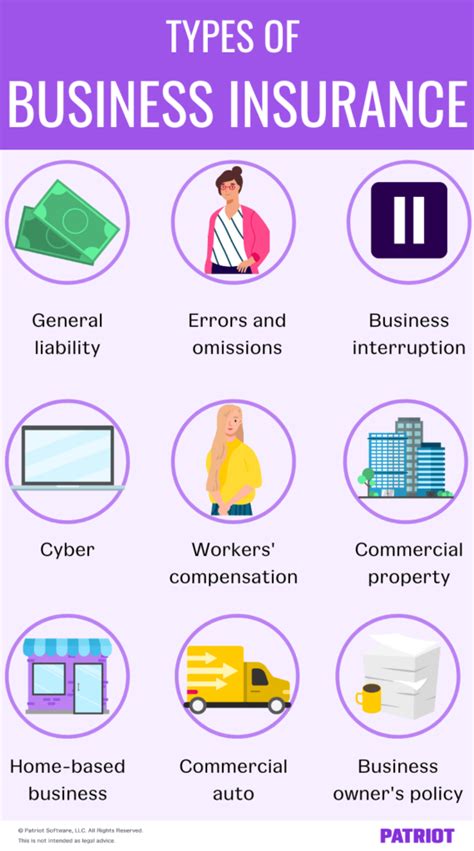

Types Of Business Insurance

Business insurance is an essential component for any company, regardless of its size or industry. It provides a safety net, protecting businesses from various risks and financial losses that could potentially cripple their operations. With the right insurance coverage, entrepreneurs can focus on growth and innovation without worrying about unforeseen circumstances. In this comprehensive guide, we will explore the diverse types of business insurance, delving into their specific benefits and relevance for different businesses.

Liability Insurance: A Safety Net for Business Operations

Liability insurance is a cornerstone of any business insurance portfolio. It safeguards companies from financial losses resulting from lawsuits and claims arising from bodily injury, property damage, or personal and advertising injury. This insurance is particularly crucial for businesses that interact directly with the public or provide professional services, as it covers a wide range of potential liabilities.

For instance, consider a scenario where a customer slips and falls on a wet floor in a retail store. Liability insurance would step in to cover the costs associated with the customer's injuries, including medical expenses and potential legal fees. This type of insurance is vital for businesses to maintain their financial stability and reputation in the face of unforeseen accidents.

Product Liability Insurance: Protecting Businesses and Consumers

Product liability insurance is a specialized form of liability coverage designed for businesses that manufacture, distribute, or sell physical products. This insurance provides protection in cases where a product causes harm to a consumer, whether it’s due to a defect, improper labeling, or incorrect instructions. By having product liability insurance, businesses can mitigate the financial risks associated with product-related incidents and maintain consumer trust.

| Category | Coverage |

|---|---|

| Manufacturing | Covers defects in the manufacturing process |

| Design | Protects against flaws in the product's design |

| Warning Labels | Insures against claims related to inadequate warning labels |

Professional Liability Insurance: Defending Against Negligence Claims

Professional liability insurance, often referred to as Errors and Omissions (E&O) insurance, is tailored for businesses providing professional services. It offers protection against claims of negligence, errors, or omissions in the provision of professional advice or services. This insurance is crucial for industries such as consulting, legal, medical, and financial services, where the potential for mistakes and their financial repercussions are high.

Imagine a consulting firm that provides business strategy advice to a client. If the client's business suffers losses due to the firm's faulty advice, professional liability insurance would cover the legal and financial costs associated with the claim. This type of insurance ensures that professionals can continue operating with confidence, knowing they are protected from potential errors.

Property Insurance: Safeguarding Business Assets

Property insurance is a vital component of business insurance, providing coverage for physical assets such as buildings, equipment, inventory, and furniture. This insurance protects businesses from financial losses resulting from damage or destruction caused by various perils, including fire, theft, vandalism, and natural disasters.

Building Insurance: Securing the Business’s Physical Space

Building insurance is specifically designed to cover the structure of a business’s premises, whether it’s an office, retail space, or warehouse. It offers protection against a range of risks, including fire, wind damage, and vandalism. By having building insurance, businesses can ensure that they have the financial means to repair or rebuild their physical space in the event of a disaster.

For example, a restaurant located in a hurricane-prone area would greatly benefit from building insurance. In the event of a severe storm causing significant damage to the restaurant's building, this insurance would cover the costs of repairs, allowing the business to reopen and continue serving its customers.

Contents Insurance: Protecting Business Equipment and Inventory

Contents insurance, also known as business personal property insurance, covers the business’s contents and equipment, including furniture, computers, machinery, and inventory. This insurance is crucial for businesses to ensure they can replace or repair essential assets in the event of damage or loss.

Consider a small manufacturing business that relies on specialized machinery to produce its products. If a fire were to break out and damage the machinery, contents insurance would provide the financial means to repair or replace the equipment, minimizing downtime and allowing the business to continue operations.

Business Interruption Insurance: Maintaining Business Continuity

Business interruption insurance is a critical component of any business insurance portfolio, as it provides coverage for lost income and additional expenses incurred when a business is unable to operate due to a covered peril. This insurance helps businesses maintain financial stability during temporary shutdowns, ensuring they can meet their ongoing obligations and survive until normal operations can resume.

Key Coverage Scenarios

- Natural Disasters: Covers losses resulting from events like hurricanes, floods, or earthquakes.

- Fire and Explosions: Provides financial support in the event of a fire or explosion on the business premises.

- Civil Unrest: Offers protection during periods of civil unrest or rioting.

- Disease Outbreaks: Crucial for businesses affected by disease outbreaks, such as the COVID-19 pandemic.

For instance, a retail store affected by a fire would be covered by business interruption insurance, allowing it to pay rent, utilities, and other ongoing expenses while it rebuilds or relocates. This insurance is a vital safety net for businesses, ensuring they can weather temporary disruptions and emerge ready to serve their customers.

Workers’ Compensation Insurance: Protecting Employees and Employers

Workers’ compensation insurance is a mandatory coverage for businesses with employees, providing benefits to workers who are injured or become ill due to their job. This insurance not only covers medical expenses and a portion of lost wages but also protects employers from lawsuits related to workplace injuries or illnesses. It is a vital component of any business’s risk management strategy.

Key Benefits of Workers’ Compensation Insurance

- Medical Care: Covers the cost of medical treatment for work-related injuries or illnesses.

- Wage Replacement: Provides a portion of an employee’s wages while they are unable to work due to a work-related injury.

- Vocational Rehabilitation: Offers support for injured workers to return to work, including retraining if necessary.

- Death Benefits: Provides financial support to the dependents of a worker who dies due to a work-related incident.

By having workers' compensation insurance, businesses can ensure the well-being of their employees and avoid costly legal battles. It is a critical aspect of fostering a safe and healthy work environment.

Cyber Liability Insurance: Guarding Against Digital Threats

In today’s digital age, cyber liability insurance has become an essential component of business insurance. It provides coverage for losses resulting from cyber attacks, data breaches, and other online threats. With the increasing frequency and sophistication of cyber crimes, this insurance is vital for businesses of all sizes to protect their digital assets and reputation.

Key Coverage Areas

- Data Breach: Covers the costs associated with a data breach, including notification, credit monitoring, and legal fees.

- Cyber Extortion: Provides protection against ransom demands following a cyber attack.

- Network Security: Offers coverage for losses resulting from network security breaches.

- Cyber Crime: Insures against financial losses due to fraudulent activities, such as phishing or identity theft.

Consider a small business that falls victim to a ransomware attack. Cyber liability insurance would step in to cover the costs of restoring the business's systems, paying the ransom (if necessary), and mitigating the impact of the attack, allowing the business to quickly recover and continue operations.

Commercial Auto Insurance: Covering Business Vehicles

Commercial auto insurance is designed to cover vehicles owned or used by a business. This insurance provides protection for the vehicles themselves, as well as the business and its employees in the event of an accident. It is a crucial coverage for businesses that rely on vehicles for their operations, ensuring financial protection and legal compliance.

Key Coverage Elements

- Liability Coverage: Covers bodily injury and property damage claims arising from an accident involving a business vehicle.

- Comprehensive Coverage: Provides protection for the vehicle against non-collision incidents, such as theft, fire, or vandalism.

- Collision Coverage: Covers damage to the insured vehicle in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: Protects the business and its employees if involved in an accident with an uninsured or underinsured driver.

For a business that relies on a fleet of delivery vehicles, commercial auto insurance is essential. In the event of an accident, this insurance would cover the cost of repairs or replacement of the vehicle, as well as any legal liabilities, ensuring the business can continue its operations without significant financial setbacks.

Conclusion: Navigating the Complex World of Business Insurance

The world of business insurance is diverse and complex, offering a range of coverage options to protect businesses from various risks. From liability insurance to protect against lawsuits, to property insurance safeguarding physical assets, and even cyber liability insurance guarding against digital threats, the right insurance coverage is crucial for any business’s long-term success and stability.

As businesses evolve and face new challenges, it's essential to stay informed about the various types of insurance available and to work with trusted insurance professionals to tailor a comprehensive insurance plan. By doing so, businesses can navigate the unpredictable nature of their industries with confidence and peace of mind.

What is the difference between general liability insurance and professional liability insurance?

+

General liability insurance covers a broad range of liability risks, including bodily injury, property damage, and personal and advertising injury. It is a basic form of liability insurance suitable for most businesses. Professional liability insurance, on the other hand, is tailored for businesses providing professional services and covers claims of negligence, errors, or omissions in the provision of those services. It is a more specialized form of liability coverage, designed to protect professionals from the unique risks associated with their expertise.

How does business interruption insurance work in practice?

+

Business interruption insurance provides coverage for lost income and additional expenses incurred when a business is unable to operate due to a covered peril. For instance, if a restaurant is forced to close due to a fire, this insurance would cover the lost revenue and pay for additional expenses like rent and utilities during the closure period. It helps businesses maintain financial stability and survive until they can reopen their doors.

What is the purpose of workers’ compensation insurance, and why is it mandatory for businesses with employees?

+

Workers’ compensation insurance is designed to provide benefits to employees who are injured or become ill due to their job. It covers medical expenses, a portion of lost wages, and even death benefits for the dependents of workers who pass away due to work-related incidents. This insurance is mandatory for businesses with employees because it protects both the employees and the employer from the financial and legal repercussions of workplace injuries or illnesses. It ensures that injured workers receive the necessary medical care and financial support, while also protecting the employer from potential lawsuits.

How does cyber liability insurance differ from traditional liability insurance?

+

Cyber liability insurance is a specialized form of insurance designed to cover losses resulting from cyber attacks, data breaches, and other online threats. It provides coverage for a range of cyber-related incidents, including data breach response costs, cyber extortion, network security breaches, and cyber crime. Traditional liability insurance, on the other hand, covers general liability risks such as bodily injury, property damage, and personal injury, but it does not typically include coverage for cyber-related incidents. Therefore, businesses that rely heavily on digital operations or store sensitive data should consider cyber liability insurance as an essential addition to their insurance portfolio.