Vehicle Insurance Prices

Vehicle insurance is an essential aspect of responsible car ownership, offering protection and peace of mind to drivers across the globe. The cost of insurance, however, is a topic that sparks curiosity and concern among many vehicle owners. The price of insurance can vary significantly, influenced by a myriad of factors unique to each driver and their circumstances. This comprehensive guide aims to demystify the complexities surrounding vehicle insurance prices, providing an in-depth analysis of the key determinants, practical strategies for securing the best rates, and a clear understanding of the underlying market dynamics.

Unraveling the Complexity: Factors Influencing Vehicle Insurance Prices

The cost of vehicle insurance is determined by a delicate interplay of various elements, each contributing to the final premium. Understanding these factors is crucial for drivers seeking to make informed decisions about their insurance coverage.

Risk Assessment: A Key Determinant

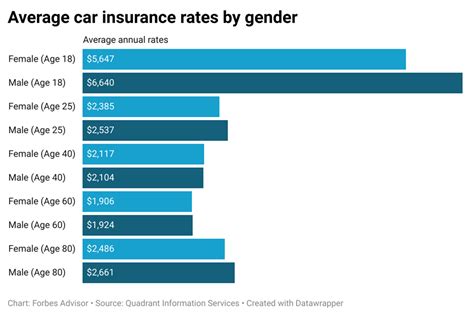

At the heart of insurance pricing lies the concept of risk assessment. Insurance companies meticulously evaluate a range of criteria to gauge the potential risk associated with insuring a particular driver. This assessment forms the basis for calculating insurance premiums.

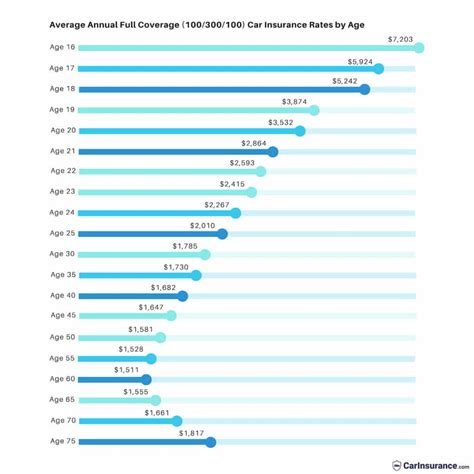

One of the primary risk factors is the driver's age. Younger drivers, especially those under 25, are often considered higher-risk due to their lack of experience on the road. This perception is reflected in higher insurance premiums for this demographic. Conversely, older drivers, particularly those over 65, may also face increased premiums due to concerns about age-related health conditions that could impact driving ability.

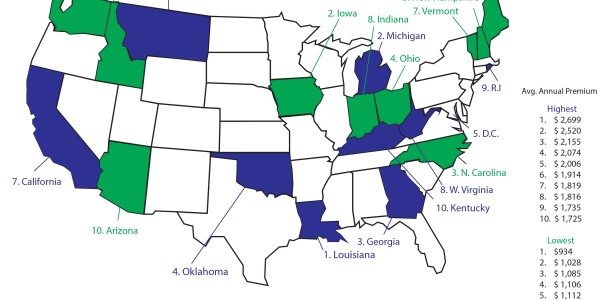

The location where a driver resides plays a significant role in insurance pricing. Urban areas, with their higher population density and increased traffic, often result in more frequent claims, leading to higher insurance costs. In contrast, rural areas tend to have lower insurance premiums due to reduced traffic and a lower likelihood of accidents.

The type of vehicle insured is another critical factor. Insurance companies consider the make, model, and year of a vehicle when determining premiums. Sports cars and high-performance vehicles, for instance, are generally more expensive to insure due to their association with higher speeds and increased risk of accidents. Conversely, sedans and compact cars are often more affordable to insure.

The driver's claim history is a major consideration in insurance pricing. A clean driving record with no accidents or violations typically leads to lower insurance premiums. Conversely, drivers with a history of accidents or traffic violations are often considered higher-risk, resulting in increased insurance costs.

| Risk Factor | Impact on Premium |

|---|---|

| Age | Younger and older drivers often face higher premiums due to perceived risk. |

| Location | Urban areas tend to have higher premiums due to increased traffic and accident frequency. |

| Vehicle Type | Sports cars and high-performance vehicles generally cost more to insure. |

| Claim History | Clean driving records lead to lower premiums, while accident-prone drivers pay more. |

Securing the Best Insurance Rates: Practical Strategies

Understanding the factors that influence insurance prices is the first step towards securing the best rates. However, there are additional strategies drivers can employ to further optimize their insurance costs.

Shop Around and Compare

One of the most effective ways to find the best insurance deal is to shop around and compare quotes from multiple insurance providers. Each company has its own unique rating system and pricing structure, so obtaining quotes from several sources can help identify the most competitive rates.

Online insurance marketplaces, such as InsuranceQuotePro, offer a convenient platform for comparing quotes from various providers. These marketplaces allow drivers to input their details once and receive multiple quotes, making the comparison process efficient and straightforward.

Bundle and Save

Many insurance companies offer bundling discounts when drivers insure multiple vehicles or combine their auto insurance with other policies, such as home or life insurance. By bundling policies, drivers can often save a significant amount on their overall insurance costs.

For instance, Allstate provides a Multi-Policy discount of up to 25% when customers bundle their auto insurance with another policy. Similarly, State Farm offers a Multi-Line discount for customers who combine auto insurance with home, renters, or condo insurance.

Explore Discount Opportunities

Insurance companies often provide a range of discounts to attract and retain customers. These discounts can significantly reduce insurance premiums, so it’s worth exploring all available options.

Some common discounts include:

- Safe Driver Discount: Reward for maintaining a clean driving record.

- Good Student Discount: Offered to students with good academic standing.

- Loyalty Discount: Incentive for long-term customers.

- Multi-Vehicle Discount: Saving for insuring multiple vehicles.

- Safe Vehicle Discount: Recognition for vehicles with advanced safety features.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to pricing insurance based on a driver’s actual usage and behavior. This type of insurance uses a device or smartphone app to track driving habits, such as miles driven, time of day, and driving style.

For example, Progressive offers Snapshot, a usage-based insurance program that provides personalized rates based on individual driving habits. By encouraging safer driving, these programs can result in significant savings for responsible drivers.

Market Dynamics: Understanding the Insurance Landscape

The vehicle insurance market is characterized by a complex interplay of economic, regulatory, and technological forces. Understanding these dynamics is essential for drivers seeking to make informed decisions about their insurance coverage.

Economic Factors

Economic conditions play a significant role in the vehicle insurance market. During periods of economic prosperity, when disposable income is high, drivers may be more inclined to invest in comprehensive insurance coverage. Conversely, in times of economic downturn, drivers may opt for more basic coverage or explore cost-saving options.

Additionally, the cost of living in a particular region can influence insurance prices. Areas with higher living costs often see increased insurance premiums, as the cost of repairing or replacing vehicles is generally higher in these locations.

Regulatory Environment

The regulatory landscape is a critical aspect of the insurance market. Government regulations dictate the minimum levels of coverage required by law, influencing the types of insurance policies available and their associated costs.

For instance, states like Michigan and New Jersey have no-fault insurance laws, where drivers must carry Personal Injury Protection (PIP) coverage as part of their auto insurance policy. This type of coverage can significantly impact insurance premiums, as it provides broader protection for medical expenses and lost wages in the event of an accident.

Technological Innovations

Advancements in technology have had a profound impact on the insurance industry. Telematics, as mentioned earlier, has revolutionized the way insurance companies assess risk and price policies. By leveraging data analytics and real-time driving information, insurance providers can offer more accurate and personalized premiums.

Furthermore, autonomous vehicles and advanced driver-assistance systems (ADAS) are expected to transform the insurance market in the coming years. As these technologies become more prevalent, insurance companies will need to adapt their policies and pricing structures to account for the reduced risk associated with self-driving cars.

Conclusion: Navigating the Complex World of Vehicle Insurance

The landscape of vehicle insurance is multifaceted, influenced by a myriad of factors ranging from personal circumstances to broader economic and regulatory trends. By understanding these dynamics and employing strategic approaches, drivers can navigate this complex world to secure the best insurance rates and coverage.

As the insurance market continues to evolve, driven by technological advancements and changing consumer needs, staying informed and proactive is key to making the most of your insurance coverage. Whether it's shopping around for the best deals, exploring discount opportunities, or embracing innovative insurance models like usage-based insurance, there are numerous avenues to optimize your insurance costs and ensure you're getting the coverage you need at a price that fits your budget.

How often should I shop for car insurance to get the best rates?

+It’s recommended to shop for car insurance at least once a year, especially if your circumstances have changed. Regularly comparing quotes can help you stay informed about the market and ensure you’re getting the best deal.

Are there any disadvantages to usage-based insurance?

+While usage-based insurance can lead to significant savings for safe drivers, it may not be advantageous for those with less-than-stellar driving records. Additionally, privacy concerns have been raised regarding the collection of driving data.

What impact does credit score have on car insurance premiums?

+Insurance companies often use credit scores as a factor in determining insurance premiums. Generally, individuals with higher credit scores tend to receive lower insurance rates, as they are seen as more financially responsible and less likely to file claims.

Can I negotiate my car insurance premium?

+While insurance premiums are largely determined by risk assessment and market factors, it doesn’t hurt to ask about potential discounts or rate adjustments, especially if you’ve been a loyal customer or your driving record has improved.