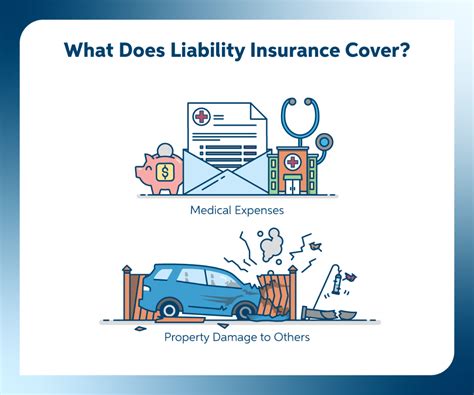

What Does A Liability Insurance Cover

Liability insurance is an essential component of any comprehensive insurance portfolio, offering protection against a wide range of potential risks and liabilities. It serves as a vital safeguard for individuals, businesses, and professionals, providing financial coverage in the event of claims or lawsuits arising from accidents, injuries, property damage, or other unintended consequences of their actions or products. This type of insurance is designed to mitigate the potentially devastating financial impacts that can result from such incidents, ensuring that policyholders are not left solely responsible for the often substantial costs associated with legal settlements, medical expenses, or property repairs.

Understanding Liability Insurance

Liability insurance, at its core, is a form of risk management that provides coverage for damages an individual or entity becomes legally obligated to pay due to their negligence or wrongdoing. This can encompass a broad spectrum of situations, from personal injury and property damage to contractual liability and even defamation. The primary objective of this insurance is to shield policyholders from the financial burden of compensating third parties for losses or damages they have suffered as a result of the policyholder’s actions or inaction.

The scope of liability insurance coverage can vary significantly depending on the policy, the insurer, and the specific circumstances of the claim. It is not a one-size-fits-all solution, but rather a customizable tool that can be tailored to meet the unique needs and risks of the policyholder. This flexibility allows individuals and businesses to secure the appropriate level of protection for their specific activities, locations, and potential liabilities.

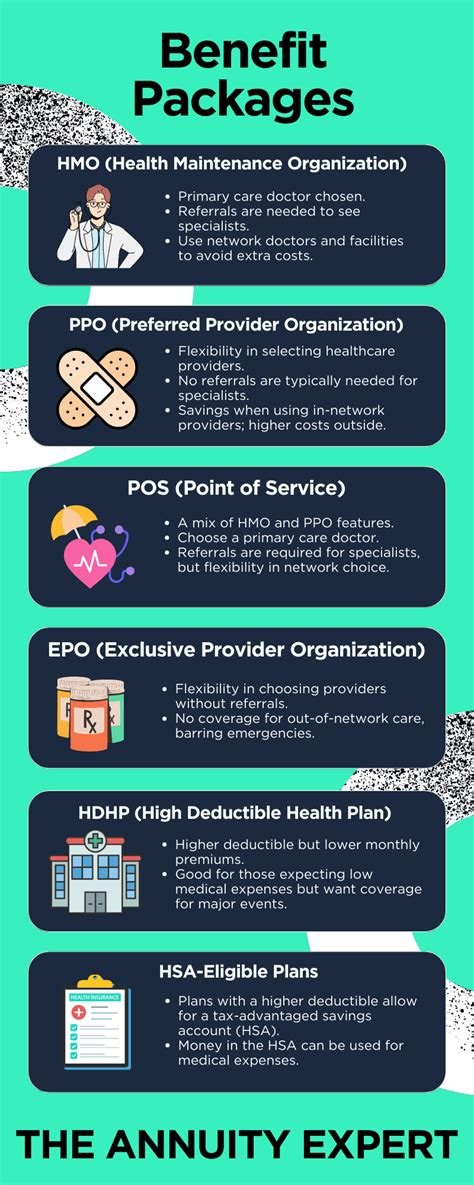

Key Coverages and Protections

Personal Liability

Personal liability insurance is a cornerstone of many homeowners’ and renters’ insurance policies. It offers protection against bodily injury or property damage claims made against the policyholder. This can include scenarios such as a guest slipping and falling on the policyholder’s property, a neighbor’s property being damaged by a tree from the policyholder’s yard, or even instances of dog bites. Personal liability insurance typically covers not only the costs of the resulting medical bills or property repairs but also the legal fees and settlements associated with such claims.

Product Liability

Product liability insurance is a critical safeguard for businesses that manufacture, distribute, or sell goods. It provides coverage for claims arising from defective products, covering both the cost of replacing or repairing the product and any associated legal fees. This type of insurance is especially important given the potential for significant financial losses and legal repercussions if a product causes injury or property damage.

Professional Liability (Errors and Omissions)

Professional liability insurance, often referred to as errors and omissions (E&O) insurance, is tailored for professionals such as consultants, advisors, accountants, and lawyers. It provides coverage for claims of negligence, errors, or omissions in the professional services provided by the insured. This type of insurance is vital for professionals, as it protects them from the financial consequences of lawsuits resulting from their work.

General Liability

General liability insurance is a broad form of coverage that protects businesses from a variety of risks. It typically covers bodily injury, property damage, personal and advertising injury, and medical payments. This insurance is essential for businesses, as it helps them manage the financial risks associated with their operations, especially those involving public interaction or the use of commercial spaces.

The Process of Claims Handling

When a claim is made under a liability insurance policy, the process typically involves several key steps. First, the insured must report the claim to their insurer, providing as much detail as possible about the incident. The insurer will then assign an adjuster to investigate the claim, reviewing the policy terms and conditions, assessing the damage or injury, and determining whether the claim is covered under the policy.

If the claim is approved, the insurer will work with the policyholder and the claimant to settle the claim, which may involve negotiating a settlement amount, covering legal fees, or providing other necessary financial support. Throughout this process, the insurer acts as a key advocate for the policyholder, helping to manage the claim and ensure that the policyholder's rights and interests are protected.

Tailoring Liability Insurance to Your Needs

One of the key advantages of liability insurance is its adaptability. Policyholders can often customize their coverage to address their specific risks and concerns. This might involve adjusting policy limits, adding endorsements for specific risks, or even purchasing separate policies to cover unique or high-risk activities.

For instance, a business might purchase a general liability policy to cover everyday operations, but also purchase a separate product liability policy to protect against the risks associated with manufacturing or selling goods. Similarly, a professional might opt for a basic professional liability policy, but also consider additional coverage for specific types of errors or situations that are more common in their field.

The Importance of Adequate Coverage

Ensuring adequate coverage is a critical aspect of liability insurance. Policyholders should carefully review their policies to understand the limits and exclusions, ensuring that they have sufficient coverage for their potential risks. In many cases, it may be advisable to increase policy limits or consider umbrella liability insurance to provide additional layers of protection.

Adequate coverage is particularly important in light of the potentially catastrophic financial consequences of liability claims. A single lawsuit or claim can result in substantial damages, legal fees, and other related expenses. Without sufficient insurance coverage, policyholders could be left with substantial out-of-pocket expenses, which can be devastating for individuals and businesses alike.

Conclusion: The Peace of Mind That Liability Insurance Provides

Liability insurance is an essential tool for managing risk and protecting against the financial fallout of accidents, errors, and other unintended consequences. By providing coverage for a wide range of potential liabilities, this insurance offers policyholders peace of mind, knowing that they are protected from the often-devastating financial impacts of claims and lawsuits. Whether for individuals, businesses, or professionals, liability insurance is a critical component of a comprehensive risk management strategy, ensuring that policyholders can focus on their activities and goals without the constant worry of unforeseen liabilities.

How much does liability insurance cost?

+The cost of liability insurance can vary widely depending on several factors, including the type of insurance, the policy limits, the deductible, and the insured’s risk profile. Personal liability insurance, which is often included in homeowners or renters insurance policies, typically costs a few hundred dollars annually. Business liability insurance, such as general liability or product liability, can range from a few hundred to several thousand dollars per year, depending on the size and nature of the business. Professional liability insurance premiums can also vary significantly based on the professional’s industry and the level of risk involved in their work.

What happens if I don’t have enough liability insurance coverage?

+If you don’t have sufficient liability insurance coverage and you’re faced with a claim or lawsuit, you may be personally responsible for paying any damages or settlements that exceed your policy limits. This can result in significant out-of-pocket expenses, potentially causing financial hardship or even bankruptcy. It’s crucial to regularly review your insurance policies and adjust your coverage as needed to ensure you have adequate protection for your potential risks.

Are there any exclusions or limitations to liability insurance coverage?

+Yes, liability insurance policies typically contain exclusions and limitations. These can vary depending on the insurer and the type of policy. Common exclusions may include intentional acts, contract disputes, certain types of professional services, pollution, and damages resulting from war or terrorism. It’s important to carefully review your policy to understand what is and isn’t covered, so you can make informed decisions about your insurance needs and any additional coverage you might require.