Uhc Dental Insurance

Welcome to an in-depth exploration of UnitedHealthcare's (UHC) Dental Insurance, a comprehensive coverage plan designed to cater to individuals and families seeking optimal oral health. This article aims to provide an extensive overview, shedding light on the various facets of UHC's dental insurance offerings, from their network of providers to the specific benefits and coverage limits.

Understanding UHC’s Dental Insurance Network

At the heart of UHC’s dental insurance lies its expansive network of dental providers, carefully curated to offer a wide range of specialized services. This network, comprising general dentists, orthodontists, pediatric dentists, and specialists in fields such as periodontics and endodontics, ensures that policyholders have access to a diverse array of oral healthcare professionals. The inclusion of in-network providers is a key advantage, as it typically results in lower out-of-pocket costs and streamlined claims processes.

UHC's dental insurance network extends across the nation, with thousands of dental offices conveniently located to serve policyholders. This extensive reach means that individuals and families can easily find a trusted dentist nearby, whether they're at home or traveling. Furthermore, the network's depth allows for choice and flexibility in selecting a dental care provider, ensuring that personal preferences and specific oral health needs are accommodated.

Network Benefits and Coverage

The benefits of UHC’s dental insurance network are twofold. Firstly, policyholders enjoy reduced costs when utilizing in-network providers. This is because UHC has negotiated favorable rates with these dental professionals, resulting in lower fees for services compared to out-of-network care. Secondly, the network facilitates efficient claims processing, as UHC has established relationships and standardized procedures with these providers, streamlining the reimbursement process.

In terms of coverage, UHC's dental insurance plans typically encompass a range of essential dental services, including preventive care, basic procedures, and major treatments. Preventive care, which includes regular check-ups, cleanings, and X-rays, is often covered at 100% with no deductible, encouraging policyholders to maintain optimal oral hygiene. Basic procedures, such as fillings, extractions, and root canals, are covered at varying percentages, with policyholders typically responsible for a co-payment or co-insurance portion.

Major treatments, including crowns, bridges, and dentures, are covered at a lower percentage compared to basic procedures, reflecting their higher cost. However, UHC's dental insurance plans often include annual maximums and lifetime maximums to provide comprehensive coverage for these more extensive treatments. Additionally, some plans may offer orthodontic benefits, covering a portion of the cost for braces or other orthodontic appliances, subject to specific plan provisions.

| Dental Service | Coverage Percentage |

|---|---|

| Preventive Care | 100% |

| Basic Procedures | 70-80% |

| Major Treatments | 50% |

| Orthodontic Care | Varies by Plan |

Eligibility and Enrollment

UHC’s dental insurance is available to a wide range of individuals and families, offering flexible enrollment options to suit diverse needs. Whether you’re an individual seeking standalone dental coverage or a family looking for a comprehensive health and dental plan, UHC has options to cater to your circumstances.

Individual and Family Plans

For individuals, UHC offers standalone dental plans, providing comprehensive oral health coverage without the need for a concurrent medical insurance policy. These plans are particularly beneficial for those who value specialized dental care and want the flexibility to choose their own dental providers. Additionally, family plans are available, allowing multiple family members to be covered under a single policy, ensuring that everyone’s oral health needs are met.

The enrollment process for UHC's dental insurance is straightforward and can often be completed online. Policyholders can typically expect to receive their coverage details and member ID cards within a few weeks of enrollment. It's important to note that, depending on the state and plan type, there may be specific enrollment periods or the option for year-round open enrollment.

Employer-Sponsored Plans

UHC also works closely with employers to offer group dental insurance plans as part of their employee benefits packages. These plans provide cost-effective coverage for employees and their families, often with reduced premiums due to the group purchasing power. Additionally, employer-sponsored plans may offer additional benefits, such as wellness programs or discounts on certain dental services, enhancing the overall value proposition.

Employers interested in providing UHC's dental insurance as a benefit can work directly with UHC's dedicated team to design a plan that meets the unique needs of their workforce. This may involve customizing the plan's benefits, setting contribution levels, and integrating the plan with existing health benefits for a comprehensive and cohesive package.

Cost and Premiums

The cost of UHC’s dental insurance plans varies depending on several factors, including the type of plan (individual, family, or employer-sponsored), the chosen level of coverage, and the policyholder’s location. Generally, premiums are lower for individual plans compared to family plans, reflecting the broader scope of coverage and the potential inclusion of additional family members.

Factors Influencing Premiums

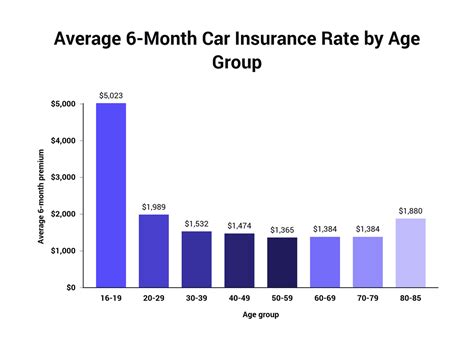

When determining premiums, UHC considers various factors, such as the policyholder’s age, geographic location, and chosen network of providers. Age is a significant factor, as younger individuals typically pay lower premiums, while older adults may face higher costs due to potentially higher utilization of dental services. Geographic location also plays a role, as dental care costs can vary significantly from one region to another.

Additionally, the choice of network can impact premiums. UHC offers Preferred Provider Organization (PPO) plans, which provide greater flexibility in choosing dental providers but may result in higher premiums compared to Health Maintenance Organization (HMO) plans. HMO plans typically have lower premiums but require policyholders to choose a primary care dentist and utilize in-network providers exclusively.

It's worth noting that employer-sponsored plans may offer additional cost-saving benefits, such as employer contributions or premium discounts for employees who opt into the dental insurance plan. These incentives can make dental coverage more accessible and affordable for employees, encouraging them to prioritize their oral health.

Claims and Reimbursement Process

UHC’s dental insurance plans are designed with a streamlined claims and reimbursement process to ensure policyholders receive their benefits efficiently. When a policyholder receives dental care, the dental provider is responsible for submitting a claim to UHC, typically within a specified timeframe after the service is rendered.

Submitting Claims

Dental providers are required to complete a claim form, providing details about the services rendered, the dates of service, and any relevant diagnostic codes. They may also need to submit supporting documentation, such as X-rays or treatment notes, to support the claim. Once the claim is submitted, UHC’s claims processing team reviews the information to ensure it meets the criteria for coverage under the policyholder’s plan.

During the claims review process, UHC's team may verify the accuracy of the claim, check for any applicable exclusions, and determine the allowable amount for the services rendered. This allowable amount is calculated based on the policyholder's coverage limits, the provider's negotiated rates, and any applicable deductibles or co-payments.

Reimbursement Options

UHC offers various reimbursement options to suit the needs of both policyholders and dental providers. For policyholders, the most common reimbursement method is direct payment to the provider, where UHC pays the provider directly for the covered services. This option is particularly convenient, as it reduces the policyholder’s out-of-pocket expenses and eliminates the need for reimbursement paperwork.

Alternatively, policyholders may choose to be reimbursed directly for the covered services. In this case, the policyholder would be responsible for paying the provider in full at the time of service and then submitting a reimbursement claim to UHC. UHC would then review the claim and, if approved, issue a reimbursement payment to the policyholder.

For dental providers, UHC offers electronic funds transfer (EFT) as a reimbursement method. With EFT, UHC deposits the reimbursement amount directly into the provider's bank account, streamlining the payment process and reducing administrative burdens.

Future of UHC’s Dental Insurance

As the landscape of healthcare continues to evolve, UHC remains committed to innovating its dental insurance offerings to meet the changing needs of its policyholders. This includes staying abreast of advancements in dental technology and incorporating new treatments and procedures into its coverage whenever feasible.

Embracing Digital Health

UHC recognizes the growing role of digital health technologies in oral healthcare and is exploring ways to integrate these innovations into its dental insurance plans. This may involve covering telehealth services for dental consultations or supporting the use of digital platforms for teledentistry, which can enhance access to care, particularly for individuals in remote or underserved areas.

Additionally, UHC is investigating the potential of digital tools to improve the overall patient experience and enhance oral health education. This could include mobile apps that provide personalized oral hygiene tips, digital records for easier access to dental history, and online platforms for scheduling appointments and managing dental benefits.

Focus on Preventive Care

UHC remains dedicated to promoting preventive oral healthcare as a cornerstone of its dental insurance plans. The company understands that regular dental check-ups and cleanings are critical to maintaining good oral health and can help prevent more serious and costly issues down the line. As such, UHC is continuing to emphasize the importance of preventive care and educating policyholders about the value of these services.

Furthermore, UHC is exploring ways to incentivize policyholders to prioritize preventive care. This may involve offering rewards or discounts for those who maintain regular dental check-ups or implementing programs to encourage better oral hygiene habits, such as toothbrush replacement programs or incentives for flossing regularly.

How can I find an in-network dentist under UHC’s dental insurance plan?

+You can easily find an in-network dentist by visiting UHC’s website and using their provider search tool. Simply enter your location and preferred specialty, and the tool will generate a list of nearby in-network providers. Alternatively, you can contact UHC’s customer service team, who can assist you in finding a suitable dentist based on your specific needs and preferences.

What happens if I need emergency dental care while traveling?

+If you require emergency dental care while traveling, you can utilize UHC’s network of providers nationwide. Simply locate an in-network dentist in your current location and present your insurance card. UHC’s dental insurance plans typically cover emergency care, although you may be subject to a deductible or co-payment depending on your specific plan details.

Are there any exclusions or limitations to UHC’s dental insurance coverage?

+While UHC’s dental insurance plans offer comprehensive coverage, there may be certain exclusions or limitations based on your specific plan. Common exclusions include cosmetic procedures, orthodontic treatment for adults, and certain experimental or investigational treatments. It’s important to review your plan’s details carefully to understand any potential exclusions or limitations.