Rbc Insurance

RBC Insurance, a renowned name in the insurance industry, has established itself as a trusted provider of a wide range of insurance products and services. With a focus on customer satisfaction and financial security, RBC Insurance offers comprehensive coverage tailored to meet the diverse needs of individuals and businesses. This article delves into the world of RBC Insurance, exploring its history, key offerings, and the impact it has had on the insurance landscape.

A Legacy of Financial Protection: The Story of RBC Insurance

The roots of RBC Insurance can be traced back to the late 19th century when the Royal Bank of Canada (RBC) first entered the insurance business. Over the years, RBC Insurance has grown into a leading provider, offering a comprehensive suite of insurance products and services. Today, it stands as a pillar of financial security, protecting millions of individuals and businesses across Canada and beyond.

RBC Insurance's journey began with a vision to provide customers with a one-stop shop for all their financial needs. This vision has since evolved into a reality, with the company offering a diverse range of insurance products, including life insurance, health insurance, travel insurance, auto insurance, and home insurance. By partnering with trusted insurers and leveraging its extensive financial expertise, RBC Insurance has become a go-to provider for those seeking peace of mind and financial protection.

Key Milestones and Growth

The growth and success of RBC Insurance can be attributed to several significant milestones and strategic initiatives. Here’s a glimpse into some of the key moments in its history:

- 1908: RBC launched its first life insurance policy, marking the beginning of its journey into the insurance sector.

- 1960s: The company expanded its insurance offerings to include property and casualty insurance, diversifying its portfolio.

- 1980s: RBC Insurance established itself as a leader in the industry by acquiring several prominent insurance companies, solidifying its position in the market.

- 1990s: The company further enhanced its presence by introducing innovative products such as critical illness insurance and income protection plans.

- 2000s: RBC Insurance expanded internationally, offering its services in the United States and the Caribbean, showcasing its commitment to global growth.

- Present Day: RBC Insurance continues to innovate and adapt, leveraging technology to provide customers with convenient and accessible insurance solutions.

Through these strategic moves and a customer-centric approach, RBC Insurance has solidified its position as a trusted partner in the financial services industry.

Comprehensive Insurance Solutions: RBC Insurance’s Product Portfolio

RBC Insurance’s product portfolio is extensive and caters to a wide range of insurance needs. Let’s explore some of its key offerings:

Life Insurance

RBC Insurance offers a variety of life insurance plans, including term life insurance, whole life insurance, and universal life insurance. These policies provide financial protection to individuals and their families, ensuring they are prepared for life’s unexpected events. Whether it’s covering funeral expenses, providing income for dependents, or leaving a legacy, RBC Insurance’s life insurance products offer peace of mind.

Health Insurance

In today’s dynamic healthcare landscape, RBC Insurance recognizes the importance of comprehensive health coverage. Their health insurance plans include critical illness insurance, disability insurance, and travel medical insurance. These policies ensure individuals have access to the necessary care and financial support when faced with health challenges, both domestically and while traveling abroad.

Auto and Home Insurance

RBC Insurance understands the value of protecting one’s assets. Their auto and home insurance policies provide comprehensive coverage for vehicles and residences. From collision and liability protection to home repairs and theft coverage, RBC Insurance ensures individuals and their families are protected against unforeseen events that can impact their financial stability.

Travel Insurance

Whether it’s a business trip or a vacation, travel insurance is essential. RBC Insurance offers a range of travel insurance plans, covering medical emergencies, trip cancellations, lost luggage, and more. With RBC Insurance’s travel insurance, individuals can explore the world with confidence, knowing they are protected against unexpected travel-related mishaps.

Business Insurance

RBC Insurance recognizes the unique needs of businesses and offers tailored insurance solutions. Their business insurance policies cover a wide range of risks, including property damage, liability claims, and business interruption. By partnering with RBC Insurance, businesses can focus on growth and success, knowing they have the necessary protection in place.

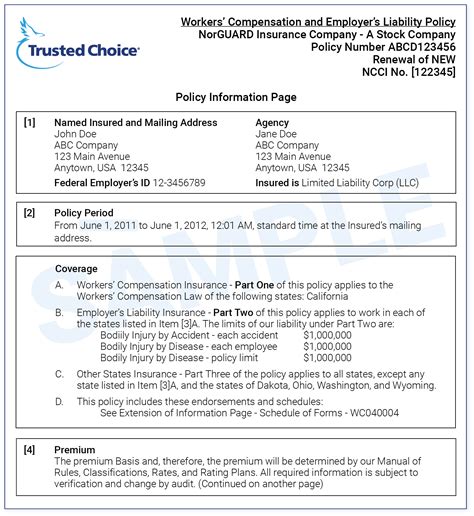

| Insurance Type | Key Features |

|---|---|

| Life Insurance | Financial protection for individuals and families, offering term, whole, and universal life plans. |

| Health Insurance | Comprehensive coverage for critical illnesses, disabilities, and travel medical emergencies. |

| Auto Insurance | Protection for vehicles, including collision, liability, and comprehensive coverage. |

| Home Insurance | Coverage for residences, including repairs, theft, and liability protection. |

| Travel Insurance | Assistance for travelers, covering medical emergencies, trip cancellations, and lost luggage. |

| Business Insurance | Tailored solutions for businesses, covering property damage, liability, and business interruption. |

Customer Experience and Service Excellence

At the heart of RBC Insurance’s success is its commitment to delivering an exceptional customer experience. The company understands that insurance is not just a product but a service that provides security and peace of mind. RBC Insurance’s customer-centric approach is evident in its dedicated support teams, efficient claims processes, and personalized insurance solutions.

Personalized Insurance Plans

RBC Insurance recognizes that every individual and business has unique needs. That’s why they offer customized insurance plans tailored to meet specific requirements. Whether it’s adjusting coverage limits, adding endorsements, or creating unique policy combinations, RBC Insurance ensures that customers receive the right coverage at competitive rates.

Digital Innovation and Convenience

In an era where convenience and accessibility are valued, RBC Insurance has embraced digital transformation. Their online platforms and mobile apps provide customers with easy access to their insurance policies, allowing them to manage their accounts, make payments, and file claims from the comfort of their homes or on the go. This digital innovation not only enhances the customer experience but also streamlines processes, reducing administrative burdens.

Claims Management and Support

When it comes to claims, RBC Insurance understands the importance of prompt and efficient handling. Their dedicated claims teams work tirelessly to ensure that customers receive the support and compensation they deserve during times of need. With a focus on customer satisfaction, RBC Insurance aims to make the claims process as smooth and stress-free as possible.

Community Engagement and Education

Beyond providing insurance products and services, RBC Insurance actively engages with communities and promotes financial literacy. The company recognizes the importance of empowering individuals to make informed insurance decisions. Through educational initiatives, workshops, and community partnerships, RBC Insurance aims to raise awareness about the value of insurance and help individuals understand the benefits of protecting their financial well-being.

Industry Recognition and Awards

The dedication and excellence of RBC Insurance have been recognized by various industry organizations and publications. Over the years, the company has received numerous accolades and awards, solidifying its position as a leader in the insurance industry. Here’s a glimpse into some of the prestigious honors RBC Insurance has achieved:

- J.D. Power Awards: RBC Insurance has consistently ranked among the top insurers in customer satisfaction, receiving multiple J.D. Power awards for its exceptional service and product offerings.

- Canadian Insurance Awards: Recognized for its innovative products and exceptional customer service, RBC Insurance has been a recipient of several Canadian Insurance Awards, including the prestigious Insurer of the Year award.

- Financial Advisor Awards: RBC Insurance's commitment to financial advisors and its support for their success have been acknowledged with awards such as the Best Insurance Provider for Advisors.

- Insurance Business Canada Awards: The company has been honored with awards for its innovative products, exceptional claims handling, and outstanding customer service, showcasing its dedication to excellence across all aspects of its business.

Future Outlook: RBC Insurance’s Vision and Strategy

As the insurance landscape continues to evolve, RBC Insurance remains committed to its core values of customer satisfaction, innovation, and financial protection. With a focus on adapting to changing market trends and customer needs, the company is well-positioned for continued success.

Digital Transformation and Innovation

RBC Insurance recognizes the importance of staying at the forefront of digital transformation. The company is investing in cutting-edge technologies and innovative solutions to enhance the customer experience. From streamlined online platforms to advanced data analytics, RBC Insurance is committed to leveraging technology to provide customers with convenient and personalized insurance solutions.

Expanding Global Reach

With a strong presence in Canada and the United States, RBC Insurance is looking to expand its global footprint. The company is exploring opportunities in emerging markets, aiming to bring its comprehensive insurance solutions to a wider audience. By partnering with local insurers and leveraging its extensive expertise, RBC Insurance aims to become a trusted provider on a global scale.

Sustainable and Ethical Practices

In today’s conscious consumer landscape, RBC Insurance understands the importance of sustainable and ethical practices. The company is committed to environmental stewardship and social responsibility. From reducing its carbon footprint to supporting community initiatives, RBC Insurance aims to be a responsible corporate citizen, aligning its values with those of its customers and stakeholders.

Collaborative Partnerships

RBC Insurance recognizes the value of collaborative partnerships. By working closely with other industry leaders, financial institutions, and technology companies, the company aims to enhance its product offerings and provide customers with even more comprehensive insurance solutions. These partnerships allow RBC Insurance to leverage expertise, resources, and innovative ideas, ensuring it remains at the forefront of the industry.

How can I purchase RBC Insurance products?

+You can purchase RBC Insurance products through a variety of channels. You can visit an RBC branch, contact an RBC Insurance advisor, or use their online platforms and mobile apps to explore and purchase insurance policies. RBC Insurance offers a convenient and personalized experience, allowing you to choose the method that best suits your preferences.

What sets RBC Insurance apart from other insurers?

+RBC Insurance stands out for its comprehensive product portfolio, customer-centric approach, and dedication to innovation. With a focus on delivering exceptional service and tailored insurance solutions, RBC Insurance ensures that customers receive the protection they need at competitive rates. Additionally, the company's commitment to digital transformation and its extensive financial expertise make it a trusted partner for individuals and businesses seeking financial security.

How does RBC Insurance ensure customer satisfaction and trust?

+RBC Insurance places customer satisfaction at the forefront of its operations. The company achieves this through its dedicated support teams, efficient claims processes, and personalized insurance plans. By providing convenient access to policies, offering innovative solutions, and actively engaging with communities, RBC Insurance builds trust and ensures that customers receive the financial protection and peace of mind they deserve.

Can I customize my insurance policy with RBC Insurance?

+Absolutely! RBC Insurance understands that every individual and business has unique insurance needs. That's why they offer customizable insurance plans. Whether you want to adjust coverage limits, add endorsements, or create unique policy combinations, RBC Insurance works with you to tailor your insurance coverage to your specific requirements.

In conclusion, RBC Insurance’s journey from its humble beginnings to becoming a leading insurance provider is a testament to its dedication, innovation, and customer-centric approach. With a comprehensive product portfolio, a commitment to excellence, and a focus on the future, RBC Insurance continues to be a trusted partner for individuals and businesses seeking financial protection and peace of mind. As the company embraces digital transformation, expands its global reach, and upholds sustainable practices, its future looks bright, ensuring that it remains a pillar of financial security for years to come.