State Farm Vehicle Insurance

Protecting Your Wheels: A Comprehensive Guide to State Farm Vehicle Insurance

In the vast landscape of vehicle insurance, State Farm stands as a prominent player, offering a comprehensive suite of insurance products tailored to meet the diverse needs of drivers across the United States. With a rich history spanning over a century, State Farm has evolved to become one of the largest insurance providers in the country, renowned for its commitment to customer satisfaction and financial stability.

This guide delves into the world of State Farm Vehicle Insurance, shedding light on its coverage options, the claims process, and the unique benefits it offers to policyholders. Whether you're a seasoned driver or a novice on the road, understanding the intricacies of vehicle insurance is crucial to ensuring your safety and financial well-being. So, buckle up as we embark on a journey to explore the features and advantages of State Farm's automotive insurance offerings.

Understanding State Farm's Vehicle Insurance Coverage

State Farm's vehicle insurance coverage is designed to provide comprehensive protection for a wide range of vehicles, including cars, motorcycles, trucks, and even recreational vehicles. The coverage options are tailored to meet the specific needs of individual policyholders, offering flexibility and customization to ensure that drivers receive the right level of protection for their unique circumstances.

Liability Coverage

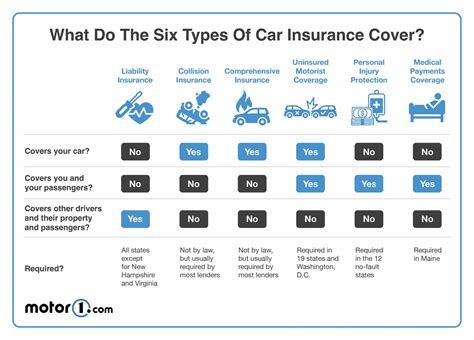

Liability coverage is a cornerstone of any vehicle insurance policy, and State Farm offers robust protection in this area. This coverage safeguards policyholders against financial losses arising from bodily injury or property damage caused to others in an accident for which the insured driver is held responsible. State Farm’s liability coverage includes both bodily injury liability and property damage liability, ensuring that policyholders are protected from the financial repercussions of such incidents.

| Bodily Injury Liability | Property Damage Liability |

|---|---|

| Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the insured driver. | Pays for the repair or replacement of property damaged in an accident caused by the insured driver, including vehicles, structures, and personal belongings. |

Collision and Comprehensive Coverage

State Farm’s Collision and Comprehensive coverage options provide protection for the insured vehicle itself. Collision coverage steps in to cover the cost of repairing or replacing the insured vehicle after an accident, regardless of fault. This coverage is particularly beneficial for drivers who wish to protect their vehicle against damages arising from collisions with other vehicles or objects.

Comprehensive coverage, on the other hand, provides protection against a range of non-collision incidents, including theft, vandalism, natural disasters, and animal-related accidents. This coverage ensures that policyholders are financially protected against unforeseen events that could result in significant damage to their vehicles.

| Collision Coverage | Comprehensive Coverage |

|---|---|

| Covers repair or replacement costs for the insured vehicle after an accident, regardless of fault. | Provides protection against a wide range of non-collision incidents, including theft, vandalism, natural disasters, and animal-related accidents. |

Medical Payments Coverage

State Farm’s Medical Payments coverage, often referred to as MedPay, is designed to provide swift financial assistance for medical expenses incurred by the insured driver and their passengers after an accident. This coverage is especially valuable as it covers medical treatments, regardless of who is at fault in the accident, ensuring that policyholders can focus on their recovery without immediate financial strain.

Uninsured/Underinsured Motorist Coverage

In the unfortunate event of an accident involving an uninsured or underinsured driver, State Farm’s Uninsured/Underinsured Motorist coverage steps in to provide financial protection to the insured driver. This coverage ensures that policyholders are not left bearing the financial burden of an accident caused by a driver who is either uninsured or lacks sufficient insurance coverage to cover the full extent of the damages.

Additional Coverages

State Farm offers a range of additional coverages to enhance the protection provided by its standard vehicle insurance policies. These include Rental Car Coverage, which provides reimbursement for rental car expenses when the insured vehicle is undergoing repairs; Emergency Roadside Assistance, which offers assistance for flat tires, dead batteries, and other common roadside emergencies; and Glass Coverage, which provides coverage for windshield repairs or replacements.

The State Farm Claims Process: A Smooth and Efficient Journey

State Farm prides itself on its commitment to providing an efficient and seamless claims process for its policyholders. The company understands that accidents can be stressful and time-sensitive, and it has streamlined its claims procedures to ensure that policyholders receive the support and compensation they need in a timely manner.

Reporting a Claim

Policyholders can report claims to State Farm through a variety of channels, including online, over the phone, or in person at a local State Farm office. The company’s 24⁄7 claims hotline ensures that policyholders can reach a representative at any time, providing immediate assistance and guidance during the claims process.

Assessing the Claim

Once a claim is reported, State Farm’s claims adjusters work diligently to assess the extent of the damages and determine the appropriate level of compensation. This process typically involves an inspection of the vehicle and a thorough review of the policyholder’s coverage options. State Farm’s adjusters are trained to provide accurate and fair assessments, ensuring that policyholders receive the full benefits to which they are entitled.

Claims Payment

Upon completion of the assessment, State Farm promptly processes claims payments. The company offers a range of payment options, including direct deposit, check, or even payment to the repair shop on the policyholder’s behalf. This flexibility ensures that policyholders can receive their compensation in a manner that is most convenient and efficient for their individual circumstances.

Unique Benefits and Advantages of State Farm Vehicle Insurance

In addition to its comprehensive coverage options and efficient claims process, State Farm offers a range of unique benefits and advantages that set it apart from other insurance providers.

Discounts and Savings

State Farm is renowned for its commitment to providing value to its policyholders through a variety of discounts and savings opportunities. These include multi-policy discounts, which reward policyholders who bundle their vehicle insurance with other State Farm policies such as homeowners or renters insurance; good student discounts for young drivers who maintain good grades; and safe driver discounts for policyholders with a clean driving record.

Digital Tools and Resources

State Farm has embraced digital innovation to enhance the customer experience. The company’s mobile app, for instance, provides policyholders with easy access to their insurance information, allowing them to manage their policies, report claims, and track the progress of their claims. Additionally, State Farm’s website offers a wealth of resources, including interactive tools to help policyholders understand their coverage options and estimate their insurance premiums.

Community Engagement and Giving Back

State Farm is deeply committed to giving back to the communities it serves. The company has a long-standing tradition of community involvement and philanthropic initiatives. Through its State Farm Good Neighbor programs, the company supports a range of causes, including education, safety, and disaster relief. This commitment to community engagement enhances State Farm’s reputation as a responsible corporate citizen and further strengthens its connection with policyholders.

State Farm's Commitment to Customer Satisfaction

At the heart of State Farm's success is its unwavering commitment to customer satisfaction. The company understands that its policyholders are at the core of its business, and it strives to provide exceptional service and support throughout the insurance journey. State Farm's customer-centric approach is evident in its focus on building long-term relationships, providing personalized guidance, and ensuring that policyholders feel valued and understood.

Personalized Service

State Farm recognizes that every policyholder has unique needs and circumstances. As such, the company takes a personalized approach to insurance, ensuring that policyholders receive tailored guidance and support. From helping policyholders select the right coverage options to offering advice on how to maximize their insurance benefits, State Farm’s agents and representatives are dedicated to providing a customized insurance experience.

Customer Support and Education

State Farm goes above and beyond to educate its policyholders about their insurance coverage and the claims process. The company offers a wealth of educational resources, including online articles, videos, and webinars, to help policyholders understand their rights and responsibilities under their insurance policies. This commitment to customer education ensures that policyholders are well-informed and empowered to make the most of their insurance coverage.

Conclusion

State Farm Vehicle Insurance stands as a beacon of reliability and trust in the world of automotive insurance. With its comprehensive coverage options, efficient claims process, and unique benefits, State Farm provides policyholders with the peace of mind that comes with knowing they are protected against the financial risks associated with vehicle ownership. As one of the largest and most respected insurance providers in the United States, State Farm continues to set the standard for excellence in the industry, ensuring that drivers can navigate the roads with confidence and security.

How can I get a State Farm vehicle insurance quote?

+

You can get a State Farm vehicle insurance quote by visiting their website, calling their customer service hotline, or contacting a local State Farm agent. The quote process typically involves providing information about your vehicle, driving history, and desired coverage options. State Farm’s representatives will guide you through the process and help you select the right coverage for your needs.

What factors influence State Farm’s vehicle insurance rates?

+

State Farm’s vehicle insurance rates are influenced by a variety of factors, including the make and model of your vehicle, your driving record, the coverage options you choose, and your location. Additionally, State Farm may consider your credit score and other demographic factors when determining your insurance premium. It’s important to note that insurance rates can vary significantly based on individual circumstances.

Does State Farm offer discounts on vehicle insurance?

+

Yes, State Farm offers a range of discounts on vehicle insurance to help policyholders save money. These discounts include multi-policy discounts, good student discounts, safe driver discounts, and loyalty discounts for long-term policyholders. State Farm’s agents can provide more information about the specific discounts available and how to qualify for them.

What should I do if I’m involved in a vehicle accident?

+

If you’re involved in a vehicle accident, it’s important to remain calm and follow these steps: ensure the safety of yourself and others involved, call the police to report the accident, exchange contact and insurance information with the other parties, and take photos of the accident scene and any damage to your vehicle. Afterward, contact your State Farm agent or the 24⁄7 claims hotline to report the accident and begin the claims process.

How can I make a State Farm vehicle insurance claim?

+

To make a State Farm vehicle insurance claim, you can contact your local State Farm agent, call the 24⁄7 claims hotline, or submit a claim online through the State Farm website. You’ll need to provide details about the accident or incident, including the date, time, location, and any relevant documentation such as police reports or photos. State Farm’s claims adjusters will guide you through the process and assess your claim.