Renters Insurance Compare

Renters insurance is a crucial yet often overlooked aspect of financial protection for individuals who rent their living spaces. While homeowners have insurance to safeguard their properties and belongings, renters need a tailored policy to protect their assets and ensure peace of mind. In this comprehensive guide, we will delve into the world of renters insurance, comparing key aspects, benefits, and considerations to help you make an informed decision.

Understanding Renters Insurance

Renters insurance is a type of property insurance specifically designed for individuals who rent apartments, condos, or houses. It provides coverage for personal belongings, liability protection, and additional living expenses in the event of covered losses. Unlike homeowners insurance, renters insurance focuses on the contents within the rental unit rather than the structure itself.

Key Components of Renters Insurance

Personal Property Coverage

One of the primary benefits of renters insurance is the protection it offers for your personal belongings. This coverage typically includes furniture, electronics, clothing, jewelry, and other items you own. In the unfortunate event of a covered loss, such as a fire, theft, or natural disaster, renters insurance can help you replace or repair your damaged possessions.

It’s important to note that renters insurance usually provides coverage for named perils, which are specific events or causes of loss listed in the policy. Common named perils include fire, lightning, windstorm, vandalism, and theft. However, it’s crucial to review your policy carefully to understand the exact perils covered and any exclusions.

To determine the appropriate coverage amount, you should conduct a home inventory and estimate the total value of your possessions. Most renters insurance policies offer actual cash value coverage, which considers depreciation when settling claims. However, some providers also offer replacement cost coverage, which ensures you receive the full cost to replace your items without deducting depreciation.

Liability Protection

Renters insurance also provides liability protection, which is a vital aspect of financial security. Liability coverage safeguards you against claims and lawsuits arising from accidents or injuries that occur on your rental property. For instance, if a guest slips and falls in your apartment, renters insurance can help cover the medical expenses and any legal fees associated with the incident.

Additionally, renters insurance typically includes personal liability coverage, which protects you in situations where you are held responsible for causing bodily injury or property damage to others, even outside your rental unit. This coverage can provide a financial safety net and peace of mind, ensuring you are protected in various scenarios.

Additional Living Expenses

In the event of a covered loss that renders your rental unit uninhabitable, renters insurance often includes additional living expenses coverage. This provision covers the costs you incur while temporarily relocating, such as hotel stays, meals, and other necessary expenses until your rental home is restored or you find a new place to live.

The coverage limits and duration for additional living expenses vary among insurance providers. It’s essential to review your policy and understand the specific terms to ensure you have adequate coverage for your needs.

Comparing Renters Insurance Policies

When comparing renters insurance policies, several key factors come into play. Here’s a breakdown of the essential considerations:

Coverage Limits and Deductibles

Coverage limits refer to the maximum amount your insurance policy will pay for covered losses. It’s crucial to choose limits that align with the value of your personal belongings and the potential liabilities you may face. Higher coverage limits provide more extensive protection but may result in higher premiums.

Deductibles, on the other hand, are the amount you must pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premiums, but it’s essential to ensure you can afford the deductible in case of a claim.

When comparing policies, carefully review the coverage limits and deductibles to find a balance that suits your financial situation and provides adequate protection.

Policy Exclusions and Endorsements

Every renters insurance policy comes with a set of standard exclusions, which are specific circumstances or perils that are not covered. It’s crucial to understand these exclusions to avoid any surprises when filing a claim. Common exclusions may include flood damage, earthquake damage, intentional acts, and damage caused by pests or rodents.

Additionally, insurance providers often offer policy endorsements or riders that allow you to customize your coverage to fit your unique needs. These endorsements may include coverage for high-value items, identity theft protection, or additional liability limits. Consider your specific circumstances and assess which endorsements could enhance your protection.

Premium Costs and Payment Options

Renters insurance premiums vary depending on several factors, including the value of your belongings, the location of your rental property, and your personal liability coverage limits. It’s essential to obtain quotes from multiple insurance providers to compare premium costs and find the most competitive rates.

Additionally, consider the payment options offered by each insurer. Some providers allow monthly payments, while others may require annual or semi-annual payments. Choose a payment option that aligns with your financial preferences and budget.

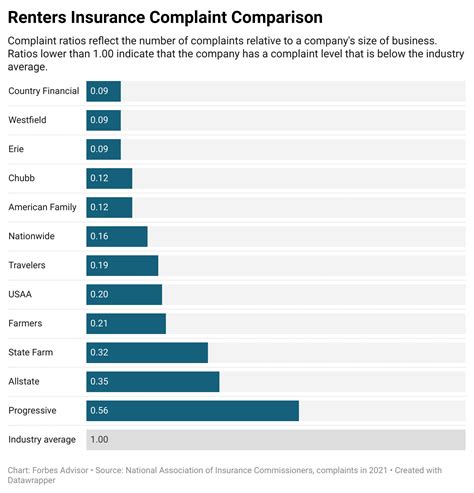

Claims Process and Customer Service

In the event of a claim, you want to ensure that your insurance provider has a streamlined and efficient claims process. Research the insurer’s reputation for handling claims promptly and fairly. Look for online reviews and ratings to gauge customer satisfaction with the claims process.

Additionally, assess the availability and quality of customer service. Consider factors such as response time, accessibility through various channels (phone, email, online chat), and the overall helpfulness of the support team. A responsive and knowledgeable customer service team can make a significant difference during the claims process.

Bundling Options and Discounts

Many insurance providers offer bundling options, allowing you to combine your renters insurance with other policies, such as auto insurance or homeowners insurance (if you own other properties). Bundling can often result in significant discounts and streamlined policy management.

Inquire about available discounts, such as multi-policy discounts, loyalty discounts, or discounts for safety features like smoke detectors or security systems. These discounts can help lower your overall insurance costs.

Case Study: Real-Life Scenario

Let’s consider a real-life example to illustrate the importance of renters insurance. Imagine Sarah, a young professional who recently moved into a cozy apartment in a bustling city. She carefully furnished her new home with a mix of new and vintage pieces, including a valuable antique rug passed down from her grandmother.

One evening, a sudden rainstorm caused a leak in the apartment above Sarah’s unit. Water seeped through the ceiling, damaging her furniture, electronics, and, unfortunately, the antique rug. Sarah was distraught, not only because of the financial loss but also because of the sentimental value attached to the rug.

Fortunately, Sarah had the foresight to purchase renters insurance with comprehensive coverage. Her policy covered the named perils of water damage and provided actual cash value coverage for her belongings. The insurance company promptly sent an adjuster to assess the damage, and Sarah was relieved to receive a settlement that allowed her to repair and restore her belongings, including the cherished antique rug.

Expert Insights and Future Implications

Renters insurance is an essential safeguard for individuals who rent their living spaces. By providing coverage for personal belongings, liability protection, and additional living expenses, renters insurance offers peace of mind and financial security. When comparing policies, it’s crucial to consider coverage limits, deductibles, exclusions, premium costs, and the insurer’s reputation for claims handling and customer service.

In today’s evolving insurance landscape, technology plays a significant role. Many insurers now offer digital platforms and mobile apps, allowing policyholders to manage their policies, file claims, and access support conveniently. Additionally, the use of advanced analytics and data-driven approaches enables insurers to offer more personalized and tailored coverage options.

Looking ahead, the future of renters insurance is likely to be shaped by technological advancements and changing consumer expectations. Insurers may continue to enhance their digital capabilities, providing seamless and efficient customer experiences. Furthermore, the integration of smart home technologies and data-driven risk assessments could lead to more accurate and affordable coverage options for renters.

As an informed consumer, staying up-to-date with industry trends and advancements will help you make the best choices when it comes to protecting your assets and ensuring a secure future.

What is the average cost of renters insurance?

+

The average cost of renters insurance varies based on factors such as location, coverage limits, and deductibles. According to industry data, the average monthly premium for renters insurance is around 15 to 30. However, it’s important to obtain personalized quotes to get an accurate estimate for your specific circumstances.

Does renters insurance cover natural disasters?

+

Renters insurance typically provides coverage for named perils, which may include some natural disasters like fire, windstorm, or hail. However, it’s crucial to review your policy carefully as certain natural disasters, such as floods or earthquakes, often require separate coverage or endorsements.

How can I lower my renters insurance premiums?

+

There are several strategies to reduce your renters insurance premiums. You can consider increasing your deductible, which lowers the insurance company’s risk and results in lower premiums. Additionally, bundling your renters insurance with other policies, such as auto insurance, often leads to significant discounts. Maintaining a good credit score and installing security devices in your rental unit may also qualify you for premium discounts.