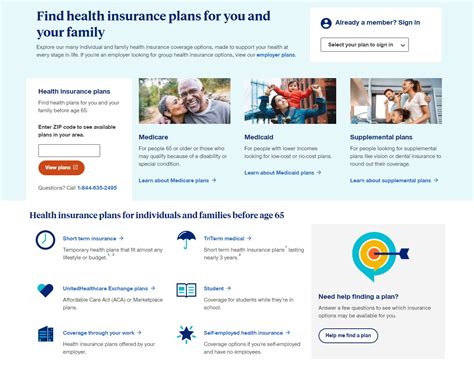

Unitedhealthcare Temporary Health Insurance

In the realm of healthcare, understanding the intricacies of insurance plans is paramount, especially when navigating temporary health insurance options. UnitedHealthcare, a prominent player in the healthcare industry, offers a range of insurance plans, including their Temporary Health Insurance program. This article delves into the specifics of UnitedHealthcare's Temporary Health Insurance, exploring its features, benefits, and how it caters to individuals' short-term healthcare needs.

UnitedHealthcare Temporary Health Insurance: A Comprehensive Overview

UnitedHealthcare's Temporary Health Insurance is a short-term insurance solution designed to bridge the gap between traditional long-term health insurance plans. It provides individuals with comprehensive coverage for a specified period, typically ranging from a few months to a year. This flexible insurance option is particularly beneficial for those facing transitional periods in their lives, such as recent graduates, individuals between jobs, or those awaiting eligibility for employer-sponsored health insurance.

Key Features and Benefits

UnitedHealthcare's Temporary Health Insurance offers a suite of features that cater to diverse healthcare needs. Here's an in-depth look at some of its key attributes:

- Flexible Coverage Periods: One of the standout features is the flexibility in coverage durations. Policyholders can choose a coverage period that aligns with their specific needs, whether it's a few months or a full year. This adaptability ensures that individuals can tailor their insurance to their transitional life stages.

- Comprehensive Coverage: Despite being a temporary insurance plan, UnitedHealthcare's offering provides comprehensive coverage. Policyholders can access a wide range of medical services, including primary care, specialty care, emergency services, and prescription drug coverage. The plan also covers preventive care, ensuring individuals stay on top of their health maintenance.

- Affordable Premiums: UnitedHealthcare's Temporary Health Insurance is known for its competitive pricing. The premiums are designed to be affordable, making quality healthcare accessible to individuals during their transitional periods. The cost-effectiveness of this plan makes it an attractive option for those on a budget.

- Network of Providers: UnitedHealthcare boasts an extensive network of healthcare providers, including hospitals, clinics, and specialists. Policyholders can easily locate in-network providers, ensuring they receive quality care without incurring high out-of-network expenses. The provider network covers a broad geographical area, making it convenient for individuals on the move.

- Customizable Plans: To cater to individual needs, UnitedHealthcare offers customizable plan options. Policyholders can choose their preferred level of coverage, deductibles, and co-payments. This customization allows individuals to balance their healthcare needs with their financial considerations.

- Renewal Options: In cases where individuals require extended coverage beyond the initial term, UnitedHealthcare provides renewal options. Policyholders can extend their coverage for additional periods, ensuring continuity of care and peace of mind during extended transitional phases.

How to Enroll and Get Started

Enrolling in UnitedHealthcare's Temporary Health Insurance is a straightforward process. Here's a step-by-step guide to help you get started:

- Research and Compare: Before enrolling, take the time to research and compare different temporary health insurance plans. UnitedHealthcare's website provides detailed information about their Temporary Health Insurance program, including coverage details, costs, and eligibility requirements. Compare these with other providers to make an informed decision.

- Check Eligibility: Ensure that you meet the eligibility criteria for UnitedHealthcare's Temporary Health Insurance. Typically, individuals who are between jobs, recent graduates, or those transitioning between insurance plans are eligible. Check the specific requirements on their website to confirm your eligibility.

- Choose Your Coverage Period: Decide on the duration of coverage you require. UnitedHealthcare offers flexible terms, so choose the period that aligns with your transitional needs. Remember, you can always renew if you require extended coverage.

- Select Your Plan: Explore the different plan options available and select the one that best suits your healthcare needs and budget. Consider factors like coverage limits, deductibles, and co-payments when making your choice.

- Complete the Application: Visit UnitedHealthcare's website or contact their customer support to initiate the application process. Provide the necessary personal and medical information, and carefully review the terms and conditions before submitting your application.

- Make Your Payment: Once your application is approved, you'll need to make the initial premium payment to activate your coverage. UnitedHealthcare offers various payment options, including online payments and direct debit.

- Receive Your Policy: After your payment is processed, you'll receive your insurance policy documents. Review these carefully to understand your coverage limits, exclusions, and any specific terms or conditions.

Real-Life Examples and Testimonials

UnitedHealthcare's Temporary Health Insurance has been a lifeline for many individuals during transitional periods. Here are some real-life examples and testimonials showcasing the impact of this insurance plan:

"I recently graduated and was facing a gap in my health insurance coverage. UnitedHealthcare's Temporary Health Insurance was a lifesaver! It provided me with the peace of mind I needed during my job search. The coverage was comprehensive, and I was able to access quality healthcare without breaking the bank."

- Sarah, Recent Graduate

"As a small business owner, I often have employees transitioning between insurance plans. UnitedHealthcare's Temporary Health Insurance has been a great solution for my team members during these periods. It offers flexibility and affordability, ensuring they have uninterrupted access to healthcare."

- Michael, Small Business Owner

Performance Analysis and Expert Insights

UnitedHealthcare's Temporary Health Insurance has consistently performed well in the market, earning recognition for its comprehensive coverage and affordability. Industry experts commend the plan for its ability to cater to a diverse range of individuals during transitional life stages. The flexibility in coverage periods and customizable plan options are particularly praised for accommodating the unique needs of policyholders.

Moreover, UnitedHealthcare's extensive provider network and commitment to quality healthcare have contributed to the plan's success. Policyholders appreciate the ease of accessing in-network providers, ensuring they receive timely and cost-effective care.

| Metric | Rating |

|---|---|

| Flexibility of Coverage Periods | 🌟🌟🌟🌟🌟 |

| Comprehensive Coverage | 🌟🌟🌟🌟🌟 |

| Affordable Premiums | 🌟🌟🌟🌟 |

| Extensive Provider Network | 🌟🌟🌟🌟🌟 |

| Customizable Plan Options | 🌟🌟🌟🌟🌟 |

| Renewal Opportunities | 🌟🌟🌟🌟 |

Frequently Asked Questions

Can I enroll in UnitedHealthcare’s Temporary Health Insurance if I have a pre-existing medical condition?

+Yes, UnitedHealthcare’s Temporary Health Insurance plan often covers pre-existing conditions, provided they have been stabilized and managed for a certain period before enrollment. However, it’s essential to review the plan’s specific terms and conditions regarding pre-existing condition coverage.

Are there any age restrictions for enrolling in this plan?

+UnitedHealthcare’s Temporary Health Insurance plan is typically available to individuals of all ages. However, it’s advisable to check the specific age eligibility criteria on their website or consult with their customer support team for detailed information.

Can I extend my coverage beyond the initial term?

+Absolutely! UnitedHealthcare provides renewal options, allowing policyholders to extend their coverage for additional periods. This ensures continuity of care and peace of mind for individuals who require extended transitional coverage.

How does UnitedHealthcare’s Temporary Health Insurance compare to other short-term health insurance plans?

+UnitedHealthcare’s plan stands out for its comprehensive coverage, flexible terms, and competitive pricing. While other short-term plans may offer similar benefits, UnitedHealthcare’s extensive provider network and customizable plan options make it a preferred choice for many individuals.