Ehealth Insurance

The rise of eHealth insurance has revolutionized the healthcare industry, offering innovative solutions and accessibility to individuals seeking comprehensive health coverage. This comprehensive article explores the world of eHealth insurance, delving into its origins, impact, and future prospects. With a focus on the United States market, we will uncover the benefits, challenges, and trends shaping this digital healthcare landscape.

Revolutionizing Healthcare: The Emergence of eHealth Insurance

eHealth insurance, an innovative concept that has rapidly gained traction, represents a paradigm shift in the traditional healthcare system. By leveraging digital technologies and online platforms, eHealth insurance providers have disrupted the status quo, offering a more convenient, transparent, and consumer-centric approach to health coverage.

The origins of eHealth insurance can be traced back to the early 2000s when pioneering companies recognized the potential of the internet to streamline the often complex and time-consuming process of purchasing health insurance. These early adopters aimed to simplify the consumer experience, making it easier for individuals to compare plans, understand their options, and enroll in coverage.

The impact of eHealth insurance has been profound, particularly in the United States, where healthcare costs and complexities have long been a significant concern for consumers. By providing an online marketplace for health insurance, eHealth platforms have empowered individuals to take control of their healthcare decisions. The ability to compare plans, obtain instant quotes, and enroll in coverage from the comfort of one's home has revolutionized the way people interact with the healthcare system.

One of the key advantages of eHealth insurance is its focus on transparency. Consumers can easily access detailed information about various health plans, including coverage options, deductibles, and out-of-pocket expenses. This transparency empowers individuals to make informed choices, ensuring they select a plan that aligns with their specific healthcare needs and financial capabilities.

Benefits of eHealth Insurance: Accessibility and Convenience

eHealth insurance has brought about a significant shift in accessibility and convenience, making health coverage more accessible to a wider population. Here are some key benefits that have contributed to its popularity:

Streamlined Enrollment Process

The online enrollment process offered by eHealth insurance platforms is remarkably efficient. Consumers can complete the entire application and enrollment process digitally, without the need for extensive paperwork or in-person visits. This streamlined approach saves time and reduces administrative burdens, making it easier for individuals to obtain the coverage they need.

Wide Range of Plan Options

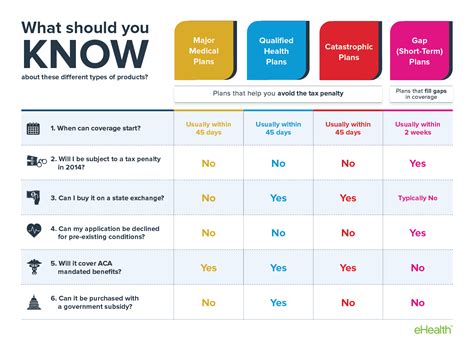

eHealth insurance platforms aggregate a vast array of health plans from multiple insurers, providing consumers with a comprehensive marketplace. This abundance of choices allows individuals to compare plans based on their specific needs, whether they require comprehensive coverage for a large family or more tailored options for young adults.

| Plan Type | Coverage Highlights |

|---|---|

| Comprehensive Plans | These plans offer extensive coverage, including hospital stays, prescription medications, and specialist visits. Ideal for families and individuals with diverse healthcare needs. |

| Catastrophic Plans | Designed for young adults and those with lower healthcare utilization, these plans provide basic coverage with higher deductibles. They are affordable options for those who prioritize cost-effectiveness. |

| Short-Term Plans | Short-term plans offer temporary coverage for individuals between jobs or during gaps in traditional insurance. They provide essential coverage for a specified period. |

Instant Quotes and Comparison Tools

eHealth insurance platforms utilize advanced algorithms to provide instant quotes based on individual needs and preferences. These quotes take into account factors such as age, location, and desired coverage levels, allowing consumers to quickly assess the affordability and suitability of different plans.

Additionally, comparison tools enable users to evaluate multiple plans side by side, making it easier to identify the most suitable option. These tools highlight key differences in coverage, costs, and provider networks, ensuring that consumers can make informed decisions based on their unique circumstances.

Challenges and Considerations in the eHealth Insurance Landscape

While eHealth insurance has brought numerous benefits, it also presents certain challenges and considerations that consumers and industry stakeholders must navigate. Understanding these aspects is crucial for making informed choices and ensuring a positive experience.

Navigating Plan Complexity

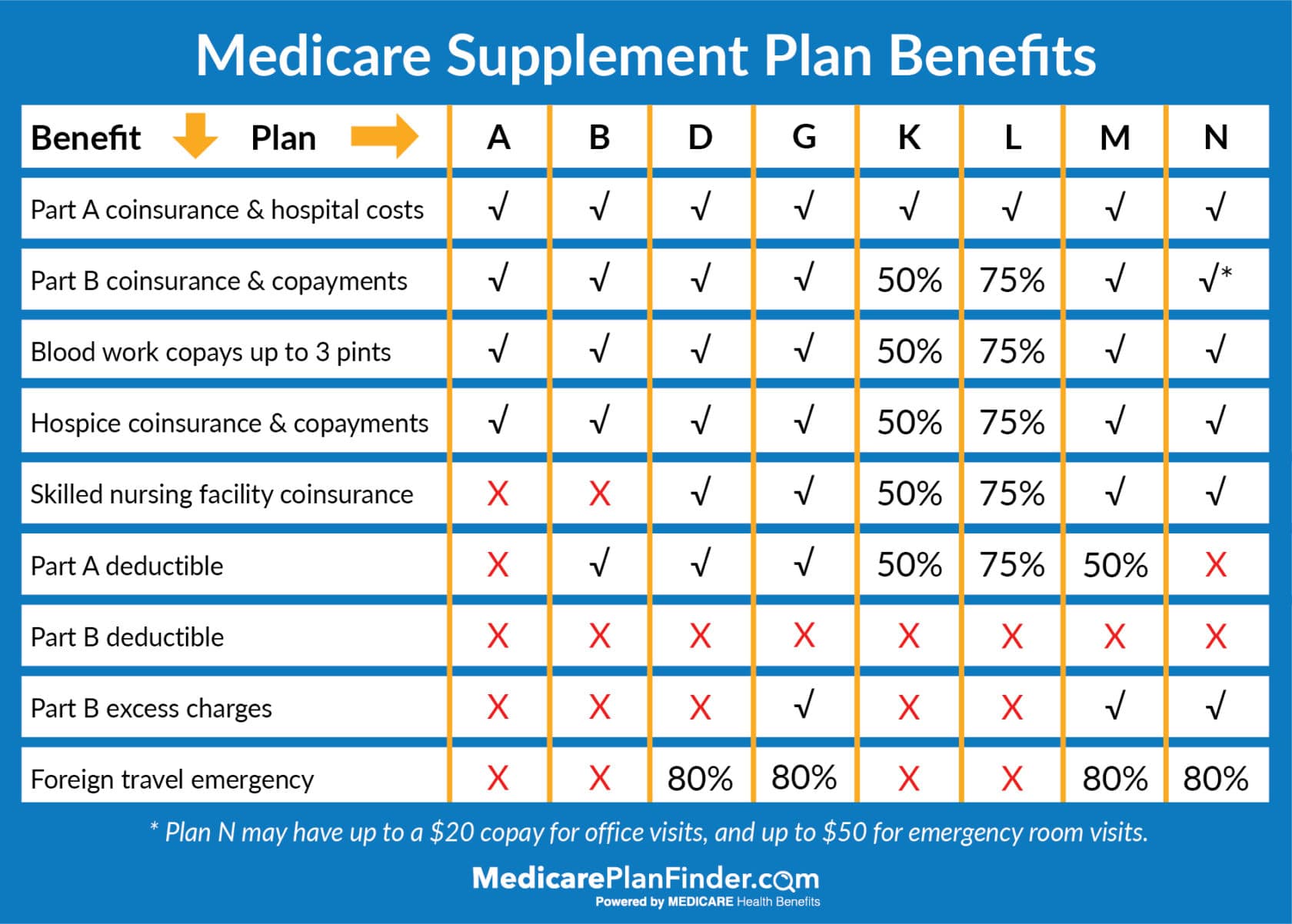

One of the challenges associated with eHealth insurance is the complexity of health plans. With a multitude of options available, consumers may struggle to understand the nuances of different plans, including coverage limits, deductibles, and out-of-pocket expenses. This complexity can make it difficult to choose the most appropriate plan, especially for individuals who are not familiar with healthcare terminology.

Provider Network and Access to Care

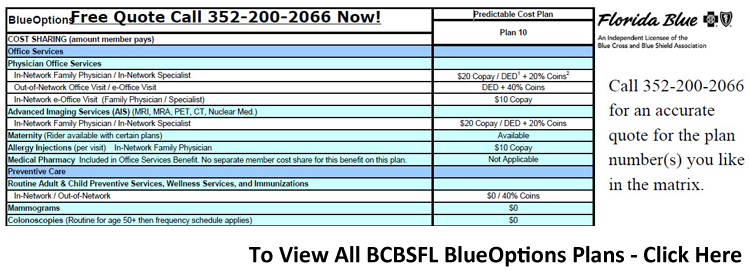

eHealth insurance plans are often offered by various insurers, each with its own provider network. Consumers must carefully review these networks to ensure that their preferred healthcare providers and facilities are included. In some cases, plans with more comprehensive coverage may have narrower provider networks, requiring individuals to adjust their healthcare choices accordingly.

Understanding Coverage Limitations

eHealth insurance plans may have certain limitations or exclusions, such as pre-existing condition clauses or specific procedures not covered. Consumers must thoroughly review the details of each plan to understand these limitations and ensure that their anticipated healthcare needs are adequately addressed. Failure to do so may result in unexpected out-of-pocket expenses or challenges in accessing necessary care.

The Future of eHealth Insurance: Trends and Innovations

As eHealth insurance continues to evolve, several trends and innovations are shaping the future of this digital healthcare landscape. These developments aim to enhance accessibility, improve consumer experiences, and address emerging healthcare needs.

Personalized Health Plans

One of the key trends in eHealth insurance is the shift towards personalized health plans. Insurers are leveraging advanced data analytics and consumer insights to offer tailored coverage options. These plans take into account individual health histories, lifestyle factors, and even genetic predispositions to provide customized coverage that aligns with each person’s unique healthcare needs.

Digital Health Solutions

eHealth insurance providers are increasingly integrating digital health solutions into their offerings. This includes partnerships with telemedicine platforms, digital therapeutics companies, and wellness apps. By incorporating these technologies, insurers aim to provide consumers with convenient access to healthcare services, remote consultations, and personalized wellness programs, all within a comprehensive insurance ecosystem.

Value-Based Care Models

The traditional fee-for-service model in healthcare is being disrupted by the rise of value-based care. eHealth insurance providers are exploring innovative payment models that reward insurers and healthcare providers for delivering high-quality, cost-effective care. These models aim to improve patient outcomes, reduce unnecessary procedures, and promote a more sustainable healthcare system.

Conclusion

eHealth insurance has emerged as a powerful force in the healthcare industry, transforming the way individuals access and understand health coverage. With its focus on accessibility, convenience, and transparency, eHealth insurance has empowered consumers to take control of their healthcare decisions. While challenges exist, the ongoing innovations and trends in this space indicate a bright future for eHealth insurance, offering hope for a more efficient, personalized, and consumer-friendly healthcare landscape.

How do I choose the right eHealth insurance plan for my needs?

+Selecting the right eHealth insurance plan involves careful consideration of your healthcare needs and preferences. Start by assessing your anticipated medical expenses, including regular doctor visits, prescription medications, and any specialized treatments. Evaluate the coverage options offered by different plans, comparing deductibles, copayments, and out-of-pocket limits. Consider the provider network to ensure access to your preferred healthcare providers. Additionally, review any exclusions or limitations to avoid unexpected gaps in coverage. By thoroughly researching and comparing plans, you can make an informed decision that aligns with your healthcare requirements and budget.

Are eHealth insurance plans more affordable than traditional insurance?

+The affordability of eHealth insurance plans can vary depending on individual circumstances and the specific plan chosen. While eHealth insurance platforms offer a wide range of options, including more affordable plans with higher deductibles, the overall cost of coverage can be influenced by factors such as age, location, and desired coverage levels. It’s important to compare quotes from multiple insurers to find the most cost-effective plan that meets your needs. Additionally, eHealth insurance providers often offer discounts or incentives for early enrollment or continuous coverage, making it beneficial to explore these opportunities.

What are the key differences between eHealth insurance and traditional insurance?

+eHealth insurance and traditional insurance differ in several key aspects. eHealth insurance is primarily offered through online platforms, providing a digital marketplace for consumers to compare and enroll in health plans. This approach offers greater convenience and accessibility, allowing individuals to research and purchase coverage from the comfort of their homes. Traditional insurance, on the other hand, often involves working with insurance agents or brokers, requiring in-person interactions and more manual processes. Additionally, eHealth insurance tends to emphasize transparency and consumer empowerment, with instant quotes and detailed plan information readily available. In contrast, traditional insurance may involve more personalized guidance but may not offer the same level of digital convenience and transparency.