Uber Insurance

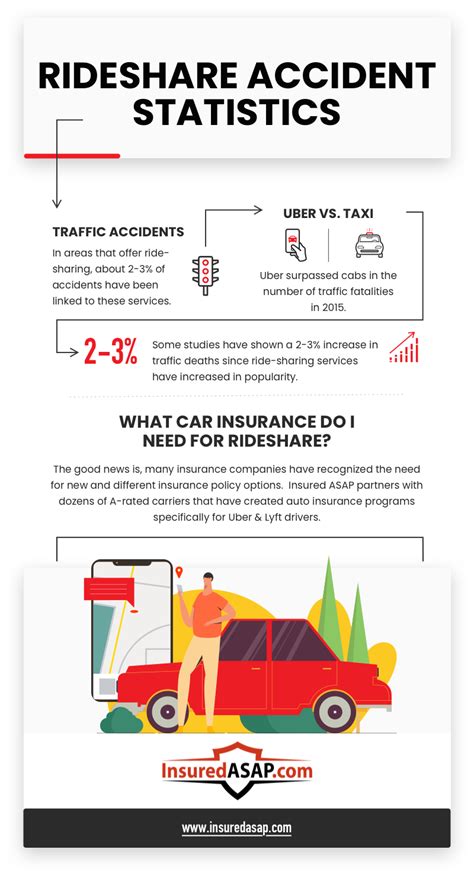

Insurance plays a pivotal role in the ride-sharing industry, providing crucial coverage for drivers, passengers, and third parties. With the rise of companies like Uber, understanding the intricacies of their insurance policies has become essential for anyone involved in this dynamic sector.

The Evolution of Uber Insurance

When Uber first disrupted the traditional taxi industry, it brought with it a unique set of insurance challenges. The ride-sharing model, with its distinct phases of operation, presented a need for tailored insurance coverage.

Initially, Uber faced criticism for its lack of comprehensive insurance, particularly during the periods when drivers were logged into the app but had not yet accepted a ride request. This period of intermittency was not covered by standard auto insurance policies, leaving drivers exposed to potential liabilities.

To address this gap, Uber introduced its own insurance policy, designed to provide coverage during all phases of the ride-sharing process. This marked a significant shift in the industry, as Uber aimed to protect its drivers and passengers more comprehensively.

Phases of Coverage

Uber’s insurance policy is structured around three key phases of a ride-sharing trip:

- Period 0: This phase covers drivers from the moment they log into the Uber app until they accept a ride request. During this period, Uber's insurance policy provides liability coverage of up to $50,000 per person and $100,000 per accident for bodily injury, as well as property damage coverage of up to $25,000.

- Period 1: Once a driver accepts a ride request, they enter Period 1. Uber's insurance policy now extends to provide higher liability coverage of up to $1 million for bodily injury and property damage. This phase covers drivers and passengers from the time the driver accepts a ride until the passenger's final destination is reached.

- Period 2: After the passenger's destination is reached and the trip is complete, drivers enter Period 2. During this phase, Uber's insurance coverage reverts back to the lower liability limits of Period 0, offering protection for drivers as they navigate back to an area with a high demand for rides.

This three-phase insurance structure is a hallmark of Uber's approach to coverage, ensuring that drivers and passengers are protected throughout the entire ride-sharing process.

Comparative Analysis: Uber vs. Traditional Auto Insurance

While Uber’s insurance policy offers comprehensive coverage, it’s essential to compare it to traditional auto insurance to understand its strengths and limitations.

| Coverage Aspect | Uber Insurance | Traditional Auto Insurance |

|---|---|---|

| Liability Coverage | Up to $1 million during Period 1 | Varies based on policy, typically lower limits |

| Property Damage Coverage | Up to $25,000 during Period 0 and 1 | Varies based on policy, typically includes comprehensive and collision coverage |

| Medical Payments Coverage | Included, with limits varying by state | Varies based on policy, may include Personal Injury Protection (PIP) |

| Uninsured/Underinsured Motorist Coverage | Included, with limits varying by state | Varies based on policy and state requirements |

| Comprehensive and Collision Coverage | Not included in base policy, but can be purchased separately | Typically included in comprehensive policies |

One of the key advantages of Uber's insurance policy is its high liability coverage during Period 1, which can provide greater peace of mind for drivers and passengers alike. However, it's important to note that comprehensive and collision coverage are not automatically included, meaning drivers may need to purchase additional policies to protect their vehicles.

Real-World Scenarios

To illustrate the practical implications of Uber’s insurance policy, let’s consider a few hypothetical situations:

- Scenario 1: A driver, while logged into the Uber app but before accepting a ride (Period 0), gets into an accident causing $30,000 worth of property damage. Uber's insurance policy would cover this, providing the driver with the necessary protection.

- Scenario 2: During a ride (Period 1), an Uber driver is involved in an accident resulting in $750,000 worth of bodily injury claims. Uber's insurance policy would cover this amount in full, demonstrating the extensive liability protection it provides.

- Scenario 3: After dropping off a passenger (Period 2), an Uber driver's car is damaged in a collision. Without comprehensive coverage, the driver would need to rely on their personal auto insurance or bear the costs themselves.

Future Implications and Industry Insights

The evolution of Uber’s insurance policy has had a profound impact on the ride-sharing industry, setting a new standard for coverage. As more companies enter this space, it’s likely that insurance policies will continue to adapt and evolve to meet the unique needs of ride-sharing drivers and passengers.

One potential future development could be the integration of telematics into insurance policies. By leveraging real-time driving data, insurance providers could offer more personalized and dynamic coverage, potentially reducing costs for safe drivers while providing additional protection for those with higher-risk driving behaviors.

Additionally, the rise of electric and autonomous vehicles in the ride-sharing industry may prompt further insurance innovations. As these technologies evolve, insurance policies will need to adapt to cover new risks and liabilities associated with these advanced vehicles.

What is the purpose of Uber’s insurance policy?

+

Uber’s insurance policy is designed to provide comprehensive coverage for drivers and passengers during all phases of a ride-sharing trip. It ensures liability and property damage protection, offering peace of mind to those involved in the ride-sharing ecosystem.

How does Uber’s insurance policy compare to traditional auto insurance?

+

Uber’s insurance policy offers higher liability limits during Period 1, providing more extensive coverage for bodily injury and property damage. However, it may lack comprehensive and collision coverage, which are typically included in traditional auto insurance policies.

Are there any gaps in Uber’s insurance coverage that drivers should be aware of?

+

Yes, while Uber’s insurance policy provides comprehensive coverage, it does not include comprehensive and collision coverage as part of its base policy. Drivers may need to purchase additional insurance to protect their vehicles from physical damage.