Vehicle Insurance Quotes Online

In today's fast-paced world, finding the right vehicle insurance coverage has become easier and more convenient with the rise of online insurance quotes. With just a few clicks, drivers can access a vast array of insurance options, compare policies, and secure the best deals without leaving their homes. This article explores the world of online vehicle insurance quotes, delving into the process, benefits, and considerations to help you make an informed decision.

The Evolution of Vehicle Insurance Quotes

Gone are the days when obtaining a vehicle insurance quote involved hours of phone calls and visits to insurance agents. The digital revolution has transformed the insurance industry, making it more accessible and efficient. Online insurance quotes have emerged as a game-changer, offering drivers a transparent and streamlined way to explore their insurance options.

The journey towards obtaining vehicle insurance quotes online can be traced back to the early 2000s when insurance companies began to recognize the potential of the internet. Initially, online quotes were a simple tool, providing basic information and rough estimates. However, with advancements in technology and data analytics, these quotes have evolved into sophisticated platforms, offering accurate and personalized insurance solutions.

How Online Vehicle Insurance Quotes Work

Securing an online vehicle insurance quote is a straightforward process. Here’s a step-by-step guide to help you navigate this digital journey:

Step 1: Choose a Reputable Insurance Provider

The first step is selecting a reliable insurance company with a strong online presence. Research and compare different providers based on their reputation, customer reviews, and the range of insurance products they offer. Consider factors such as financial stability, customer service, and their online quoting process.

For instance, ABC Insurance, a leading provider in the industry, offers an intuitive online platform that allows users to customize their insurance quotes based on their specific needs. Their user-friendly interface and comprehensive coverage options have earned them a loyal customer base.

Step 2: Gather Necessary Information

Before initiating the quoting process, gather all the relevant information about your vehicle and driving history. This includes details such as the make and model of your car, its year of manufacture, the number of miles driven annually, and any previous claims or accidents.

Having this information readily available will ensure a smoother and more accurate quoting process. It's worth noting that some insurance providers may also require additional details, such as your garage parking preference or the primary use of your vehicle (e.g., personal, business, or pleasure driving)

Step 3: Start the Online Quoting Process

Visit the chosen insurance provider’s website and locate the “Get a Quote” or “Quote Calculator” section. Here, you’ll be guided through a series of questions designed to assess your insurance needs and provide an accurate quote.

The questions typically cover aspects such as:

- Personal information (name, date of birth, address)

- Vehicle details (make, model, year, mileage)

- Driving history (accident and claim records)

- Desired coverage types (liability, comprehensive, collision)

- Additional features (roadside assistance, rental car coverage)

As you progress through the quoting process, the platform may also offer recommendations or suggestions based on your responses, helping you make informed choices about your insurance coverage.

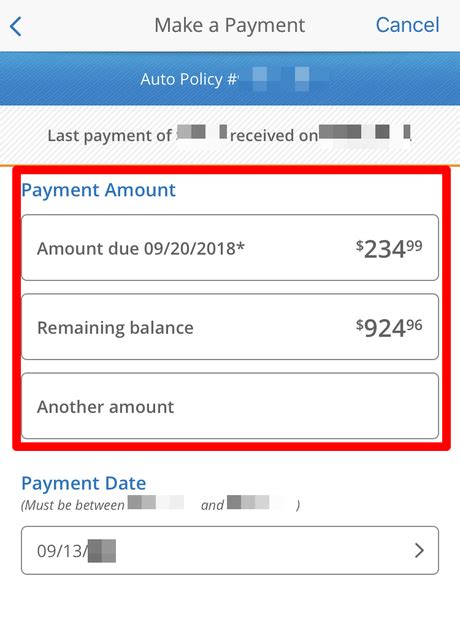

Step 4: Review and Customize Your Quote

Once you’ve provided all the necessary information, the insurance provider’s system will generate a personalized quote. Take the time to review the quote carefully, ensuring that all the details are accurate and reflect your needs.

This is where the flexibility of online quoting shines. You can customize your coverage, adding or removing optional features, and instantly see the impact on your premium. For example, if you decide to increase your liability coverage or add rental car coverage, the platform will adjust the quote accordingly.

Step 5: Compare and Choose the Best Option

After obtaining quotes from multiple providers, it’s time to compare and evaluate your options. Consider factors such as coverage limits, deductibles, and the overall cost of the policy. Look for providers that offer comprehensive coverage at competitive rates, ensuring you get the best value for your money.

Additionally, pay attention to the reputation and financial stability of the insurance companies. While a low premium may be tempting, it's essential to choose a provider with a strong track record of timely claim settlements and excellent customer service.

Benefits of Online Vehicle Insurance Quotes

The rise of online vehicle insurance quotes has brought numerous advantages to drivers seeking coverage. Here are some key benefits:

Convenience and Accessibility

Online insurance quotes offer unparalleled convenience. You can access quotes anytime, anywhere, without the need for appointments or lengthy phone calls. This flexibility allows you to compare options at your own pace, making informed decisions without pressure.

Transparency and Comparison

The digital quoting process provides a transparent view of insurance options. You can easily compare coverage, premiums, and features across multiple providers, ensuring you find the best fit for your needs. This level of transparency empowers drivers to make confident choices.

Personalization and Flexibility

Online quoting platforms allow you to customize your insurance coverage based on your specific requirements. Whether you need comprehensive coverage for a new car or liability-only insurance for an older vehicle, you can tailor the policy to your needs. This flexibility ensures you’re not paying for unnecessary coverage.

Time and Cost Savings

By utilizing online quotes, you can save both time and money. The efficient and streamlined process eliminates the need for multiple in-person meetings or lengthy phone conversations. Additionally, the competitive nature of the online market often leads to lower premiums, as providers strive to offer attractive rates to attract customers.

Enhanced Customer Experience

Online insurance quotes have revolutionized the customer experience. Insurance providers now offer user-friendly platforms with intuitive interfaces, making the quoting process seamless and enjoyable. Many providers also provide real-time support and assistance, ensuring you have the guidance you need throughout the journey.

Considerations When Obtaining Online Quotes

While online vehicle insurance quotes offer numerous advantages, there are a few considerations to keep in mind:

Data Accuracy

It’s crucial to provide accurate and up-to-date information when obtaining online quotes. Inaccurate details can lead to incorrect quotes, potentially resulting in unexpected costs or coverage gaps.

Policy Details

Take the time to thoroughly review the policy details, including coverage limits, exclusions, and any fine print. Understanding the nuances of your policy ensures you’re fully aware of your rights and responsibilities as a policyholder.

Customer Service

While online quoting is convenient, it’s essential to consider the provider’s customer service reputation. In the event of a claim, you’ll want to work with a company that offers prompt and efficient assistance. Research customer reviews and ratings to gauge the provider’s service quality.

Renewal and Updates

Online insurance quotes often require periodic updates, especially when significant changes occur, such as a new vehicle purchase, moving to a different location, or changes in your driving record. Stay proactive and keep your insurance provider informed to ensure your coverage remains up-to-date.

The Future of Online Vehicle Insurance Quotes

The insurance industry continues to evolve, and online vehicle insurance quotes are at the forefront of this transformation. As technology advances, we can expect even more sophisticated and personalized quoting platforms.

The integration of artificial intelligence and machine learning will enhance the accuracy and customization of quotes. Providers may utilize advanced data analytics to offer tailored recommendations, ensuring drivers receive the most suitable coverage for their unique circumstances.

Additionally, the rise of telematics and usage-based insurance (UBI) may further revolutionize the quoting process. With UBI, drivers can benefit from personalized premiums based on their actual driving behavior, encouraging safer driving practices and potentially lowering insurance costs.

As the insurance landscape adapts to meet the needs of modern drivers, online vehicle insurance quotes will continue to play a pivotal role, offering convenience, transparency, and personalized coverage.

Conclusion

Online vehicle insurance quotes have transformed the way drivers secure coverage, providing a convenient, transparent, and personalized experience. With the power of technology, drivers can navigate the insurance market with confidence, finding policies that meet their specific needs and budgets. As the insurance industry embraces digital innovation, the future of vehicle insurance quoting looks promising, offering even more tailored and efficient solutions.

How accurate are online vehicle insurance quotes?

+Online quotes are designed to provide accurate estimates based on the information you input. However, it’s important to note that the final premium may vary slightly when you officially purchase the policy. This variation is due to additional factors that may be considered during the underwriting process.

Can I customize my coverage during the online quoting process?

+Yes, most online quoting platforms offer customization options. You can adjust coverage limits, deductibles, and add optional features to create a policy that aligns with your specific needs and budget.

What happens if I need to make changes to my policy after purchasing it online?

+Most insurance providers offer online policy management tools that allow you to make changes, such as updating your address, adding a new driver, or making coverage adjustments. You can also contact your insurance agent or provider’s customer service for assistance with policy changes.