Mortgage Insurance Fha

In the realm of homeownership, understanding the intricacies of mortgage insurance is crucial, especially when considering options like the Federal Housing Administration (FHA) loans. This comprehensive guide will delve into the world of FHA mortgage insurance, shedding light on its mechanisms, benefits, and implications for prospective homeowners.

Unraveling FHA Mortgage Insurance

The Federal Housing Administration, established in 1934, plays a pivotal role in promoting homeownership across the United States. One of its key tools is the FHA mortgage insurance program, designed to provide lenders with protection against borrower default. This insurance enables lenders to offer loans to borrowers who might not traditionally qualify for conventional mortgages, thereby expanding homeownership opportunities.

The Structure of FHA Mortgage Insurance

FHA mortgage insurance operates on a two-tier system. Firstly, there’s the Upfront Mortgage Insurance Premium (UFMIP), which is typically 1.75% of the loan amount and can be financed as part of the mortgage. This premium is paid at the time of closing and provides immediate protection to the lender.

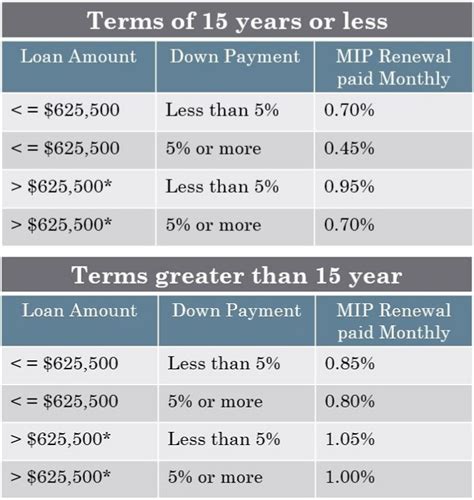

The second component is the Annual Mortgage Insurance Premium (MIP), which is calculated as a percentage of the loan amount and is paid annually. The exact percentage varies based on factors such as the loan term, loan-to-value ratio, and the initial loan amount. For instance, loans with a term of 15 years or less might have an MIP of 0.45% to 0.85% of the loan amount, while longer-term loans could have an MIP of 0.80% to 1.05%.

| Loan Term | Annual MIP Rate |

|---|---|

| 15 years or less | 0.45% - 0.85% |

| Greater than 15 years | 0.80% - 1.05% |

Eligibility and Benefits

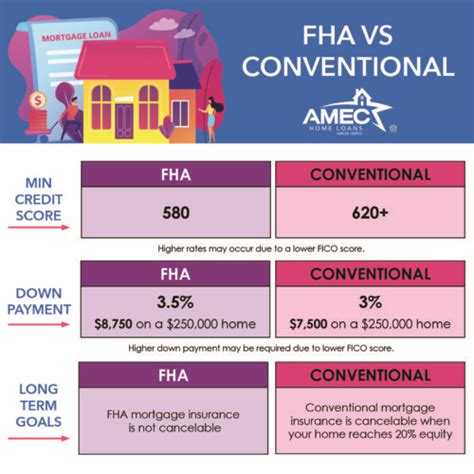

FHA loans are particularly attractive to first-time homebuyers and those with limited financial resources. The eligibility criteria are more flexible compared to conventional loans, often requiring lower credit scores and down payments. For example, while conventional loans might demand a credit score of 620 or higher, FHA loans can be approved with scores as low as 580, and even lower in certain circumstances.

One of the key advantages of FHA loans is the ability to make a down payment as low as 3.5% of the purchase price. This is especially beneficial for those who might not have substantial savings for a larger down payment. Additionally, the FHA allows for gifts or grants to cover the down payment, further easing the financial burden on borrowers.

Cancelation and Reduction of Mortgage Insurance

Unlike private mortgage insurance (PMI) on conventional loans, which can be canceled once the borrower reaches 20% equity in the home, FHA mortgage insurance operates differently. The Annual MIP is typically required for the entire life of the loan, except in specific circumstances.

For loans with a term of 15 years or less, the Annual MIP can be canceled once the loan-to-value ratio reaches 78%. However, for loans with terms exceeding 15 years, the Annual MIP is only cancellable if the loan is refinanced into a new FHA loan, or if the borrower makes a sufficient down payment to reach a 78% loan-to-value ratio.

It's important to note that the FHA reduced the Annual MIP in 2020, offering some relief to borrowers. The annual premium for loans with a term of 15 years or less was reduced to 0.45%, and for loans with longer terms, it was lowered to 0.80%.

Understanding the Costs

While FHA loans provide a pathway to homeownership for many, it’s crucial to understand the financial implications. The mortgage insurance premiums can significantly increase the overall cost of the loan. For instance, on a 200,000 loan, the UFMIP would be 3,500, and the annual MIP could range from 900 to 1,600, depending on the loan term.

To provide a clearer picture, let's consider an example. If a borrower takes out a $200,000 FHA loan with a 30-year term, a 3.5% down payment, and a 4% interest rate, their monthly payment would consist of principal, interest, taxes, and insurance (PITI). The initial monthly payment could be around $1,000, with approximately $200 going towards the Annual MIP.

Comparison with Conventional Loans

When comparing FHA loans with conventional loans, the choice often comes down to eligibility and financial considerations. Conventional loans generally require higher credit scores and larger down payments, but they offer the advantage of lower interest rates and the potential for canceling PMI once 20% equity is reached.

For borrowers with excellent credit scores and sufficient funds for a substantial down payment, conventional loans might be more cost-effective in the long run. However, for those with lower credit scores or limited savings, FHA loans provide a valuable option, albeit with the added cost of mortgage insurance.

The Impact on Homeownership

The FHA mortgage insurance program has had a significant impact on the housing market, especially in recent years. It has played a crucial role in stabilizing the market during economic downturns and has been instrumental in helping millions of Americans achieve the dream of homeownership.

By offering more accessible loan terms, the FHA has enabled a broader range of borrowers to enter the housing market. This has not only contributed to economic growth but has also helped to build wealth and stability for many families. Additionally, the program has been a key factor in the recovery of housing markets across the country.

Challenges and Future Prospects

While the FHA mortgage insurance program has been a success in many ways, it is not without its challenges. One of the primary concerns is the potential for increased risk to the government if a large number of borrowers default on their loans. To mitigate this risk, the FHA has implemented various measures, including stricter eligibility criteria and the reduction of Annual MIP rates.

Looking ahead, the future of the FHA mortgage insurance program appears promising. With ongoing efforts to streamline the loan process and improve borrower education, the program is well-positioned to continue supporting homeownership. Additionally, the FHA is exploring innovative strategies to further enhance its services, such as the development of digital platforms and the implementation of more efficient underwriting processes.

Frequently Asked Questions

How does FHA mortgage insurance work, and why is it required for FHA loans?

+FHA mortgage insurance is a safeguard for lenders, providing protection in case borrowers default on their loans. It’s a requirement for FHA loans to encourage lenders to offer loans to borrowers who might not meet the stringent criteria of conventional loans. This insurance allows lenders to mitigate risk and extend homeownership opportunities to a broader range of borrowers.

What are the eligibility criteria for FHA loans, and how do they differ from conventional loans?

+FHA loans are known for their more flexible eligibility criteria. While conventional loans often require higher credit scores and larger down payments, FHA loans can be approved with credit scores as low as 580 and down payments as low as 3.5% of the purchase price. This makes FHA loans more accessible to first-time homebuyers and those with limited financial resources.

How do the costs of FHA mortgage insurance compare to private mortgage insurance (PMI) on conventional loans?

+The costs of FHA mortgage insurance can be higher than PMI on conventional loans. For instance, the Upfront Mortgage Insurance Premium (UFMIP) on an FHA loan is typically 1.75% of the loan amount, which can be financed as part of the mortgage. Additionally, the Annual Mortgage Insurance Premium (MIP) can range from 0.45% to 1.05% of the loan amount annually. In contrast, PMI on conventional loans can be canceled once the borrower reaches 20% equity in the home, making it potentially more cost-effective in the long run.