Vehicle Insurance Estimate

When it comes to vehicle insurance, understanding the factors that influence your premium is crucial for making informed decisions. Vehicle insurance estimates can vary significantly, and a multitude of elements come into play, from the type of vehicle you own to your personal driving history and even your geographical location. This comprehensive guide aims to delve into the intricacies of vehicle insurance estimates, shedding light on the key factors that affect your premium and offering valuable insights to help you navigate the complex world of automotive coverage.

The Fundamentals of Vehicle Insurance Estimates

Vehicle insurance estimates are calculated based on a meticulous evaluation of various risk factors. These factors, which can be broadly categorized into personal, vehicle-related, and environmental aspects, are meticulously analyzed by insurance providers to assess the potential risks associated with insuring a particular vehicle and driver.

Personal Factors

Your personal characteristics play a pivotal role in determining your vehicle insurance estimate. Insurance providers consider a range of factors, including your age, gender, and marital status. Younger drivers, especially those under the age of 25, are often considered high-risk due to their limited driving experience and higher propensity for accidents. As a result, they tend to face higher insurance premiums. Conversely, mature drivers with extensive driving experience may benefit from more favorable rates.

Additionally, your driving record is scrutinized to assess your level of responsibility on the road. A clean driving record devoid of accidents or traffic violations is generally rewarded with lower insurance premiums. Conversely, a history of accidents or traffic violations can lead to significantly higher insurance costs.

Insurance companies also take into account your credit score, as it serves as an indicator of your financial responsibility. A strong credit score may result in more affordable insurance rates, while a poor credit score could lead to higher premiums.

Vehicle-Related Factors

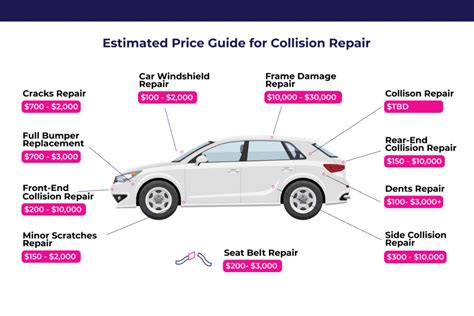

The type of vehicle you own and its specific characteristics can significantly impact your insurance estimate. Generally, sports cars and luxury vehicles are associated with higher insurance costs due to their increased risk of theft, higher repair costs, and the tendency for aggressive driving. On the other hand, standard sedans and family vehicles often carry more affordable insurance rates.

The age and condition of your vehicle are also taken into consideration. Older vehicles may be subject to lower insurance premiums, especially if they are no longer manufactured or have limited safety features. Conversely, newer vehicles with advanced safety technologies and expensive repair costs may attract higher insurance estimates.

Furthermore, the purpose for which you use your vehicle can influence your insurance estimate. Personal vehicles used for commuting or pleasure driving may have different insurance rates compared to commercial vehicles used for business purposes or vehicles employed for ridesharing services.

Environmental Factors

Your geographical location plays a crucial role in determining your vehicle insurance estimate. Insurance providers assess the risk level associated with your area based on factors such as crime rates, accident frequencies, and weather conditions. Regions with higher instances of theft, accidents, or natural disasters are often associated with elevated insurance premiums.

The population density of your area is another consideration. Urban areas with high traffic volumes and a higher concentration of vehicles may carry higher insurance costs due to the increased likelihood of accidents and traffic-related incidents.

The Impact of Coverage and Deductibles

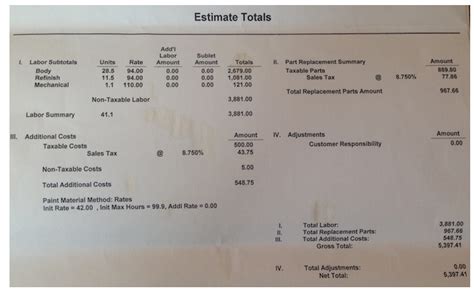

The level of coverage you choose for your vehicle insurance policy can significantly influence your premium. Comprehensive and collision coverage, which protect against damage to your vehicle from various causes, tend to be more expensive than liability-only coverage, which only covers damage to other vehicles and property.

Additionally, the deductible you select for your policy can have a substantial impact on your insurance estimate. A higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can result in lower monthly premiums. Conversely, a lower deductible may lead to higher monthly premiums, but it provides more financial protection in the event of an accident or claim.

Understanding the Trade-Offs

When selecting your vehicle insurance coverage and deductible, it’s essential to strike a balance between cost and protection. While a higher deductible can save you money in the short term, it may not be financially feasible if you frequently make claims. On the other hand, a lower deductible provides more financial security but can result in higher monthly premiums.

It’s advisable to assess your personal financial situation and risk tolerance when making these decisions. If you have a solid financial foundation and can afford to pay a higher deductible in the event of an accident, opting for a higher deductible with lower premiums may be a prudent choice. Conversely, if you prefer a more conservative approach and want greater financial protection, selecting a lower deductible with slightly higher premiums could be the better option.

Discounts and Savings Opportunities

Insurance providers offer a variety of discounts and savings opportunities to incentivize responsible behavior and loyalty. These discounts can significantly reduce your insurance estimate and make coverage more affordable.

Safe Driving Discounts

Insurance companies often reward drivers with a clean driving record by offering safe driving discounts. These discounts can be substantial, especially if you have maintained a spotless driving record for an extended period. Some insurance providers even offer telematics devices or apps that track your driving behavior, providing additional opportunities for discounts based on your safe driving habits.

Loyalty and Multi-Policy Discounts

Loyalty pays off in the insurance world. Many providers offer discounts to customers who have been with them for an extended period, rewarding their loyalty with lower premiums. Additionally, bundling multiple insurance policies, such as auto and home insurance, with the same provider can result in significant savings through multi-policy discounts.

Other Savings Opportunities

There are several other avenues to explore when seeking savings on your vehicle insurance estimate. For instance, some insurance providers offer discounts for vehicle safety features, such as anti-theft devices, airbags, and advanced driver-assistance systems. Additionally, certain professions or membership organizations may qualify for group discounts through partnerships with insurance companies.

It’s worth shopping around and comparing quotes from different insurance providers to identify the best rates and savings opportunities available to you. Each provider may have unique discounts and policies tailored to specific customer profiles, so exploring your options can lead to significant cost savings.

The Role of Insurance Providers

Insurance providers play a pivotal role in the vehicle insurance landscape, offering a range of coverage options and shaping the market through their unique policies and practices.

Choosing the Right Insurance Provider

Selecting the right insurance provider is a crucial decision that can significantly impact your insurance experience. While price is an important factor, it’s not the sole consideration. You should evaluate providers based on their financial stability, customer service reputation, and the range of coverage options they offer. Some providers specialize in certain types of coverage or cater to specific customer demographics, so understanding your needs and researching providers that align with those needs is essential.

Online reviews and ratings can provide valuable insights into a provider’s performance and customer satisfaction levels. Additionally, seeking recommendations from trusted sources, such as friends, family, or financial advisors, can offer a more personalized perspective on insurance providers.

Policy Features and Benefits

Insurance providers differentiate themselves through the features and benefits they offer in their policies. Some providers may excel in offering comprehensive coverage options, while others may focus on providing specialized coverage for unique circumstances, such as classic car insurance or coverage for high-risk drivers. Understanding the specific policy features and benefits that align with your needs is crucial in making an informed decision.

Certain providers may offer additional perks, such as roadside assistance, rental car coverage, or accident forgiveness, which can enhance your overall insurance experience. These features can provide added peace of mind and financial protection in the event of unforeseen circumstances.

Future Trends and Innovations in Vehicle Insurance

The vehicle insurance landscape is evolving, driven by technological advancements and changing consumer preferences. Several emerging trends and innovations are shaping the future of automotive coverage.

Telematics and Usage-Based Insurance

Telematics, the integration of telecommunications and informatics, is revolutionizing the way insurance providers assess risk. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, utilizes telematics devices or apps to track driving behavior and calculate insurance premiums based on actual usage. This approach rewards safe driving habits and provides a more personalized insurance experience.

By analyzing driving data, such as miles driven, time of day, and driving style, insurance providers can offer more accurate and fair premiums. This technology is particularly beneficial for young drivers, who can demonstrate their safe driving habits and potentially secure more affordable insurance rates.

Connected Car Technology

The rise of connected car technology is transforming the automotive industry, and its impact is also being felt in the insurance sector. Connected cars, equipped with advanced sensors and communication systems, can transmit real-time data to insurance providers, offering insights into driving behavior and vehicle performance. This data can be used to assess risk more accurately and offer tailored insurance solutions.

For instance, connected car technology can provide information on sudden acceleration, hard braking, and aggressive cornering, which are indicators of risky driving behavior. Insurance providers can use this data to offer discounts to drivers who exhibit safe driving habits and take proactive measures to improve their driving skills.

Autonomous Vehicle Insurance

The advent of autonomous vehicles is poised to revolutionize transportation, and it’s also prompting a reevaluation of insurance coverage. As self-driving cars become more prevalent, the traditional model of insurance, which is based on driver behavior, will need to adapt. Insurance providers are exploring new approaches to coverage, considering factors such as vehicle manufacturer liability, software and hardware failures, and the role of human oversight in autonomous driving.

While the future of autonomous vehicle insurance is still taking shape, it’s clear that this emerging technology will require innovative insurance solutions to address the unique risks and responsibilities associated with self-driving cars.

Conclusion

Vehicle insurance estimates are influenced by a multitude of factors, ranging from personal characteristics and vehicle specifics to environmental conditions and coverage choices. By understanding these factors and exploring the various discounts and savings opportunities available, you can make informed decisions to secure the best insurance coverage for your needs at a competitive price.

As the insurance landscape continues to evolve with technological advancements and changing consumer expectations, staying informed about emerging trends and innovations is essential. Telematics, connected car technology, and the rise of autonomous vehicles are reshaping the insurance industry, offering new opportunities for personalized and tailored coverage. By staying abreast of these developments, you can navigate the future of vehicle insurance with confidence and ensure you have the protection you need at a price that fits your budget.

How often should I review my vehicle insurance policy and estimate?

+It’s recommended to review your vehicle insurance policy and estimate annually, or whenever your personal circumstances or vehicle details change significantly. This ensures you stay up-to-date with the most competitive rates and coverage options available.

Can I negotiate my vehicle insurance estimate with providers?

+While insurance providers typically have standardized rates, you can negotiate certain aspects of your policy, such as coverage limits and deductibles. Shopping around and comparing quotes from multiple providers can also help you secure the best rates.

What should I do if I’m considered a high-risk driver?

+If you’re considered a high-risk driver due to a history of accidents or traffic violations, focus on improving your driving habits and maintaining a clean record. Over time, this can lead to lower insurance premiums. Additionally, explore specialized insurance providers that cater to high-risk drivers, as they may offer more affordable rates.

Are there any government programs or subsidies for vehicle insurance?

+Some governments offer subsidies or programs to assist with vehicle insurance costs, particularly for low-income individuals or certain demographic groups. Researching these programs in your region can provide additional support for your insurance expenses.