The General Insurance Get A Quote

In today's fast-paced world, having the right insurance coverage is crucial to protect ourselves and our assets. Whether it's safeguarding our homes, vehicles, or even our health, insurance plays a vital role in providing financial security and peace of mind. In this comprehensive guide, we will delve into the world of general insurance and explore how you can effortlessly obtain a quote tailored to your unique needs.

Understanding General Insurance

General insurance, often referred to as non-life insurance, encompasses a wide range of policies that cover various aspects of our lives. Unlike life insurance, which focuses on providing financial protection to beneficiaries upon the insured’s death, general insurance offers coverage for specific risks and events that may occur during our lifetime.

General insurance policies are designed to protect individuals, businesses, and organizations from financial losses arising from unforeseen circumstances. These policies provide a safety net, ensuring that in the event of accidents, natural disasters, or other unexpected occurrences, the insured party can receive compensation or financial assistance to cover the associated costs.

Types of General Insurance Policies

General insurance policies come in many forms, each tailored to address specific needs. Here are some of the most common types of general insurance:

- Home Insurance: Protects your home and its contents against damage, theft, and liability claims. It provides coverage for a wide range of risks, including fire, flooding, vandalism, and natural disasters.

- Auto Insurance: Essential for vehicle owners, auto insurance covers a variety of risks associated with driving, such as accidents, theft, and damage to your vehicle. It also provides liability coverage for any third-party claims.

- Health Insurance: Offers financial protection for medical expenses, covering hospital stays, surgeries, prescription medications, and other healthcare-related costs. Health insurance plans can vary widely, offering different levels of coverage and benefits.

- Travel Insurance: Provides coverage for unforeseen events while traveling, such as trip cancellations, medical emergencies, lost luggage, or travel delays. Travel insurance ensures you can enjoy your trips without worrying about unexpected expenses.

- Business Insurance: Tailored to meet the needs of businesses, this type of insurance covers a range of risks, including property damage, liability claims, and business interruption. It helps protect businesses from financial losses and ensures their continuity.

The Importance of Getting a Quote

Obtaining a quote for general insurance is a fundamental step in ensuring you have adequate coverage. A quote provides valuable insights into the cost and scope of the insurance policy, allowing you to make informed decisions about your protection needs.

When you request a quote, insurance providers assess various factors to determine the level of risk associated with insuring you. These factors include your personal circumstances, the type of insurance you require, and the level of coverage you desire. By providing accurate information, you can receive a precise quote that reflects your specific needs.

Benefits of Getting a Quote

There are several key advantages to obtaining a quote for general insurance:

- Cost Awareness: A quote gives you a clear understanding of the cost of the insurance policy. This allows you to budget effectively and ensure that the insurance premium fits within your financial means.

- Customized Coverage: By providing detailed information about your needs, you can receive a quote tailored to your specific circumstances. This ensures that the insurance policy covers all the risks relevant to your situation.

- Comparison Shopping: With multiple quotes in hand, you can easily compare different insurance providers and their offerings. This enables you to find the best value for your money and choose the insurance company that aligns with your preferences.

- Peace of Mind: Knowing that you have adequate insurance coverage brings peace of mind. A quote helps you identify any gaps in your existing insurance and ensures that you have the necessary protection in place.

How to Get a Quote for General Insurance

The process of obtaining a quote for general insurance has become increasingly convenient and efficient. Here are the steps you can follow to get a quote:

- Identify Your Insurance Needs: Begin by assessing your specific insurance requirements. Consider the type of insurance you need (e.g., home, auto, health) and the level of coverage you desire. Evaluate your personal circumstances and the potential risks you want to mitigate.

- Research Insurance Providers: Explore different insurance companies that offer the type of coverage you're seeking. Look for reputable providers with a strong track record and positive customer reviews. Compare their offerings, customer service, and financial stability.

- Gather Necessary Information: Before requesting a quote, gather the relevant information required by insurance providers. This may include personal details, property or vehicle specifications, medical history (for health insurance), and any additional documentation requested by the insurer.

- Contact Insurance Providers: Reach out to the insurance companies you've shortlisted. You can do this through their websites, by calling their customer service hotline, or by visiting their physical branches. Provide the necessary information and request a quote based on your specific needs.

- Compare Quotes: Once you receive quotes from multiple insurance providers, take the time to compare them thoroughly. Evaluate the coverage, premiums, deductibles, and any additional benefits or exclusions. Consider factors such as customer satisfaction, claim settlement processes, and the insurer's financial strength.

- Make an Informed Decision: Based on your comparison and assessment, choose the insurance provider that best meets your needs and budget. Ensure that the coverage is comprehensive and provides the protection you require. Don't hesitate to seek clarification or additional information if needed.

Online Quote Platforms

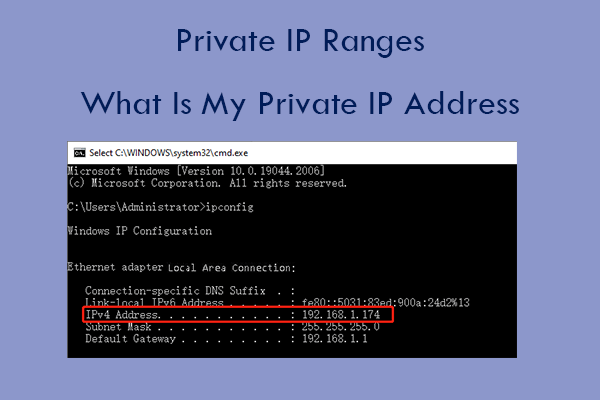

In today’s digital age, obtaining insurance quotes has become even more accessible through online platforms. Many insurance providers offer online quote tools on their websites, allowing you to input your details and receive instant quotes. These platforms often provide a user-friendly interface and allow you to compare quotes from multiple insurers simultaneously.

Online quote platforms can be a convenient and efficient way to explore your insurance options. However, it's important to ensure that the platform is secure and reputable. Look for platforms that prioritize data privacy and provide clear and transparent information about the insurance policies offered.

Understanding Your Quote

When you receive a quote for general insurance, it’s essential to understand the key components and terms to make an informed decision.

Insurance Premium

The insurance premium is the amount you pay to the insurance provider for the coverage you’ve chosen. It is typically paid annually or in installments, depending on the policy terms. The premium is influenced by various factors, including the level of coverage, the insured’s risk profile, and the insurance provider’s rates.

Policy Deductibles

A deductible is the amount you, as the policyholder, are responsible for paying out of pocket before the insurance coverage kicks in. Deductibles can vary depending on the type of insurance and the level of coverage chosen. Higher deductibles often result in lower premiums, as you are assuming a larger portion of the risk.

Coverage Limits

Coverage limits define the maximum amount the insurance provider will pay for a covered loss. These limits are specified in the policy and vary based on the type of insurance and the level of coverage selected. It’s important to carefully review the coverage limits to ensure they align with your needs and provide sufficient protection.

Policy Exclusions

Policy exclusions are specific situations or events that are not covered by the insurance policy. These exclusions are outlined in the policy document and vary depending on the insurance provider and the type of coverage. It’s crucial to thoroughly understand the exclusions to avoid any surprises when filing a claim.

Tips for Obtaining the Best Quote

To ensure you get the most competitive and suitable quote for your general insurance needs, consider the following tips:

- Shop Around: Compare quotes from multiple insurance providers to find the best deal. Don't settle for the first quote you receive. Take the time to explore different options and negotiate with insurers to get the most favorable terms.

- Bundle Your Policies: If you require multiple types of insurance, consider bundling them with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them, helping you save on premiums.

- Increase Your Deductibles: Opting for higher deductibles can result in lower premiums. However, ensure that the increased deductible amount is manageable for you in the event of a claim. It's a trade-off between premium savings and out-of-pocket expenses.

- Review Your Coverage Regularly: Insurance needs can change over time. Regularly review your insurance policies to ensure they still meet your requirements. As your circumstances evolve, such as purchasing a new home or starting a business, update your coverage accordingly.

- Utilize Online Resources: Take advantage of online insurance comparison websites and tools. These platforms can provide valuable insights into different insurance providers, coverage options, and customer reviews, helping you make an informed decision.

The Future of General Insurance Quotes

The insurance industry is continuously evolving, and so are the ways in which we obtain quotes. Technological advancements and data analytics are transforming the quote process, making it more efficient and personalized.

Digital Transformation

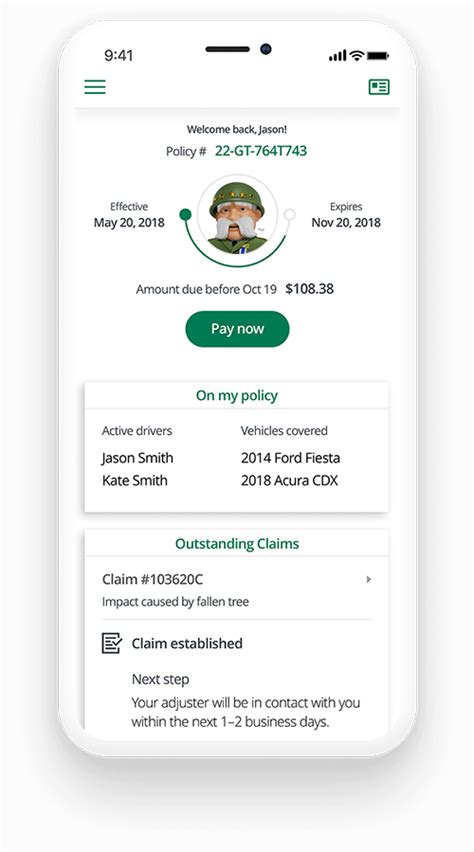

The rise of digital technologies has revolutionized the insurance industry. Insurance providers are leveraging advanced analytics and artificial intelligence to streamline the quote process and enhance customer experiences. Online quote platforms, mobile apps, and chatbot assistants are becoming increasingly popular, providing quick and convenient access to insurance quotes.

Data-Driven Insights

Insurance companies are harnessing the power of data to gain deeper insights into customer needs and behavior. By analyzing vast amounts of data, insurers can better understand risk profiles and offer more accurate and personalized quotes. This data-driven approach enables insurers to provide tailored coverage options and improve the overall customer experience.

Telematics and Usage-Based Insurance

Telematics technology is transforming the auto insurance industry. Usage-based insurance, also known as pay-as-you-drive insurance, allows insurance providers to track driving behavior and offer customized premiums based on individual driving patterns. This innovative approach rewards safe drivers with lower premiums, encouraging safer road practices.

Conclusion

Obtaining a quote for general insurance is a crucial step in ensuring you have the necessary protection for your assets and well-being. By understanding the types of general insurance policies available, the importance of quotes, and the process of obtaining them, you can make informed decisions about your insurance coverage.

Remember to compare quotes, explore different insurance providers, and tailor your coverage to your specific needs. Stay up-to-date with the latest advancements in the insurance industry, as technology continues to shape the way we access and manage our insurance policies.

With the right insurance coverage in place, you can have peace of mind knowing that you are protected against unforeseen circumstances. So, take the time to explore your options, get multiple quotes, and choose the insurance provider that best aligns with your requirements and budget.

What is the difference between general insurance and life insurance?

+General insurance, or non-life insurance, covers specific risks and events that may occur during your lifetime, such as property damage, accidents, or medical expenses. Life insurance, on the other hand, provides financial protection to beneficiaries upon the insured’s death, ensuring their financial security.

How can I lower my insurance premiums?

+To lower your insurance premiums, you can consider increasing your deductibles, bundling multiple policies with the same provider, maintaining a good credit score, and exploring discounts for safe driving or installing security devices.

What factors influence the cost of general insurance quotes?

+The cost of general insurance quotes is influenced by various factors, including the type of insurance, the level of coverage, the insured’s risk profile, location, age, and the insurance provider’s rates. It’s important to compare quotes from multiple insurers to find the best value.