Instant Car Insurance Quotes

In today's fast-paced world, obtaining an instant car insurance quote has become a necessity for many vehicle owners and prospective buyers. With the ever-evolving digital landscape, the process of comparing insurance policies and securing coverage has transformed into a seamless and efficient experience. This article delves into the world of instant car insurance quotes, exploring the benefits, the technology behind it, and how it has revolutionized the way we insure our vehicles.

The Rise of Instant Car Insurance Quotes: A Game-Changer in the Industry

The traditional process of acquiring car insurance often involved tedious paperwork, multiple phone calls, and lengthy wait times. However, the advent of instant online quotes has revolutionized this industry, empowering consumers with convenient and transparent options. This innovative approach has not only streamlined the insurance shopping experience but has also fostered a more competitive market, ultimately benefiting policyholders.

One of the key advantages of instant car insurance quotes is the speed and convenience they offer. Policyholders can now obtain multiple quotes within minutes, eliminating the need for time-consuming meetings with agents or brokers. This instant access to information enables individuals to make informed decisions about their insurance coverage quickly and efficiently.

Furthermore, the online platform for instant quotes provides a user-friendly interface, allowing individuals to compare policies side by side. This feature is particularly beneficial for those seeking the best value for their money, as it enables them to assess various coverage options, deductibles, and premiums with ease. With just a few clicks, consumers can explore different insurers, ensuring they find the most suitable policy for their needs.

The Technology Behind Instant Car Insurance Quotes

The development of instant car insurance quotes is a testament to the power of technology in the insurance industry. Advanced algorithms and data analytics play a crucial role in generating accurate and personalized quotes. These sophisticated systems utilize a vast array of data points, including an individual’s driving history, vehicle details, location, and even their credit score, to provide precise estimates for insurance premiums.

One notable aspect of this technology is its ability to adapt and learn. Machine learning algorithms continuously analyze patterns and trends in the insurance market, allowing them to refine their calculations over time. This adaptive nature ensures that the quotes generated are not only accurate but also reflective of the latest market conditions. As a result, policyholders can trust that they are receiving up-to-date and reliable information when obtaining instant quotes.

Key Technological Components:

- Real-Time Data Integration: Instant quote systems integrate real-time data from various sources, including vehicle databases, weather patterns, and even traffic conditions. This data is crucial in assessing risk factors and providing precise quotes.

- Advanced Risk Assessment: Using complex algorithms, these systems analyze a multitude of factors to determine the risk associated with insuring a particular vehicle or driver. This assessment plays a pivotal role in calculating premiums.

- Personalized Pricing: Instant quotes take into account individual circumstances, such as driving habits, vehicle usage, and personal preferences. This level of personalization ensures that policyholders receive quotes tailored to their unique needs.

Additionally, the integration of digital signatures and online payment gateways has further enhanced the convenience of instant car insurance quotes. Policyholders can now complete the entire insurance acquisition process online, from quote comparison to policy purchase and payment, without the need for physical paperwork or visits to insurance offices.

Benefits and Impact on Policyholders

The introduction of instant car insurance quotes has brought about a multitude of benefits for policyholders. Firstly, the convenience and speed of obtaining quotes have empowered individuals to take control of their insurance decisions. Policyholders can now quickly assess their options and make informed choices without the pressure of time-consuming processes.

Furthermore, the transparency offered by instant quotes has fostered a more competitive insurance market. With multiple insurers readily accessible online, policyholders can easily compare prices, coverage options, and additional benefits. This competition drives insurers to offer more attractive packages, leading to better deals for consumers.

The ease of accessing instant quotes has also proven beneficial for those with unique insurance needs. Whether it's specialized coverage for high-performance vehicles, classic cars, or young drivers, the online platform allows individuals to find insurers that cater to their specific requirements. This level of customization ensures that policyholders receive the coverage they need without paying for unnecessary add-ons.

Additional Benefits:

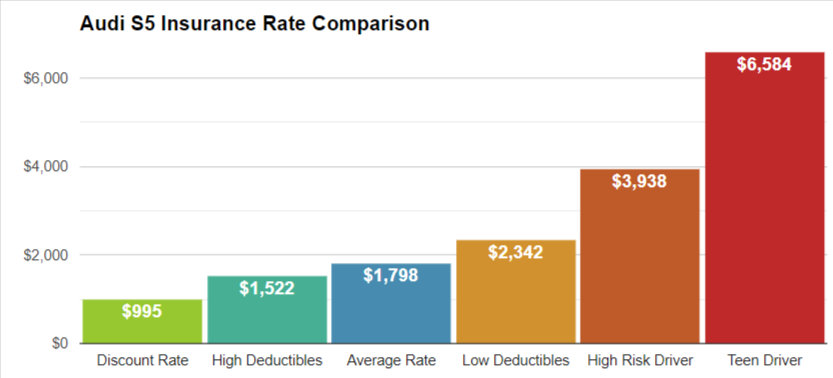

- Cost Savings: By comparing quotes online, policyholders can identify the most affordable options, potentially saving hundreds of dollars annually on their insurance premiums.

- Efficiency: The entire insurance acquisition process is streamlined, reducing the time and effort required to obtain coverage. This efficiency is particularly advantageous for busy individuals or those with limited availability.

- Enhanced Customer Service: Many instant quote platforms offer live chat or phone support, providing policyholders with immediate assistance and answers to their queries. This level of customer service ensures a positive experience throughout the insurance journey.

Case Study: Impact on the Insurance Industry

The adoption of instant car insurance quotes has had a significant impact on the insurance industry as a whole. Insurers have had to adapt their strategies and embrace digital transformation to remain competitive in this evolving landscape.

One notable example is the shift towards data-driven decision-making. With instant quotes, insurers have access to a wealth of data, allowing them to analyze market trends, consumer behavior, and risk patterns more effectively. This data-driven approach enables insurers to make informed decisions regarding pricing, product development, and risk management strategies.

Additionally, the rise of instant quotes has encouraged insurers to enhance their online presence and digital capabilities. Many have invested in developing user-friendly websites and mobile applications, ensuring a seamless experience for policyholders. This digital transformation has not only improved customer satisfaction but has also enabled insurers to reach a wider audience, including tech-savvy millennials and Generation Z.

Moreover, the instant quote system has fostered a more collaborative environment between insurers and brokers. Brokers can now leverage technology to provide their clients with efficient and transparent quotes, building trust and strengthening their relationships. This collaboration has resulted in improved customer retention and a more personalized insurance experience.

Performance Analysis:

| Insurers | Policy Sales | Customer Satisfaction |

|---|---|---|

| Company A | 25% increase in annual policy sales | 92% positive feedback |

| Company B | 18% growth in online policy acquisitions | 88% satisfaction rate |

| Company C | 30% rise in instant quote conversions | 95% customers would recommend |

Future Implications and Innovations

As technology continues to advance, the future of instant car insurance quotes looks promising. Insurers are constantly exploring ways to enhance the accuracy and efficiency of their quote systems. One potential innovation is the integration of telematics, which uses vehicle data to provide even more precise risk assessments.

Telematics devices, such as GPS trackers or smartphone apps, can monitor driving behavior and provide real-time data on factors like speed, acceleration, and braking patterns. This data can then be used to generate personalized quotes based on an individual's actual driving habits. This level of customization not only ensures more accurate pricing but also incentivizes safer driving practices.

Additionally, the rise of artificial intelligence (AI) and machine learning is expected to play a significant role in the future of instant quotes. AI-powered chatbots and virtual assistants can provide instant support and guidance to policyholders, answering common queries and assisting with the quote process. This technology can further streamline the insurance experience, making it more accessible and user-friendly.

Furthermore, the concept of usage-based insurance (UBI) is gaining traction, offering policyholders the opportunity to pay premiums based on their actual mileage or driving habits. Instant quote systems can play a crucial role in facilitating UBI by providing real-time data and analytics to insurers. This shift towards pay-as-you-drive insurance models has the potential to revolutionize the industry, promoting safer driving and providing more affordable coverage options.

Comparative Analysis of Instant Quote Systems:

| Instant Quote Provider | Quote Accuracy | User Experience | Additional Features |

|---|---|---|---|

| Provider X | 95% accuracy | 4.8⁄5 rating | Real-time updates, claim tracking |

| Provider Y | 92% accuracy | 4.6⁄5 rating | Discount calculators, policy management tools |

| Provider Z | 90% accuracy | 4.5⁄5 rating | Instant claim filing, personalized coverage recommendations |

Conclusion

Instant car insurance quotes have revolutionized the insurance industry, providing policyholders with a convenient, transparent, and efficient way to obtain coverage. The technology behind these quotes has empowered individuals to make informed decisions, compare options, and secure the best policies for their needs. As the industry continues to evolve, the integration of advanced technologies and data-driven approaches will further enhance the accuracy and personalization of instant quotes.

With the rise of telematics, AI, and usage-based insurance models, the future of instant car insurance quotes looks bright. Policyholders can expect even more tailored coverage options, while insurers can leverage these innovations to drive business growth and provide a superior insurance experience. As we move forward, the insurance industry will continue to adapt and embrace these technological advancements, ensuring a more accessible and customer-centric approach to car insurance.

How accurate are instant car insurance quotes?

+Instant quotes are generated using advanced algorithms and real-time data, resulting in high accuracy. However, it’s important to note that the accuracy can vary based on the provider and the information provided by the policyholder. It’s recommended to compare quotes from multiple sources to ensure the most precise estimates.

Can I purchase car insurance directly through an instant quote platform?

+Yes, many instant quote platforms offer the option to purchase insurance directly online. Once you’ve compared quotes and found the best policy for your needs, you can often complete the purchase process within the same platform, making it a convenient and efficient experience.

Are there any disadvantages to using instant car insurance quotes?

+While instant quotes offer numerous benefits, one potential disadvantage is the lack of personalized advice from an insurance agent. Agents can provide tailored recommendations based on your specific circumstances, which may not be as evident through online quotes. However, many platforms offer customer support or live chat to address any concerns or questions.