Typical Life Insurance Rates

Life insurance is a vital financial tool that provides security and peace of mind to individuals and their loved ones. It offers a safety net by ensuring that beneficiaries receive a payout in the event of the policyholder's untimely demise. While the primary purpose of life insurance remains consistent, the rates and costs associated with it can vary significantly based on numerous factors. In this comprehensive guide, we will delve into the world of life insurance rates, exploring the key determinants, typical costs, and strategies to secure the best coverage at affordable prices.

Understanding Life Insurance Rates

Life insurance rates, also known as premiums, are the amounts individuals pay to insurance companies in exchange for coverage. These rates are calculated based on a complex assessment of an individual’s health, lifestyle, and other relevant factors. Understanding how these rates are determined is crucial for anyone seeking life insurance coverage.

Factors Influencing Life Insurance Rates

Several factors come into play when insurance companies calculate life insurance rates. These factors can significantly impact the cost of coverage, and it’s essential to be aware of them when shopping for a policy.

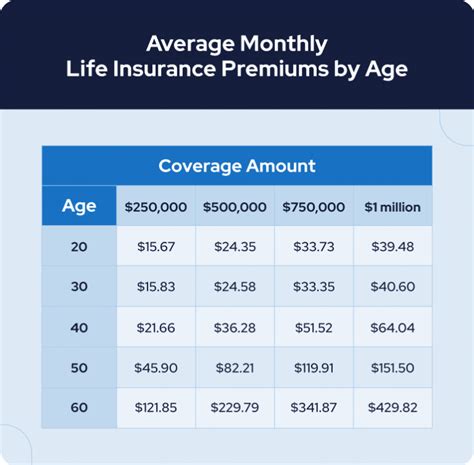

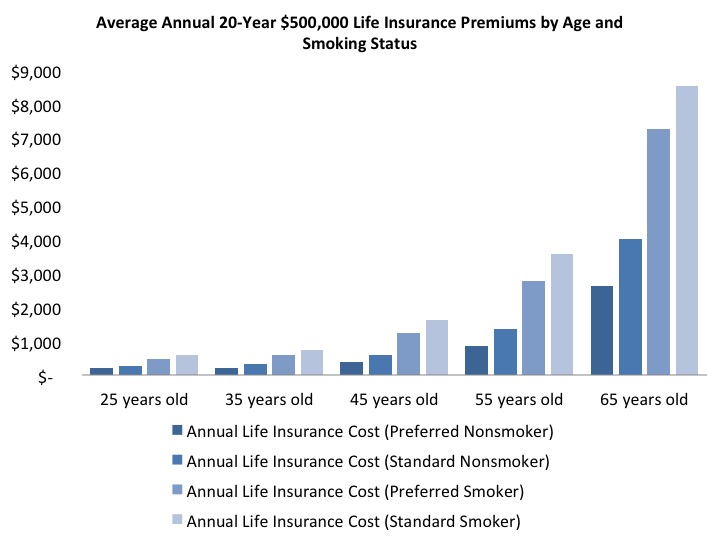

- Age: One of the primary determinants of life insurance rates is the policyholder’s age. Generally, younger individuals pay lower premiums because they are statistically less likely to pass away during the policy term. As individuals age, the risk of mortality increases, leading to higher premiums.

- Health Status: The state of an individual’s health plays a significant role in determining life insurance rates. Insurance companies thoroughly assess an applicant’s medical history, including any pre-existing conditions, to gauge the risk of potential claims. Individuals with good health and no significant medical issues often enjoy more affordable rates.

- Lifestyle Choices: Insurance companies also consider an individual’s lifestyle habits when setting rates. Factors such as smoking, alcohol consumption, and engagement in high-risk activities like extreme sports can increase the cost of coverage. Leading a healthy lifestyle can lead to more favorable rates.

- Occupation and Hobbies: The nature of an individual’s occupation and hobbies can impact life insurance rates. Jobs or hobbies that involve high-risk activities or exposure to hazardous conditions may result in higher premiums. For example, professions like firefighting or aviation can be considered high-risk.

- Family History: Insurance companies often examine an applicant’s family medical history to assess the risk of certain hereditary conditions. A history of serious illnesses or premature deaths in the family can lead to higher rates.

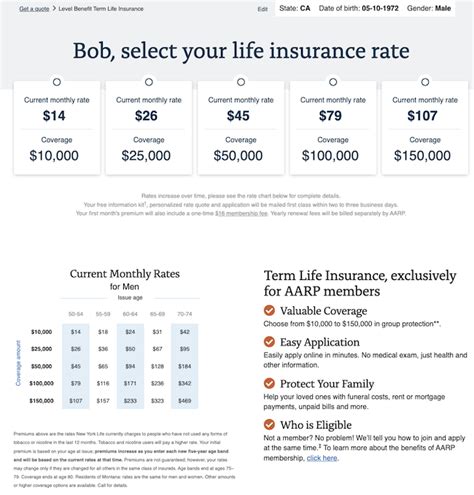

- Amount of Coverage: The level of coverage an individual chooses also affects the cost. Higher coverage amounts generally result in higher premiums.

- Type of Policy: There are various types of life insurance policies, including term life and permanent life insurance. Term life insurance typically offers lower premiums for a specified period, while permanent life insurance provides coverage for the individual’s entire life but comes with higher costs.

Typical Life Insurance Rates

The cost of life insurance can vary widely depending on the factors mentioned above. To give a general idea, here are some average life insurance rates based on age and coverage amount for a healthy individual with no significant health issues or high-risk lifestyle factors:

| Age | Coverage Amount ($) | Monthly Premium ($) |

|---|---|---|

| 25 | 250,000 | 15 |

| 30 | 300,000 | 20 |

| 35 | 400,000 | 25 |

| 40 | 500,000 | 35 |

| 45 | 600,000 | 50 |

| 50 | 750,000 | 70 |

It's important to note that these rates are merely estimates and can vary significantly based on individual circumstances and the insurance company. Additionally, these rates are for term life insurance policies, which are generally more affordable than permanent life insurance policies.

Comparison of Term and Permanent Life Insurance

Understanding the difference between term and permanent life insurance is crucial when considering life insurance options. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is designed to protect individuals during their working years, when financial responsibilities are often at their peak. Term life insurance is generally more affordable, making it an attractive option for those on a budget.

On the other hand, permanent life insurance, such as whole life or universal life insurance, offers coverage for the policyholder's entire life. It also accumulates cash value over time, which can be borrowed against or used to pay premiums. While permanent life insurance provides lifelong coverage and additional financial benefits, it comes at a higher cost compared to term life insurance.

Strategies for Affordable Life Insurance

Securing affordable life insurance coverage is possible by considering the following strategies:

- Shop Around: Compare rates and policies from multiple insurance companies. Each company has its own underwriting guidelines, and rates can vary significantly. Using online quote comparison tools can be a great starting point.

- Improve Health: Maintaining a healthy lifestyle can lead to more favorable rates. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can improve your overall health and reduce insurance costs.

- Bundle Policies: Consider bundling your life insurance with other insurance policies, such as auto or home insurance. Many insurance companies offer discounts when you purchase multiple policies from them.

- Choose the Right Coverage: Determine the appropriate level of coverage based on your financial needs and responsibilities. Overinsuring yourself can lead to unnecessary expenses, while underinsuring may leave your loved ones vulnerable.

- Consider Term Length: When opting for term life insurance, choose a term length that aligns with your financial goals. Shorter terms may result in lower premiums, but ensure the coverage duration matches your needs.

- Seek Professional Advice: Consulting with an experienced insurance broker or financial advisor can provide valuable insights and help you navigate the complexities of life insurance.

Future Implications and Considerations

Life insurance rates are not static and can change over time. As individuals age and their health or lifestyle circumstances evolve, insurance companies may adjust rates accordingly. It’s essential to regularly review and reassess your life insurance needs to ensure you have adequate coverage at the most affordable rates.

Additionally, keeping yourself informed about industry trends and changes in life insurance policies can help you make informed decisions. The life insurance market is dynamic, and staying updated can lead to better coverage and cost-effective solutions.

Conclusion

Understanding life insurance rates is a crucial step in securing the right coverage for yourself and your loved ones. By considering the factors that influence rates and employing strategic approaches, you can navigate the life insurance market with confidence. Remember, life insurance is a long-term investment in your financial security, and finding the right balance between coverage and cost is essential.

Can I get life insurance if I have pre-existing health conditions?

+Yes, individuals with pre-existing health conditions can still obtain life insurance. However, the rates may be higher, and the insurance company may require a medical examination or additional information about your condition. It’s important to be transparent about your health to ensure accurate coverage and avoid potential issues with claims in the future.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy at least once a year, especially if there are significant changes in your life, such as marriage, divorce, the birth of a child, or changes in your financial situation. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

What is the difference between term and whole life insurance?

+Term life insurance provides coverage for a specified period, typically 10-30 years, and offers lower premiums. Whole life insurance, on the other hand, provides coverage for your entire life and accumulates cash value over time. Whole life insurance is more expensive but offers lifelong coverage and additional financial benefits.