobbies and investments are protected.

| Category | Coverage |

|---|---|

| Furniture | Couches, beds, tables, chairs, etc. |

| Appliances | Refrigerators, ovens, washing machines, etc. |

| Electronics | TVs, computers, gaming consoles, etc. |

| Clothing | All types of apparel, including shoes and accessories |

Liability Protection: Safeguarding Against Legal Risks

Renters insurance not only covers your personal property but also provides essential liability protection. This aspect of the policy is designed to protect you from financial losses arising from accidents or injuries that occur on your rental property and for which you may be held responsible.

Here's a breakdown of the liability coverage provided by renters insurance:

- Bodily Injury: If someone is injured on your rental property, renters insurance can cover the medical expenses and legal fees associated with the incident. This includes situations where a guest slips and falls or sustains an injury due to a hazardous condition on your premises.

- Property Damage: In the event that you accidentally cause damage to someone else's property, renters insurance steps in to cover the costs of repairs or replacement. For instance, if you accidentally spill a drink on your neighbor's antique rug, your policy may cover the necessary repairs or compensation.

- Legal Defense: If you are sued due to an accident or injury that occurred on your rental property, renters insurance provides legal defense coverage. This ensures that you have the necessary resources to defend yourself and navigate any legal proceedings.

Additional Living Expenses: Covering the Unexpected

Renters insurance also includes coverage for additional living expenses, which can be incredibly beneficial in certain situations. This aspect of the policy ensures that you have financial support if you need to relocate temporarily due to a covered event, such as a fire or severe storm damage to your rental unit.

Here's how additional living expenses coverage works:

- If your rental unit becomes uninhabitable due to a covered loss, renters insurance will reimburse you for the additional costs incurred while you find temporary housing. This includes expenses like hotel stays, meals, and other necessary living expenses.

- The coverage typically provides a set daily or monthly limit, ensuring that you have the financial means to maintain your standard of living during the transition period.

Personal Injury Coverage: Protecting Your Reputation

Renters insurance goes beyond tangible possessions and liability concerns. It also includes personal injury coverage, which provides protection against non-physical damages resulting from false accusations or defamation.

Here's an overview of personal injury coverage:

- Libel and Slander: If you are falsely accused of defamation, renters insurance can provide coverage for legal fees and any associated damages. This ensures that you have the necessary resources to defend your reputation.

- Invasion of Privacy: In the event that your privacy is invaded, either through unauthorized use of your image or other personal information, renters insurance can cover the resulting legal expenses and any settlements or judgments.

Guest Medical Coverage: Extending Protection to Your Guests

Renters insurance often includes guest medical coverage, which provides additional protection for your guests' medical expenses if they are injured on your rental property.

- This coverage is separate from your liability coverage and specifically caters to medical expenses, ensuring that your guests receive the necessary care without affecting your liability limits.

- It covers accidents that occur on your property, whether it's a slip and fall or an injury sustained while engaging in recreational activities on your premises.

Optional Coverages: Customizing Your Policy

While the standard renters insurance policy provides comprehensive coverage, you have the option to customize your policy to meet your specific needs. Here are some optional coverages you can consider:

- Water Backup Coverage: If your rental property experiences water damage due to a backed-up sewer or drain, this coverage ensures that the resulting repairs and cleanup are covered.

- Identity Theft Coverage: In today's digital age, identity theft is a growing concern. With this optional coverage, you can receive assistance and compensation if you become a victim of identity theft.

- Earthquake and Flood Coverage: Depending on your location and the potential risks, you may want to consider adding coverage for earthquakes or floods. These natural disasters are often excluded from standard policies but can be added as optional endorsements.

The Benefits of Renters Insurance: Peace of Mind and Financial Security

Renters insurance offers a multitude of benefits that extend beyond the coverage provided. Here are some key advantages of having a renters insurance policy:

- Peace of Mind: Knowing that your possessions and personal liability are protected brings a sense of tranquility and security. Renters insurance ensures that you can focus on enjoying your rental experience without worrying about potential financial burdens.

- Financial Security: In the event of a covered loss, renters insurance provides the necessary funds to replace your belongings and cover any associated expenses. This financial support can be crucial in helping you get back on your feet quickly and efficiently.

- Customizable Coverage: Renters insurance allows you to tailor your policy to fit your unique needs and circumstances. Whether you have high-value items or specific concerns, you can work with your insurance provider to create a policy that provides the right level of protection.

Choosing the Right Renters Insurance Policy: Factors to Consider

When selecting a renters insurance policy, it's essential to consider several factors to ensure you get the right coverage for your situation. Here are some key considerations:

- Coverage Limits: Evaluate your personal property and determine the value of your belongings. Choose a policy with coverage limits that align with the actual value of your possessions. This ensures that you are adequately protected in the event of a loss.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Consider your financial situation and choose a deductible that you can comfortably afford.

- Liability Limits: Assess your potential liability risks and choose a policy with sufficient liability coverage. This is especially important if you frequently host guests or have valuable assets that could be at risk.

- Additional Coverages: Review the optional coverages available and determine which ones are relevant to your situation. Adding endorsements for specific risks, such as water backup or identity theft, can provide added peace of mind.

Frequently Asked Questions (FAQ)

What is the difference between renters insurance and homeowners insurance?

+Renters insurance covers the possessions and liability of the tenant, while homeowners insurance covers the structure and contents of the property itself, as well as the liability of the homeowner.

How much does renters insurance typically cost?

+The cost of renters insurance varies depending on factors such as the location, the value of your possessions, and the coverage limits you choose. On average, renters insurance policies can range from $15 to $30 per month.

Is renters insurance mandatory for tenants?

+While renters insurance is not legally required in most places, it is highly recommended. Landlords typically require tenants to have their own insurance to protect their possessions and avoid any potential liability.

Can I add my roommates to my renters insurance policy?

+Yes, many renters insurance policies allow you to add your roommates as additional insureds. This ensures that their belongings and liability are also covered under the same policy.

What should I do if I need to file a claim under my renters insurance policy?

+If you experience a covered loss, contact your insurance provider as soon as possible to report the claim. They will guide you through the claims process and help you receive the compensation you are entitled to.

Renters insurance is an essential tool for protecting your possessions and ensuring your financial well-being while living in a rental property. By understanding the comprehensive coverage it provides, from personal property to liability protection, you can make informed decisions and choose a policy that suits your needs. Remember, it’s always better to be prepared and have the right insurance coverage to navigate any unexpected challenges that may arise during your rental journey.