Vehicle Insurance Search

Vehicle insurance, also known as car insurance or auto insurance, is a vital aspect of responsible vehicle ownership. It provides financial protection against potential losses resulting from accidents, theft, or other unforeseen events. In this comprehensive guide, we will delve into the world of vehicle insurance, exploring its various facets, importance, and how it can safeguard both you and your vehicle. As we navigate through the complexities of insurance policies, we'll uncover the factors that influence coverage, premiums, and claims processes, empowering you to make informed decisions about your vehicle insurance.

Understanding Vehicle Insurance Policies

Vehicle insurance policies are legal contracts between you, the policyholder, and the insurance company. These policies outline the coverage, terms, and conditions of the insurance agreement. They specify what events are covered, the limits of coverage, and the responsibilities of both parties. Understanding the different types of coverage available is crucial to ensure you select a policy that aligns with your specific needs.

Types of Vehicle Insurance Coverage

Vehicle insurance policies offer a range of coverage options, each designed to address different risks. The most common types of coverage include:

- Liability Coverage: This coverage is mandatory in most jurisdictions and protects you against claims arising from bodily injury or property damage caused by your vehicle. It provides financial protection if you are found at fault in an accident.

- Comprehensive Coverage: Comprehensive coverage is optional but highly recommended. It covers non-collision-related incidents such as theft, vandalism, natural disasters, and damage caused by animals. This type of coverage ensures your vehicle is protected beyond typical accidents.

- Collision Coverage: Collision coverage, like comprehensive coverage, is optional. It covers damage to your vehicle resulting from collisions with other vehicles or objects. This coverage is especially beneficial if you frequently drive in areas with high traffic or potential hazards.

- Personal Injury Protection (PIP) or Medical Payments Coverage: PIP coverage, or medical payments coverage, provides compensation for medical expenses incurred by you or your passengers in an accident, regardless of fault. It ensures you have financial support for medical treatment and lost wages resulting from injuries.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who has insufficient or no insurance. It covers damages and injuries caused by uninsured or underinsured motorists, ensuring you’re not left financially vulnerable.

Each type of coverage has its own set of limitations and exclusions, so it's crucial to carefully review the policy documents to understand the specific terms and conditions applicable to your coverage.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against claims for bodily injury and property damage caused by your vehicle. |

| Comprehensive Coverage | Covers non-collision incidents like theft, vandalism, and natural disasters. |

| Collision Coverage | Provides coverage for damage to your vehicle resulting from collisions. |

| Personal Injury Protection (PIP) | Compensates for medical expenses and lost wages resulting from injuries. |

| Uninsured/Underinsured Motorist Coverage | Protects you if involved in an accident with an uninsured or underinsured driver. |

Factors Influencing Vehicle Insurance Premiums

Vehicle insurance premiums, or the cost of your policy, are determined by various factors. Understanding these factors can help you make informed decisions when choosing insurance and potentially lower your costs. Here are some key factors that influence insurance premiums:

Vehicle Factors

The type of vehicle you own plays a significant role in determining your insurance premiums. Factors such as the make, model, year, and safety features of your vehicle impact the cost of insurance. For instance, sports cars or high-performance vehicles often attract higher premiums due to their association with higher risk and potential for accidents.

Driver Factors

Your personal driving history and demographics also influence insurance premiums. Insurance companies consider factors such as your age, gender, driving record, and the number of years you’ve held a valid driver’s license. Younger drivers, especially those under 25, may face higher premiums due to their relatively limited driving experience and higher risk of accidents.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select can significantly impact your insurance premiums. Comprehensive and collision coverage, while offering more protection, tend to increase premiums. On the other hand, opting for higher deductibles (the amount you pay out of pocket before insurance coverage kicks in) can lower your premiums. However, it’s important to strike a balance between coverage and affordability.

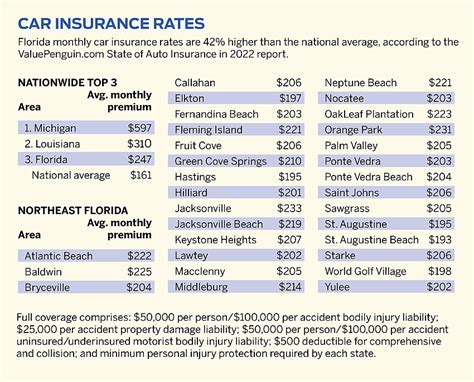

Location and Usage

The area where you reside and the purpose for which you use your vehicle can also affect insurance premiums. Insurance companies consider factors such as the crime rate, traffic density, and accident rates in your area. Additionally, if you primarily use your vehicle for commuting or business purposes, your premiums may differ from those who use their vehicles solely for pleasure.

Claims History

Your claims history is a critical factor in determining insurance premiums. Insurance companies view frequent claims as a sign of higher risk and may adjust your premiums accordingly. Maintaining a clean claims history can help keep your premiums more affordable.

Discounts and Bundling

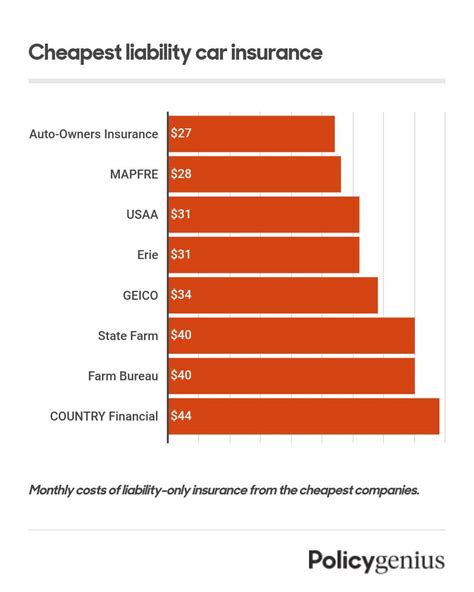

Insurance companies often offer discounts to policyholders who meet certain criteria. These discounts can include safe driver discounts, good student discounts, loyalty discounts, and multi-policy discounts (bundling your vehicle insurance with other types of insurance, such as home or life insurance). Taking advantage of these discounts can help lower your overall insurance costs.

| Factor | Description |

|---|---|

| Vehicle Factors | Make, model, year, and safety features of your vehicle impact premiums. |

| Driver Factors | Age, gender, driving record, and years of driving experience influence premiums. |

| Coverage and Deductibles | The level of coverage and chosen deductibles affect the cost of insurance. |

| Location and Usage | Residential area, traffic density, and purpose of vehicle usage impact premiums. |

| Claims History | A clean claims history can help keep premiums more affordable. |

| Discounts and Bundling | Insurance companies offer discounts for various criteria, and bundling policies can save costs. |

The Claims Process: What to Expect

In the unfortunate event of an accident or incident that triggers your vehicle insurance policy, understanding the claims process is crucial. Here’s a step-by-step guide to help you navigate the process effectively:

Reporting the Incident

As soon as possible after an accident or incident, report it to your insurance company. Most insurance providers have dedicated phone lines or online portals for reporting claims. Be prepared to provide details such as the date, time, and location of the incident, as well as any relevant information about the other parties involved.

Filing a Claim

Once you’ve reported the incident, you’ll need to file a formal claim. This typically involves completing a claim form, providing supporting documentation (such as photos, police reports, and repair estimates), and submitting any relevant medical records if there were injuries involved. Ensure you keep thorough records of all communications and documents related to the claim.

Claims Investigation

After filing your claim, the insurance company will initiate an investigation to assess the validity and extent of the claim. This process may involve inspecting the damage to your vehicle, reviewing police reports, and gathering statements from witnesses or other parties involved. It’s important to cooperate fully with the insurance company during this phase.

Assessment and Settlement

Once the investigation is complete, the insurance company will assess the claim and determine the appropriate settlement amount. This amount is based on the policy coverage, the extent of the damage, and any applicable deductibles. The insurance company will provide you with a settlement offer, which you can either accept or negotiate further if you believe it doesn’t adequately cover your losses.

Repair or Replacement

If your vehicle is repairable, the insurance company will typically work with a preferred repair shop to ensure timely and quality repairs. In cases where the vehicle is deemed a total loss (the cost of repairs exceeds a certain percentage of the vehicle’s value), the insurance company will provide you with a settlement based on the vehicle’s actual cash value (ACV). This amount is determined by factors such as the vehicle’s make, model, year, mileage, and condition before the incident.

Dealing with Disputes

In some cases, you may disagree with the insurance company’s assessment or settlement offer. If this occurs, it’s essential to communicate your concerns and provide additional evidence or arguments to support your claim. If a resolution cannot be reached, you may need to seek mediation or arbitration services, or in extreme cases, legal action.

Tips for a Smooth Claims Process

- Always prioritize safety and well-being after an accident.

- Document the scene of the accident with photos and notes.

- Cooperate with the insurance company’s investigation process.

- Keep all communications and documentation organized.

- Understand your policy’s coverage and exclusions.

- Consider seeking legal advice if needed.

| Step | Description |

|---|---|

| Reporting the Incident | Promptly report the accident to your insurance company. |

| Filing a Claim | Complete the necessary claim forms and provide supporting documentation. |

| Claims Investigation | Cooperate with the insurance company's investigation process. |

| Assessment and Settlement | Negotiate the settlement offer if needed. |

| Repair or Replacement | Work with the insurance company for repairs or receive a settlement for a total loss. |

| Dealing with Disputes | Seek mediation or legal advice if necessary. |

Future Trends and Innovations in Vehicle Insurance

The world of vehicle insurance is constantly evolving, and several trends and innovations are shaping the industry. Here’s a glimpse into the future of vehicle insurance:

Telematics and Usage-Based Insurance (UBI)

Telematics technology, which uses data from sensors and GPS systems to monitor driving behavior, is gaining popularity in the insurance industry. Usage-Based Insurance (UBI) policies use telematics data to assess driver behavior and offer personalized insurance rates based on real-time driving data. This technology rewards safe drivers with lower premiums and encourages safer driving practices.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are revolutionizing various aspects of the insurance industry, including claims processing and fraud detection. Insurance companies are leveraging AI algorithms to automate tasks, streamline claims processes, and enhance fraud detection capabilities. These technologies enable faster and more accurate assessments, leading to improved customer experiences.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with advanced sensors and connectivity features, is transforming the insurance landscape. Insurance providers can now access real-time data from connected cars, enabling them to offer more precise and tailored insurance policies. This technology also facilitates the development of predictive analytics, allowing insurers to anticipate and mitigate risks more effectively.

Blockchain Technology

Blockchain, the technology underlying cryptocurrencies like Bitcoin, is finding applications in the insurance industry. Blockchain’s decentralized and secure nature can enhance data verification, streamline claims processes, and improve overall efficiency. By leveraging blockchain, insurance companies can reduce administrative costs and enhance transparency in transactions.

Personalized Insurance Products

The insurance industry is moving towards more personalized insurance products tailored to individual needs and preferences. With advancements in data analytics and customer segmentation, insurance providers can offer customized coverage options, allowing policyholders to select the specific types and levels of coverage they require.

Collaborative Insurance Models

Collaborative insurance models, such as peer-to-peer (P2P) insurance and parametric insurance, are gaining traction. P2P insurance allows individuals to pool resources and share risks, often resulting in more affordable coverage. Parametric insurance, on the other hand, uses predefined triggers and payouts, providing faster and more predictable claim settlements.

| Trend | Description |

|---|---|

| Telematics and UBI | Telematics technology rewards safe drivers with personalized insurance rates. |

| AI and Machine Learning | AI automates tasks, streamlines claims, and enhances fraud detection. |

| Connected Car Technology | Connected cars enable precise, tailored insurance policies and predictive analytics. |

| Blockchain Technology | Blockchain enhances data verification and streamlines transactions. |

| Personalized Insurance Products | Insurance providers offer customized coverage options to meet individual needs. |

| Collaborative Insurance Models | Peer-to-peer and parametric insurance models offer affordable and predictable coverage. |

Conclusion

Vehicle insurance is an essential component of responsible vehicle ownership, providing financial protection and peace of mind. By understanding the different types of coverage, the factors influencing premiums, and the claims process, you can make informed decisions about your insurance coverage. As the insurance industry embraces technological advancements and innovative models, staying updated on these trends can help you maximize the benefits of your vehicle insurance.

Remember, vehicle insurance is a crucial investment that safeguards your assets and ensures your financial stability in the event of an accident or other unforeseen incidents. Take the time to review your insurance options, compare quotes, and tailor your coverage to your specific needs. With the right vehicle insurance policy, you can drive with confidence, knowing you're protected on the road.

How can I lower my vehicle insurance premiums?

+To lower your vehicle insurance premiums, consider increasing your deductibles, maintaining a clean driving record, and exploring discounts offered by insurance providers. Additionally, comparing quotes from multiple insurers can help you find the most competitive rates.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, prioritize your safety and the safety of others involved. Document the scene, exchange information with the other party, and report the accident to your insurance company promptly. Follow the claims process outlined by your insurance provider.