Personalized Auto Insurance

In the ever-evolving landscape of the insurance industry, the concept of personalized auto insurance has emerged as a revolutionary approach to meet the diverse needs of modern motorists. This innovative strategy aims to tailor coverage and pricing specifically to individual drivers, offering a more equitable and efficient alternative to traditional, one-size-fits-all policies.

Understanding Personalized Auto Insurance

Personalized auto insurance, also known as usage-based insurance (UBI) or pay-as-you-drive (PAYD), is an innovative model that leverages advanced technologies and data analytics to offer customized insurance plans. Unlike conventional insurance models, which often rely on generalized risk profiles and demographic factors, personalized insurance focuses on the specific driving habits and behaviors of individual policyholders.

This approach is underpinned by the principle that every driver is unique, and their insurance premiums should reflect their actual risk profile. By considering factors such as miles driven, driving behavior, and even the time of day a person drives, personalized auto insurance providers can offer rates that are more accurately aligned with an individual's actual risk.

The Technological Foundation

At the heart of personalized auto insurance lies a sophisticated technological infrastructure. Insurers employ a range of tools, including telematics devices, smartphone apps, and advanced analytics platforms, to gather and process data on driving behavior. These technologies can track a vehicle’s location, speed, acceleration, and braking patterns, providing a detailed picture of an individual’s driving habits.

For instance, telematics devices, which can be installed in vehicles or integrated into existing infotainment systems, continuously monitor a range of driving parameters. This data is then transmitted to the insurer, where it is analyzed to assess the driver's risk profile. Similarly, smartphone apps can utilize GPS and accelerometer data to provide similar insights, making personalized insurance accessible to a wider range of drivers.

| Telematics Device | Smartphone App |

|---|---|

| Installed in vehicle, continuous data collection | Utilizes GPS and accelerometer, accessible to a wider audience |

Benefits of Personalized Auto Insurance

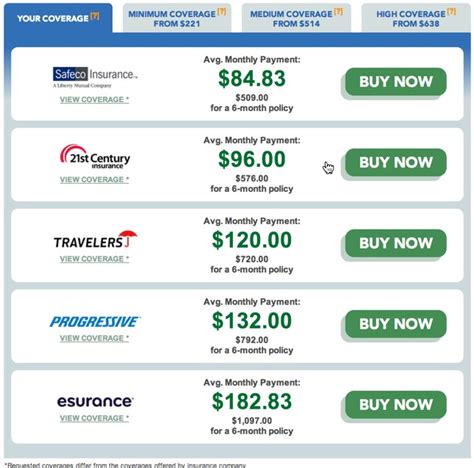

Precision in Pricing

One of the most significant advantages of personalized auto insurance is its ability to offer highly precise pricing. By analyzing an individual’s driving behavior, insurers can accurately assess their risk level and price their insurance accordingly. This means that safe, low-mileage drivers may benefit from lower premiums, while those with riskier driving habits may see their rates increase.

For instance, consider a hypothetical case study: John, a 25-year-old city dweller who commutes 10 miles each way to work. He drives cautiously and only during daylight hours. With personalized insurance, John's premium would likely be lower compared to a traditional policy due to his safe driving habits and limited mileage.

Incentivizing Safe Driving

Personalized auto insurance also serves as a powerful tool to incentivize safe driving behaviors. With rates directly tied to an individual’s driving habits, policyholders have a tangible incentive to drive more safely and responsibly. This not only leads to lower premiums but also contributes to overall road safety.

Furthermore, some personalized insurance programs offer rewards or discounts for safe driving. For example, drivers who maintain a consistent record of safe, low-risk driving behaviors might be eligible for loyalty bonuses or reduced premiums over time. This positive reinforcement can encourage long-term safe driving habits.

Adaptability and Flexibility

The personalized insurance model is inherently adaptable and flexible. It can accommodate the diverse needs and circumstances of different drivers, whether they’re teenagers learning to drive, professionals with long commutes, or retirees who only drive occasionally. By adjusting premiums based on real-time data, personalized insurance provides a dynamic and responsive solution that traditional policies often lack.

The Future of Personalized Auto Insurance

As technology continues to advance, the future of personalized auto insurance looks increasingly promising. With the integration of artificial intelligence and machine learning, insurers can further refine their risk assessment models, leading to even more accurate pricing and improved customer experiences.

Additionally, the growing popularity of electric vehicles (EVs) and autonomous driving technologies presents new opportunities and challenges for personalized insurance. These advancements will likely require insurers to adapt their models to account for the unique risks and benefits associated with these new technologies.

Potential Challenges

Despite its numerous advantages, personalized auto insurance is not without its challenges. One of the primary concerns is the potential for privacy invasion. With insurers collecting vast amounts of data on individual driving behaviors, there are valid concerns about data security and privacy. To address this, insurers must implement robust data protection measures and ensure transparency in their data collection and usage practices.

Another challenge lies in the initial cost of implementing personalized insurance programs. The technology and infrastructure required to support these models can be significant, and insurers must carefully weigh these costs against the potential benefits and customer demand.

Conclusion

Personalized auto insurance represents a significant shift in the insurance industry, offering a more equitable and precise approach to automotive coverage. By leveraging technology and data analytics, insurers can offer policies that are tailored to the unique needs and behaviors of individual drivers. While challenges remain, the potential benefits of personalized insurance—including precision in pricing, incentivizing safe driving, and adaptability—make it a compelling and promising direction for the future of the insurance industry.

How does personalized auto insurance determine rates?

+

Personalized auto insurance rates are determined through a comprehensive analysis of an individual’s driving behavior and habits. Factors such as miles driven, driving speed, acceleration, braking patterns, and the time of day a person drives are considered. This data is collected using telematics devices or smartphone apps and then analyzed to assess the driver’s risk profile. Based on this assessment, insurers can offer rates that are more accurately aligned with an individual’s actual risk.

Is personalized auto insurance available for all drivers?

+

Personalized auto insurance is becoming increasingly accessible to a wider range of drivers. While it was initially more prevalent for younger or high-risk drivers, many insurers now offer personalized insurance programs for all types of motorists. The use of smartphone apps, which are more widely available than telematics devices, has also made personalized insurance more accessible to a broader audience.

What are the potential privacy concerns with personalized auto insurance?

+

Personalized auto insurance relies on the collection of detailed driving data, which can raise concerns about privacy and data security. To address these concerns, insurers must implement robust data protection measures, including encryption and secure data storage. Additionally, insurers should be transparent about their data collection and usage practices, providing clear information to policyholders about what data is being collected and how it is used.