Single Day Event Insurance

In the world of event planning, unforeseen circumstances can arise at any moment, potentially leading to costly consequences. This is where Single Day Event Insurance steps in as a crucial safeguard for event organizers, offering comprehensive protection for a specific day or duration of their event.

This type of insurance policy is designed to provide coverage for a wide range of risks, ensuring that event organizers can focus on delivering a successful experience without the added worry of financial setbacks. Whether it's a music festival, corporate gathering, wedding, or any other type of event, Single Day Event Insurance is a versatile tool to mitigate risks and ensure peace of mind.

Understanding the Scope of Single Day Event Insurance

Single Day Event Insurance, as the name suggests, is tailored to provide coverage for a single day or a specific duration of an event. It is a flexible option that can be customized to meet the unique needs of different event types and sizes. From small-scale community gatherings to large-scale concerts, this insurance policy can be adapted to offer the right level of protection.

The scope of coverage typically includes a range of potential risks, such as:

- Cancellation or Postponement: If your event needs to be canceled or postponed due to unforeseen circumstances like severe weather, natural disasters, or even venue unavailability, Single Day Event Insurance can reimburse you for non-refundable expenses.

- Liability: This insurance covers claims for bodily injury or property damage that may occur during your event. For instance, if a guest slips and falls at your event, this policy can provide financial protection.

- Equipment and Property Damage: It offers coverage for damage or loss of equipment and property used during the event, including rented items like sound systems, lighting equipment, or decorations.

- Public Relations: In the event of a crisis or an issue that affects the reputation of your event, this insurance can help manage public relations and cover associated costs.

- Specialized Coverages: Depending on the nature of your event, you can tailor the policy to include specific coverages. For example, events involving alcohol may require additional liquor liability coverage.

The beauty of Single Day Event Insurance is its adaptability. Organizers can choose the level of coverage they need, ensuring they are not overinsured or underinsured for their specific event.

Real-World Examples of Single Day Event Insurance in Action

Let’s explore a few scenarios where Single Day Event Insurance has proven to be an invaluable asset for event organizers:

Music Festival’s Weather Woes

Imagine organizing a large-scale outdoor music festival, with multiple stages and thousands of attendees expected. Just days before the event, a severe storm rolls in, forcing the festival to be canceled. With Single Day Event Insurance, the organizers are able to recover their significant expenses, including artist fees, venue rental, and promotional costs.

Corporate Event’s Unforeseen Venue Closure

A corporate client has planned a team-building event at a local amusement park. However, on the day of the event, the park unexpectedly closes due to a mechanical failure. Single Day Event Insurance steps in to reimburse the client for their non-refundable expenses, ensuring they can reschedule the event without financial strain.

Wedding Day Mishaps

A couple has meticulously planned their dream wedding, but on the big day, a severe thunderstorm causes damage to the outdoor venue and decorations. Single Day Event Insurance covers the cost of repairing or replacing the damaged items, ensuring the couple can still celebrate their special day without added financial stress.

The Benefits of Customizable Coverage

One of the key advantages of Single Day Event Insurance is its ability to be tailored to specific events. Whether you’re planning a low-risk community event or a high-stakes corporate conference, the coverage can be adjusted to match your needs and budget.

For instance, a community fair with minimal activities and a small budget may opt for a basic coverage plan, focusing on essential protections like liability and equipment damage. On the other hand, a high-profile gala with expensive decorations, entertainment, and potential VIP guests might require more comprehensive coverage, including public relations management and higher liability limits.

| Event Type | Coverage Focus |

|---|---|

| Community Fair | Basic Liability, Equipment Damage |

| Gala Dinner | Comprehensive Liability, Public Relations, VIP Protection |

| Music Festival | Cancellation, Equipment Loss, Artist Liability |

By allowing event organizers to choose their coverage, Single Day Event Insurance ensures that every event, regardless of size or scope, can have the right level of protection without unnecessary costs.

Expert Insights: Making the Most of Your Policy

As an industry expert, here are some key considerations to ensure you maximize the benefits of your Single Day Event Insurance policy:

- Know Your Risks: Understand the unique risks associated with your event. Whether it's severe weather in your region, the potential for venue closures, or specific liabilities related to your event type, being aware of these risks allows you to tailor your coverage accordingly.

- Review and Update Regularly: Event planning can evolve, and so should your insurance policy. Regularly review your coverage to ensure it aligns with the latest details of your event. This includes any changes to the venue, activities, or guest numbers.

- Communicate with Your Insurer: Don't hesitate to reach out to your insurance provider for guidance. They can offer expert advice on the best coverage options for your event and help you understand the fine print of your policy.

- Document and Plan: Keep detailed records of your event planning process, including contracts, invoices, and correspondence. This documentation will be invaluable if you need to make a claim. Additionally, create a comprehensive event plan to identify potential risks and how you intend to mitigate them.

Single Day Event Insurance is a powerful tool for event organizers, providing the financial safety net needed to navigate the unpredictable world of event planning. By understanding the scope of coverage, exploring real-world examples, and implementing expert strategies, you can ensure your event is protected, allowing you to focus on creating memorable experiences.

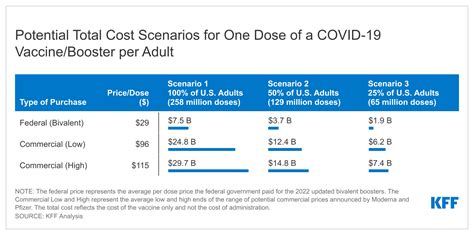

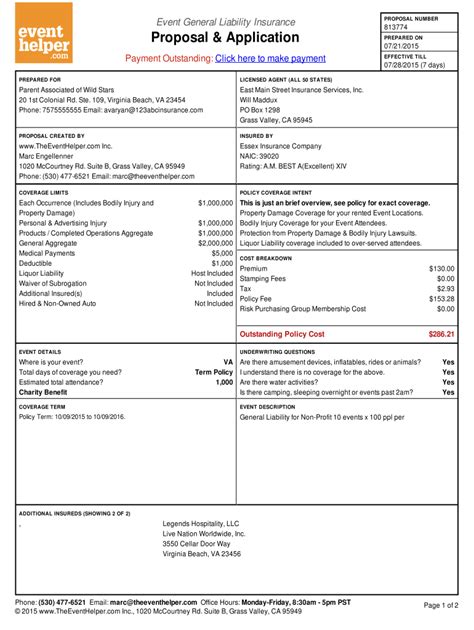

How much does Single Day Event Insurance typically cost?

+The cost of Single Day Event Insurance can vary widely depending on the nature and size of your event. Factors such as the level of coverage required, the event’s location, and the number of attendees can all impact the premium. It’s best to obtain quotes from insurance providers to get an accurate estimate for your specific event.

Can I purchase Single Day Event Insurance at the last minute?

+While it’s generally recommended to secure insurance well in advance of your event, some providers offer last-minute coverage. However, last-minute policies may have limited coverage options and higher premiums. It’s best to plan ahead to ensure you have the right protection.

What happens if I need to make a claim on my Single Day Event Insurance policy?

+In the event of a claim, you’ll need to contact your insurance provider and provide detailed documentation of the incident and any associated expenses. The claims process can vary depending on the insurer and the nature of the claim, so it’s important to understand your policy’s specific requirements.