What Is A Sr22 Insurance

In the realm of automotive insurance, the term "SR22 Insurance" often surfaces as a critical component for drivers facing specific legal and financial situations. This type of insurance, while less commonly known than standard auto policies, plays a pivotal role in ensuring compliance with legal requirements and facilitating continued driving privileges for certain individuals.

Understanding SR22 Insurance

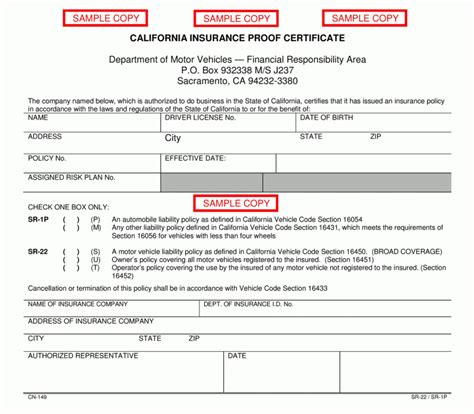

SR22 insurance, also known as a certificate of financial responsibility, is a specialized type of auto insurance policy that demonstrates to the state that a driver has met the minimum liability insurance requirements. It is typically required for drivers who have had their licenses suspended or revoked due to various reasons, including driving under the influence (DUI), driving without insurance, or accumulating too many traffic violations.

The primary function of an SR22 is to act as proof of financial responsibility, assuring the state that the driver can cover any potential liabilities resulting from their driving activities. This is a crucial step for drivers looking to regain their driving privileges after a suspension or to avoid further legal consequences.

Who Needs SR22 Insurance?

The necessity for SR22 insurance arises when a driver is deemed a higher risk to insurers. This categorization often stems from a history of traffic violations, DUIs, or even a single serious accident. In such cases, the state may require the driver to file an SR22 to ensure they are maintaining adequate insurance coverage.

Drivers with a history of insurance lapses might also find themselves in need of an SR22. This requirement ensures that these drivers maintain continuous insurance coverage, a crucial aspect for maintaining driving privileges and avoiding additional legal complications.

How SR22 Insurance Works

Obtaining an SR22 involves working with an insurance provider to secure a policy that meets the state’s minimum liability requirements. Once the policy is in place, the insurance company electronically files the SR22 form with the state’s Department of Motor Vehicles (DMV) or equivalent agency.

The SR22 form serves as a guarantee to the state that the driver carries the necessary insurance coverage. It includes details such as the driver's name, policy limits, and the insurer's information. The form must be kept active for a period determined by the state, which could range from one to three years, depending on the violation or reason for the requirement.

| State | Duration of SR22 Requirement |

|---|---|

| California | 3 years |

| Florida | 1 year |

| Texas | 2 years |

| New York | 1 year |

During the period the SR22 is active, the driver must maintain continuous insurance coverage. Any lapse in coverage or cancellation of the policy can result in the state being notified, which could lead to further penalties or the immediate suspension of driving privileges.

Cost and Coverage of SR22 Insurance

The cost of SR22 insurance can be significantly higher than standard auto insurance policies due to the increased risk associated with the driver’s history. The premium can vary widely based on factors such as the driver’s location, the specific violation or reason for the requirement, and their overall driving record.

In addition to the higher premiums, drivers with an SR22 requirement might also face additional fees. These could include a filing fee charged by the insurance company for processing the SR22 form, as well as potential reinstatement fees charged by the state's DMV for processing the SR22 filing.

Coverage Options

The coverage provided by an SR22 policy is typically the state’s minimum liability requirements, which may not be sufficient to fully protect the driver in the event of an accident. As such, it is often recommended that drivers opt for higher coverage limits to better safeguard their financial interests.

Some insurance providers might offer additional coverage options tailored to drivers with SR22 requirements. These could include roadside assistance, rental car reimbursement, or even accident forgiveness, which can be particularly beneficial for drivers looking to rebuild their driving record.

Filing an SR22

The process of filing an SR22 involves several steps. First, the driver must locate an insurance provider willing to issue an SR22 policy. Not all insurance companies offer this type of coverage, so it may require shopping around to find the right provider.

Once an insurer is found, the driver will need to purchase a policy that meets the state's minimum liability requirements. The insurance company will then file the SR22 form with the state's DMV, providing proof of insurance to the state. The driver will also receive a copy of the SR22 form for their records.

Monitoring and Renewal

Throughout the period the SR22 is active, the insurance company will monitor the policy to ensure continuous coverage. If any changes occur, such as a lapse in coverage or a policy cancellation, the insurance company is obligated to notify the state, which could result in the driver’s license being suspended again.

As the SR22 period nears its end, the driver will need to renew their policy to ensure uninterrupted coverage. Failure to renew could lead to the SR22 being cancelled, which may result in the driver's license being suspended once more.

Can I Get SR22 Insurance Online?

+Yes, many insurance providers now offer the ability to purchase SR22 insurance online. This process typically involves filling out an online form and providing necessary details. However, it’s important to ensure that the online provider is legitimate and licensed in your state.

How Long Does an SR22 Stay on My Record?

+The duration of an SR22 on your record varies by state and the reason for the requirement. It can range from one to three years, but it’s important to maintain continuous insurance coverage during this period to avoid further complications.

Can I Drive Without an SR22 if I’ve Had One in the Past?

+Once the SR22 period has ended and you’ve maintained continuous insurance coverage, you may no longer need an SR22. However, it’s important to check with your state’s DMV to ensure that all requirements have been met and that your driving privileges are fully restored.